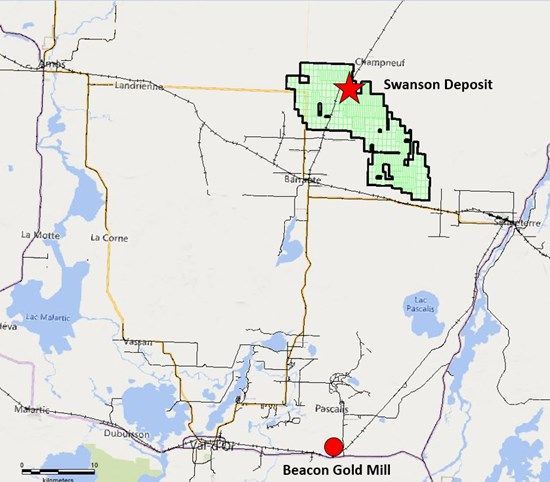

LaFleur Minerals Inc. (CSE: LFLR) (OTCQB: LFLRF) (FSE: 3WK0) ("LaFleur Minerals" or the "Company") is pleased to announce that it has initiated the permitting process to extract a surface bulk sample from its Swanson Gold Deposit located within a mining lease of the Company's district-scale, Swanson Gold Project, positioned in the prolific Abitibi Gold Belt. The bulk sample material will be processed at the Company's 100%-owned and fully permitted Beacon Gold Mill, located in Val-d'Or, Québec, and approximately 50 km from Swanson.

If the processed surface bulk sample of mineralized material from Swanson is deemed viable, the intention is to complete a Scoping Study, which will include evaluating the processing of Swanson mineralized material at the Beacon Gold Mill. A Scoping Study would further consider mine design, mining methodology, mining rate and gold production profile, facilities requirements, development schedules, and the overall project economics.

The permitting process at Swanson is a first step in LaFleur's two prong approach as it aims to expand the current resource estimate at the Swanson Gold Project, while in parallel launching operations for the intended gold production revival at Beacon Mill by year end, ideally sourcing mineralized material from Swanson, among other regional deposits. Since the acquisition of both projects in 2024, LaFleur's approach for efficient and effective value creation by consistently meeting key operational milestones, substantiated by a clear path to production, pivots the Company years ahead of other players in the region as it quickly transitions from explorer to producer.

The bulk sample will be taken from a high-potential gold zone identified during exploration work and is a key step toward advancing the project toward a production decision. Historical near-surface drill hole results at Swanson include 4.44 g/t Au over 36.0 m (BAR31-84) and 3.62 g/t Au over 41.0 m (SW-03-07). Because the deposit is situated on a Mining Lease, the permitting process is significantly more streamlined for a larger bulk sample compared to projects located on standard mining claims.

LaFleur Minerals is currently evaluating a bulk sample of approximately 100,000 t with an estimated average grade of 1.89 g/t Au and a total contained gold content of approximately 6,350 oz of gold. This bulk sample represents approximately 3% of the current mineral resource estimate for the Swanson Project.

Paul Ténière, CEO of LaFleur Minerals commented, "We are excited to begin this next step in advancing the Swanson gold deposit and developing a positive cash flow from the bulk sample collected within our mining lease. Combining and leveraging our near-surface Swanson gold deposit and fully permitted Beacon Mill gives us a unique opportunity to assess the project's potential with minimal additional capital investment and to fast-track our development plans in the Abitibi region. With the price of gold having risen exponentially over the past 12 months from USD$2,000 per ounce, to a current record price approaching USD$3,500 per ounce, we are excited to look at generating a positive cash flow in the near term to further our exploration and development work. The Swanson deposit is directly accessible by truck to the Beacon Mill via truck hauling on paved highway. With offsite processing and tailings disposal, the Swanson Gold Deposit could potentially quickly become a low-cost, low-impact, and highly profitable mining operation."

SWANSON BULK SAMPLING DETAILS

The surface bulk sample for the Swanson deposit will be collected on a fully permitted Mining Lease (BM 885) registered with the Québec government, of which no previous mining has been undertaken on the mining lease. The Swanson mining lease was initially applied and registered for by Agnico-Eagle following a 2009 internal review and Scoping Study based on a gold price of US$779 per ounce and an exchange of 1.10 $C/$US.

Strategically located near established mining communities such as Val-d'Or and existing infrastructure, the Swanson Project benefits from excellent access to roads, power, and a skilled local workforce, significantly reducing costs, logistical and operational hurdles associated with bulk sampling.

The permitting process will be conducted in compliance with all regulatory requirements, and the Company is committed to working closely with government agencies, local communities, and other stakeholders to ensure a responsible and transparent approach. Prior to collecting the bulk sample, the Company will be submitting a Restoration Plan to the MRNF as well as acquiring Environmental Authorization from the MELCCFP.

Further updates will be provided as the bulk sampling permitting process advances.

BEACON MILL RESTART UPDATE

The Company is in the final stages of developing its restart plan and budget for the Beacon Mill with results expected by the end of April. The Company is also working with its engineering and environmental team to select a geotechnical engineering firm to act as its Engineer of Record (EOR) for the Beacon Tailings Storage Facility (TSF) and to ensure design and construction oversight for the TSF.

SWANSON GOLD PROJECT SUMMARY

The Swanson Gold Project is over 16,000 hectares in size and includes several prospects rich in gold and critical metals previously held by Monarch Mining, Abcourt Mines, and Globex Mining. The Swanson Gold Project covers major structural breaks that hosts the Swanson Gold Deposit, and Bartec, and Jolin gold targets and numerous other showings which make up the Swanson Gold Project. The Swanson Gold Project has had in excess of 36,000 metres of historical diamond drilling, is easily accessible by road with a rail line running through the property, allowing direct access to several nearby gold mills, which further enhances its development potential.

The Swanson Gold Deposit hosts:

- Indicated Mineral Resource:

- 2,113,000 t with an average grade of 1.8 g/t gold, containing 123,400 oz of gold.

- Inferred Mineral Resource Estimate:

- 872,000 t with an average grade of 2.3 g/t gold, containing 64,500 oz of gold.

(MRE source: NI 43-101 technical report, effective September 17, 2024, filed on the Company's SEDAR+ profile).

- The Swanson Gold Project is located within 50 km of the Company's fully-permitted Beacon Gold Mill (Figure 1), and includes:

- Jolin target (Au): Historical Mineral Resource Estimate

(source: GESTIM -1996, GM62629 - historical estimate not compliant with NI 43-101)

- Jolin target (Au): Historical Mineral Resource Estimate

- Bartec target (Au): Historical Mineral Resource Estimate.

(source: GESTIM - DV 87-01 - historical estimate not compliant NI 43-101)

Figure 1: Swanson Deposit - 50 km from the Beacon Gold Mill

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/250325_e8dabac634229a2d_001full.jpg

BEACON GOLD MILL SUMMARY

The Beacon Gold Mill is a fully-refurbished, permitted mill capable of processing over 750 tonnes per day (Figure 2 and 3), nestled within the world-renowned Abitibi Gold Belt, a prime area that is host to over 100 historical and operational mines.

The entirely refurbished Beacon Gold Mill was last fully operational in early 2023 when the price of gold was USD$1,800 per ounce and has been under care and maintenance since that time. As gold approaches a record price of USD$3,500 per ounce, the goal of restarting the Beacon Gold Mill in the coming months is an exceptional opportunity for LaFleur Minerals to also target the custom milling of mineralized material from nearby gold deposits that surround the Beacon Mill. LaFleur Minerals demonstrates significant upside potential by ultimately generating revenue at the current elevated gold prices, with the restart of the Beacon Mill targeting a potential annual production scenario of approximately 30,000 to 40,000 ounces of gold based on the current mill capacity. The Company is currently finalizing the restart cost estimates for the Beacon Mill and aims to relaunch production by the end of 2025.

Figure 2: Photo of interior of Beacon Mill currently undergoing detailed inspections for restart

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/250325_e8dabac634229a2d_002full.jpg

Figure 3: Photo of exterior of Beacon Mill in Val-d'Or, Québec

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/250325_e8dabac634229a2d_003full.jpg

LaFleur Minerals' strategy combines advancing the Swanson Gold Deposit resource estimate, custom milling at the Beacon Gold Mill, and leveraging regional gold deposits and infrastructure to maximize value.

QUALIFIED PERSON STATEMENT

All scientific and technical information in this news release has been prepared and approved by Louis Martin, P.Geo., Technical Advisor to the Company and considered a Qualified Person for the purposes of NI 43-101.

About LaFleur Minerals Inc.

LaFleur Minerals Inc. (CSE: LFLR) (OTCQB: LFLRF) (FSE: 3WK0) is focused on the development of district-scale gold projects in the Abitibi Gold Belt near Val-d'Or, Québec. Our mission is to advance mining projects with a laser focus on our resource-stage Swanson Gold Project and the Beacon Gold Mill, which have significant potential to deliver long-term value. The Swanson Gold Project is over 16,000 hectares (160 km2) in size and includes several prospects rich in gold and critical metals previously held by Monarch Mining, Abcourt Mines, and Globex Mining. LaFleur has recently consolidated a large land package along a major structural break that hosts the Swanson, Bartec, and Jolin gold deposits and several other showings which make up the Swanson Gold Project. The Swanson Gold Project is easily accessible by road with a rail line running through the property allowing direct access to several nearby gold mills, further enhancing its development potential. LaFleur Minerals' fully-refurbished and permitted Beacon Gold Mill is capable of processing over 750 tonnes per day and is being considered for processing mineralized material at Swanson and for custom milling operations for other nearby gold projects.

ON BEHALF OF LaFleur Minerals INC.

Paul Ténière, P.Geo.

Chief Executive Officer

E: info@lafleurminerals.com

LaFleur Minerals Inc.

1500-1055 West Georgia Street

Vancouver, BC V6E 4N7

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding "Forward-Looking" Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements in this news release include, without limitation, statements related to the use of proceeds from the Offering. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/250325