June 18, 2024

ASX-listed emerging mid-tier gold mining company Horizon Minerals (ASX:HRZ) focuses on a portfolio of highly promising gold projects in the world-class Western Australian goldfields. The company's near-term cash-flow potential and significant land package in the prolific Western Australian Goldfields position the company to positively leverage the current bull gold market opportunity.

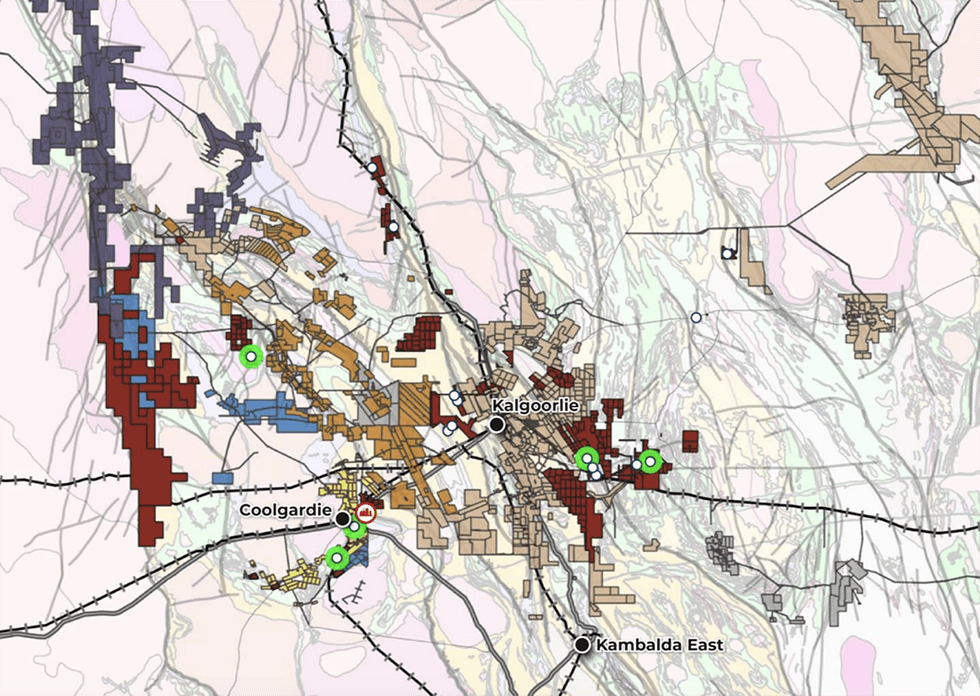

Horizon Minerals' recent merger with Greenstone has added nearly 0.5 million ounces (Moz) of high-grade resource to Horizon, taking its total tally to 1.8 Moz, and will result in Horizon Minerals holding a land package of 939 sq km in the Kalgoorlie-Coolgardie district.

The merger brings near-term cash-generating opportunities and adds greater scale to its baseload assets (Boorara) with the high-grade Burbanks deposit. Horizon’s dual-track strategy involves generating immediate cash flows by leveraging a pipeline of development-ready production assets and concurrently advancing the cornerstone assets, Boorara and Burbanks, which have a combined resource inventory of 914 koz at 1.7 grams per ton (g/t) gold with potential to support a profitable, long-life operation.

Company Highlights

- Horizon Minerals is an emerging mid-tier gold producer with an extensive portfolio of highly promising gold projects located in the world-class Western Australian goldfields.

- The recently announced merger with Greenstone Resources will establish Horizon as a mid-tier gold producer in the Western Australian Goldfields. The combined entity will boast a resource base of 1.8 Moz and enhance Horizon’s portfolio by combining two complementary cornerstone gold assets — Burbanks and Boorara (combined resource of 914,000 oz).

- Horizon is also progressing with other projects, including the Cannon and Penny’s Find underground mines, and bringing the Boorara open pit into production.

- Amidst the current record gold prices, Horizon seeks to capitalize on this opportunity by advancing its substantial resource endowment towards development, thereby generating cash flow.

This Horizon Minerals profile is part of a paid investor education campaign.*

Click here to connect with Horizon Minerals (ASX:HRZ) to receive an Investor Presentation

HRZ:AU

Sign up to get your FREE

Horizon Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

21 August 2025

Horizon Minerals

Emerging stand-alone gold producer in Western Australia

Emerging stand-alone gold producer in Western Australia Keep Reading...

09 March

Gold Mining, Processing and Cash Update

Horizon Minerals (HRZ:AU) has announced Gold Mining, Processing and Cash UpdateDownload the PDF here. Keep Reading...

05 March

Long lead items ordered to fast-track development of BSPH

Horizon Minerals (HRZ:AU) has announced Long lead items ordered to fast-track development of BSPHDownload the PDF here. Keep Reading...

25 February

Share Purchase Plan

Horizon Minerals (HRZ:AU) has announced Share Purchase PlanDownload the PDF here. Keep Reading...

18 February

Successful A$175M Capital Raising

Horizon Minerals (HRZ:AU) has announced Successful A$175M Capital RaisingDownload the PDF here. Keep Reading...

17 February

Studies Support Standalone Gold Development in WA Goldfields

Horizon Minerals (HRZ:AU) has announced Studies Support Standalone Gold Development in WA GoldfieldsDownload the PDF here. Keep Reading...

3h

FOKUS MINING CORP. ANNOUNCES RECEIPT OF INTERIM ORDER AND UPDATE REGARDING PROPOSED ACQUISITION BY GOLD CANDLE LTD.

(All amounts expressed in Canadian Dollars unless otherwise noted)Fokus Mining Corporation ("Fokus" or the "Company") (TSXV: FKM,OTC:FKMCF) (OTCQB: FKMCF) announced today the filing of its management information circular (the "Circular") and related materials for the special meeting (the... Keep Reading...

4h

Visible Gold Intersected at Roy, Sunbeam

First Class Metals PLC ("First Class Metals", "FCM" or the "Company") the UK listed company focused on the discovery of economic metal deposits across its exploration properties in Ontario, Canada, is pleased to provide an update on the ongoing drilling programme at the Roy prospect on the... Keep Reading...

6h

Galway Metals Enters into Letter of Engagement with Eskar Capital Corporation for Investor Relations Services

TORONTO, ON / ACCESS Newswire / March 12, 2026 / Galway Metals Inc. (TSX-V:GWM)(OTCQB:GAYMF) ("Galway Metals" or the "Company") is pleased to announce that it has entered into a six (6) month Capital Markets Advisory Agreement (the "Agreement") with Eskar Capital Corporation ("Eskar Capital"),... Keep Reading...

12h

Peruvian Metals Announces Private Placement

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that it has arranged a non-brokered private placement for gross proceeds of up to $750,000 which will be used to make improvements and additions for expansion to its Aguila Norte processing... Keep Reading...

16h

Additional Strong Assays Results Extend High-Grade Antimony Mineralisation at Oaky Creek

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”) a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce that it has received continued strong assay results... Keep Reading...

11 March

Jeffrey Christian: Gold, Silver Prices to Rise, Risk Highest Since WWII

Jeffrey Christian, managing partner at CPM Group, sees gold and silver prices continuing to rise as global political and economic risks persist. "We look at the world right now and we see a world where the risks and uncertainties are greater now than at any time since Pearl Harbor. December... Keep Reading...

Latest News

Sign up to get your FREE

Horizon Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00