September 02, 2024

Up to 18.5% Copper & 34.8% Zinc in initial pXRF readings* on drillcore

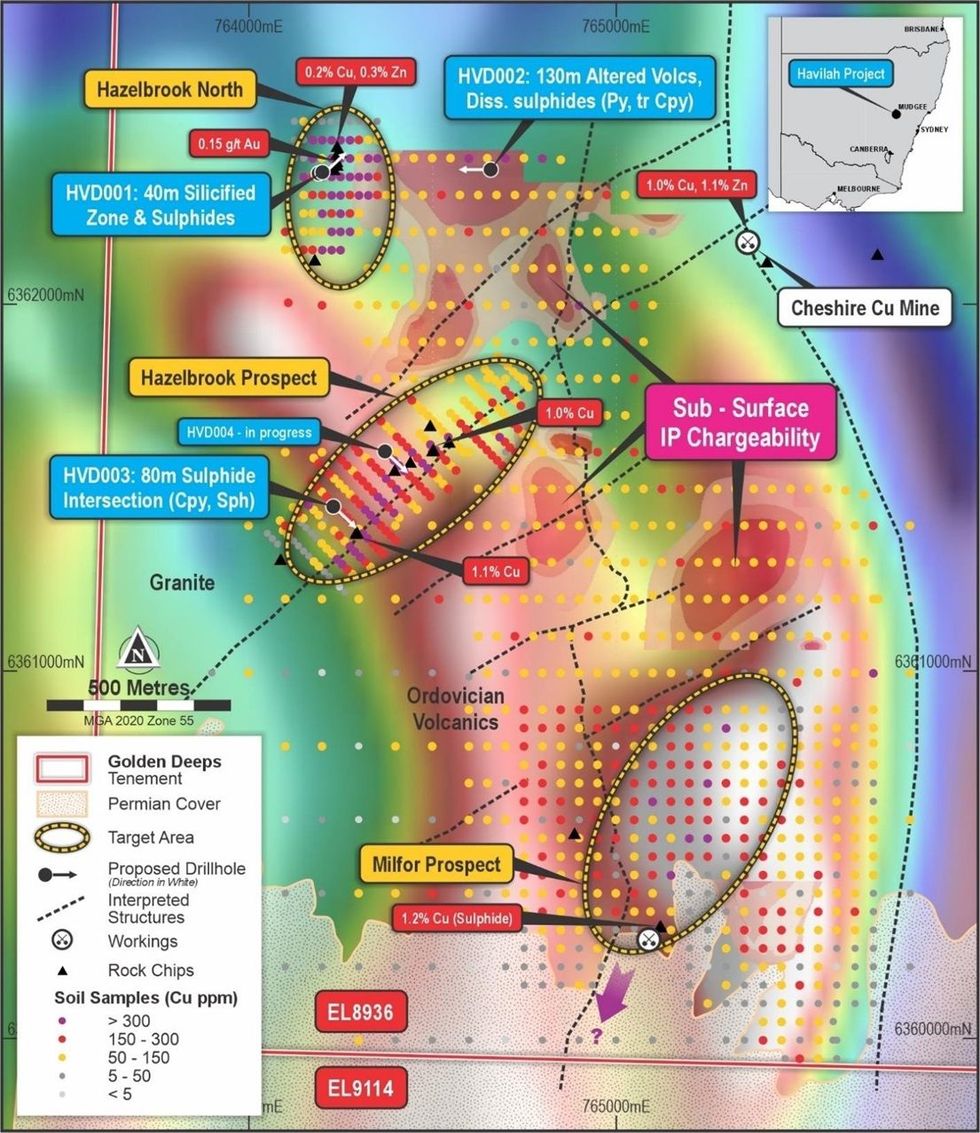

Golden Deeps Ltd (ASX: GED) is pleased to announce the intersection of significant sulphide mineralisation in all three completed diamond drillholes at its 100% owned Havilah Project in the Lachlan Fold Belt Copper-Gold Province of central NSW (see Figure 1, below, and regional location, Figures 3 and 4).

- Thick copper and zinc sulphide mineralisation has been intersected in diamond drilling of key targets at the Company’s Havilah Project in the world-class Lachlan Fold Belt Copper-Gold Province of NSW1,2 (see Hazelbrook Prospect plan - Figure 1, cross section - Figure 2 and location plans - Figures 3 and 4).

- Diamond drillhole HVD003, which tested the extensive Hazelbrook copper soil and rockchip (>1% Cu) anomaly3, intersected patches of semi-massive copper (chalcopyrite) and zinc (sphalerite) sulphides as well as vein and disseminated sulphides across an 80m zone in the targeted Sofala Volcanics (see Image 1 showing the sulphide mineralisation; Appendix 1 for drillhole details & Appendix 2 for descriptions of mineralisation).

- The mineralised intersection in HVD003 included a 28m zone (from 85.8m) of more intense sulphide mineralisation which produced high-grade portable XRF (pXRF) readings of up to 18.5% Cu and 34.8% Zn, averaging 0.5% Cu and 0.7% Zn* (see Appendix 3 for full tables of pXRF readings and Cautionary Note below).

- Diamond hole HVD001, which tested the Hazelbrook North Cu-Zn-Au anomaly3, intersected 40m of silicified breccia/veining and disseminated sulphides (py +/-cpy, sph) from surface, and HVD002, which tested a strong Induced Polarisation (IP) anomaly1, intersected a 130m zone of altered mafic volcanics with scattered veinlets and disseminations of pyrite and rare chalcopyrite (see Figure 1, location, and Appendix 2, descriptions).

- The diamond drilling program continues with HVD004 testing the Hazelbrook anomaly 200m along strike to the northeast of HVD003, again under rockchip sample values of >1% Cu3 (see Figure 1).

*Cautionary Note in relation to disclosure of visual estimates and pXRF readings described in this release and detailed in Appendix 2 and 3 respectively: The Company cautions that visual estimates of sulphide mineralisation abundance and pXRF readings should never be considered a proxy or substitute for laboratory analyses. Laboratory assays (ICP MS/OES and Fire Assay for gold) are required to determine representative grades and intervals of the elements associated with the visible mineralisation reported from geological logging and pXRF readings. Core is being sampled for submission to ALS laboratories in Orange, NSW. Laboratory analytical results are expected within 3 to 6 weeks.

Golden Deeps CEO Jon Dugdale commented: “The intersection of sulphide mineralisation in all three initial holes at Havilah, including thick zones of copper and zinc sulphide mineralisation in HVD003, indicates we’re on top of a large porphyry-sulphide system with similar characteristics to other major copper-gold discoveries in the Lachlan Fold Belt such as Cadia-Ridgeway and the recent Boda-Kaiser discovery.

“We look forward to completing the remainder of our diamond drilling program and receiving the laboratory results from the holes completed, which will be released as soon as they come to hand and are compiled.”

The third hole of the program, HVD003, tested the Hazelbrook target where an extensive northeast-southwest trending copper-zinc soil anomaly has been defined with rockchip values of over 1% Cu3 (Figure 1).

HVD003 intersected a sulphide mineralised zone from 85m to 119m which included patches and stringers (averaging 1-2%) of the copper-sulphide - chalcopyrite and the zinc-sulphide - sphalerite. These patches occur within extensively altered (Ordovician) mafic volcanic/volcanoclastic rocks with disseminated chalcopyrite-sphalerite-pyrite mineralisation which occurs from 85m to 166m (over 80m) (see Appendix 2).

The mineralisation aligns with the surface soil and rockchip copper-zinc anomaly, striking northeast, dipping to the northwest, and the drilling intersection approximating true width (see cross section, Figure 2, below).

Click here for the full ASX Release

This article includes content from Golden Deeps, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00