October 25, 2023

Global Oil & Gas Limited (ASX: GLV) (Global or Company) is pleased to provide the following report on its activities during the quarter ending 30 September 2023.

Peruvian Project

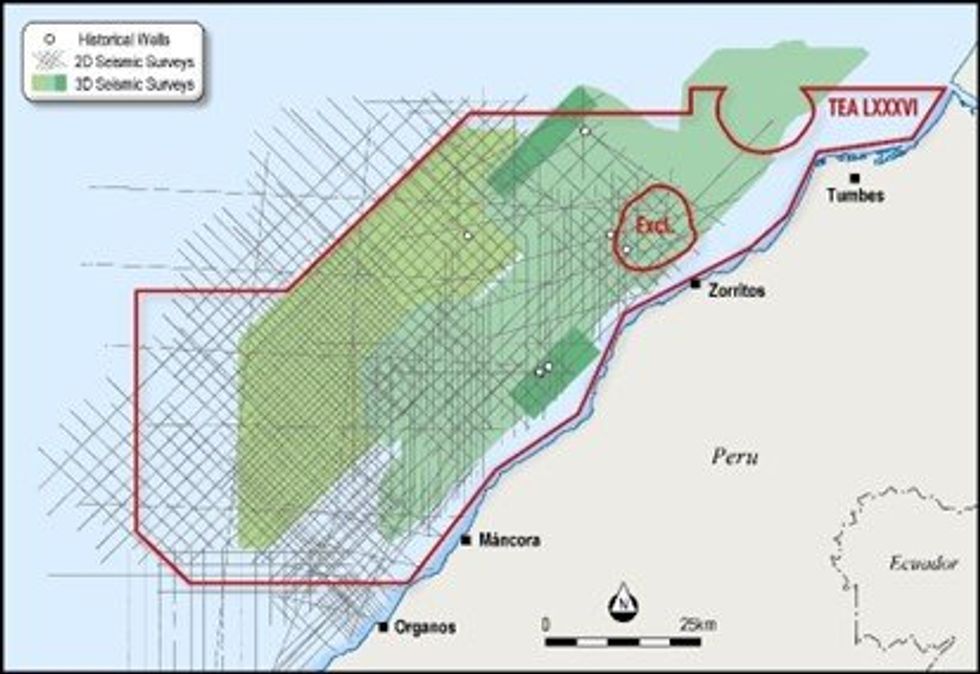

Global Oil and Gas Limited announced during the quarter that it had executed a Technical Evaluation Agreement LXXXVI (TEA) with the Peruvian National Agency of Hydrocarbons, Perupetro, for a 4,858km2 oil and gas exploration block offshore Peru. The Company now holds 80% of the TEA with project partner, US based oil and gas exploration company Jaguar Exploration, Inc. (Jaguar), holding the remaining 20%.

The oil and gas block is located in the Tumbes-Progreso basin, in water depths that range from 100m to 1,500m. Immediately to the south is the Talara Basin which is one of the most productive basins in Peru having already produced more than 1.6 billion barrels.

The block is surrounded by, and incorporates, multiple historic and currently producing oil and gas fields. The southeast of the block borders the Alto-Pena Negra oil field which is one of Peru’s most productive fields, currently producing around 3,000 barrels of oil per day (bopd) with total historical production of more than 143 million barrels of oil.

In the northeast, the block incorporates the excised 27.8 million barrel Corvina oil field which generated past production rates of up to 4,000 barrels of light oil per day (28.45⁰ API).

The southern border of the TEA is also only 70km from the Talara crude oil refinery which received production from the Corvina field.

Exploration Opportunity

In the early 1970's three exploration wells, drilled on poor quality 2D seismic, all encountered oil shows. Since then, additional 2D seismic and four (3,800 km2) 3D seismic surveys have been acquired but only one well has been drilled based on these new data. That well which did not reach the primary basin’s reservoir encountered gas shows and is now a valuable calibration point. It is rare to have the opportunity to explore a basin system with a proven and prolific petroleum system where the 3D has already been acquired and paid for but remains essentially undrilled.

The historical discoveries are located in shallow waters offering an opportunity to tap into relatively inexpensive targets, however, the most western part of the block also hosts other prospects in deeper waters (400m to 800m).

Global’s partner in the block, Jaguar, has recognised the value of utilising the historical seismic data and has already identified various prospects and leads within the block that can potentially be classified as Prospective Resources.

Of particular interest, are the Bonito prospect, delineated by a 82km2 late fold anticline (~500m of closure), and the Tiburon prospect, a broad buttress and fold ~140km2 (~150m of closure).

Click here for the full ASX Release

This article includes content from Global Oil & Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00