January 19, 2025

After consultation with ASX, European Lithium Ltd (ASX: EUR, FRA:PF8, OTC: EULIF) (European Lithium or the Company) is now releasing the 1st drill results from the Tanbreez Project (7.5% owned by EUR), that was previously announced by Critical Metals Corp on the NASDAQ on the 26th of November 2024 and the 9th of December 2024.

European Lithium Limited is pleased to announce that it has received the results for the first out of sixteen diamond drill holes from its confirmation drilling program at the Tanbreez Project in Greenland containing high-grade rare-earth and rare metal elements.

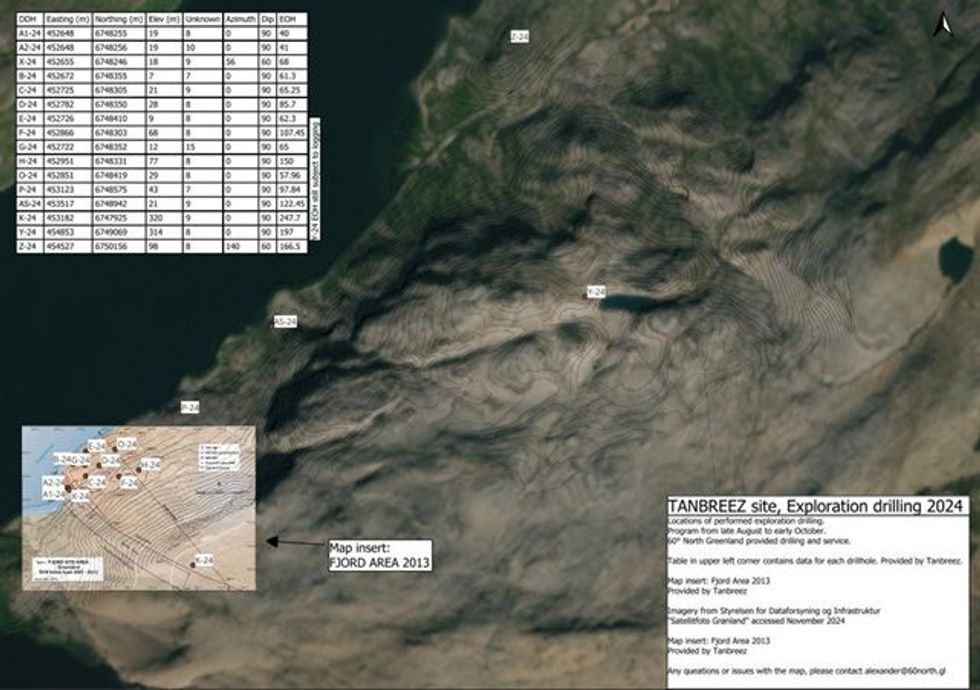

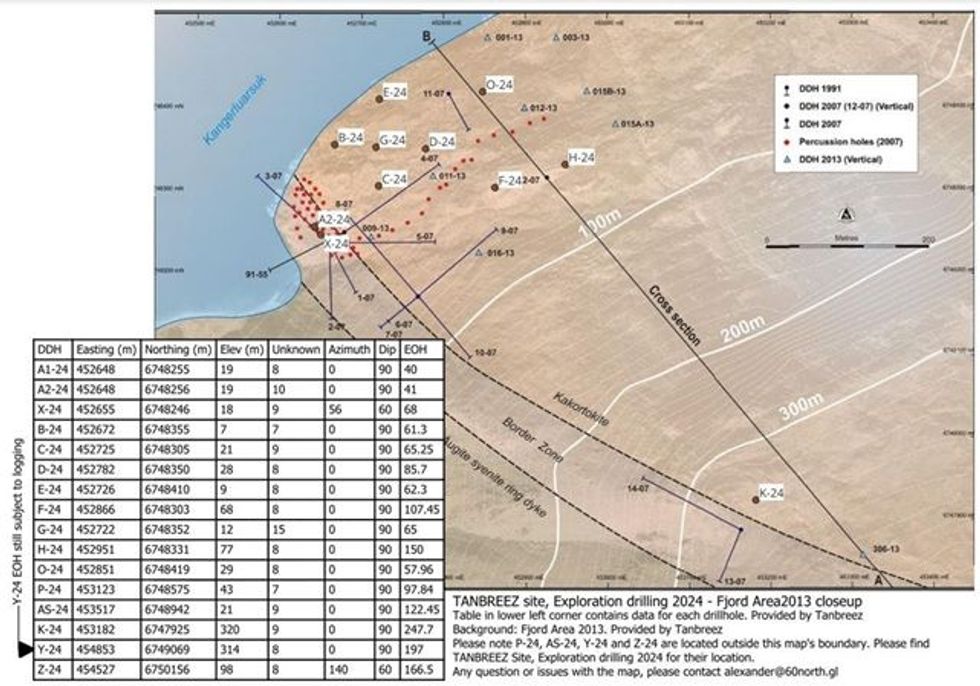

The drill program executed in September-October 2024 comprised sixteen holes with samples from the first hole having now been received back from the laboratory.

The Tanbreez mineralization is contained within a highly fractionated Zr-Nb-Ta- REE, including HREE, in the southern part of the Ilimaussaq intrusive complex in South Greenland. The Ilimaussaq intrusion is possibly the most differentiated deposit known globally to date, covering a potential area of approximately18 km long and 8 km wide, and of significant depth, that covers a portion of the Tanbreez tenement.

The commodities are hosted in the mineral eudialyte being concentrated in the kakortokite rock layer at the floor of the exposed intrusion. The kakortokite sequence is outcropping over an area of approximately 5.0 km by 2.5 km and has a total thickness of 270 m.

The assays from the first drill hole confirm a significant 40 m wide intersection from surface of high- grade rare-earth oxide averaging 4,722.51 ppm TREO (including 26.96% averaged heavy rare earth” HREO”), 1.82% ZrO2 “zircon oxide”, 130.92 ppm Ta2O “tantalum pentoxide”, 1852.22 ppm Nb2O5 “niobium pentoxide”, 393.68 ppm HfO2 “hafnium oxide” and 101.67 ppm Ga2O3 “gallium oxide” (See Appendix 1 Sample and assay sheet and Appendix 2 Drill hole collars)

Commenting on the assay results, Tony Sage, Executive Chairman of the Company, said:

”I am pleased to report the outstanding assay results from the first hole confirming the high-grade, high-tonnage and high-quality potential that Tanbreez brings to EUR and Critical Metals Corp. The company is pleased to announce that its first confirmation drill hole has yielded the high-grade percentage of light earth and heavy rare earth ratios with strong tantalum, niobium, and gallium results. We are excited by the scale of the thick source rock only 40 meters from the surface containing the mineralized high-grade intersection within the first drill hole”.

About European Lithium

European Lithium Limited is an exploration and development stage mining company focused mainly on lithium in Austria, Ireland, Ukraine, and Australia.

European Lithium currently holds 66,416,641 (74.34%) ordinary shares in Critical Metals. Based on the closing share price of Critical Metals being US$8.50 per share as of 17 January 2025, the Company’s current investment in Critical Metals is valued at US$564,541,448 (A$908,911,732) noting that this valuation is subject to fluctuation in the share price of Critical Metals.

For more information, please visit https://europeanlithium.com.

This announcement has been approved for release on ASX by the Board of Directors.

About CRML

Critical Metals Corp. is a leading mining development company focused on critical metals and minerals, and producing strategic products essential to electrification and next generation technologies for Europe and its western world partners. Its initial flagship asset is the Wolfsberg Lithium Project located in Carinthia, 270 km south of Vienna, Austria. The Wolfsberg Lithium Project is the first fully permitted mine in Europe and is strategically located with access to established road and rail infrastructure and is expected to be the next major producer of key lithium products to support the European market. Wolfsberg is well positioned with offtake and downstream partners to become a unique and valuable building block in an expanding geostrategic critical metals portfolio. In addition, Critical Metals owns a 20% interest in prospective Austrian mineral projects previously held by European Lithium and recently entered into an agreement to acquire a 92.5% controlling interest in the Tanbreez Greenland Rare Earth Mine (refer ASX announcement 11 June 2024 and 19 June 2024).

Click here for the full ASX Release

This article includes content from European Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EUR:AU

The Conversation (0)

07 September 2023

European Lithium

Developing the Advanced Wolfsberg Lithium Deposit in Austria

Developing the Advanced Wolfsberg Lithium Deposit in Austria Keep Reading...

27 August 2025

CRML signs LOI Offtake Agreement with UCORE (DOD Funded)

European Lithium (EUR:AU) has announced CRML signs LOI Offtake Agreement with UCORE (DOD Funded)Download the PDF here. Keep Reading...

20 August 2025

Outstanding New 2024 Diamond Drill Results Tanbreez Project

European Lithium (EUR:AU) has announced Outstanding New 2024 Diamond Drill Results Tanbreez ProjectDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities Report and Appendix 5B

European Lithium (EUR:AU) has announced Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

24 July 2025

EUR Sells 0.5m CRML Shares for U$1.8m (A$2.7m)

European Lithium (EUR:AU) has announced EUR Sells 0.5m CRML Shares for U$1.8m (A$2.7m)Download the PDF here. Keep Reading...

09 July 2025

EUR Sells 0.5m CRML Shares for U$1.625m (A$2.5m)

European Lithium (EUR:AU) has announced EUR Sells 0.5m CRML Shares for U$1.625m (A$2.5m)Download the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00