April 08, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to provide an update on exploration programmes planned for its Eastern Goldfields and Gascoyne region projects.

- Working towards maiden Bangemall Ni-Cu-Co-PGE drill campaign

- Targets outlined for RC drill testing at Gidji JV gold project north of Kalgoorlie

- New tenement application over 11 kilometre long aircore gold anomaly with similarities to +2Moz Invincible gold deposit

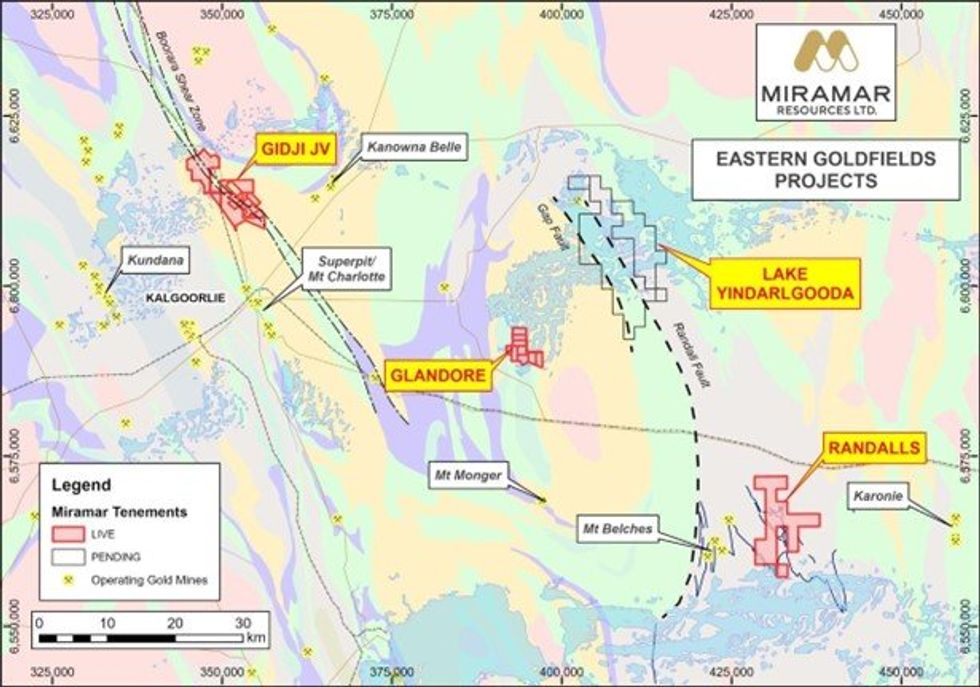

The Company is currently working toward the maiden drilling campaign within the Bangemall Ni-Cu-Co- PGE projects and has expanded its strategic 480 km2 Eastern Goldfields tenement portfolio (Figure 1).

Miramar’s Executive Chairman, Mr Allan Kelly, said the Company’s Eastern Goldfields exploration project portfolio had significant value not recognised in the current share price.

“Since listing in 2020 with a portfolio of highly prospective early-stage gold, nickel and copper projects in Western Australia, we have systematically advanced our key projects up the exploration value chain, added to our land position through strategic tenement applications and relinquished those tenements which lacked significant discovery potential,” Mr Kelly said.

“In a record gold price environment, the inherent value of our gold projects, including our flagship Gidji JV Project, where we have made multiple new gold discoveries immediately along strike from one of the richest patches of earth on the planet, is significant,” he added.

“We’ve also advanced our Bangemall Projects from the initial concept to high priority drill targets which could define a new style of nickel mineralisation in a new mineral province,” he said.

Bangemall Ni-Cu-Co-PGE Projects

Miramar holds a strategic land position within the Edmund and Collier Basins where it is targeting nickel- copper-cobalt-PGE mineralisation related to Kulkatharra Dolerite sills, part of the Warakurna Large Igneous Province and the same age as the Giles Complex intrusions which host the large Nebo and Babel nickel-copper deposits in the West Musgraves of WA.

Miramar’s initial aim is to show “proof of concept” of its Norilsk-style deposit model by discovering Ni-Cu- Co-PGE sulphide mineralisation.

Over the previous 24 months, the Company has progressed from regional-scale area selection to collection of project-scale datasets and, more recently, to delineation of individual drill targets at the Mount Vernon and Trouble Bore Projects (Figure 2).

The Company is now working towards the first drill programme targeting this style of mineralisation within the region and has already received Programme of Work (POW) approval from the Department of Energy, Mines, industry Regulation and Safety (DMEIRS).

Upcoming work includes completion of a heritage survey, systematic rock chip sampling and/or further ground geophysics to help refine the initial RC drill targets.

Pending receipt of all relevant approvals, the Company hopes to complete the maiden drill programme during mid-2024.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00