January 12, 2025

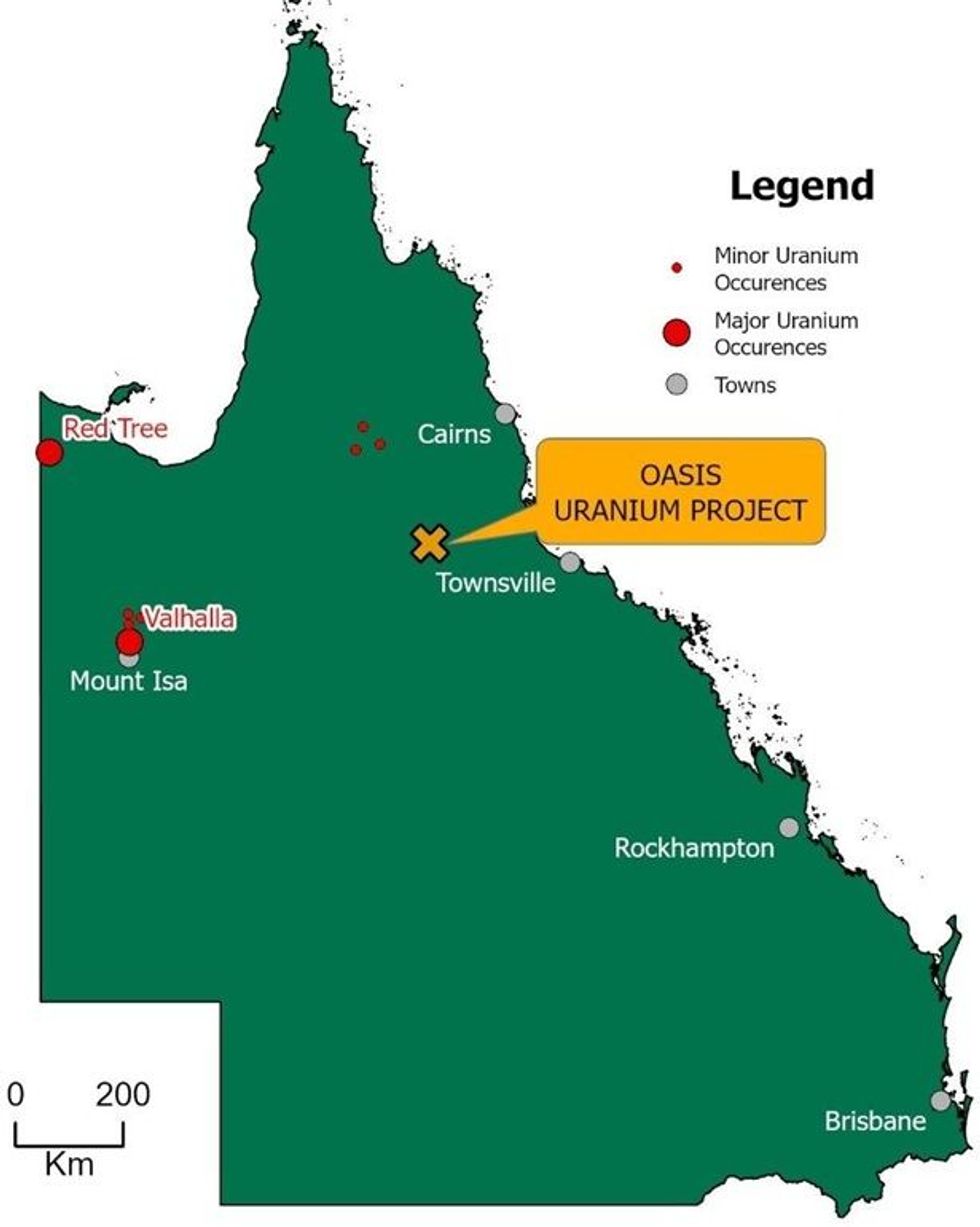

Greenvale Energy Ltd (ASX: GRV, “Greenvale” or “the Company”) is pleased to advise it has acquired a 100% interest in the advanced high grade Oasis Uranium project. The Oasis deposit and associated regional uranium anomalism are contained with EPM 27565 which cover 53 subblocks over an area of 90 km2 and located 250 km west of Townsville and 50 km west of Greenvale in FNQ (Figure 1). The project area is located entirely within the Lynd Station pastoral land. The company has acquired the 100% interest from the vendors Maverick Exploration Pty Ltd, Remlain Pty Ltd and Mineral Intelligence Pty Ltd (equal 1/3 each interest) for a consideration of $200,000 cash and the issue of 20 million Greenvale shares.

Oasis was discovered during the 1970s uranium exploration push by International companies , most notably Esso whose subsequent work (1977-1979) defined high priority targets with only the Oasis deposit drill tested to date Oasis occurs along a structure associated with a major crustal terrane boundary. (Lynd Mylonite Zone). The metamorphic host rocks, voluminous granite and leucogranite and deformation history share many of the characteristics that can be interpreted as Intrusive (Alaskite) style of uranium mineralisation . This is an exciting possibility, if further exploration continues to strengthen the analogy with world class uranium mines like the Rossing, Namibia.

Highlights:

- Greenvale acquires 100% interest in EPM 27565, covering 90 km2 of fault bound alkaline intrusive and metamorphic terrane which includes the high grade Oasis uranium deposit and 8 additional high priority uranium targets

- Airborne radiometric uranium anomalies were located by Anglo American in 1973, Esso completed major on ground work 1977-1979 1nd drilled 46 holes (32 diamond, 14 percussion) for a total of 4755 m. Esso defined high grade primary uranium mineralisation over a 300m strike length and 200m vertical depth. Mineralisation remains open at depth and possibly along strike.

- Four due diligence diamond drill holes completed in 2006 by Glengarry Resources validated the historic Esso data and confirmed continuous high grade mineralisation with intercepts up to 1m @ 0.72% U3O8 (15.8 lbs/t).

- Oasis shear is interpreted to extend undercover for another 1.5Km to the north and remains untested for extensions to mineralisation.

- Historical radiometric and magnetic data identified large zones of structurally controlled anomalism which remain untested by drilling

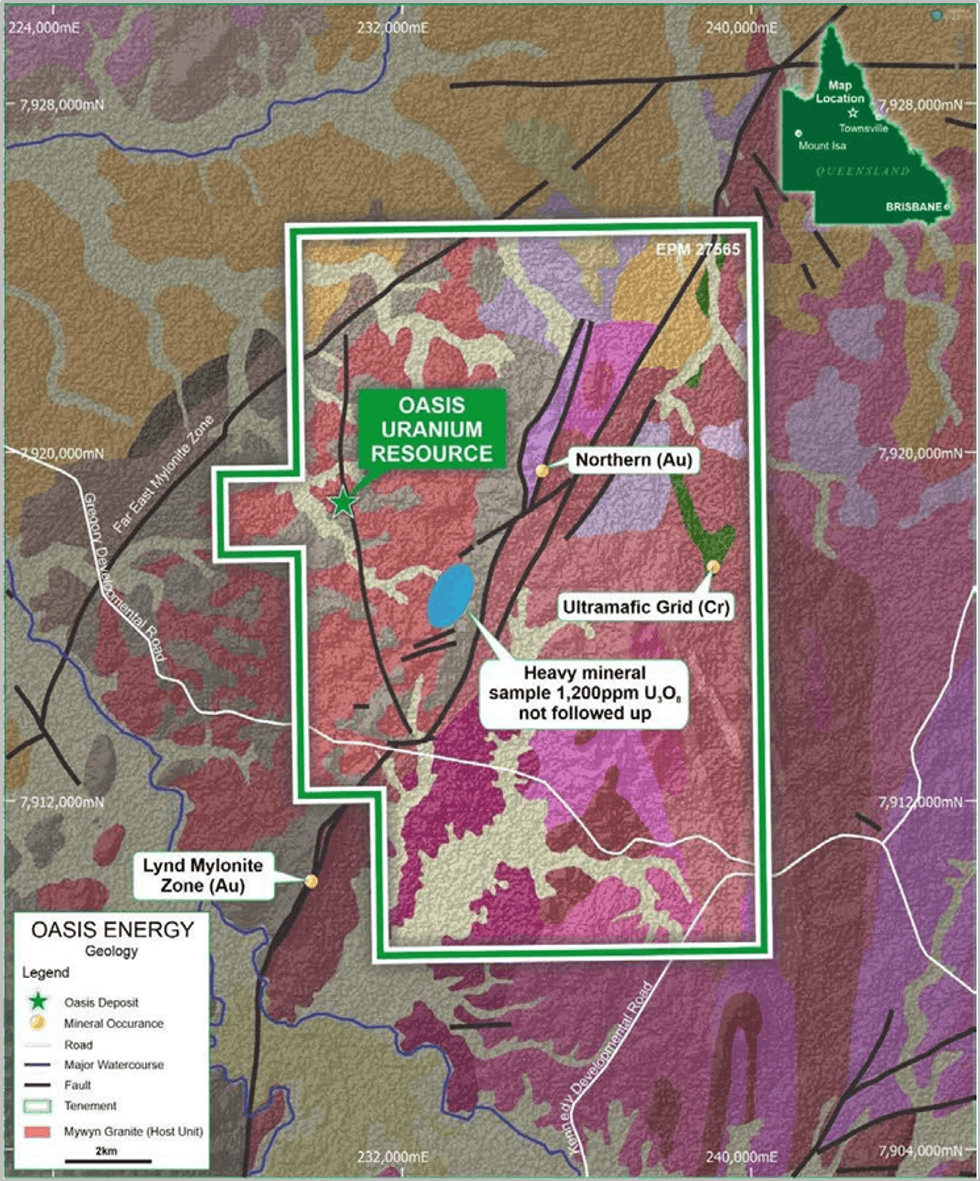

- Most recently Terra Search Pty Ltd reprocessed and interpreted the historic geophysical data identifying 9 priority Uranium anomalies over a 10km strike length adjacent to ,, and apparently emanating from the major terrane boundary delineated as the Lynd Mylonite Zone.

- Geoscience Australia (GA) have age dated Oasis Uraninite and associated alteration sericite which has determined a mineralisation age of 433 +/-4 Ma. This Silurian date coincides the uranium mineralisation with the major period of felsic plutonism present across the region. It also strengthens the association of the intrusive bodies of the age in the area which are the likely drivers of the U mineralization. The recording of alaskite intrusives of similar age , along with other features such as the mineralisation occurring in shear hosted structural niches within tightly folded high grade metamorphism associated with chlorite- biotite alteration, again strengthens the intrusive related ”Alaskite mineralization style” analogy.

- This latter point could be highly significant as Alaskites account for around 10% of global Uranium reserves and are generally large, moderate grade deposits, the most striking example being Rossing, Namibia.

The acquisition of Oasis adds considerable weight to Greenvale’s portfolio of Uranium exploration projects and is expected to be rapidly upgraded to resource status during the 2025 exploration season.

Project Geology and Mineralisation

Geology within EPM 27565 is dominated by structurally complex mixture of intrusive granitic and metamorphic rocks of Proterozoic, , Ordovician and Silurian Age with recent age dating of uraninite from the Oasis deposit recording a Silurian age. The Lynd Mylonite Zone is a dominant structural feature which strikes north north-east through the centre of the exploration permit. Multiple faults and fractures splaying off the western side of the mylonite appear to control the distribution of extensive zones of uranium anomalism including the Oasis deposit. The granitic-metamorphic terrane hosting the uranium mineralisation is bounded 10km’s to the east by the Far East Mylonite Zone which strikes parallel to the Lynd Mylonite Zone

Previous Exploration

Uranium potential was first identified by Aust Anglo American in 1973-74 from airborne radiometrics followed up by ground radiometrics, mapping and trenching. Three clusters of anomalies were identified on the western side of the Lynd Mylonite Zone including the Oasis anomaly. From 1977-1979 Esso Minerals conducted ground radiometrics, mapping and auger drilling prior to completing 34 diamond drill holes and 14 percussion holes at the Oasis prospect. Esso drilling defined a continuous zone of high grade mineralisation of varying thickness over a 300m strike length and 200m vertical depth (Table 1). The mineralisation remained open along strike and at depth. No further work was undertaken at oasis or other prospects.

Click here for the full ASX Release

This article includes content from Greenvale Energy Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Greenvale Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

27 May 2025

Greenvale Energy

Strategic exploration of prospective uranium assets in Queensland and the Northern Territory

Strategic exploration of prospective uranium assets in Queensland and the Northern Territory Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Sign up to get your FREE

Greenvale Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00