July 23, 2023

3.83mt @ 5.85g/T Gold For 721,200 Ounces - Never Never 16.70mt @ 2.2g/T Gold For 1.183moz - Dalgaranga

Gascoyne Resources Limited (“Gascoyne” or “Company”) (ASX: GCY) is pleased to announce the Updated Mineral Resource Estimate (“MRE”) for the Never Never Gold Deposit, part of its 100%-owned Dalgaranga Gold Project in Western Australia.

Highlights:

- Updated Mineral Resource Estimate (MRE) completed for the high-grade Never Never Gold Deposit, which remains open at depth, at the 100%-owned Dalgaranga Gold Project in WA:

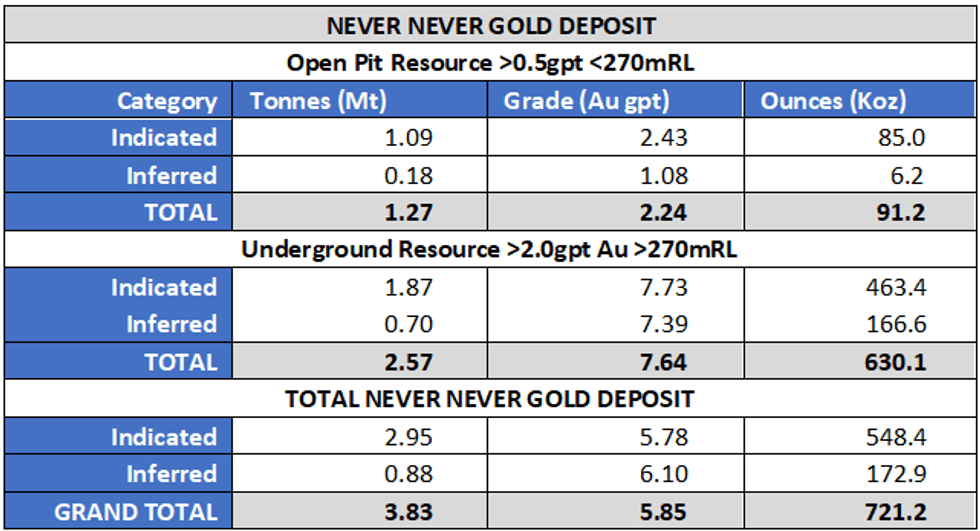

- 3.83Mt @ 5.85g/t gold for 721,200 ounces, comprising:

- 2.57Mt @ 7.64g/t for 630,100 ounces – “Underground” (>2.0g/t Au g/t)

- 1.27Mt @ 2.24g/t for 91,100 ounces – constrained “Open Pit” (>0.5g/t Au g/t)

- 3.83Mt @ 5.85g/t gold for 721,200 ounces, comprising:

- Resource Classification breakdown for the updated Never Never Gold Deposit MRE:

- 2.95Mt @ 5.78g/t gold for 548,400 ounces (76%) classified as Indicated

- 0.88Mt @ 6.10g/t gold for 172,800 ounces (24%) classified as Inferred

- Highly successful systematic in-fill drilling has resulted in more than 76% of the updated Never Never Gold Deposit MRE ounces converting to the higher confidence Indicated Resource classification, available for future conversion to Ore Reserves.

- Updated Never Never Gold Deposit MRE has increased the average global resource grade of the Dalgaranga Gold Project by 40% and the reportable ounces by 51%.

- Discovery cost to date for the Never Never MRE of just A$13/oz.

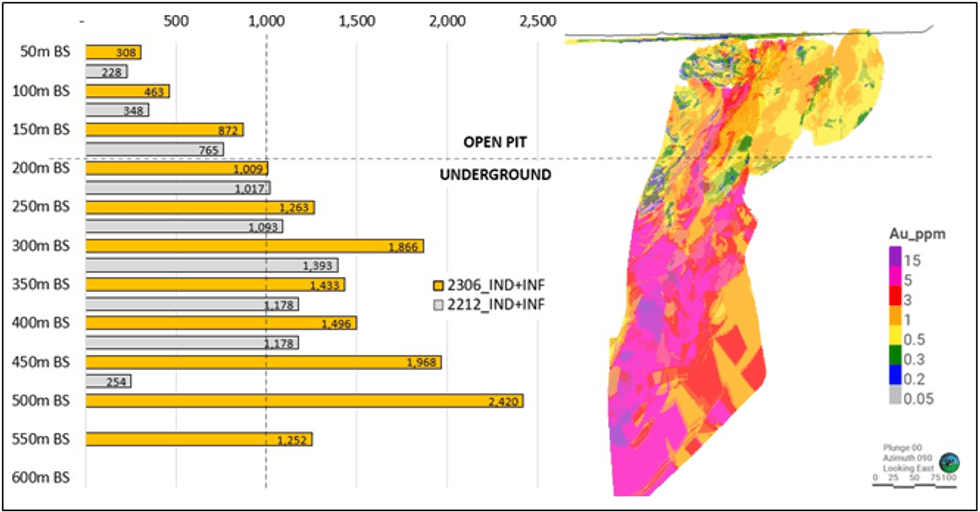

- Underground component of the MRE averages ~1,590 ounces per vertical metre, over a short strike length and appears to be increasing with depth, highlighting the significant endowment of the Never Never deposit.

- Updated Dalgaranga Gold Project Mineral Resources, all located within 10km of the 2.5Mtpa processing plant, now stand at:

- 16.70Mt @ 2.2g/t gold for 1,183,300 ounces

- Updated Murchison Region Mineral Resources, including the Dalgaranga and Yalgoo Gold Projects, have increased by 31% in grade and 39% in contained ounces, and now stand at:

- 21.94Mt @ 2.0g/t gold for 1,426,900 ounces

- Updated Gascoyne Group Mineral Resources, inclusive of the Murchison and Gascoyne Region Mineral Resources (Glenburgh and Egerton Gold Projects), now stand at:

- 38.51Mt @ 1.6g/t gold for 1,964,000 ounces

Stage 1 of the 2023 resource drilling at Never Never has now been completed, with assays from only one DD hole still awaited and expected to be received in the coming 1-2 weeks. The remainder of the announced drill results from the 2023 drilling campaign have been included in the updated Mineral Resource Estimate, which is summarised below, together with a block model showing the significant gold endowment of the Never Never deposit.

The recently discovered Ink deposit is not included in this MRE update.

Gascoyne Resources Managing Director and CEO, Mr Simon Lawson, said: “This is a fantastic result for our shareholders! Less than six months ago we established Never Never as a significant new high-grade gold discovery within the Dalgaranga field with a very healthy high-grade resource of 303,000oz @ 4.64g/t.

“Since then, we have been single-minded in focusing on adding high-grade ounces. This landmark resource upgrade provides unequivocal evidence that this is one of the most exciting new gold discoveries seen in Western Australia in recent years – and an asset that has clear potential to underpin a potential restart decision for the Dalgaranga processing plant.

“The substantial upgrade, which has seen the contained ounces from the previous MRE more than doubling, has been achieved at an average discovery cost to date of just A$13/oz. This shows the enormous value that can be created with cost effective and targeted exploration!

“The other standout feature of this updated MRE is the phenomenal endowment of the orebody. The underground component of Never Never averages 1,590 ounces per vertical metre over a short strike length with favourable geometry. For all the underground miners out there, that should equate to very profitable mining in the future – particularly given that 1,000oz per vertical metre is generally seen as a strong benchmark for underground mines.

“Due to the highly consistent nature of Never Never and our success in drilling out a very reasonable spacing of intercepts from surface, we have also converted more than 76% of those resource ounces to the higher confidence Indicated category. To have more than 548,000 ounces in the Indicated category gives us great confidence as we move towards economic studies and the mine scheduling process.

“Of note, the substantial increase in tonnes, grade and ounces at Never Never brings the total gold resource endowment within 10km of the processing plant at Dalgaranga to 16.70Mt @ 2.2g/t for 1,183,300 ounces of gold.

“Given the strategic location of the relatively new 2.5Mtpa processing plant sitting at the centre of this resource inventory, we can now see a clear pathway to developing a very solid +5-year mine plan.

“That said, our immediate focus remains on adding more high-grade ounces with one rig starting this week and an even more expansive phase of surface drilling utilising up to 3 rigs set to commence in August. This drilling will target strategic extensions of Never Never itself, the newly defined high-grade Ink prospect adjacent to Never Never and, perhaps most importantly, commence testing a series of shallow Never Never ‘look-alike’ targets we have identified along strike to the north and south of the deposit.”

Click here for the full ASX Release

This article includes content from Gascoyne Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00