June 15, 2022

Elevate Uranium Limited (“Elevate Uranium”, or the “Company”) (ASX:EL8) (OTCQX:ELVUF) is pleased to provide an update on exploration activities at its Hirabeb Project in the Namib Area of Namibia.

Highlights:

- Hirabeb I – Drilling delineates uranium mineralisation extending over 4 km in length

- Hirabeb II – Drilling delineates anomalous mineralised zone extending over 9 km in length

- Mineralisation remains open along strike to the northeast and southwest

Elevate Uranium’s Managing Director, Murray Hill, commented:

“Exploration activities to date have delineated two large zones of significant uranium mineralisation, named Hirabeb I and Hirabeb II, both of which cover an extensive area. Drilling is currently wide spaced with drill lines 500 metres apart. The results are very encouraging and follow up drill programs are being planned for later this year to reduce the line spacing and confirm the extent of mineralised areas greater than 100 ppm eU3O8, particularly at Hirabeb II.”

Technical Information:

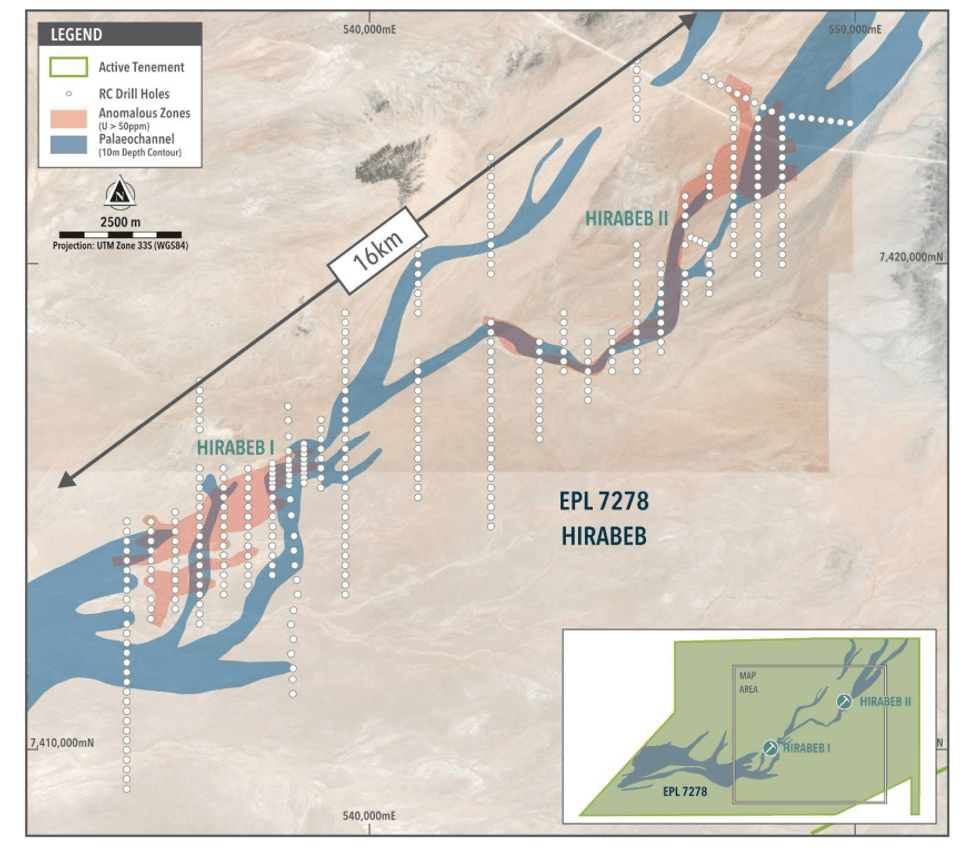

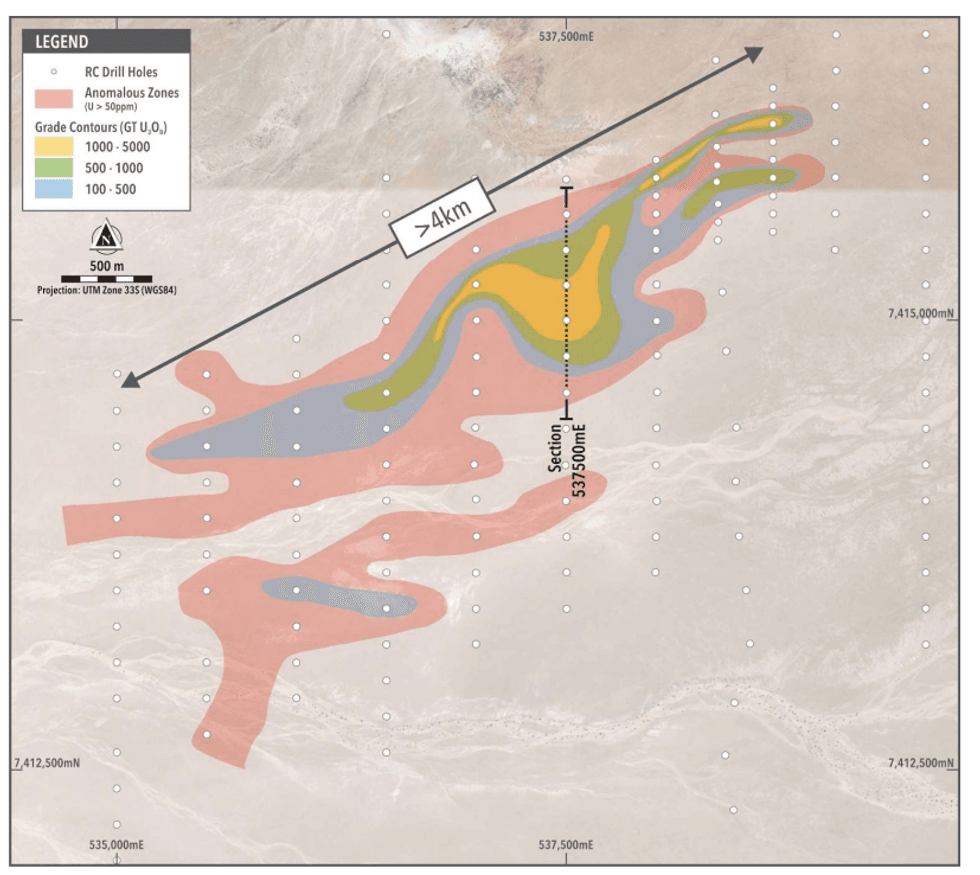

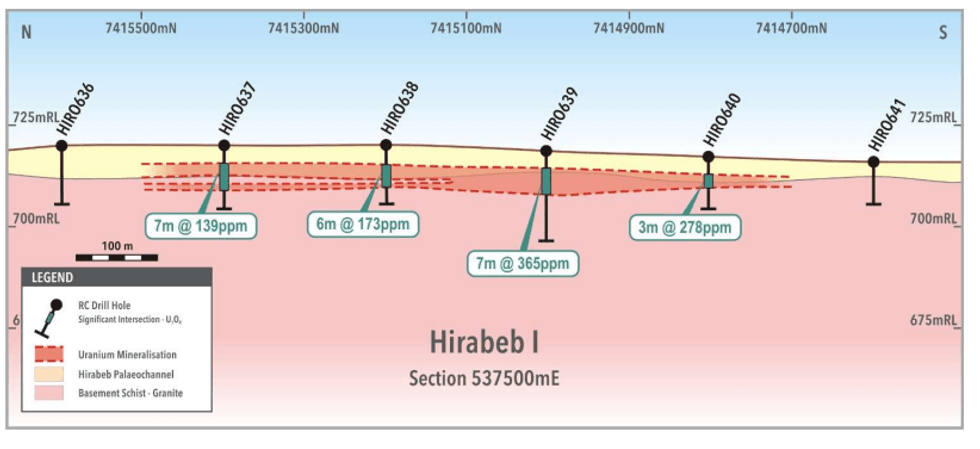

Drilling focused on the central section of the Hirabeb palaeochannel has delineated two significant zones of uranium mineralisation, named Hirabeb I and Hirabeb II (Figure 1) with limited drilling between the two zones. The mineralisation has been identified based on widely spaced drilling, mainly 200 metre spaced holes on drill lines 500 metres apart. Mineralisation at Hirabeb I extends over 4 kilometres along strike and is up to 800 metres wide, with uranium results exceeding 100 ppm eU3O8 varying in thickness from 3 to 7 m on section 537500mE (Figures 2 and 3).

At Hirabeb II, anomalous uranium (>50 ppm eU3O8) is continuous over 9 kilometres of the palaeochannel and remains open in several directions (Figure 1). Grades in excess of 100 ppm eU3O8 have so far been intersected in four areas within this anomalous zone and further exploration drilling is planned to establish continuity between these two zones of mineralisation.

Drilling at the Hirabeb Project subsequent to the initial Hirabeb discovery, see ASX announcement dated 21 July 2020 titled ”Extensive Palaeochannel Discovered in Namibia, Mineralised over 30 Kilometres” totals 341 holes for 4,181 metres at an average hole depth of 12.3 metres. Intersections greater than 100 ppm U3O8 and drill hole information for the recent 341 holes are listed in Tables 1 and 2 respectively.

Drilling to date at the Hirabeb Project totals 686 holes for 8,316 metres at an average hole depth of 12.2 metres (Figure 1).

Further exploration drilling to establish the continuity and extent of mineralisation is planned for later this year.

Click here for the full ASX Release for the full ASX Release

This article includes content from Elevate Uranium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EL8:AU

The Conversation (0)

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

27 January

Standard Uranium CEO Outlines Athabasca Exploration Plans and Uranium Market Outlook

Standard Uranium (TSXV:STND,OTCQB:STTDF) is advancing an ambitious exploration strategy in Saskatchewan’s Athabasca Basin, according to CEO and Chairman Jon Bey, who spoke with the Investing News Network at the 2026 Vancouver Resource Investment Conference.The company is preparing for a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00