July 03, 2023

Ora Gold Limited (“Ora” or the “Company”, ASX: OAU) is pleased to announce a high- grade gold intercept from the first drill core at the Crown Prince South-East Extension (M51/886).

Highlights:

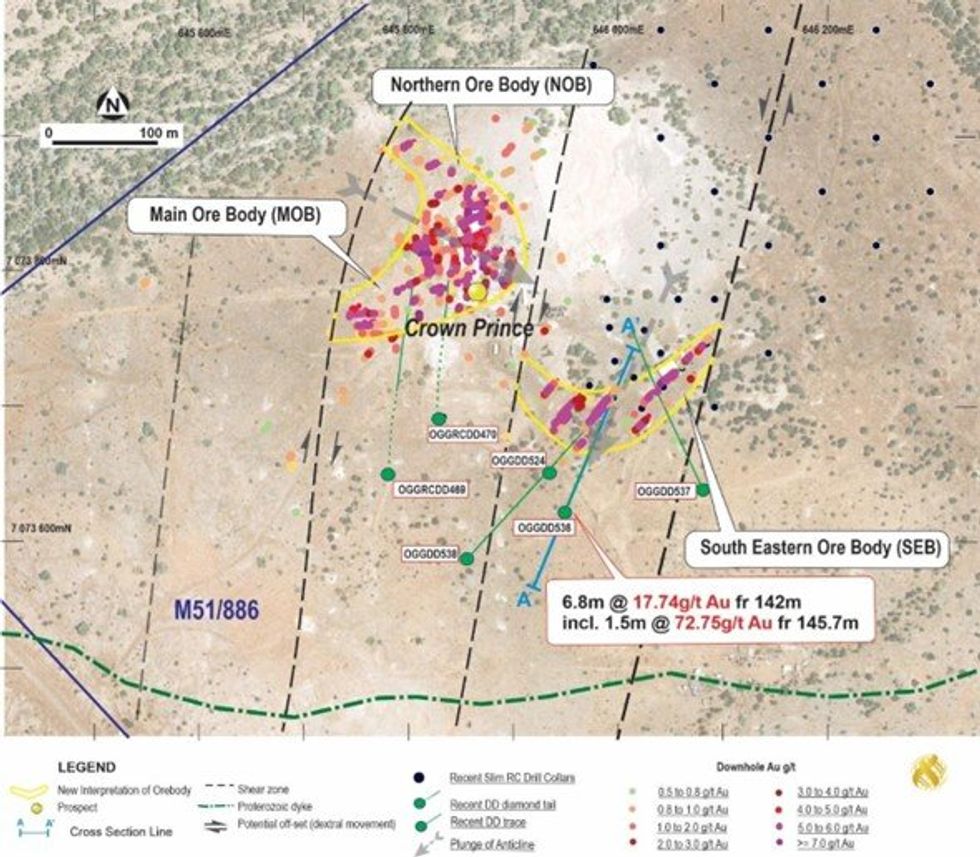

- High grade gold results returned from the first diamond drilling at the South- Eastern Ore Body (SEB) of Crown Prince Gold Prospect. This intercept returned from the hinge zone of the newly delineated SEB anticline hosting the main CVX Lode.

- The intersection indicates that the high-grade gold mineralization remains open below 150m. The lode is folded, plunging to the SSW and consists of quartz- carbonate-chlorite-sericite with sporadic veinlets of pyrite, arsenopyrite, pyrrhotite and traces of galena. The intercept from OGGDD536 includes:

6.8m @ 17.74g/t Au from 142m incl. 1.5m @ 72.75g/t Au from 145.7m - RC Drilling to further delineate the SEB mineralisation between 100m and 300m vertical depth is ongoing. Results to be incorporated into an updated resource model.

The Crown Prince south-east extension (SEB) continues to develop as a key growth area for gold resources at the prospect.

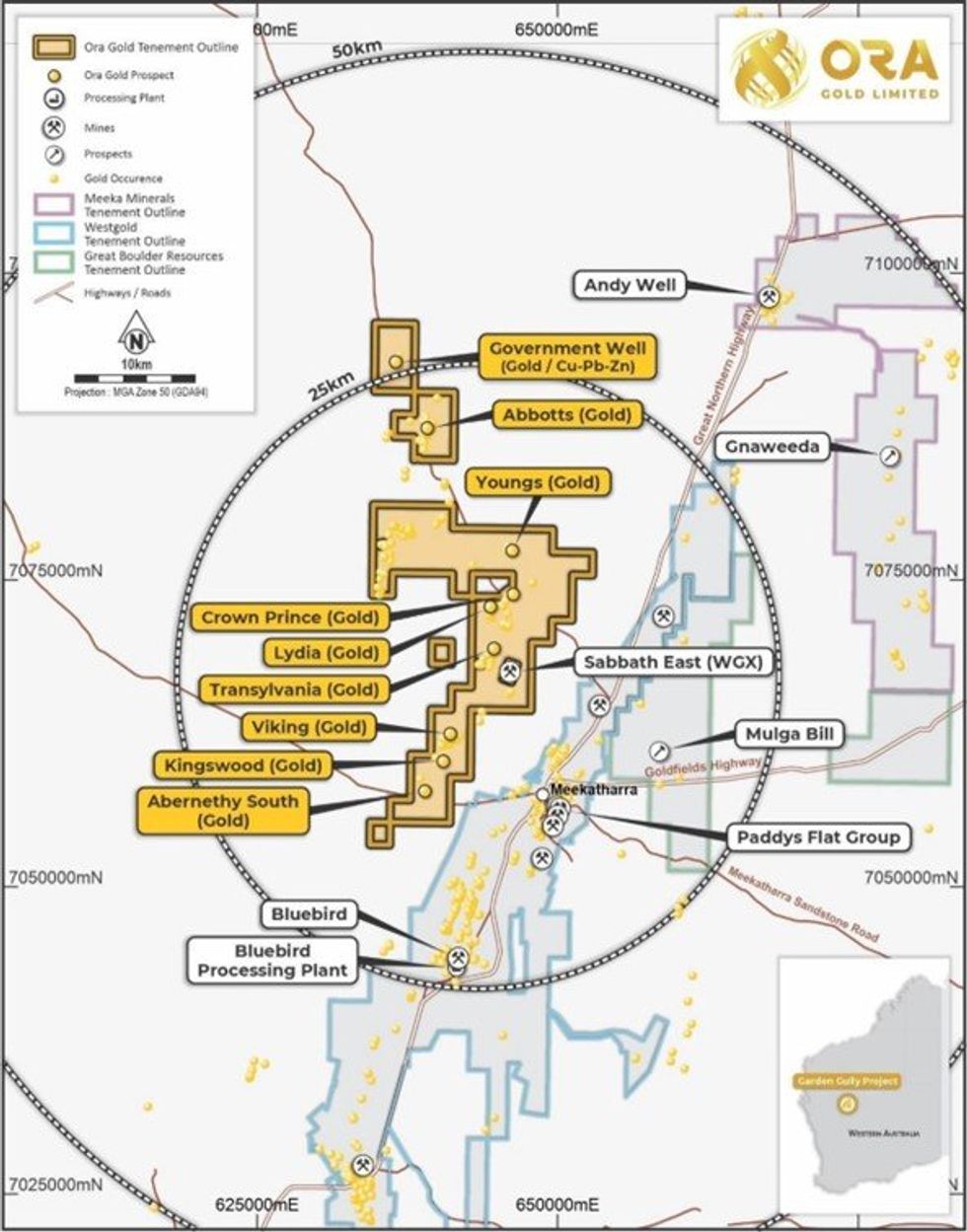

The Crown Prince Prospect is a high-grade gold deposit within Ora Gold’s Garden Gully Project. Crown Prince is located 22km north-west of Meekatharra in Western Australia via the Great Northern Highway and the Mt Clere Road (Figure 1).

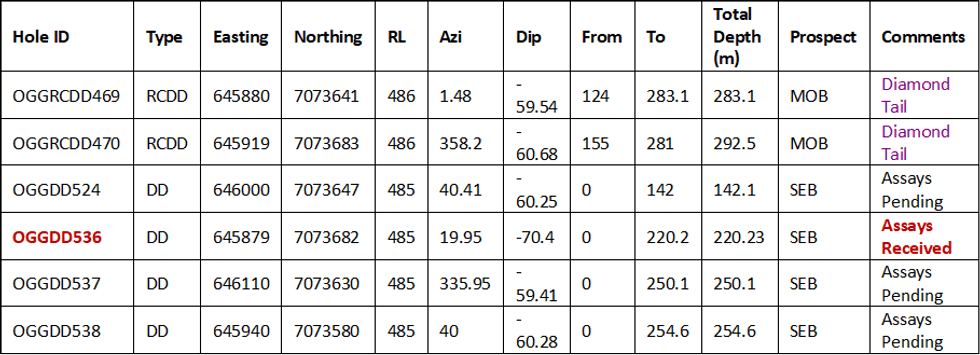

Assay results from one diamond drill hole have been returned (Table 1, Appendix 1 & Figures 2-3). Core samples from another three holes have been delivered to Perth and the assays are pending.

The results in this release indicate the new down-dip extension of high-grade at SEB and support the new structural interpretation for mineralized shoots at Crown Prince (Figure 2). Mineralized envelopes are contorted and folded between northerly trending shears. MOB mineralization occurs in a steep south-east plunging anticline. SEB mineralization is hosted within a steep south westerly plunging anticline. The two zones are separated by a northerly trending shear zone (Figure2).

All hole details and sampling information are included in Table 1. Assay results received to date with more than 0.1ppm Au are included in Appendix 1.

South-Eastern Ore Body (SEB)

Exceptional high-grade gold intercepts have been recently reported on ASX release dated 28 June 2023. They included:

- 40m @ 17.53g/t Au from 30m incl. 19m @ 36.8g/t Au from 35m in OGGRC488

- 16m @ 35.77g/t Au from 28m and 3m @ 20.38g/t Au from 10m in OGGRC489

- 13m @ 21.9g/t Au from 32m and 9m @ 6.22g/t Au from 57m in OGGRC490

- 12m @ 9.73g/t Au from 6m in OGGRC483

- 21m @ 2.53g/t Au from surface in OGGRC502 and

- 25m @ 2.00g/t Au from 3m in OGGRC491

The first diamond intersection was obtained along the south-westerly plunge of the anticlinal hinge of the SEB and opens the deep potential of the CVX lode, which has delivered to date the most consistent high-grade gold intercepts (Figures 2-3 and Photo 1).

Click here for the full ASX Release

This article includes content from Ora Gold Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00