June 26, 2024

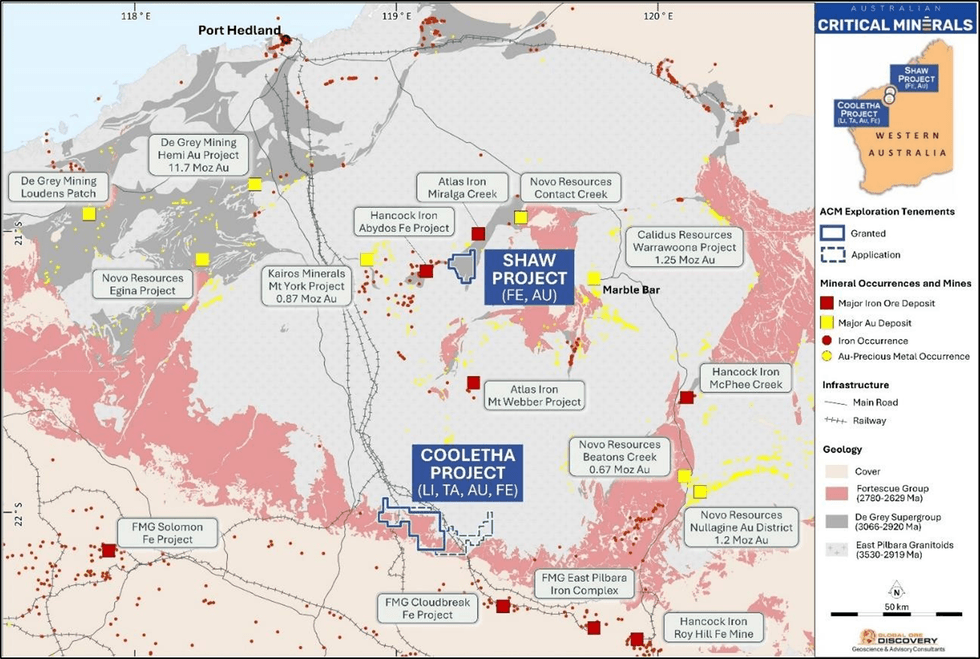

Australian Critical Minerals (ASX: ACM, “Australian Critical Minerals” or “the Company”) a mineral exploration company focused on the exploration and development of critical mineral projects in Western Australia, is pleased to announce the commencement of iron ore exploration on its Pilbara portfolio.

Highlights

- An initial mapping and sampling campaign focused on Iron Ore prospectivity has commenced on the Cooletha and Shaw Projects in the Pilbara, Western Australia

- Objective of the program is to develop drill targets for a follow up field campaign

- ACM’s Pilbara portfolio covers 494km2 and is highly prospective for Iron Ore

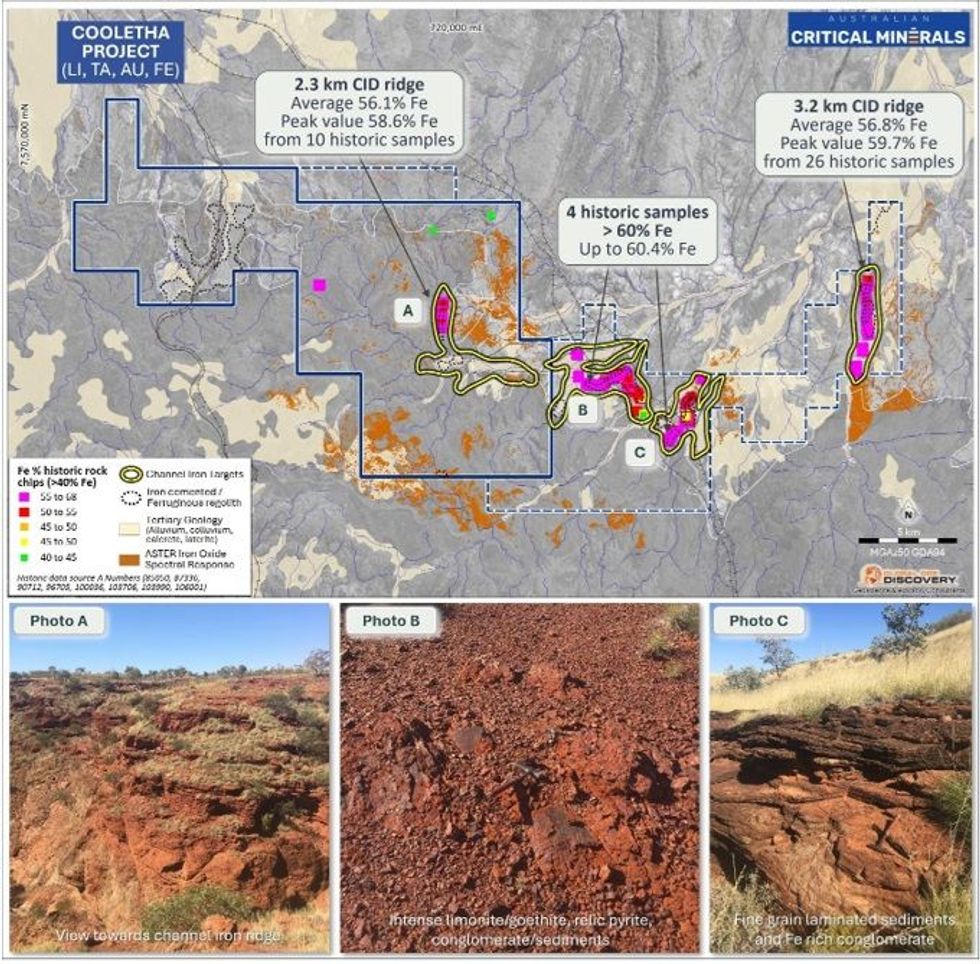

- Over 20km of prospective Channel Iron Deposits (CID), with historical sampling returning an average grade of 56% Fe across various CID ridges at the Cooletha Project

- Over 10km of Banded Iron Formations (BIF) and CID targets will be followed up at the Shaw Project

- Excellent infrastructure including rail and port that currently service established iron ore mines

- Located amongst Iron Ore Giants

- The Shaw Project sits directly south of Atlas Iron’s Miralga Creek Iron Ore Mine and directly east of the Abydos Iron Ore Complex. The Abydos host stratigraphy potentially extends into the Shaw tenement

- The Cooletha Project is located north of FMG’s Cloudbreak Mine and northwest of Hancock Prospecting’s Roy Hill Mine

Cooletha Fe Project

The Cooletha Project, covering over 400 km2 of ground in the Pilbara, is highly prospective for Iron Ore. The Project is located north of Fortescue Metals Group’s (ASX:FMG) Cloudbreak Mine and north west of Hancock Prospecting's Roy Hill Iron Ore Mine (Figure 1).

As sampling work progresses and drill targets are defined at Cooletha and Shaw it is anticipated that the currently known CID areas will be extended and further CIDs may be identified (Figure 2).

An advanced, high-resolution satellite-borne sensor mapping study has been completed and this will guide the current sampling program.

The Cooletha Project has excellent infrastructure with both FMG and Hancock Prospecting’s rail infrastructure transecting the tenements. Once ACM’s CIDs are defined, the Company expects they may be of significant interest to major mining companies given the ease of which exisiting road, rail and port infrastructure can be accessed from Cooletha and Shaw.

Pastoral stations in the Cooletha and Shaw areas provide an excellent base from which ACM will be able to support exploration teams to conduct exploration and drill programs.

Shaw Fe Project

The Shaw Project of almost 100km2 of ground is prospective for Iron Ore in Banded Iron Formation (BIF) and as CID’s (Fig 3). Historic sampling of the BIF at Shaw returned +50% Fe (previously reported in the Company Prospectus 29 June 2023). This BIF unit will be followed up with further sampling in the current program to further identify its size and grade potential. The CIDs in Shaw have not had historic work and provide targets that represent potential substantial upside.

The Shaw Project sits directly south of Atlas Iron’s Miralga Creek Iron Ore Mine and directly east of the Abydos Iron Ore Complex. The Abydos host stratigraphy potentially extends into the Shaw tenements. The proximity of the Shaw project to Miralga Creek offers the scope to discover a Direct Shipping Ore (DSO) resource which may be attractive to Miralga Creek where Atlas have mine plans to develop five open pits to extract 8 million tonnes of Iron Ore over four to five years. 1

The Shaw Project is close to existing infrastructure including rail and is only 100km SSE of Port Hedland. The Miralga Creek to Abydos road passes within 100m of the Shaw tenement boundary. The Miralga Creek mine site is only 6km from the tenement boundary. Miralga Creek is one of three nearby Atlas Iron locations which together reported 100Mt of iron ore production in 2022-2023.

Click here for the full ASX Release

This article includes content from Australian Critical Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

11 November 2025

BHP Invests AU$944 Million in Western Australia Communities

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has released its 2025 Community Development Report for Western Australia, demonstrating a record-breaking investment of AU$944 million. According to the report, a majority of this year’s investment went to local suppliers, with AU$737 million spent. Of this, AU$529... Keep Reading...

02 April 2025

Fortescue's Forrest Hones in on Renewable Energy, Aims to Go Green by 2030

Andrew Forrest, founder and executive chair of major mining company Fortescue (ASX:FMG,OTCQX:FSUMF), has been making headlines following his bold statements on renewable energy.Toward the end of February, the mining tycoon was quoted as saying that Fortescue is quitting fossil fuels. According... Keep Reading...

10 March 2025

Rio Tinto Plans US$1.8 Billion Investment in BS1 Extension, Completes Arcadium Acquisition

Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) made headlines after two announcements on March 6. The mining giant said it will invest US$1.8 billion to develop the Brockman Syncline 1 mine project (BS1), a move that will extend the life of the Brockman region in West Pilbara, Western Australia.BS1 now... Keep Reading...

13 August 2024

Australia's Mining Dilemma: Can ESG Goals and Competitive Production Coexist?

With investors placing increasing value on environmental, social and governance (ESG) issues, mining companies are having to choose between maintaining competitive production and promoting ESG principles. That's the topic explored in an August 8 report from Callum Perry, Solomon Cefai, Alice Li... Keep Reading...

27 February 2020

Rio Tinto to Invest US$1 Billion to Reach Zero Emissions Goal by 2050

Mining giant Rio Tinto (ASX:RIO,LSE:RIO,NYSE:RIO) is set to invest US$1 billion in the next five years to reach its new climate change targets. The company is aiming to reduce emissions intensity by 30 percent and absolute emissions by a further 15 percent from 2018 levels by 2030. “Climate... Keep Reading...

02 January 2020

Iron Outlook 2020: Prices to Stabilize Following Supply Shock

Click here to read the latest iron outlook. Iron ore prices have come off their highest level of 2019, but are still ending on a high note. The year was marked once again by a disaster in the space, with Vale’s (NYSE:VALE) news of a dam collapse in January remaining in the spotlight throughout... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00