September 25, 2024

Gladiator Resources Ltd (ASX: GLA) (Gladiator or the Company) is pleased to provide an update on its ongoing exploration activity at the Mkuju Uranium Project, located in southern Tanzania.

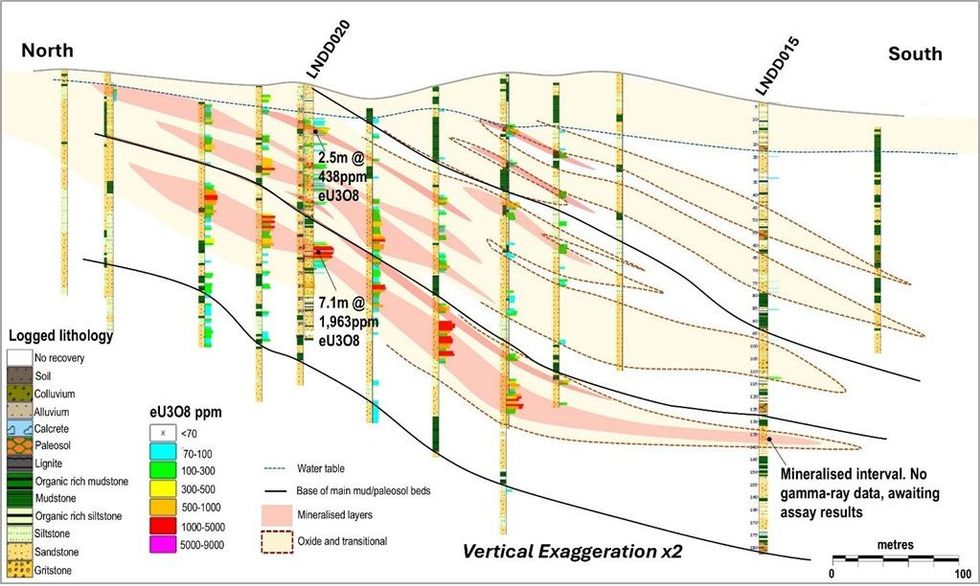

- Drill-hole LNDD020 drilled at the Likuyu North deposit, part of the Mkuju Project, returns 6 mineralised intervals including 7.1 metres averaging 1,963ppm eU3O81, from 63.1 metres depth. This hole was drilled central to the deposit to provide core for an assessment of In Situ Recovery (ISR) of the uranium.

- ISR is the preferred method for mining uranium deposits. ERM Australia Consultants Pty Ltd (ERM) are undertaking an initial ISR assessment for Likuyu North.

- Drill-hole LNDD015 down-dip of the deposit has a ~5m mineralised interval; samples have been dispatched to the lab. This interval is 100m south of the current Mineral Resource Estimate (MRE).

- The 2022 JORC compliant MRE for Likuyu North (4.6 Mlbs U3O8) was based on a pit- shell assuming conventional open-pit mining methods; adoption of ISR may support expansion of it.

Commenting on the drill results, Gladiator’s Chairman Greg Johnson said:

“Drillhole LNDD020 demonstrates the quality of the Likuyu North deposit, and we are excited by the potential opportunity the area provides. Grade and other characteristics appear to be well-suited to ISR. With that in mind, Gladiator has appointed ERM (formerly CSA Global) to help advance this strategy, and if the ISR study is encouraging the Company will consider larger-scale exploration at Likuyu North, Likuyu South and at the Mtonya deposit area, with an aim of maximizing the resource available for a potential ISR operation”.

Drillhole LNDD020

This hole was drilled to provide fresh drill-core to assist with initial assessment of the potential of ISR as a mining method for the Likuyu North deposit. The deposit has a JORC compliant Mineral Resource Estimate of 4.6Mlbs U3O8 with an average grade of 267ppm U3O8. The hole was positioned in an area relatively central to the deposit known to have thick and high-grade mineralisation, hosted by medium to coarse grained sandstone beds. Figure 1 is a cross-section and shows LNDD020. The hole contains 6 mineralised intervals (Table 2) including:

- 2.5 metres with an average grade of 438 ppm eU3O8 from 17.1m depth.

- 7.1 metres with an average grade of 1,963 ppm eU3O8 from 63.1m depth.

Click here for the full ASX Release

This article includes content from Gladiator Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLA:AU

The Conversation (0)

29 May 2024

Gladiator Resources

Capitalizing on the uranium momentum with prolific assets in Tanzania

Capitalizing on the uranium momentum with prolific assets in Tanzania Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00