PERTH, Australia - Oct. 13, 2025 - IsoEnergy Ltd. ("IsoEnergy") (NYSE American: ISOU) (TSX: ISO) and Toro Energy Ltd. ("Toro") (ASX: TOE,OTC:TOEYF) are pleased to announce that they have entered into a scheme implementation deed (the " SID ") pursuant to which, among other things, IsoEnergy has agreed to acquire all of the issued and outstanding ordinary shares of Toro (the " Toro Shares ") 1 by way of a scheme of arrangement under Australia's Corporations Act 2001 (Cth) (the " Transaction " or the " Scheme "), subject to the satisfaction of various conditions. Toro owns 100% of the Wiluna Uranium Project, located 30km south of the town of Wiluna in the northern goldfields of Western Australia (" Wiluna Uranium Project ").

On implementation of the Transaction, the two companies will combine to strengthen IsoEnergy's development pipeline by adding Toro's high-quality, scoping-stage Wiluna Uranium Project in Western Australia to IsoEnergy's existing portfolio, which includes past-producing U.S. mines, the ultra-high-grade Hurricane deposit in Canada's Athabasca Basin and a diversified suite of development and exploration assets across Canada , the U.S. and Australia . Toro shareholders will gain exposure to a larger, more diversified portfolio of high-quality uranium exploration, development and near-term production assets in tier-one jurisdictions in an enlarged, liquid vehicle while retaining direct exposure to the Wiluna Uranium Project and all other Toro assets.

Under the terms of the Transaction, Toro shareholders will receive 0.036 of a common share of IsoEnergy (each whole share, an " ISO Share ") for each Toro Share held on the Scheme record date (the " Exchange Ratio "). Existing shareholders of IsoEnergy and Toro will own approximately 92.9% and 7.1% on a fully-diluted in-the-money basis, respectively, of the outstanding ISO Shares upon implementation of the Transaction. 2

The Exchange Ratio implies consideration of A$0.584 per Toro Share , representing: 3

- a 79.7% premium to the last traded price on the ASX of A$0.325 per Toro Share , on October 10, 2025 ; and

- a 92.2% premium to Toro's 20-day volume weighted average price (" VWAP ") on the ASX as at October 10, 2025 .

The implied fully-diluted in-the-money equity value of the Transaction is equal to approximately A$75.0million ( C$68.1million ). 4

_________________________

1 Other than those held by or on behalf of members of the IsoEnergy Group.

2 Based on a pro-forma fully diluted in-the-money shares outstanding of 62,423,144 of the combined entity.

3 Based on the closing price of the ISO Shares over all Canadian exchanges on October 10, 2025 of C$14.73 and an AUD:CAD exchange rate of 0.9078.

4 Based on a Toro's fully diluted in-the-money shares outstanding of 128,406,848. The implied value is not fixed and depends on the price at which ISO Shares trade.

Strategic Rationale

- Tier One Uranium Portfolio – The combination of IsoEnergy's past-producing U.S. mines, the ultra-high-grade Hurricane deposit in Canada's Athabasca Basin, and multiple development/exploration assets across Canada , the U.S. and Australia with Toro's flagship Wiluna Uranium Project in Western Australia , creates a development-ready platform with significant near-term production potential in stable, mining-friendly jurisdictions. The Wiluna Uranium Project—comprising the Centipede-Millipede, Lake Way and Lake Maitland deposits—is a scoping-level project with mineral resources that complement IsoEnergy's development pipeline.

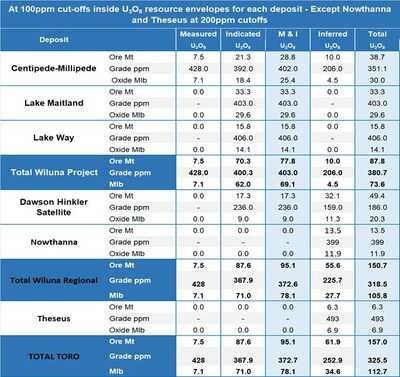

- Significantly Expands and Diversifies Uranium Resource Base – The pro forma company (" Merged Group ") will hold current NI 43-101 compliant resources of 55.2 Mlbs U 3 O 8 M&I and 4.9 Mlbs U 3 O 8 Inferred 5 , and JORC 2012 and 2004 compliant resources of 78.1 Mlbs U 3 O 8 M&I and 34.6 U 3 O 8 Mlbs Inferred 6 (please see the table on page 26 of this announcement for the breakdown of the JORC 2012 and 2004 compliant resources). The Merged Group will also hold historical resources of 154.3 Mlbs U 3 O 8 M&I and 88.2 Mlbs U 3 O 8 Inferred, establishing a robust and geographically diversified resource base 7 . 8

Cautionary statement: The pro forma Merged Group resources include foreign and historical estimates reported by IsoEnergy. These estimates are not reported in accordance with the JORC Code. A competent person has not done sufficient work to classify the historical estimates or foreign estimates as Mineral Resources or Ore Reserves in accordance with the JORC Code. It is uncertain that following evaluation and/or further exploration work that the historical estimates or foreign estimates will be able to be reported as Mineral Resources or Ore Reserves in accordance with the JORC Code. - Strengthens Merged Group's Exposure to Top Uranium Jurisdictions – Wiluna will become IsoEnergy's flagship Australian project. Australia ranks #1 globally for uranium resources and was a Top-5 producer in 2024, supported by strong infrastructure and mining institutions 9 . Western Australia hosts significant undeveloped uranium projects, including Kintyre and Yeelirrie (Cameco) and Mulga Rock (Deep Yellow). Toro shareholders will have exposure to IsoEnergy's significant near-term production potential in stable, mining friendly jurisdictions in Canada and parts of the U.S.

- Well-Timed to Capitalize on Strong Nuclear Market Momentum – The World Nuclear Association's 2025 Fuel Report projects uranium demand to rise ~30% by 2030 and to more than double by 2040. A strengthened resource base and diversified jurisdictional exposure is expected to position IsoEnergy to benefit from rapidly tightening supply/demand outlook.

- Well Placed to Pursue Value Accretive Growth Opportunities – The Merged Group will have significant balance sheet strength and access to capital markets to fund the Merged Group's portfolio including Toro's existing projects.

_____________________________

5 For additional information on the current resources for the Tony M Mine and Larocque East Project see the Tony M Technical Report and the Larocque East Technical Report, respectively. See Disclaimer on IsoEnergy Mineral Resource Estimates below for additional details.

6 Based on updated mineral resource estimates for the Wiluna Uranium Project Deposits of Lake Maitland announced by Toro on September 24, 2024 and Centipede-Millipede and Lake Way announced by Toro on March 7, 2024 , the Dawson Hinkler Satellite Deposit announced by Toro on May 2, 2024 , the Nowthanna Deposit announced by Toro on February 1, 2016 and the Theseus Project, announced by Toro on December 5, 2012 , prepared in accordance with JORC Code 2012, except Theseus which is in accordance with JORC Code 2004. Information contained in this announcement in connection with the Theseus Project was prepared and first disclosed under the JORC Code 2004. It has not been updated since to comply with the JORC Code 2012 on the basis that the information has not materially changed since it was last reported. The JORC Table 1 relevant to all of the Toro resource estimates can be found in Toro's ASX announcement of September 24, 2024 (titled "Significant Expansion Stated Lake Maitland Uranium Resource", except for Theseus, which is found in Toro's ASX announcement of December 5, 2012 (titled "Maiden Inferred Uranium Resource for Toro's Theseus Deposit"). For the purposes of ASX Listing Rule 5.23, Toro confirms that it is not aware of any new information or data that materially affects the information included in those original announcements, and that all material assumptions and technical parameters underpinning the estimates in the original announcements continue to apply and have not materially changed.

7 These mineral resources are considered to be "historical estimates" as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). A Qualified Person has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves and IsoEnergy is not treating the historical estimates as current mineral resources. See Disclaimer on Mineral Resource Estimates below for additional details.

8 Refer to the Pro forma Mineral Resources disclaimer on page 10.

9 World Nuclear Association - https://world-nuclear.org/information-library/nuclear-fuel-cycle/uranium-resources/supply-of-uranium

Philip Williams , CEO and Director of IsoEnergy, commented, "The acquisition of Toro Energy marks another important step in advancing IsoEnergy's strategy to build a globally diversified, development-ready uranium platform. The Wiluna Uranium Project strengthens our portfolio with a large, previously permitted asset in a top-tier jurisdiction at a time when global nuclear demand is accelerating. This transaction positions IsoEnergy to deliver meaningful scale, optionality, and sustained value creation for shareholders. We look forward to welcoming the Toro team, who have done an admirable job stewarding the company and its projects through often challenging markets, to IsoEnergy and advancing the project together."

Richard Homsany , Executive Chairman of Toro, commented, "This Transaction creates significant value for our shareholders, representing a material premium for Toro shareholders of 79.7% to Toro's last traded price and 92.2% to Toro's 20 day VWAP. It also provides Toro shareholders the opportunity to be part of a larger, leading uranium company listed on the TSX and NYSE. Toro shareholders will have exposure to a diverse uranium portfolio that has strong growth potential and is located in favourable regulatory jurisdictions, and the ability to attract enhanced access to funding including for the Wiluna Uranium Project.

The Toro team will benefit from the significant financial strength of ISO and looks forward to working together on the successful development of the Wiluna Uranium Project for all stakeholders."

Anticipated Benefits to IsoEnergy shareholders

- Secures Wiluna Uranium Project, positioned for potential development, pending alignment of government policy with uranium production in Western Australia

- Strengthens ranking among the Australian uranium players, on the basis of potential production capacity, advanced mining assets and resource exposure

- Addition of large scale mineral resource at the scoping study stage with an exploration portfolio hosting additional uranium resources

- Opportunity for re-rating through de-risking near-term potential production and enhancing scale and asset diversification across key jurisdictions in the U.S., Canada and Australia

- Creation of a larger platform with greater scale for M&A, access to capital and liquidity

Anticipated Benefits to Toro shareholders

- Immediate and significant premium of 79.7% to last close and 92.2% based on the respective 20-day VWAPs of both companies, ending on October 10, 2025 10

- Exposure to a larger, more diversified portfolio of high-quality uranium exploration, development and near-term production assets in tier-one jurisdictions of U.S. and Canada

- Entry into the Athabasca Basin, a leading uranium jurisdiction, with the high-grade Hurricane deposit

- Upside from an accelerated path to potential production as well as from synergies with IsoEnergy's other Utah uranium assets

- Toro shareholders will be exposed to geographic project locations within the Merged Group outside of Western Australia including favourable uranium regulatory jurisdictions such as Canada and parts of the U.S.

- Continued exposure to Toro's Wiluna Uranium Project through holding of approximately 7.1% of the outstanding fully diluted in-the-money ISO Shares on closing of the Transaction 11

- A Merged Group backed by corporate and institutional investors of IsoEnergy, including NexGen Energy Ltd., Energy Fuels Inc., Mega Uranium Ltd. and uranium ETFs

- Increased scale expected to provide greater access to capital for project development and on potentially more favourable terms, increased trading liquidity, wider research coverage and greater scale for M&A

Toro IBC Recommendations and Major Shareholders Intentions

Following receipt of an initial, confidential non-binding indicative offer from IsoEnergy, the Toro Board of Directors (the " Toro Board ") established an independent board committee (" Toro IBC "), comprising Richard Homsany and Michel Marier , to consider the proposal. The Toro Board formed the Toro IBC since Richard Patricio (a Toro non-executive director) is also the Chair of the Board of Directors of IsoEnergy.

The Toro IBC, and the Board of Directors of IsoEnergy (with Mr. Patricio abstaining from voting) have each unanimously approved the SID. A copy of the SID is included at Annexure A of this announcement.

The Toro IBC unanimously recommends that Toro shareholders vote in favour of the Scheme in the absence of a superior proposal and subject to the independent expert's report concluding that the Scheme is in the best interests of Toro shareholders (other than IsoEnergy). Subject to the same qualifications, each member of the Toro IBC intends to vote, or procure the voting of, all Toro Shares held or controlled by them in favour of the Scheme. As at the date of this announcement, the Toro IBC collectively has a relevant interest in 1.8% of the Toro Shares on issue.

Substantial shareholder Mega Uranium Ltd. (together with its associate Mega Redport Pty Ltd) (representing 15,226,256 Toro Shares, being 12.7% of all Toro Shares) have provided Toro with a voting intention statement that they each intend to vote in favour of the Scheme, subject to no superior proposal emerging and the independent expert concluding (and continuing to conclude) that the Scheme is in the best interests of Toro shareholders (other than IsoEnergy). 12

As at the date of this announcement IsoEnergy holds 6,000,000 Toro Shares (approximately 4.99% of Toro shares on issue at the date of this announcement).

__________________________

10 Based on the closing price of the ISO Shares on the TSX of $14.73 , a closing price of A$0.325 of Toro Shares on the ASX and an AUD:CAD exchange rate of 0.9078 on October 10, 2025 and a 20-day VWAP for the period ending October 10, 2025 of Toro Shares on the ASX of A$0.304

11 Based on a pro-forma fully diluted in-the-money shares outstanding of 62,423,144 of the combined entity

12 Mega Uranium Ltd and Mega Redport Pty Ltd have each consented to the inclusion of this voting intention statement in this document.

Conditions to completion of the Scheme

Implementation of the Scheme is subject to various conditions, including (among others):

- Approval of Toro shareholders in relation to the Scheme (including approval of more than 50% of the number of Toro shareholders voting and at least 75% of the total votes cast);

- Court approval in relation to the Scheme;

- No formal changes in Western Australian uranium policy to permit uranium mining and/or mining or development of all or any part of the Wiluna Uranium Project;

- All Toro unquoted options having lapsed, been exercised, or cancelled;

- Certain regulatory approvals, including Foreign Investment Review Board of Australia , the Australian Securities Exchange (" ASX "), the Toronto Stock Exchange (the " TSX ") and the NYSE American LLC (" NYSE ");

- An independent expert concluding (and continuing to conclude) that the Scheme is in the best interests of Toro shareholders (other than IsoEnergy); and

- No material adverse change or prescribed occurrences (each as defined in the SID) occurring in relation to either IsoEnergy or Toro and no regulatory restraints.

The SID provides for customary deal protection provisions with respect to Toro, including "no shop" as well as "no talk" and "no due diligence" restrictions (subject to customary exceptions to enable the Toro IBC to comply with its fiduciary and statutory duties), notification obligations and a matching right regime in the event any superior proposal is received by Toro. In addition, the SID provides that, under certain circumstances, IsoEnergy or Toro would be entitled to a break fee which, should either become payable, is approximately A$700,000 . 13

Following implementation of the Transaction, the ISO Shares will continue trading on the TSX and NYSE and Toro will be removed from the official list of ASX. If determined appropriate in the future, IsoEnergy may apply for admission to the official list of ASX, and quotation of the ISO Shares on ASX. Any such listing, if pursued, will be subject to IsoEnergy complying with the rules and policies of the ASX in force at such time. IsoEnergy cautions that no decision has been made to apply for an ASX listing, and that it is not a condition of the Transaction that such a listing be pursued. Approximately 54.7 million ISO Shares are currently outstanding on a non-diluted basis and approximately 58.0 million ISO Shares are currently outstanding on a fully-diluted basis. Upon implementation of the Transaction (assuming no additional issuances of ISO Shares or Toro Shares), there will be approximately 59.2 million ISO Shares outstanding on a non-diluted basis and approximately 62.4 million ISO Shares outstanding on a fully-diluted basis.

Toro option holders who validly exercise their Toro options and are issued Toro Shares prior to the Scheme record date will be entitled to participate in the Scheme. Toro and IsoEnergy propose to enter into option cancellation deeds with holders of unquoted Toro options (all of which are "out-of-the-money" as at the date of this announcement) pursuant to which the options will, subject to (among other things) the Scheme being approved and becoming effective, be cancelled for a cash payment and/or ISO share issuance 14 based on a form of Black-Scholes valuation methodology.

Furthermore, Toro must ensure that all unvested Toro performance rights automatically vest in accordance with their terms upon the Scheme becoming effective and must procure that prior to the Scheme record date, each Toro performance right is converted, such that the relevant Toro performance rights holders are entitled to participate in the Scheme.

________________________________

13 Equivalent to approximately C$635,000 , based on an AUD:CAD exchange rate of 0.9078.

14 Implied price of the ISO share issuance to be subject approval of the TSX

Timetable

Shareholders of Toro will be asked to approve the Scheme at a shareholder meeting which is expected to be held in early 2026.

Full particulars of the Scheme will be provided to Toro shareholders in the Scheme Booklet which will include the Independent Expert Report, the reasons for the Independent Toro Directors' recommendation and an explanatory statement in respect of the Scheme.

It is expected that the Scheme Booklet will be dispatched to Toro shareholders in early 2026. Toro shareholders are not required to take any action at this stage in relation to the Scheme. It is expected that the Transaction will close in first half of 2026, subject to satisfaction of all conditions, including receipt of all necessary approvals.

Advisors

SCP Resource Finance LP is acting as financial advisor to IsoEnergy. Cassels Brock & Blackwell LLP is acting as Canadian legal advisor, Hamilton Locke is acting as Australian legal advisor and Paul, Weiss, Rifkind, Wharton & Garrison LLP as US legal advisor to IsoEnergy.

Canaccord Genuity is acting as financial advisor to Toro. Cardinals Lawyers and Consultants is acting as legal advisor to Toro.

Qualified Person Statement

The scientific and technical information contained in this news release with respect to IsoEnergy was reviewed and approved Dr. Dan Brisbin , P.Geo., IsoEnergy's Vice President, Exploration, who is a "Qualified Person" (as defined in NI 43-101 – Standards of Disclosure for Mineral Projects (" NI 43-101 ")).

Each of the mineral resource estimates in respect of IsoEnergy contained in this news release, except for the Larocque East project and the Tony M mine, are considered to be "historical estimates" as defined under NI 43-101 and are not considered to be current. See "Disclaimer on Historical Mineral Resource Estimates " for additional details.

See " Disclaimer on IsoEnergy Mineral Resource Estimates" and Disclaimer on IsoEnergy Historical Mineral Resource Estimates" below for additional details.

The scientific and technical information contained in this news release with respect to Toro was prepared by Dr. Greg Shirtliff , Geology Manager of Toro, who is a Member of the Australian Institute of Mining and Metallurgy and "Competent Person" as defined Joint Ore Reserves Committee (JORC) 2012 Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Shirtliff consents to the inclusion in this release of the matters based on that information in the form and context in which it appears.

About IsoEnergy

IsoEnergy (NYSE American: ISOU; TSX: ISO) is a leading, globally diversified uranium company with substantial current and historical mineral resources in top uranium mining jurisdictions of Canada , the U.S. and Australia at varying stages of development, providing near-, medium- and long-term leverage to rising uranium prices.

IsoEnergy is currently advancing its Larocque East project in Canada's Athabasca basin, which is home to the Hurricane deposit, boasting the world's highest-grade indicated uranium mineral resource. IsoEnergy also holds a portfolio of permitted past-producing, conventional uranium and vanadium mines in Utah with a toll milling arrangement in place with Energy Fuels. These mines are currently on standby, ready for rapid restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer.

About Toro Energy

Toro Energy Limited (ASX:TOE,OTC:TOEYF) is an ASX listed uranium development and exploration company with projects in Western Australia . Toro is committed to building an energy metals business with the flagship Wiluna Uranium Project as the centrepiece. The Wiluna Uranium Project consists of the Centipede-Millipede, Lake Maitland and Lake Way uranium deposits 30km to the south of the town of Wiluna in Western Australia's northern goldfields.

Toro is committed to safe and sustainable uranium production and has health, safety, environment and community policies in place to underpin this commitment.

No securities regulatory authority has either approved or disapproved of the contents of this news release.

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (collectively, referred to as "forward-looking information"). Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". The forward-looking information includes statements with respect to the consummation and timing of the Transaction; receipt and timing of approval of Toro shareholders with respect to the Transaction; the anticipated benefits of the Transaction to the parties and their respective shareholders; the expected receipt of court, regulatory and other consents and approvals relating to the Transaction; the expected ownership interest of IsoEnergy shareholders and Toro shareholders in the Merged Group; anticipated strategic and growth opportunities for the Merged Group; the successful integration of the businesses of IsoEnergy and Toro; the prospects of each companies' respective projects, including mineral resources estimates and mineralization of each project; the potential for, success of and anticipated timing of commencement of future commercial production at the companies' properties, including expectations with respect to any permitting, development or other work that may be required to bring any of the projects into development or production; increased demand for nuclear power and uranium and the expected impact on the price of uranium; and any other activities, events or developments that the companies expect or anticipate will or may occur in the future.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, assumptions that IsoEnergy and Toro will complete the Transaction in accordance with, and on the timeline contemplated by the terms and conditions of the relevant agreements; that the parties will receive the required shareholder, regulatory, court and stock exchange approvals and will satisfy, in a timely manner, the other conditions to the closing of the Transaction; the accuracy of management's assessment of the effects of the successful completion of the Transaction and that the anticipated benefits of the Transaction will be realized; the anticipated mineralization of IsoEnergy's and Toro's projects being consistent with expectations and the potential benefits from such projects and any upside from such projects; the price of uranium; that general business and economic conditions will not change in a materially adverse manner; that financing will be available if and when needed and on reasonable terms; and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Merged Group's planned activities will be available on reasonable terms and in a timely manner. Although each of IsoEnergy and Toro have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Such statements represent the current views of IsoEnergy and Toro with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by IsoEnergy and Toro, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include, but are not limited to the following: the inability of IsoEnergy and Toro to complete the Transaction; a material adverse change in the timing of and the terms and conditions upon which the Transaction is completed; the inability to satisfy or waive all conditions to closing the Transaction; the failure to obtain shareholder, regulatory, court or stock exchange approvals in connection with the Transaction; the inability of the Merged Group to realize the benefits anticipated from the Transaction and the timing to realize such benefits; the inability of the consolidated entity to realize the benefits anticipated from the Arrangement and the timing to realize such benefits, including the exploration and drilling targets described herein; unanticipated changes in market price for ISO Shares and/or Toro Shares; changes to IsoEnergy's and/or Toro's current and future business plans and the strategic alternatives available thereto; growth prospects and outlook of Toro's business; regulatory determinations and delays; stock market conditions generally; demand, supply and pricing for uranium; and general economic and political conditions in Canada , the United States and other jurisdictions where the applicable party conducts business. Other factors which could materially affect such forward-looking information are described with respect to IsoEnergy in IsoEnergy's annual information form in respect of the year ended December 31, 2024 and other filings with the securities regulators which are available under IsoEnergy's profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov and with respect to Toro at www.asx.com.au . IsoEnergy and Toro do not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Disclaimer on IsoEnergy Mineral Resource Estimates

For additional information regarding IsoEnergy's Tony M Mine, including the current mineral resource estimate, please refer to the Technical Report entitled "Technical Report on the Tony M Mine, Utah, USA – Report for NI 43-101" dated effective September 9, 2022 authored by Mr. Mark B. Mathisen , C.P.G. of SLR Consulting ( Canada ) Ltd. (the " Tony M Technical Report ") , available under IsoEnergy's profile on www.sedarplus.ca . Mr. Mathisen is a "qualified person" under NI 43-101.

For additional information regarding IsoEnergy's Larocque East Project, including the current mineral resource estimate, please refer to the Technical Report entitled "Larocque East project, including the mineral resource estimate, please refer to the Technical Report entitled "Technical Report on the Larocque East Project, Northern Saskatchewan, Canada " dated effective July 8, 2022 , authored by Mr. Mark B. Mathisen , C.P.G. of SLR Consulting ( Canada ) Ltd. (the " Larocque East Technical Report ") , available under IsoEnergy's profile on www.sedarplus.ca . Mr. Mathisen is a "qualified person" under NI 43-101.

Disclaimer on IsoEnergy Historical Mineral Resource Estimates

Each of the mineral resource estimates, except for the Larocque East Project and Tony M, contained in this presentation are considered to be "historical estimates" as defined under NI 43-101, and have been sourced as follows:

- Daneros Mine: Reported by Energy Fuels Inc. in a technical report entitled "Updated Report on the Daneros Mine Project, San Juan County, Utah , U.S.A.", prepared by Douglas C. Peters , C. P. G., of Peters Geosciences, dated March 2, 2018 ;

- Sage Plain Project: Reported by Energy Fuels Inc. in a technical report entitled "Updated Technical Report on Sage Plain Project (Including the Calliham Mine)", prepared by Douglas C. Peters , CPG of Peters Geosciences, dated March 18, 2015 ;

- Coles Hill: reported by Virginia Uranium Holdings Inc. In a technical report entitled "NI43-101 preliminary economic assessment update (revised)", prepared by John I Kyle of Lyntek Incorporated dated August 19, 2013 ;

- Dieter Lake: Dated 2006 and reported by Fission Energy Corp. In a company report entitled "Technical Report on the Dieter Lake Property, Quebec, Canada " dated October 7, 2011 ;

- Matoush: Dated December 7, 2012 and reported by Strateco Resources Inc. in a press release dated December 7, 2012 ;

- Ben Lomond: Dated as of 1982, and reported by Mega Uranium Ltd. In a company report entitled "Technical Report on the Mining Leases Covering the Ben Lomond Uranium-Molybdenum Deposit Queensland, Australia " dated July 16, 2005 .

- Milo Project: Reported by Gmb Resources Ltd. in a scoping study entitled "Milo Project Scoping Study" prepared by Peter Owens and Basile Dean of Mining One Consultants, dated March 6, 2013 .

For the Daneros Mine, as disclosed in the above noted technical report, the historical estimate was prepared by Energy Fuels using a wireframe model of the mineralized zone based on an outside bound of a 0.05% eu3o8 grade cutoff at a minimum thickness of 1 foot. Surface drilling would need to be conducted to confirm resources and connectivity of resources in order to verify the Daneros historical estimate as a current mineral resource.

For the Sage Plain Project, as disclosed in the above noted technical report, the historical estimate was prepared by Peters Geosciences using a modified polygonal method. An exploration program would need to be conducted, including twinning of historical drill holes, in order to verify the Sage Plain historical estimate as a current mineral resource.

For the Coles Hill Project, as disclosed in the above noted revised preliminary economic assessment, the historical estimated was prepared by John I Kyle of Lyntek Incorporated. Twinning of a selection of certain holes would need to be completed along with updating of mining, processing and certain cost estimates in order to verify the Coles Hill Project historical resource estimate as a current mineral resource estimate.

For Dieter Lake, as disclosed in the above noted technical report, the historical estimate was prepared by Davis & Guo using the Thiessen (Voronoi) polygon method. Data constraints used were 200 ppm, 500 ppm, and 1000ppm u3o8 over a minimum of 1 metre thickness. Polygons created had radii of 200 metres. A rock density of 2.67g/cm3 was used. An exploration program would need to be completed, including twinning of historical drill holes, in order to verify the Dieter Lake historical estimate as a current mineral resource.

For Matoush, as disclosed in the above noted press release, the historical estimate was prepared by RPA using block U 3 O 8 grades within a wireframe model that were estimated by ordinary kriging. The historical estimate was estimated at a cut-off grade of 0.1% U 3 O 8 and using an average long-term uranium price of us$75 per pound. Six zones make up the historical estimate at Matoush: am-15, mt-34, mt-22, mt-02, mt-06, and mt-36. Each zone is made up of one or more lenses, most of which strike north (009°) and dip steeply (87°) to the east. Outlines of the mineralized lenses were interpreted on ten-metre spaced vertical sections. Minimum criteria of 0.10% U 3 O 8 over 1.5 m true thickness was used as a guide. An exploration program would need to be conducted, including twinning of historical drill holes, in order to verify the Matoush historical estimate as a current mineral resource.

For Ben Lomond, as disclosed in the above noted technical report, the historical estimate was prepared by the Australian Atomic Energy Commission (AAEC) using a sectional method. The parameters used in the selection of the ore intervals were a minimum true thickness of 0.5 metres and maximum included waste (true thickness) of 5 metres. Resource zones were outlined on 25 metre sections using groups of intersections, isolated intersections were not included. The grades from the composites were area weighted to give the average grade above a threshold of 500 ppm uranium. The area was measured on each 25 metres section to give the tonnage at a bulk density of 2.603. An exploration program would need to be conducted, including twinning of historical drill holes, in order to verify the Ben Lomond historical estimate as a current mineral resource.

For the Milo Project, as disclosed in the above noted scoping study, the historical estimate was prepared by Peter Owens and Basile Dean of Mining One Consultants. An exploration program would need to be conducted, including twinning of a selection of certain holes, along with updating of mining processing and certain cost estimates in order to verify the Milo Project historical resource estimate as a current mineral resource estimate.

In each instance, the historical estimate is reported using the categories of mineral resources and mineral reserves as defined by the Canadian Institute CIM Definition Standards for Mineral Reserves, and mineral reserves at that time, and these "historical estimates" are not considered by IsoEnergy to be current. In each instance, the reliability of the historical estimate is considered reasonable, but a Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource, and neither IsoEnergy nor Toro is treating the historical estimate as a current mineral resource. The historical information provides an indication of the exploration potential of the properties but may not be representative of expected results.

Cautionary Note to United States Investors Regarding Presentation of Mineral Resource Estimates

The mineral resource estimates included in this press release have been prepared in accordance with the requirements of the securities laws in effect in Canada and Australia , as applicable, which differ in certain material respects from the disclosure requirements promulgated by the U.S. Securities and Exchange Commission (the " SEC "). Accordingly, information contained in this press release may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

Pro forma Mineral Resources

This announcement refers to IsoEnergy and Toro having a combined pro forma Mineral Resource estimates of 133.4 Mlbs M&I (+141%) and 39.4 Mlbs Inferred (+704%), along with historical resources of 154.0 Mlbs M&I and 88.0 Mlbs Inferred. This is comprised of the individual Mineral Resource estimates of Toro reported in accordance with the JORC Code 2012 and 2004, and IsoEnergy reported in accordance with NI 43-101. Refer to the Mineral Resource estimates of each entity, confirmation in accordance with ASX Listing Rule 5.23 in respect of Toro on page 2 and page 26), and ASX Listing Rule 5.12 disclosures on behalf of IsoEnergy on page 11).

Competent person disclosures

The information presented here that relates to U 3 O 8 and V 2 O 5 Mineral Resources of Toro Energy's Centipede-Millipede, Lake Way, Lake Maitland, Dawson Hinkler and Nowthanna deposits is based on information compiled by Dr Greg Shirtliff of Toro Energy Limited and Mr Daniel Guibal of Condor Geostats Services Pty Ltd. Mr Guibal takes overall responsibility for the Resource Estimate, and Dr Shirtliff takes responsibility for the integrity of the data supplied for the estimation. Dr Shirtliff is a Member of the Australasian Institute of Mining and Metallurgy (AusIMM) and Mr Guibal is a Fellow of the AusIMM and they have sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity they are undertaking to qualify as Competent Persons as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code 2012)'. The Competent Persons consent to the inclusion in this release of the matters based on the information in the form and context in which it appears.

The information presented here that relates to Mineral Resources of Toro's Theseus Uranium Project is based on work supervised by Michael Andrew , who is a member of the Australian Institute of Mining and Metallurgy of the Australian Institute of Geoscientists. Mr Andrew is an employee of Snowden Optiro, and has sufficient experience which is relevant to the style of mineralisation and type of deposits under consideration and to the activity he is undertaking to qualify as a Competent Persons as defined in the 2004 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Andrew consents to the inclusion in this release of the matters based on his information in the form and context in which it appears.

Mineral Resource Estimates of IsoEnergy

| Project | Location | Country | Category | Tonnes | U ₃ O ₈ grade (%) | contained | | V ₂ O ₅ grade (ppm) | contained |

| Hurricane | Saskatchewan | Canada | Indicated | 0.1 | 34.50 % | 48.6 | | | |

| | | | Inferred | 0.1 | 2.20 % | 2.7 | | | |

| Tony M | Utah | USA | Indicated | 1.1 | 0.28 % | 6.6 | | | |

| | | | Inferred | 0.4 | 0.27 % | 2.2 | | | |

| Sage Plain | Utah | USA | Indicated* | 0.2 | 0.16 % | 0.8 | | 1.3 % | 6.5 |

| | | | Inferred* | 0.0 | 0.13 % | 0.0 | | 0.9 % | 0.2 |

| Daneros | Utah | USA | Indicated* | 0.0 | 0.36 % | 0.1 | | | |

| | | | Inferred* | 0.0 | 0.37 % | 0.1 | | | |

| Ben Lomond | Queensland | Australia | Indicated* | 1.3 | 0.28 % | 8.1 | | | |

| | | | Inferred* | 0.6 | 0.21 % | 2.8 | | | |

| Dieter Lake | Quebec | Canada | Inferred* | 19.3 | 0.06 % | 24.4 | | | |

| Milo | Queensland | Australia | Inferred* | 88.4 | 0.01 % | 14.0 | | | |

| Matoush | Quebec | Canada | Indicated* | 0.6 | 0.95 % | 12.3 | | | |

| | | | Inferred* | 1.7 | 0.44 % | 16.4 | | | |

| Coles Hill | Virginia | USA | Indicated* | 108.5 | 0.06 % | 132.9 | | | |

| | | | Inferred* | 32.9 | 0.04 % | 30.4 | | | |

| | | | | | | | | | |

| Total M&I - 43-101 | | | | 1.1 | | 55.2 | | | - |

| Total Inferred 43-101 | | | | 0.4 | | 4.9 | | | - |

| | | | | | | | | | |

| Total M&I | | | | 111.8 | | 209.5 | | | 6.5 |

| Total Inferred | | | | 143.4 | | 93.1 | | | 0.2 |

| *Includes historical resources | | | | | | | | ||

| | | | | | | | |||

Cautionary statement: The IsoEnergy Mineral Resource estimates comprise foreign and historical estimates for the purposes of the ASX Listing Rules. These estimates are not reported in accordance with the JORC Code. A competent person has not done sufficient work to classify the historical estimates or foreign estimates as Mineral Resources or Ore Reserves in accordance with the JORC Code. It is uncertain that following evaluation and/or further exploration work that the historical estimates or foreign estimates will be able to be reported as Mineral Resources or Ore Reserves in accordance with the JORC Code.

ASX Listing Rule 5.12 disclosures regarding historical and foreign estimates

| Listing Rule | Explanation | Commentary |

| 5.12.1 | The source and date of the historical estimates or foreign estimates. | Milo: Milo Mineral Resource Statement: 22 November 2012 contained in an ASX Announcement by GBM Resources Ltd (ASX:GBZ). |

| Ben Lomond: McKay, A. D., 1982, Ben Lomond Deposit: In Situ Uranium Resource Estimate. Confidential Report of the Australian Atomic Energy Commission Uranium Resource Evaluation Unit.

Vigar, A & Jones, D. 2005 Technical Report on the Mining Leases Covering the Ben Lomond Uranium – Molybdenum Deposit Queensland, Australia. Prepared for Maple Minerals Corporation as a NI-43-101 Report. Available at https://ww.sedarplus.ca. | ||

| Coles Hill: The Coles Hill Mineral Resources are considered to be historic in nature. The most recent Mineral Resource estimate was prepared by Lyntek, Inc. and BRS Engineering in 2013 (Kyle, John I., P. E. and Douglas Beahm, P.E., P.G., 2013; NI 43-101 Preliminary Economic Assessment Update (REVISED), Coles Hill Uranium Property, Pittsylvania County, Virginia, United States of America, and is based upon assay and geologic data collected by the former owner, Marline Oil Co, who drilled out the project between 1979 and 1981. All assays and geotechnical data used to develop the Mineral Resource estimate for the Coles Hill project was generated from that exploration program. | ||

| Tony M: IsoEnergy's Tony M mine project has a Mineral Resource estimate that is current within the context of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Code for Mineral Reserves and Mineral Resources (CIM Code). While the CIM Code is a foreign estimate, its classification of Mineral Resources is similar in most respects to those of the JORC Code. | ||

| Daneros: The Mineral Resource estimate for the Daneros mine project of IsoEnergy is considered to be historic in nature. Historical exploration data used in IsoEnergy's project evaluation was derived from surface rotary and core holes drilled by Utah Power & Light and White Canyon Uranium (collectively 603 drill holes), and underground long holes (583 holes) drilled by Deneson Mines and Energy Fuels. Various Mineral Resource estimates, all of which are historical in nature and not in compliance with the JORC Code in 2009 for White Canyon Uranium and Energy Fuels, Inc. in 2012 and 2018. The data used to prepare those reports was historical exploration drilling data and geologic information from prior mining operations. | ||

| Dieter Lake: The most recent historical, foreign Mineral Resource estimate done for the Dieter Lake project in Northern Quebec is documented in two reports. The first is "2005 Exploration at the Dieter Lake Property, Quebec dated November 3, 2006" by Dahrouge Geological Consulting Ltd. for Strathmore Minerals Corporation which for the first time describes the new resource estimate. This estimate, along with an update on exploration activity from 2007 to 2011, was repeated in "Technical Report on the Dieter Lake Property, Quebec, Canada" dated October 7, 2011", prepared GeoVector Management Inc. for Fission Energy Corp (www.sedarplus.ca). Clinton Davis was an author on both reports. Michael Guo did the 2005 modelling and was a co-author on the 2006 report. Prior to the 2005 estimate, historical resource estimates had been completed in 1981, 1989, and 2004. Davis, C. & Guo, M. (2006). 2005 Exploration at the Dieter Lake Property, Quebec; NI 43-101 Report for Strathmore Minerals Corp, 28 p., with appendices.

Davis, C.F, (2011), Fission Energy Corp, Technical Report on the Dieter Lake Property, Quebec, Canada, NI43-101 Report for Fission Energy Corp, 47 p., with appendices (www.sedarplus.ca). | ||

| Sage Plain: Mineral resources for IsoEnergy's Sage Plain project were estimated by an independent contractor to the project's then current owner, Energy Fuels, Inc. and reported in the "Updated Technical Report on Sage Plain Project (including the Calliham Mine)" dated March 18, 2015 and authored by Douglas C. Peters, CPG of Peters Geosciences. The Technical Report follows the format of NI 43-101, but the author did not identify any Mineral Reserve and Mineral Resource code used to classify the mineralization. Resources were estimated by employing a polygonal method. IsoEnergy considers the Sage Plain resources to be historic in nature. | ||

| Matoush: The most recent historical, foreign Mineral Resource estimate is documented in "Technical Report on the Mineral Resource Update for the Matoush Project, Central Québec, Canada, NI43-101 Report" dated February 15, 2012, prepared by David A. Ross, R. Barry Cook, Normand L. Lecuyer, and Bruce Fielder (Melis Engineering Ltd.) of Roscoe Postle Associates Inc. ("RPA") for Strateco Resources Inc. This report is available on www.sedarplus.ca. The historical, foreign Mineral Resource estimate was further updated by RPA in December 2012, as disclosed in a press release of Strateco dated December 7, 2012, and in Strateco Resources' Annual Information For, dated March 21, 2013 (available on www.sedarplus.ca). RPA updated the Mineral Resource estimate for the Matoush project based on drill results available as at November 22, 2012. | ||

| Hurricane: The most recent foreign Mineral Resource estimate is documented in "Technical Report on the Larocque East Project, Northern Saskatchewan, Canada" for IsoEnergy Ltd. This report was prepared by Mark B. Mathisen of SLR Consulting (Canada) Ltd. ("SLR"). Two versions, both with an effective date of July 8, 2022, are available at www.sedarplus.ca - one with a signature date of July 12, 2022, and an amended version with a signature date of August 4, 2022. It is explained in the amended report that this Technical Report conforms to NI 43-101 Standards of Disclosure for Mineral Projects and replaces the technical report filed on SEDAR on July 19, 2022, which has been revised to correct the typographical error related to the Indicated U3O8 grades in Table 14-11, which summarizes the block model sensitivity to cut-off grade. Additional typographical errors have been corrected to align the descriptions of historical drilling in Section 6 with Table 10-1. The recommended work plan has been revised. | ||

| 5.12.2 | Whether the historical estimates or foreign estimates use categories of mineralisation other than those defined in Appendix 5A (JORC Code) and if so, an explanation of the differences. | Milo: The Inferred resource was calculated in accordance with JORC 2004. |

| Ben Lomond: The Inferred resource used JORC terminology of the time (1982). | ||

| Coles Hill: Estimates of Mineral Resources for the Coles Hill project were prepared in accordance with Canadian National Instrument 43-101 and CIM standards that were in effect at the time that the resource estimate was prepared (2013). The estimate predates the current CIM Standards and CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines, which became effective in November, 2019. IsoEnergy considers the Coles Hill resources to be historical in nature. The use of "Inferred Mineral Resources" and "Indicated Mineral Resources" follow the requirements of the CIM Code. The definitions of such classifications ("Inferred Mineral Resources" and "Indicated Mineral Resources") are similar to those classifications under the JORC Code, and there are no differences in the definitions of "Inferred Mineral Resources" and "Indicated Mineral Resources" between the two Codes. | ||

| Tony M: The "current" Mineral Resource estimate for the Tony M project was prepared in compliance with the CIM Definition Standards for Mineral Resources & Mineral Reserves (2014), CIM Uranium Leading Practice Guidelines (2024) and Canadian National Instrument 43-101. The definitions of Mineral Resource classifications for "Indicated Mineral Resources" and "Inferred Mineral Resources" under the CIM Code are similar to the JORC Code definitions of "Inferred Mineral Resources" and "Indicated Mineral Resources". | ||

| Daneros: Mineral resources for the Daneros Mine project were estimated for former project owner Energy Fuels, Inc. by Douglas C. Peters, CPG and this estimate is contained within the "Updated Report On The Daneros Mine Project, San Juan County, Utah, U. S. A." dated March 2, 2018. Although the resource is considered to be historic, the estimate uses resource classifications that are the same as those of the JORC Code. | ||

| Dieter Lake: The Davis and Guo (2006) report and contained Mineral Resource estimate predate the current CIM Standards (May 2014) and CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines (November 2019), and for IsoEnergy the Mineral Resources are a historical estimate under National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") and a qualified person has not done sufficient work to classify the historical estimate as current Mineral Resources. It is uncertain whether the Inferred resources in the 2006 report would qualify as Inferred resources under JORC standards. | ||

| Sage Plain: Resources estimated and reported in the 2015 Technical Report on the Sage Plain Project" are historical in nature do not appear to be consistent with Mineral Resource codes in effect at the time of the report. | ||

| Matoush: The Ross et al (2012) report and contained Mineral Resource estimate, and the historical, foreign Mineral Resource update in the March 21, 2013 Strateco Resources Annual Information Form predate the current CIM Standards (May 2014) and CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines (November 2019), and for IsoEnergy the Mineral Resources are a historical estimate under National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") and a Competent Person has not done sufficient work to classify the historical estimate as current Mineral Resources. It is uncertain whether the Inferred and Indicated resources in the 2012 report would qualify as Inferred resources under JORC (2012) standards. | ||

| Hurricane: The Mathison (2022) report conforms to NI 43-101 Standards of Disclosure for mineral projects. Foreign mineral resources were classified in accordance with definitions for mineral resources in the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014. The definitions of Mineral Resource classifications for "Indicated Mineral Resources" and "Inferred Mineral Resources" under the CIM Code are similar to the JORC Code definitions of "Indicated Mineral Resources" and "Inferred Mineral Resources". | ||

| 5.12.3 | The relevance and materiality of the historical estimates or foreign estimates to the entity. | Milo, Ben Lomond, Daneros, Dieter Lake, Sage Plain, Matoush, Coles Hill: The estimate is considered relevant however not material in the context of global uranium resources held. |

| Tony M: The Tony M project Mineral Resources are "current" under the CIM Code and are not "historic" in nature. As such they are relevant and are material to IsoEnergy. | ||

| Hurricane: The Mathisen (2022) foreign Mineral Resource estimate, is considered to be both relevant and material to IsoEnergy. | ||

| 5.12.4 | The reliability of historical estimates or foreign estimates, including by reference to any of the criteria in Table 1 of Appendix 5A (JORC Code) which are relevant to understanding the reliability of the historical estimates or foreign estimates. | Milo: The estimates would require some additional work to conform to JORC 2012 however the methodologies for preparing the resource estimates have not changed significantly in comparison to previous reporting. |

| Ben Lomond: The estimate is indicative of the mineralisation present however substantial re-drilling and assaying, down hole surveys and radiometric logging etc would be required to provide a JORC 2012 resource estimate. | ||

| Coles Hill: Although the Coles Hill resource estimate is considered to be an accurate and relevant representation of the nature of the uranium mineralization at the project, additional work, as per the recommendations in the technical report, will be required for the resources to be reclassified as "current" under the CIM Code and the CIM Uranium Leading Practice Guidelines (2024). The existing resource estimate was prepared in accordance with the then-prevailing NI 43-101 and CIM standards, although the drill hole data that forms the basis of the resource estimate had not been confirmed at the time the estimate was prepared. While this estimate predates the current CIM Standards (2014) and CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines (November, 2019), the methodologies for preparing and evaluating the resource estimates have not changed significantly in comparison to those in effect at the time of the most recent estimate (2013). The historical Mineral Resources are considered to be reliable. | ||

| Tony M: The Tony M resources are relevant and reliable in the context of evaluating the project. The resources are "current" and are not historical in nature. | ||

| Daneros: Resources at the Daneros mine are not "current" and are historic in nature. However, they may be relevant to the evaluation of the project and its exploration potential in the future. | ||

| Dieter Lake: The historical, foreign, Inferred resources presented in both the Davis and Guo (2006) and Davis (2011) reports predate the current CIM Standards (May 2014) and CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines (November 2019), and for IsoEnergy the Inferred resources are a historical estimate under National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") and a Competent Person has not done sufficient work to classify the historical estimate as current Mineral Resources. Until this work is done, the reliability of the historical Dieter Lake resource estimate is uncertain. | ||

| Sage Plain: The methodology for resource estimation used for the Sage Plain project is consistent with historical work throughout the central Colorado Plateau uranium region. Polygonal estimation methodology, and the classification of resources and/or reserves derived from such studies have served small underground uranium mining adequately for decades. While local miners are familiar with the classifications and methodologies, they are not appropriate or reliable for IsoEnergy. | ||

| Matoush: The Ross et al (2012) report and contained Mineral Resource estimate, and the historical, foreign Mineral Resource update in the March 21, 2013 Strateco Resources Annual Information Form predate the current CIM Standards (May 2014) and CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines (November 2019), and for IsoEnergy the Mineral Resources are a historical estimate under National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") and a Competent Person has not done sufficient work to classify the historical, foreign estimate as current Mineral Resources. Until this work is done, the reliability of the historical, foreign Mineral Resource estimate is uncertain, and it is uncertain whether the Inferred and Indicated resources in the 2012 report would qualify as Inferred and Indicated resources under JORC (2012) standards. | ||

| Hurricane: The Mathison (2022) report conforms to NI 43-101 Standards of Disclosure for mineral projects. Foreign Mineral Resources were classified in accordance with definitions for Mineral Resources in the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 current CIM Standards (May 2014), and IsoEnergy reports the Mineral Resources as a compliant estimate under National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). | ||

| 5.12.5 | To the extent known, a summary of work programs on which the historical estimates or foreign estimates are based and a summary of the key assumptions, mining and processing parameters and methods used to prepare the historical or foreign estimates. | Milo: The most recent JORC 2004 Mineral Resource estimate was completed for the Milo Project by Kerrin Allwood F.AusIMM and published as a JORC 2004 Resource in 2012 (Allwood.K , Nov, 2012). The Nov, 2012 historical JORC 2004 Resource estimate was calculated for co-incident TREEYO & P2O5 and a copper equivalent resource comprising Au, Ag, Cu, Mo, Co & U. The Milo JORC 2004 estimate block model was generated from 34 drillholes and 9878 samples with a total core length of 11572m, all of which were competed by GBM Resources Ltd (ASX:GBZ) from 2009 to 2012. |

| Ben Lomond: In total 73,151 m of drilling was completed with 63,292 available for the quatoed estimate. ( detailed below ). All holes were radiometrically logged. The data was digitised so that computer analysis including the restitution of logs and the estimation of resources, could be carried out at various cut-off grades.

Drilling 1975-1981 Underground 30 2,797 1982-1984: | ||

| Coles Hill: The Coles Hill uranium deposits were discovered by Marline Oil in 1979 and 1980. Marline conducted a large-scale core drilling program to test their previously identified geophysical, radiometric, and geochemical anomalies at the project site, and this work resulted in the initial definition of the Coles Hill North and South uranium deposits. The Marline core drilling program extended into 1981, and the data generated from that drilling program has served as the basis for all subsequent resource estimations. In 1982 Union Carbide Corporation (later known as Umetco) entered into a joint venture with Marline with the objective of preparing a feasibility study that would lead to the development of the Coles Hill uranium deposits and advance the project to a production status. Mineral resource estimates for the project that are considered to be relevant to the project were prepared utilizing the radiometric and chemical assays derived from the 1979-1981 drilling program of 263 core holes, as well as 3 core holes drilled at the property in 2008. The fundamental assay and geological data for the project was preserved, and a significant portion of the core was stored in covered facilities. Comparison of historical assay data with "check" assays from sampling programs in 2008 and 2013 generally confirmed the validity of the historical data. The Mineral Resource estimate for the project were estimated by BRS Engineering, a Wyoming-based independent minerals exploration and engineering company that has extensive experience in the evaluation of uranium projects. BRS employed radiometric assay data from 264 drill holes to develop the estimate of Mineral Resources at Coles Hill. Drill hole assay data was compiled in Datamine software at an interval of 0.50 feet within a "mineralized envelope" of 0.02% eU3O8 to constrain grade interpolation. A sample composite of 1.0 feet was selected.

The kriging methodology employed optimum block sizes and the optimum number of samples to access in the estimate were determined by a number of test runs on strategically placed blocks in high density and low-density areas in each area. The optimum parameters were determined by observing what produced the best regression slope (R) and kriging efficiency, and the lowest spread in 90% confidence limits, but still retaining the smallest block size relating to the probable future smallest mining unit ("SMU"). These three parameters produced good correlations amongst themselves. Three separate searches were affected, namely 1 times the range of the variogram, 1.5 times the range of the variogram and 2 times the range of the variogram. For the North Coles a minimum of 17 samples and a maximum of 25 samples were deemed to be geostatistically appropriate for the first two searches. The 3rd search was set at a minimum of 8 samples and a maximum of 25 samples. For the South Coles a minimum of 10 samples and a maximum of 20 samples for the first two searches and for the 3rd a minimum of 8 samples and a maximum of 20 samples were deemed to be appropriate (Figures 19 and 21). The search was confined to a specific layer due to the vertical variability of the mineralization and therefore the octant search method was deemed unnecessary. A draft NI 43-101 Preliminary Economic Assessment date (Revised) on the Coles Hill project was prepared for former owner Virginia Energy in 2013 by John Kyle of Lyntek, Inc. and Douglas Beahm, principal Engineer of BRS Engineering, Inc. This study, which is not publicly available, includes data verification information for all of the drill hole information, including assays, as well as summaries of metallurgical testing undertaken by Umetco Minerals, proposed mining methods, metallurgical recovery methods, and proposed project infrastructure. Copies of this report are in IsoEnergy's files. This study of the Coles Hill project included data on mining and mineral processing methodologies in sufficient detail to identify cut-off grade criteria for estimation of Mineral Resources. | ||

| Tony M: The Tony M uranium deposit and several other similar and nearby deposits were discovered in a remote part of southeast Utah in the mid 1970s by Plateau Resources, a subsidiary of a midwestern US electrical utility company. Plateau's discovery was made through wide-spaced exploration drilling in an area of several very small-scale underground mines. The newly discovered deposits were outlined by conventional "open hole" rotary drilling and "spot "coring of potentially economic mineralization within favorable flat lying sandstones. Plateau commenced with the development of a large-scale room and pillar underground mine in 1978. There was limited uranium production from Tony M prior to its shut-down in 1984, but production was restarted for a short period of time in 2007-2008, before being shut down again due to low commodity prices. From the time of discovery to shut-down of mining operations at Tony M a considerable amount of drill data from surface drilling and underground long-hole drilling was collected, and that data, as well as mine operational data and metallurgical recovery information provided a substantial foundation for a new Mineral Resource estimate that was prepared in 2022 by SLR International Corporation. and these data conform to Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects. The report, entitled "Technical Report on the Tony M Mine, Utah, USA Report for NI 43-101" is dated September 9, 2022, and can be viewed via IsoEnergy's profile on the SEDAR Plus web site (accessed 8/11/2025). The resource estimate was based upon the results of 1,678 vertical conventional ("open hole") rotary drill holes, totalling 947,610 feet. One thousand six hundred seventy of the drill holes were completed by former owner of the Tony M mine Plateau Resources and the remainder (eight) were completed by IsoEnergy. The eight IsoEnergy holes were drilled as offsets to holes previously drilled by Plateau in order to confirm the results of the historical drill holes. The holes drilled by IsoEnergy included 2,555 feet of "conventional" open hole rotary drilling and 439 feet of core. All holes were vertical in orientation. Mineral resources at the Tony M project were classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves, dated May 10, 2014, definitions which are incorporated by reference in NI 43-101. SLR estimated the resources using a conventional block modelling approach utilizing the inverse squared (ID2) methodology and length-weighted 1.0- foot uncapped composites to estimate the uranium grades (% eU3O8) in a three-pass approach. The resource estimate was based upon a US$65 per pound uranium price, and a cut-off grade oof 0.14% eU3O8. IsoEnergy is in possession of all of the technical data used to prepare the current Mineral Resource estimate. | ||

| Daneros: The Daneros mine project has been the site for numerous exploration and development activities since the early 1950s. Much of the data from those efforts has been lost or is not accessible to IsoEnergy. Recent mine production and exploration undertaken by IsoEnergy has provided data for evaluation of the project and exploration planning but is not complete enough for a new resource estimate or for updated mine planning. | ||

| Dieter Lake: Based on the Davis and Guo (2006) and Davis (2011) reports, the 2006 historical, foreign Mineral Resource estimate, which is repeated in the 2011 report, used both 2005 drill core resampling data and historic data from 96 drill holes. Resource modelling was also updated in 2005 as part of the evaluation of the data collected during the 2005 exploration program and compared to the existing historical resource model. This estimate used 200 m radius polygons, a minimum cutoff of 200 ppm over 1 metre, and a density of 2.67g/cm 3 . | ||

| Sage Plain: Records of exploration results and uranium production from the Sage Plain project area are generally limited to borehole gamma-ray logs, and drill hole maps of programs carried out periodically, and they have served as the basis for the historical estimates. The historic resource estimates for the Sage Plain project were generally calculated using either a polygonal or circle-tangent modelling method, both of which have been superseded by more applicable geostatistical resource estimation methods. Summaries of historical exploration and mining activities at the Sage Plain project are not available to IsoEnergy. The historical resource estimates do not conform to either the current JORC Code or the CIM Code. | ||

| Matoush: The Ross et al (2012) historical, foreign Mineral Resource estimate in the NI43-101 report dated February 15, 2012 for Strateco Resources utilized drill hole data available as of December 31, 2011 when the Matoush Gemcom database included 515 diamond core holes up to and including hole MT-11-039. Of these, 392 holes representing 175,190 m of drilling are located within the area of resources. The wireframe models representing the mineralized zones are intersected by 150 drill holes. As of December 31, 2011, chemical analyses for all holes had been received. Equivalent U3O8 (eU3O8) values were not used for this resource estimate, as was done in previous resource estimates. A set of cross-sections and plan views were used to construct three-dimensional wireframe models at a cut-off grade of 0.1% U3O8. High-grade values were cut to 9% U3O8 prior to compositing. Outlines of the mineralized lenses were interpreted on ten-metre spaced vertical sections. Minimum criteria of 0.1% U3O8 over 1.5 m true thickness was used as a guide. Narrow intercepts grading 0.05% to 0.1% U3O8 located adjacent to the main mineralized intercept were included. Where necessary, the wireframe intercept was "bulked out" to a minimum of 1.5 m true thickness. Low-grade intercepts were included in the initial wireframe models for zones MT-34 and MT-22. Many of these intercepts were removed by clipping the resource wireframe if below 0.1% U3O8. Some intersections grading 0.05% to 0.1% U3O8 were included in the grade interpolation to preserve continuity and/or maintain a soft boundary. Variogram parameters were interpreted from two-metre composited values. Sample intervals within the wireframe models range from ten centimetres to five metres, and average 70 cm. Assays within the wireframe models were composited to two-metre lengths starting at the first mineralized wireframe boundary from the collar and resetting at each new lens wireframe boundary. Several shorter composites occur at the bottom of the mineralized zone, immediately above where the drill hole exits the wireframe. Partial composites less than 60 cm long were removed from the dataset. Non-assayed intervals were treated as zero grade. Block U3O8 grades within the wireframe models were estimated by ordinary kriging. For density, RPA reviewed results of 945 bulk density measurements made by Strateco technicians using the water immersion method. RPA concluded that smaller samples may have poor accuracy and precision, and therefore elected to use only samples weighing greater than 450 g to calculate the average density of mineralization at 2.6 t/m3. This factor was then used to convert resource volumes to a tonnage. RPA manually classified the Mineral Resources based on drill hole spacing, geology, lens thickness, continuity, and variogram ranges. Most areas of Indicated are supported by 30 m to 40 m drill hole spacing, with some exceptions in areas of thicker and more continuous mineralization where drill hole spacing up to 50 m was included. The drill hole spacing in the AM-15 zone is generally less than 20 m. The MT-34 (Main lens), South lens, and most of the North Lens were classified as Indicated. Although there are some areas of closely spaced drilling in the upper MT-34 (part of AM-15 zone) and South lenses, no blocks were classified as measured because grade and geometrical continuity has not been established to the confidence level required for the measured category.

Several shorter composites occur at the bottom of the mineralized zone, immediately above where the drill hole exits the wireframe. Partial composites less than 60 cm long were removed from the dataset. Non-assayed intervals were treated as zero grade. Block U3O8 grades within the wireframe models were estimated by ordinary kriging. For density, RPA reviewed results of 945 bulk density measurements made by Strateco technicians using the water immersion method. RPA concluded that smaller samples may have poor accuracy and precision and therefore elected to use only samples weighing greater than 450 g to calculate the average density of mineralization at 2.6 t/m3. This factor was then used to convert resource volumes to a tonnage. RPA manually classified the Mineral Resources based on drill hole spacing, geology, lens thickness, continuity, and variogram ranges. Most areas of Indicated are supported by 30 m to 40 m drill hole spacing, with some exceptions in areas of thicker and more continuous mineralization where drill hole spacing up to 50 m was included. The drill hole spacing in the AM-15 zone is generally less than 20 m. The MT-34 (Main lens), South lens, and most of the North Lens were classified as Indicated. Although there are some areas of closely spaced drilling in the upper MT-34 (part of AM-15 zone) and South lenses, no blocks were classified as measured because grade and geometrical continuity has not been established to the confidence level required for the measured category.

In 2012, Strateco Resources carried out an additional 15,000-metres drilling, including some 11,000 metres of definition drilling aimed at outlining the Indicated resource within the boundaries of the new Inferred resource zones. On December 7, 2012, the Strateco Resources announced the results of the latest Matoush project historical, foreign Mineral Resource update by RPA, which showed that the Indicated Mineral Resource had increased since the previous resource estimate, dated February 15, 2012. The update was based on drill results available as of November 22, 2012 and was also published in their March 21, 2013 Annual Information Form which is available on www.sedarplus.ca | ||

| Hurricane: The cut-off date of the Mineral Resource database is March 22, 2022, which represents the date in which all assays were received from IsoEnergy's Winter 2022 drill program. The Hurricane resource database, dated March 22, 2022, includes drill hole collar locations (including dip and azimuth), assay, alteration, geochemical, and lithology data from 106 drill holes totalling 37,875.3 m of drilling completed from 1983 through spring of 2022. A total of 785 samples of the 1,504 in the database were contained within the mineralized uranium wireframes. The wireframe models representing the Hurricane low-grade (LG), medium-grade (MG) and high-Grade (HG) mineralized zones are intersected by 48 of 106 drill holes. Geological interpretations supporting the estimate were generated by SLR and reviewed by IsoEnergy personnel. Wireframe models of mineralized zones were used to constrain the block model grade interpolation process. The models represent grade envelopes using the geological interpretation described above as guidance. The wireframes consisted of a LG domain using a nominal COG of 0.05% U3O8 and a minimum core length of one metre. SLR considers the selection of 0.05% U3O8 to be appropriate for construction of mineralized wireframe outlines, as this value reflects the lowest COG that is expected to be applied for reporting of the Mineral Resources in an underground operating scenario and is consistent with other known deposits in the Athabasca Basin. Sample intervals with assay results less than the nominated COG were included within the mineralized wireframes if the core length was less than two metres or allowed for modelling of grade continuity. Wireframes of the MG and HG domains were created using a grade intercept limit equal to or greater than one metre with a minimum grade of 5% U3O8 and 25% U3O8, respectively, although lower grades were incorporated in places to maintain continuity and to meet a minimum thickness of one metre.

Uranium outliers were capped at 5% U3O8 and 20% U3O8 within the LG and MG domains, resulting in a total of 10 capped assay values. No capping was applied to the HG domain. SLR's QP chose to limit the influence of the higher grade composites by employing spatial restriction in the High Grade domain. SLR used the Leapfrog restrictive search tool "clamp" that reduces the high value to a threshold value once the maximum distance is reached rather than discarding the high grade composite completely. The maximum distance of influence was set to 15 m x 15 m x 1.5 m with a grade x density threshold value of 250 (approximately equivalent to 55% U3O8) in both estimation passes. Composites were created from the capped, raw assay values using the downhole compositing function of Seequent Leapfrog Geo modelling software package. The composite lengths used during interpolation were chosen considering the predominant sampling length, the minimum mining width, style of mineralization, and continuity of grade, and ranged from 0.5 m to 3.0 m within the wireframe models, with 97.2% of the samples taken at 0.5 m intervals. Given this distribution, and considering the width of the mineralization, the SLR QP chose to composite to one metre lengths. Assays within the wireframe domains were composited starting at the first mineralized wireframe boundary from the collar and resetting at each new wireframe boundary. Assays were capped prior to compositing. A small number of unsampled and missing sample intervals were ignored. Residual composites were maintained in the dataset.

SLR generated downhole, omni-directional, and directional variograms using the one metre U3O8 composite values located within the LG and MG mineralized domains. The MG domain variogram was calculated using composites located within MG and HG wireframes to allow for more pairs in the analysis. The variograms were used to support search ellipsoid anisotropy, linear trends observed in the data, and Mineral Resource classification decisions. The downhole variograms suggests a relative nugget effect of approximately 10%. Long range directional variograms were focused in the primary plane of mineralization, which commonly strikes northeast and horizontally across the strike direction. Most ranges were interpreted to be 27 m to 35 m. The uranium grade was used to estimate the density of each sample with the polynomial formula. Densities were then interpolated into the block model to convert mineralized volumes to tonnage and were also used to weight the uranium grades interpolated into each block. All modelling work was carried out using Leapfrog Edge version 2021.2.4 software. The Hurricane block model has 5 m x 2 m x 1 m whole blocks. A regularized whole block approach was used whereby the block was assigned to the domain where its centroid was located. The variables Grade, Density, and Grade x Density were interpolated for U3O8 using the inverse distance cubed (ID3) methodology. Estimation of grades was controlled by mineralized wireframe zones. In order to reproduce the direction of the thin, folded, and faulted domains, SLR employed a variable orientation tool in Leapfrog Edge. The tool allows the search to be locally adjusted to the orientation of the mineralization, which results in improved local grade estimates. SLR used the hanging wall and footwall of each domain to guide the variable direction search.