May 17, 2023

Gander Gold Corp. ("Gander" or the "Company") (CSE:GAND)(OTCQB:GANDF) is pleased to announce the start of first-ever drilling in Newfoundland. For the past two years the Company has systematically and methodically advanced an attractive pipeline of grassroots gold properties across a dominant land position of 2,259 sq. km, offering compelling high-grade discovery potential.

Highlights:

- Gander has commenced a planned 70-hole rotary air blast (RAB) drill program across four major projects beginning with the 485 sq. km Gander North Project, 15 km east of New Found Gold's Keats' Zone discovery;

- Gander North and Mt. Peyton are fully permitted for both preliminary air blast (RAB) drilling and follow-up diamond drilling. BLT and Cape Ray II drill permits are pending;

- In total across its eight Central Newfoundland Gold Belt projects, Gander Gold has outlined more than 100 linear km of potential strike along which gold-in-soil geochemistry anomalies are overlain on top of identified geophysical anomalies.

Mr. Mark Scott, Gander Gold CEO, commented: "We are very pleased with the abundance of drill targets which have emerged from our two-year greenfield exploration program that included a Newfoundland-best 40,000 soil samples. 2023 will see first-ever drill testing of many of these targets and will be an exciting time for the Company and its shareholders in the midst of a robust gold market. We look forward to realizing Gander Gold's significant discovery potential in the Central Newfoundland Gold Belt and maximizing value for shareholders."

The RAB drill program over the next few months at Gander North, Mt. Peyton, Thwart Island and Cape Ray II will provide first-ever testing of the bedrock and structural environments overlain by significant soil geochemistry anomalies. Data gathered from daily XRF measurements and in-hole televiewer will help guide the program and prioritize targets for follow-up diamond drilling. Geological mapping, prospecting, ground VLF-Mag geophysical surveys, and ground penetrating radar (GPR) surveys are being employed ahead of drilling, as required, to optimize target definition.

Drilling has started in the "Viking" area of Gander North where VLF surveys have outlined conductive structures underneath extensive soil anomalies.

Marketing Agreement Signed

The Company has entered into an arm's length marketing agreement effective May 15, 2023, with 11636952 Canada Inc. (O/A Business Financial Network, Roger Choudhury) (the "Consultant") of North York, Ontario, Canada, to provide digital consulting and marketing services for a period of three months. The Company has paid the Consultant a lump sum of CAD $300,000 (+GST) for the procurement of digital marketing materials, advertising and services, and will pay the Consultant a monthly sum of $5,000 (+GST) for its direct provision of services. Consideration offered to the Consultant does not include any securities of the Company. Aside from this engagement, the Company does not have any relationship with the Consultant. Business Financial Network can be contacted by email at BusinessFinancialNetwork@gmail.com. For further information, please visit their website at https://bfn-news.com.

Gander Gold Corporate Video

To view the latest Gander Gold corporate video, click on the link below:

https://www.youtube.com/watch?v=op06adMXkHs

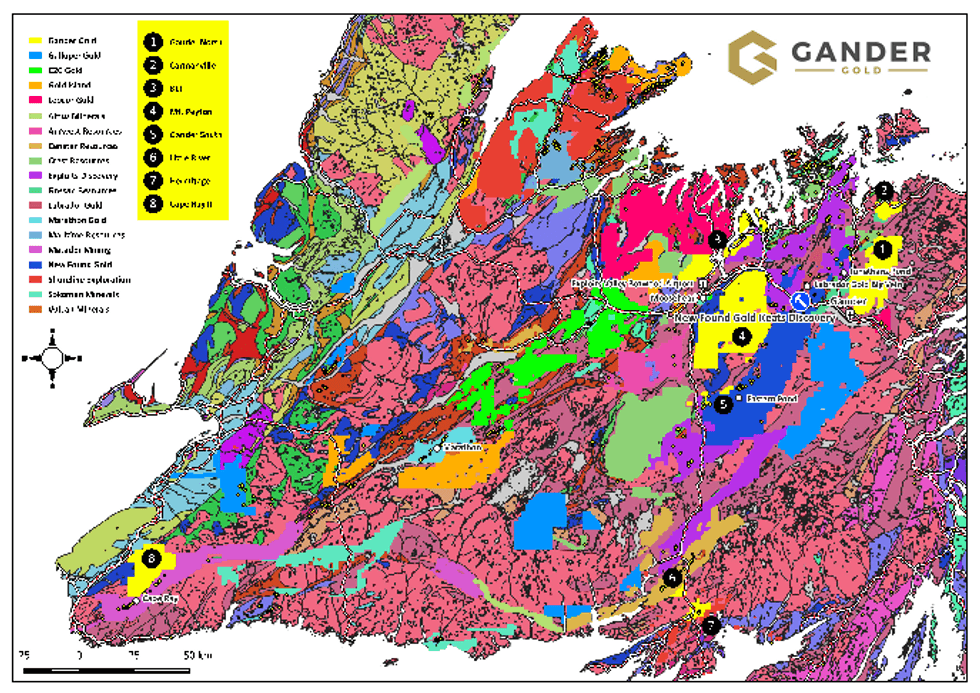

Gander Gold Newfoundland Projects Map

Qualified Person

The technical information in this news release has been reviewed and approved by Ian Fraser, P.Geo., Vice- President of Exploration for Gander Gold. Mr. Fraser is the Qualified Person responsible for the scientific and technical information contained herein under National Instrument 43-101 standards.

Acknowledgment

Gander Gold acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of Newfoundland and Labrador.

About Gander Gold Corporation

Gander Gold is "All Newfoundland, All the Time". The Company is one of the island's largest claimholders targeting new high-grade gold discoveries with a current focus on the large Gander North, Mount Peyton, BLT (Botwood-Laurenceton-Thwart Island) and Cape Ray II projects where there has been very promising early exploration success. Other opportunities advancing through the pipeline are Carmanville, Gander South, Little River and Hermitage.

Contact Info:

Mark Scott

Chief Executive Officer & Director

info@gandergold.com

Terry Bramhall

Gander Gold - Corporate Communications

1.604.833.6999 (mobile)

1.604.675.9985 (office)

terry.bramhall@gandergold.com

Caution Regarding Forward Looking Statements

Investors are cautioned that, except for statements of historical fact, certain information contained in this document includes "forward looking information", with respect to a performance expectation for Gander Gold Corp. Such forward looking statements are based on current expectations, estimates and projections formulated using assumptions believed to be reasonable and involving a number of risks and uncertainties which could cause actual results to differ materially from those anticipated. Such factors include, without limitation, fluctuations in foreign exchange markets, the price of commodities in both the cash market and futures market, changes in legislation, taxation, controls and regulation of national and local governments and political and economic developments in Canada and other countries where Gander carries out or may carry out business in the future, the availability of future business opportunities and the ability to successfully integrate acquisitions or operational difficulties related to technical activities of mining and reclamation, the speculative nature of exploration and development of mineral deposits, including risks obtaining necessary licenses and permits, reducing the quantity or grade of reserves, adverse changes in credit ratings, and the challenge of title. The Company does not undertake an obligation to update publicly or revise forward looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Some of the results reported are historical and may not have been verified by the Company.

The CSE has neither approved nor disapproved the contents of this news release. Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this news release.

The Conversation (0)

9h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

10h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

10h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

15h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

01 February

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00