Highlights:

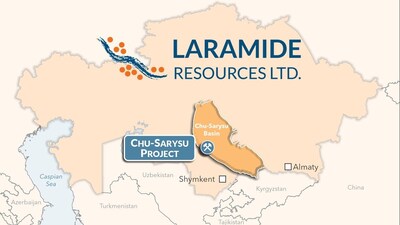

- Laramide has completed the agreement terms for the opportunity to explore 22 subsoil use license applications covering approximately 5,500 km 2 comprising the Chu-Sarysu Project located in the Suzak District of the South Kazakhstan Oblast, Republic of Kazakhstan .

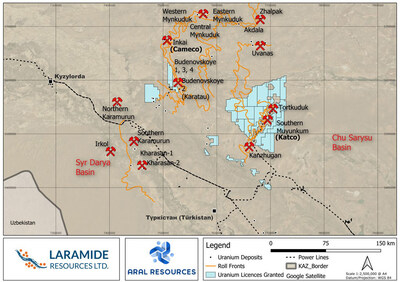

- The prospective land package covers an area which is proximal to some of Kazatomprom's largest uranium deposits and operational mines, including Cameco's JV project, Inkai, and Orano's JV project, Muyunkum-Tortkuduk.

- The Chu-Sarysu Project area includes a number of mapped, paleo-channel roll-fronts, associated with uranium deposits and amenable to ISR mining.

- Laramide will operate and fund the exploration program towards the discovery of a viable uranium resource.

Laramide Resources Ltd. ( "Laramide" or the "Company" ) (TSX: LAM) (ASX: LAM) (OTCQX: LMRXF), a uranium mine development and exploration company with globally significant assets in the United States and Australia is pleased to announce the successful closing of a three-year option agreement (the " Option Agreement "), with an option to extend for an additional year, with Aral Resources Ltd. (" Aral "), a Kazakh company registered with the Astana International Financial Center and the shareholders of Aral (the " Optionors "). Aral has secured 22 mineral licenses covering nearly 5,500 square kilometres of the Chu-Sarysu sedimentary basin of Kazakhstan (collectively, the " Chu-Sarysu Project ").

Under the terms of the Option Agreement, Laramide has the right (the " Option ") to acquire all outstanding shares of Aral at any time during the option period, thereby obtaining full ownership of the Chu-Sarysu Project. The Chu-Sarysu Project is located in the Suzak District of the South Kazakhstan Oblast, Republic of Kazakhstan (Figure 1).

In 2022 Kazakhstan accounted for over 43% 1 of global U 3 O 8 production. Among the country's five main uranium-producing basins, the Chu-Sarysu and Syr Darya basins located in the south of the country, contribute more than 75% of national output. These basins host major deposits and operational in-situ recovery (" ISR ") mines including Inkai (Cameco JV) and Muyunkum-Tortkuduk (Katco JV).

Additionally, the Chu-Sarysu Basin is notable for its significant copper potential, exemplified by the Dzhezkazgan sediment-hosted copper deposit located in the northern region. This potential is further reinforced by the ongoing exploration efforts across large tenement packages in the basin by major companies such as Rio Tinto, Fortescue, and First Quantum.

Throughout the Option period, Laramide will serve as the exclusive operator, assuming responsibility for all operational and exploration expenses. The mineral licenses included in the option agreement cover nearly 5,500 square kilometres and represent a unique greenfield exploration opportunity covering properties adjacent to some existing large operational uranium mines. Each license has an initial term of up to six years, with the option for a one-time renewal for an additional five years.

Marc Henderson , Laramide's President and CEO, comments:

"The uranium sector has faced years of underinvestment, and with nuclear energy now widely recognized as one of the most effective solutions to meet global energy demands, nuclear commitments are increasing. This has put further pressure on the existing supply-demand deficit. As many existing mines are nearing depletion or failing to meet production targets, there are few new projects to bridge the shortfall and an urgent focus on greenfield exploration is clearly warranted.

" Kazakhstan's government actively supports the uranium sector, with favourable policies for foreign investment and streamlined permitting processes. Furthermore, their high-grade, large-scale deposits are amenable for the environmentally friendly and cost-efficient in-situ recovery (ISR) mining method.

"While Laramide had not been actively seeking to expand its portfolio, the high-impact exploration potential in Kazakhstan presented an exceptional low-risk, high-reward opportunity to strengthen our pipeline of quality projects. As a company committed to building a uranium producer capable of meeting utility needs, this aligns perfectly with our long-term strategy.

"The Chu-Sarysu Basin is an underexplored region and offers significant potential, comparable to the merits of Canada's Athabasca Basin. With strong government support for uranium mining and foreign partnerships, this venture represents an exciting addition to Laramide's portfolio of existing development assets. Exploration for ISR deposits in an infrastructure-rich region with many existing producing operations has significant cost advantages and we are looking forward to advancing this asymmetric opportunity in an aggressive manner."

| __________________________ |

| 1 https://wna.origindigital.co/information-library/nuclear-fuel-cycle/mining-of-uranium/world-uranium-mining-production |

Option Agreement Highlights:

- Aral has received grant notifications for all license applications related to the Chu-Sarysu Project and Laramide has received conditional approval from the TSX.

- Laramide has made a one-time payment of US$450,000 to the Optionors as follows: (i) US$225,000 in cash; and (ii) 421,038 common shares in the capital of Laramide (the "Laramide Shares") at a deemed price of CDN$0.751 determined from the 20-day volume-weighted average sale trading price of the Laramide Shares on the TSX as of November 25, 2024 .

- Annual payments of US$150,000 will be payable in cash on each anniversary of the Option Agreement, commencing on the first anniversary.

- The Option is exercisable for a term of three years and may be extended for an additional one-year term with a one-time payment of US$400,000 , 50% in cash and 50% in Laramide Shares.

- The Option can be exercised by Laramide at any time during the term of the agreement through a one-time payment of US$14,000,000 , 50% in cash and 50% in Laramide Shares.

- The Option Agreement also contemplates and allows for an alternative mechanism to develop this opportunity by way of a spin-off transaction.

2025 Plans for the Chu-Sarysu Project

In late 2024, Laramide commenced the process of acquiring historical data from Kazakhstan's state National Geological Services. Review of historical geological reports and data is ongoing and includes the digitization of Soviet-era data. By early 2025, Laramide expects to secure the required ecological permits and will then proceed with submitting exploration work plans to the Ministry of Industry and Construction.

Laramide's initial exploration activities will focus on geological ground reconnaissance, in conjunction with a broad airborne geophysical survey. This survey, scheduled to begin in Q2 2025, will be designed to establish a modern, high-quality baseline dataset across the entire project and will incorporate magnetic, electromagnetics and radiometric measurements.

Target generation from a combination of thorough historical data review and geophysical interpretation will support the plan to drill test initial roll-front uranium targets during Q4 2025.

Details of the Option Agreement

With the exception of the annual payments, all payments outlined above are payable as follows: (i) 50% in United States dollars; and (ii) 50% in Laramide Shares, the value of which shall be determined in accordance with the 20-day volume-weighted average sale price per share of the Laramide Shares on the TSX as of the date prior to the relevant date of each of the payments as described above.

During the term of the Option Agreement, Laramide will be the operator of the Property and will exercise exclusive supervision, direction and control over any and all operations, programs and budgets relating to the Property. Laramide will provide funding to Aral for the purposes of satisfying and fulfilling minimum economic commitments and expenditures in relation to each license comprising the Property, as required under Kazakhstan's mining regulations.

In connection with the Option Agreement, and in order to ensure Aral's compliance with the bonding requirements of Kazakhstan's mining regulations for the licenses comprising the Property, Laramide agreed to provide funding to Aral in an amount of up to US$1,450,000 in the form of interest-free loans pursuant to the terms and conditions of a grid promissory note and credit facility agreement dated as of June 24, 2024 (the " Promissory Note ") issued by Aral for the benefit of Laramide. Laramide loaned Aral an aggregate amount of US$900,000 in connection with the Promissory Note and Aral has successfully obtained appropriate bonding for all licenses comprising the Chu-Sarysu Project. The funds loaned under the Promissory Note are repayable by Aral to Laramide in the event Laramide does not exercise the Option, or the Option Agreement is terminated for any reason, or in part if a license is terminated or withdrawn.

The Optionors will retain a 1% net smelter royalty which is subject to a buy down provision where Laramide may, at its discretion, repurchase 25% at a price to be agreed among the parties or by an independent third-party appraiser. In addition, Laramide holds a right of first offer regarding the sale, transfer or assignment of any portion of the net smelter royalty.

Qualified/Competent Person

The information in this announcement relating to Exploration Results is based on information compiled or reviewed by Mr. Rhys Davies , a contractor to the Company. Mr. Davies is a Member of The Australasian Institute of Geoscientists and has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves', and is a "Qualified Person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects . Mr. Davies consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

To learn more about Laramide, please visit the Company's website at www.laramide.com.

Follow us on Twitter @LaramideRes

About Laramide Resources Ltd.

Laramide is focused on exploring and developing high-quality uranium assets in Tier-1 uranium jurisdictions. The company's portfolio comprises predominantly advanced uranium projects in districts with historical production or superior geological prospectivity. The assets have been carefully chosen for their size and production potential, and the two large development projects are considered to be late-stage, low-technical risk projects. As well, Laramide has expanded its pipeline with strategic exploration in Kazakhstan where the company is exploring over 5,500 km 2 of the prolific Chu-Sarysu Basin for world-class roll-front deposits which are amenable to in-situ recovery.

Forward-looking Statements and Cautionary Language

This release includes certain statements that may be deemed to be "forward-looking statements". All statements in this release, other than statements of historical facts, that address events or developments that management of the Company expects, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "plans", "projects", "intends", "estimates", "envisages", "potential", "possible", "strategy", "goals", "objectives", or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions. Actual results or developments may differ materially from those in forward-looking statements. Laramide disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, save and except as may be required by applicable securities laws.

Since forward-looking information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, exploration and production for uranium; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of resource estimates; health, safety and environmental risks; worldwide demand for uranium; uranium price and other commodity price and exchange rate fluctuations; environmental risks; competition; incorrect assessment of the value of acquisitions; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws, royalties and environmental regulations.

SOURCE Laramide Resources Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2024/06/c7935.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2024/06/c7935.html