July 31, 2024

Antilles Gold Limited (“Antilles Gold” or the “Company”) (ASX: AAU, OTCQB: ANTMF) is pleased to advise results from the first 7 of 25 shallow diamond drill holes in a 2,000m in-fill program on the Nueva Sabana oxide deposit in central Cuba, which was completed in July 2024.

The aim of the program was to increase the Indicated Resources in the Initial Mineral Resource Estimate advised to ASX on 6 March 2024.

HIGHLIGHTS

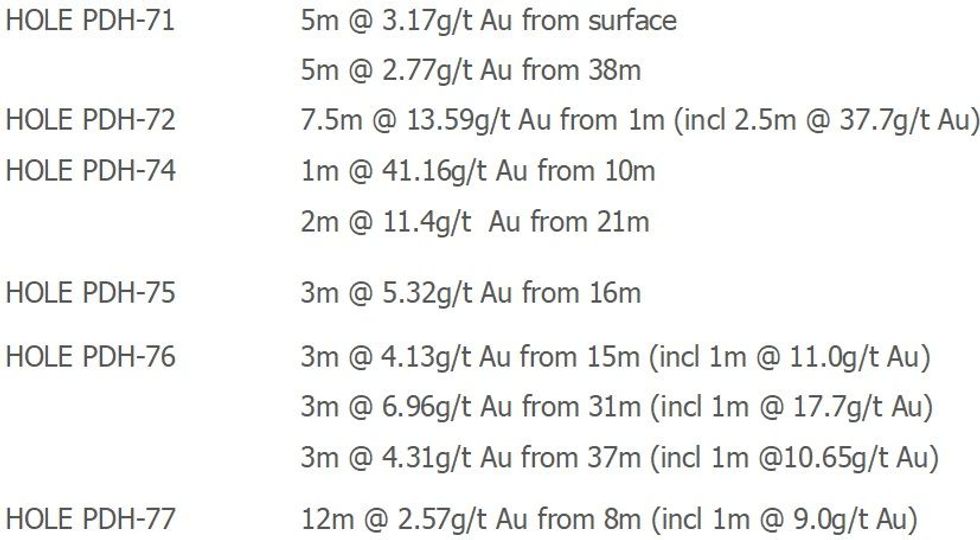

Gold Domain – Nueva Sabana

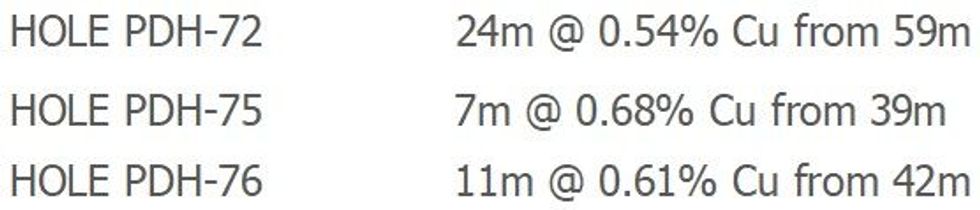

Copper Domain – Nueva Sabana

Sampling Techniques and Data are set out in the JORC Code 2012 Edition Template attached.

NUEVA SABANA GOLD-COPPER MINE

- The in-fill results continue the excellent grades for both gold and copper in the oxide deposit that were incorporated in the Scoping Study for the first stage of the proposed Nueva Sabana gold-copper mine reported to ASX on 7 May 2024.

- Results from the remaining 18 holes are expected by the end of this month.

- An updated Mineral Resource Estimate (“MRE”) for the proposed mine is expected to be completed within two weeks of receiving these results, after which the pit design and mine schedule will be updated, followed by a Pre-Feasibility Study in September 2024.

- The Nueva Sabana oxide deposit is metallurgically simple, and the mine is being planned as a copper project which will benefit from the high-grade gold cap during initial operations.

- Metallurgical test work by Blue Coast Research Laboratories in Canada has indicated a gold recovery of 85% from a simple rougher flotation circuit, and a concentrate of 70.2 g/t Au.

- A copper recovery of 84.5% yielded concentrate grades of 27% Cu from a rougher and cleaner circuit, which has formed the basis of the process design criteria for the Nueva Sabana concentrator.

- Planning and permitting for the proposed mine is well advanced.

- Total development costs are estimated to be ~US$30 million including ~US$5 million of pre- development and concession acquisition costs, and ~US$25 million for mine construction based on quotations for site works, industrial buildings, and a turnkey offer for the design and construction of the concentrator and associated power station.

- The project requires minimal pre-stripping and will not involve the purchase of a mining fleet which is to be hired from the Cuban subsidiary of an international supplier.

- Finance for the mine construction is being negotiated in the form of an advance on concentrate purchases by an international commodities trader.

- The Nueva Sabana project, which is being developed by the 50% owned joint venture company, Minera La Victoria SA, is expected to be development-ready in October 2024.

Click here for the full ASX Release

This article includes content from Antilles Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AAU:AU

The Conversation (0)

23 June 2024

Antilles Gold Limited

Developing Gold and Copper Projects in mineral‐rich Cuba

Developing Gold and Copper Projects in mineral‐rich Cuba Keep Reading...

17 February 2025

Antilles Gold to Raise $1.0M for Working Capital

Antilles Gold Limited (AAU:AU) has announced Antilles Gold to Raise $1.0M for Working CapitalDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Antilles Gold Limited (AAU:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12 January 2025

Summary of Pre-Feasibility Study for Nueva Sabana Mine

Antilles Gold Limited (AAU:AU) has announced Summary of Pre-Feasibility Study for Nueva Sabana MineDownload the PDF here. Keep Reading...

11 December 2024

Revision to Updated Scoping Study Nueva Sabana Mine, Cuba

Antilles Gold Limited (AAU:AU) has announced Revision to Updated Scoping Study Nueva Sabana Mine, CubaDownload the PDF here. Keep Reading...

3h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

3h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

04 March

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00