- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

October 03, 2023

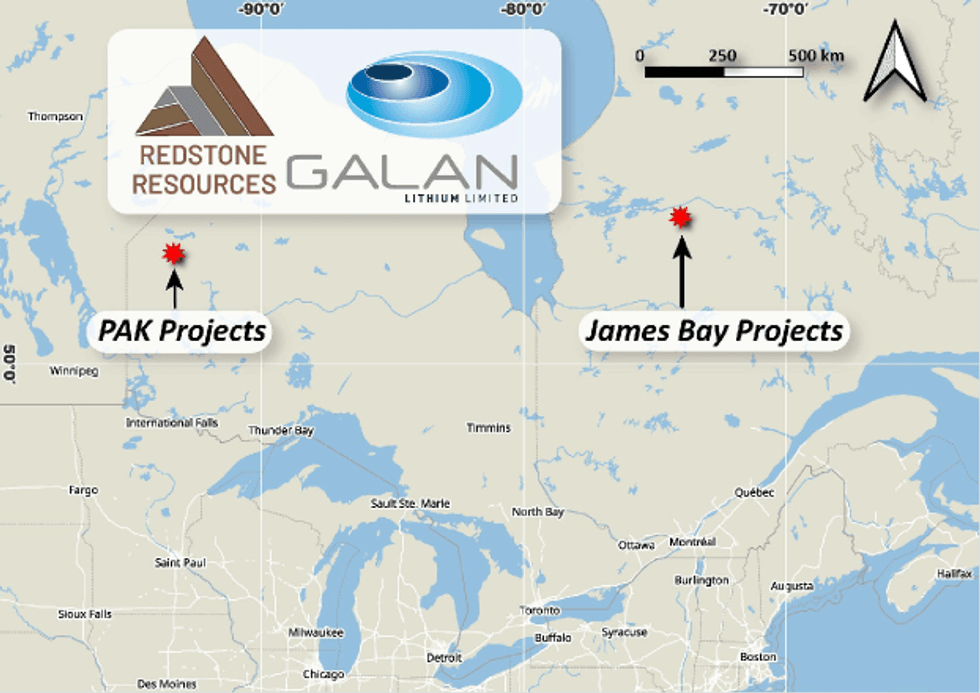

Galan Lithium Limited (ASX: GLN) (Galan or the Company) is pleased to announce it has entered into an exclusive binding agreement to acquire 100% of the Camaro-Taiga-Hellcat property blocks collectively covering 5,187 hectares located in the world-class James Bay Lithium Province, host to several advanced lithium projects and new lithium discoveries in Quebec, Canada. The Joint venture also includes an option to acquire 1,415 hectares in Ontario’s Electric Avenue near the Frontier Lithium’s PAK Lithium Project.

Highlights

- Galan has entered into a binding JV agreement with Redstone Resources Limited (as JV manager) to acquire 100% of the Taiga, Camaro, and Hellcat Lithium Projects in the heart of the James Bay lithium province.

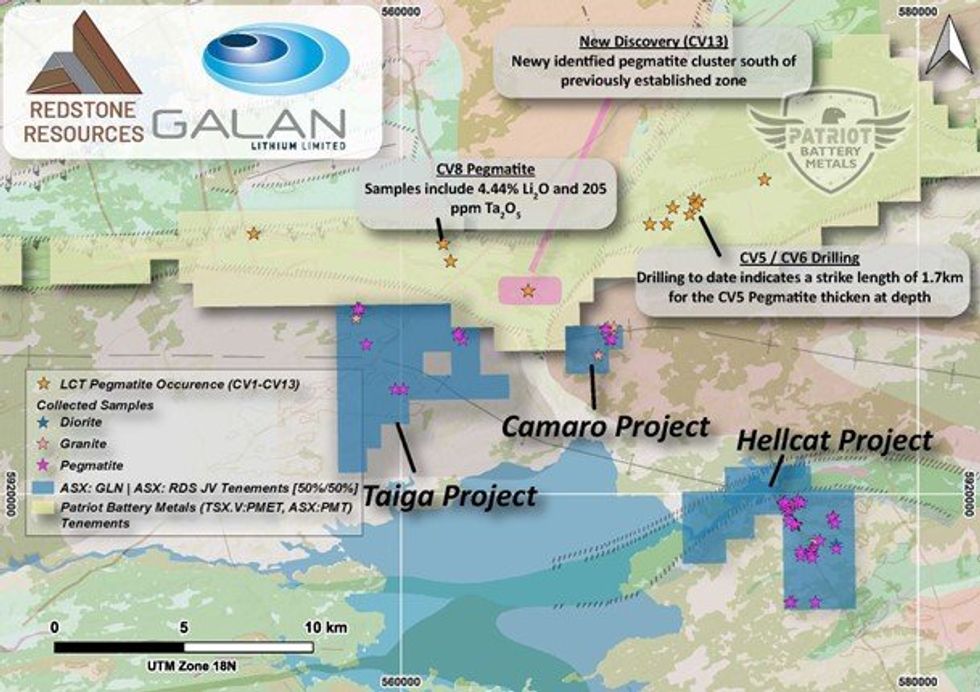

- Initial exploration in the James Bay Projects completed by Axiom Exploration Group Ltd identified 28 prospective pegmatite dykes.

- James Bay Projects cover 5,187 hectares adjacent to Patriot Battery Metals Inc (TSX.V:PMET) discovery – Taiga and Camaro both share tenement boundaries with PMET.

- PMET’s CV8 pegmatite, with samples averaging 4.6% Li2O, is located 1.4 km north of the Taiga Project and PMET’s newly-discovered CV13 pegmatite cluster is located 1.5 km north of the Camaro Project.

- Galan and Redstone Resources Limited have also entered into a JV agreement to secure an option to acquire 100% of the PAK East and PAK Southeast Lithium Project in Ontario’s Electric Avenue.

- PAK Projects cover agreements over 1,415 hectares in Ontario and are adjacent to Frontier Lithium Inc’s (TSX.V:FL) PAK Lithium Project

- Frontier Lithium Inc’s PAK Lithium project contains North America’s highest- grade lithium resource and is the second largest in North America by size

- With these acquisitions Galan continues to build a quality exploration portfolio including in world class lithium provinces, renowned for Tier 1 lithium discoveries.

All projects (see Figure 1) will be housed within a 50/50 unincorporated joint venture with ASX-listed Redstone Resources Ltd (ASX:RDS) (Redstone).

Commenting on the lithium acquisitions and joint venture with Redstone, Galan’s Managing Director Jian Pablo (JP) Vargas de la Vega said:

“Galan is very pleased to invest in the world renowned James Bay Lithium district in Québec, Canada. In Joint Venture with Redstone, who will be the manager. Galan is very experienced in lithium exploration and looks forward to the Joint Venture initiating exploration in the region. Securing an option in a premier lithium district of North-West Ontario also pleasing to Galan. Both projects are low entry cost ventures into Canada.

The JV projects are of quality and situated nearby excellent lithium discoveries, with the James Bay Lithium Projects being adjacent to the Patriot Battery Metals high-grade CV8 pegmatite discovery, and the PAK Lithium Projects situated in Ontario's Electric Avenue area.

Securing a prospective position in two premier lithium exploration global hotspots is value accretive and complements our exploration efforts in Greenbushes South in Western Australia to create further value for shareholders in parallel with our development and production lithium brine assets in Argentina.”

James Bay Lithium Projects - Taiga, Camaro and Hellcat

The 5,187-hectare James Bay Lithium Projects are located adjacent to Patriot Battery Metals’ Corvette Property in the James Bay Region of Quebec, approximately 235 kilometres east of Radisson, Quebec and 245 kilometres northeast of the Cree village municipality of Nemaska. The James Bay Lithium Projects contain three property blocks: Taiga, Camaro, and Hellcat. These projects cover 3,850 hectares and are adjacent to Patriot Battery Metals’ (TSX.V:PMET) Corvette Lithium discovery in James Bay. PMET’s CV8 pegmatite is one of the finest new hard rock lithium discoveries, with grab samples averaging 4.6% Li2O, and is located only 1.4 km north of the Taiga Project, and PMET’s newly-discovered CV13 pegmatite cluster is located 1.5 km north of the Camaro Project (See Figure 2).

Geology

Three primary ingredients have been identified in the industry as necessary for spodumene-bearing pegmatite emplacement: 1) Nearby granites, providing a source for melts; 2) Greenstone belts, acting as host rocks; and 3) large-scale structural features acting as conduits for the melts. The Taiga, Camaro and Hellcat properties in James Bay contain all three ingredients and multiple high-value exploration targets.

Taiga and Camaro Projects

These properties are situated in the Meso-Archean to Paleoproterozoic La Grande Subprovince of the Superior Provence. The Corvette Pegmatite series is hosted in the Mesoarchean Guyer Grupe, which is dominantly a meta-basalt (greenstone). The Taiga and Camaro projects are underlain by the Poste Le Moyne and Langelier plutons, respectively. The Camaro project is hosted in the Semonville Pluton with local windows of the Rouget Formation metabasalt. Properties are hosted in hornblende biotite diorite, quartz-rich diorite, biotite hornblende tonalite, granodiorite, granite, conglomerate, wacke, and amphibolite. Pegmatite dykes range from cm-scale irregular anatectic sweats to locally 5m wide dykes traced up to 200 m in length. The dykes are comprised of plagioclase feldspar, potassium feldspar, quartz, and minor biotite with local tourmaline and muscovite.

Click here for the full ASX Release

This article includes content from Galan Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLN:AU

The Conversation (0)

20 April 2025

Galan Lithium

Developing high-grade lithium brine projects in Argentina

Developing high-grade lithium brine projects in Argentina Keep Reading...

24 August 2025

Successful Due Diligence Ends - $20M Placement To Proceed

Galan Lithium (GLN:AU) has announced Successful Due Diligence Ends - $20m Placement To ProceedDownload the PDF here. Keep Reading...

01 August 2025

Final At-The-Market Raise for 2025

Galan Lithium (GLN:AU) has announced Final At-The-Market Raise for 2025Download the PDF here. Keep Reading...

30 July 2025

Quarterly Activities and Cash Flow Report

Galan Lithium (GLN:AU) has announced Quarterly Activities and Cash Flow ReportDownload the PDF here. Keep Reading...

25 July 2025

Incentive Regime for HMW Project in Argentina

Galan Lithium (GLN:AU) has announced Incentive Regime for HMW Project in ArgentinaDownload the PDF here. Keep Reading...

24 July 2025

Trading Halt

Galan Lithium (GLN:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00