- Gold mineralisation extended 200 meters down plunge from previous holes

- 49.0 m @ 1.3 g/t Au (AMD54A)

- 52.0 m @ 1.1 g/t Au (AMD56)

- 46.5 m @ 1.0 g/t Au (AMD58)

- 41.2 m @ 1.7 g/t Au (AMD94)

- Infill drilling confirms near surface, high-grade gold mineralisation

- 49.5 m @ 4.2 g/t Au (AMD87)

- 37.0 m @ 3.2 g/t Au (AMD78)

- 7.5 m @ 13.8 g/t Au (AMD97)

- Updated Mineral Resource Estimate (MRE) and Preliminary Economic Assessment (PEA) anticipated in Q4 2025

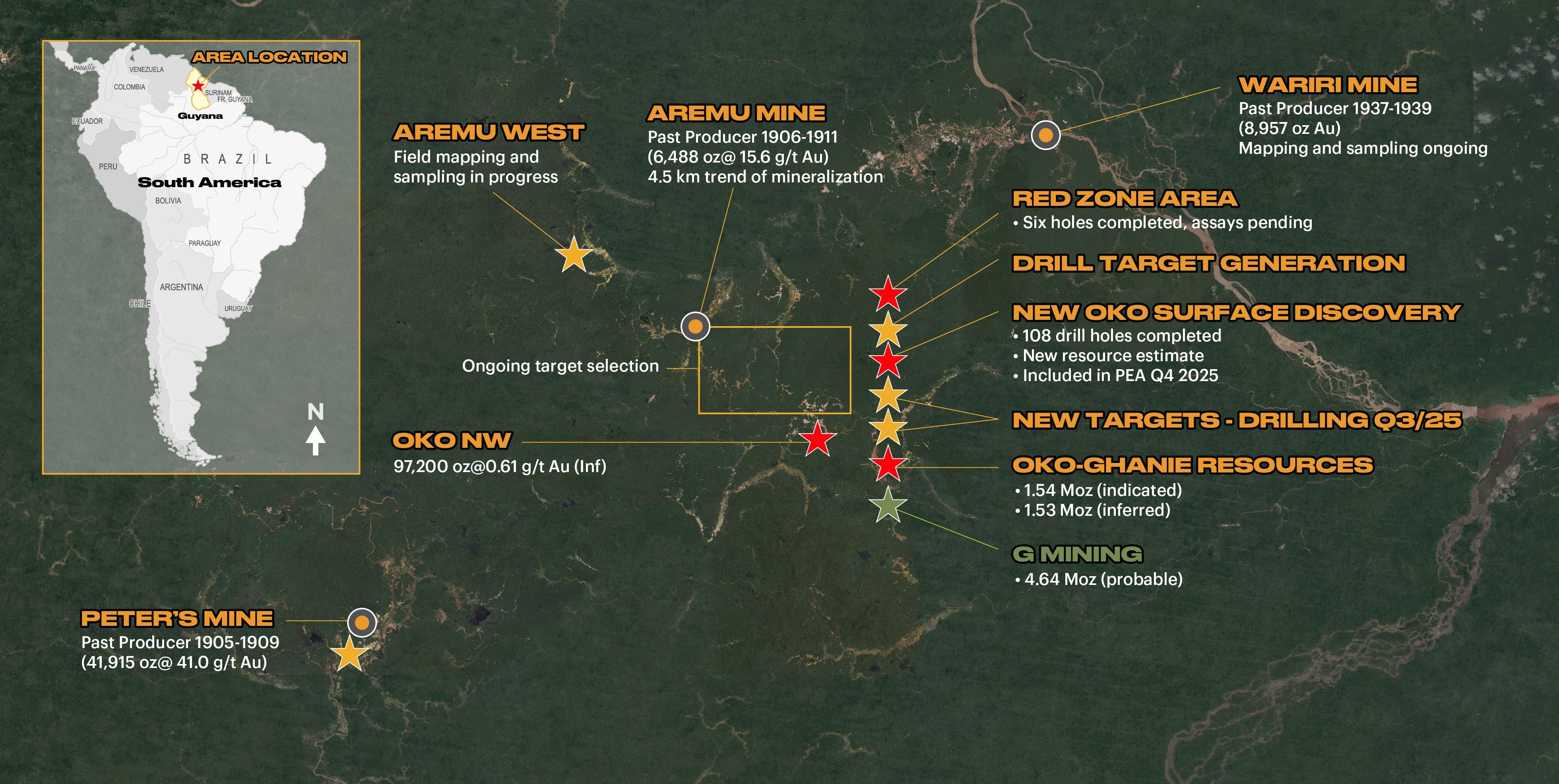

G2 Goldfields Inc. (" G2 " or the " Company ") (TSX: GTWO; OTCQX: GUYGF) announces new assay results from the Company's ongoing drilling program in the greater OKO-AREMU district, Guyana. G2 currently holds exploration rights to 83,967 acres in the district and the New Oko Discovery Area represents the third significant gold discovery on the Company's holdings. Drill results within this release are part of an ongoing program from a new discovery initially announced in March (see press releases dated March 18, April 1, April 28, June 9 and July 15, 2025, available on SEDAR+ and the Company's website) which lies 10km north of its existing gold resources at the Oko-Ghanie Deposit ( 1.5 million ounces indicated at 3.40 gt Au and 1.6 million ounces inferred at 2.48 gt Au). Multiple gold targets are currently being explored along a prominent 15km trend extending north from the Oko-Ghanie deposit.

Figure 1 — Plan View of District Target Areas

Within the New Oko Discovery, G2 has completed 108 drill holes totalling 20,423m to date. This release provides assay results for forty-nine drill holes (AMD 51 to AMD 99 inclusive) and a complete set of results is available here , with highlights shown in Tables 1 and 2 below.

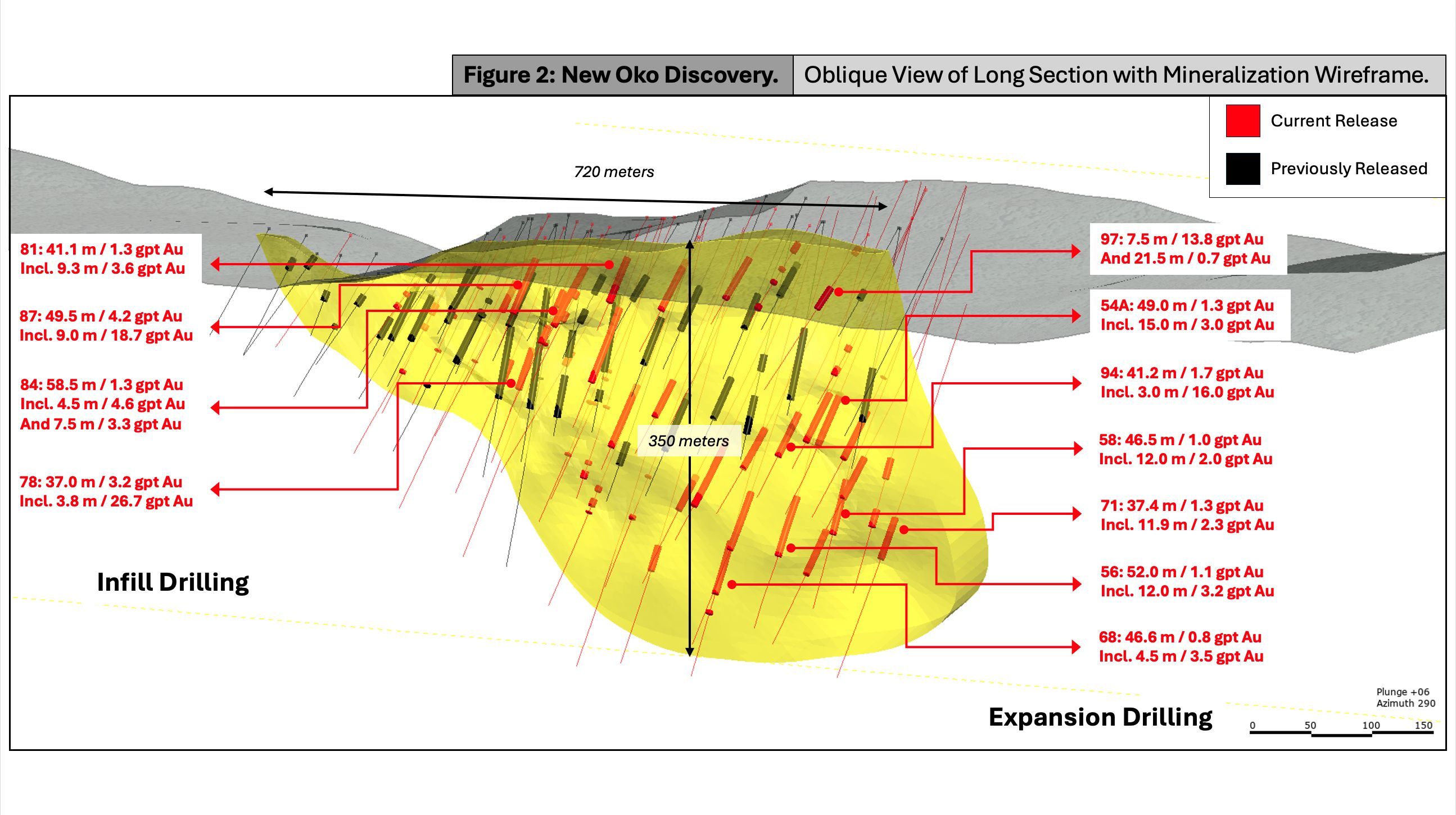

Figure 2 – New Oko Discovery Long Section with Wireframe of Mineralisation

Discussion of Results

Diamond drilling in the New Oko Discovery area is primarily focused on defining near surface gold mineralisation amenable to open pit mining methods. This current round of drilling has established significant gold mineralisation down plunge of previously released gold intercepts, extending gold mineralisation to vertical depths of 350m. Highlights of expansion holes are presented in Table 1.

Table 1 – Highlights of Expansion Drill Holes

| DRILL HOLE | FROM (METRES) | TO (METRES) | INT. (METRES) | GRADE (G/T AU) | GRADE x DH WIDTH |

| AMD54A | 202.0 | 251.0 | 49.0 | 1.3 | 63.2 |

| Incl. | 219.5 | 234.5 | 15.0 | 3.0 | 44.6 |

| AMD56 | 274.0 | 326.0 | 52.0 | 1.1 | 58.7 |

| Incl. | 278.5 | 290.0 | 12.0 | 3.2 | 37.9 |

| AMD58 | 257.0 | 303.5 | 46.5 | 1.0 | 46.7 |

| Incl. | 272.0 | 284.0 | 12.0 | 2.0 | 24.4 |

| AMD68 | 303.5 | 350.1 | 46.6 | 0.8 | 35.2 |

| Incl. | 314.0 | 318.5 | 4.5 | 3.5 | 15.7 |

| AMD68 | 365.0 | 368.0 | 3.0 | 0.5 | 1.6 |

| AMD71 | 322.6 | 360.0 | 37.4 | 1.3 | 47.5 |

| Incl. | 322.5 | 334.5 | 11.9 | 2.3 | 27.9 |

| A MD94 | 218.9 | 260.0 | 41.2 | 1.7 | 68.3 |

| Incl. | 226.0 | 229.0 | 3.0 | 16.0 | 48.0 |

Notes to Table 1: Intercepts reported are down-hole widths. True widths are estimated between 68% and 93% of reported down-hole widths. Average grades are calculated with un-capped gold assays, as insufficient drilling has been completed to determine capping levels for higher grade intercepts.

Additionally, shallow infill drilling above 100m vertical depth has further defined high-grade gold mineralisation in upper parts of the new Oko Discovery Zone. Highlights of drill intercepts are included in Table 2.

Table 2 – Highlights of Infill Diamond Drill Holes

| DRILL HOLE | FROM (METRES) | TO (METRES) | INT. (METRES) | GRADE (G/T AU) | GRADE x DH WIDTH |

| AMD78 | 117.1 | 154.0 | 37.0 | 3.2 | 117.7 |

| Incl. | 124.1 | 127.9 | 3.8 | 26.7 | 102.3 |

| AMD81 | 21.3 | 62.4 | 41.1 | 1.3 | 52.4 |

| Incl. | 30.0 | 39.3 | 9.3 | 3.6 | 33.2 |

| AMD84 | 31.5 | 90.0 | 58.5 | 1.3 | 78.8 |

| Incl. | 36.0 | 40.5 | 4.5 | 4.6 | 20.5 |

| And | 75.0 | 82.5 | 7.5 | 3.3 | 24.7 |

| AMD84 | 106.5 | 108.0 | 1.5 | 1.5 | 2.3 |

| AMD87 | 19.5 | 69.0 | 49.5 | 4.2 | 207.6 |

| Incl. | 27.0 | 36.0 | 9.0 | 18.7 | 168.4 |

| * AMD97 | 13.5 | 21.0 | 7.5 | 13.8 | 103.3 |

| AMD97 | 55.5 | 77.0 | 21.5 | 0.7 | 15.6 |

Notes to Table 2: Intercepts reported are down-hole widths. True widths are estimated between 68% and 93% of reported down-hole widths. Average grades are calculated with un-capped gold assays, as insufficient drilling has been completed to determine capping levels for higher grade intercepts.

* N.B. Pending additional assays for the upper contact of this zone (AMD97).

Dan Noone, G2 CEO, stated: "We are very encouraged by the ongoing progress at the project, especially the expansion of near-surface, open-pittable gold zones that will be reflected in the updated Mineral Resource Estimate (MRE) scheduled for Q4 2025. In parallel, work on the Preliminary Economic Assessment (PEA) is advancing well, and we remain confident that the project will develop into a very significant new gold mine for Guyana."

Patrick Sheridan, G2 Executive Chairman, added: "The next three months will be a pivotal time for our shareholders as we deliver the initial economic parameters for a multi-open pit operation combined with a high-grade underground mine at our Oko Main Zone (776,600 oz. Au Indicated contained within 2,729,000 tonnes @ 8.85 g/t Au and 498,200 oz Au. Inferred contained within 2,938,000 tonnes @ 5.27 g/t Au). At the same time, we will continue drilling across several new promising areas."

QA/QC

Drill core is logged and sampled in a secure core storage facility located on the OKO Project site, Guyana. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to MSALABS Guyana, in Georgetown, Guyana, which is an accredited mineral analysis laboratory, for analysis. Samples from sections of core with obvious gold mineralisation are analysed for total gold using an industry-standard 500g metallic screen fire assay (MSALABS method MSC 550). All other samples are analysed for gold using standard Fire Assay-AA with atomic absorption finish (MSALABS method; FAS-121). Samples returning over 10.0 g/t gold are analysed utilizing standard fire assay gravimetric methods (MSALABS method; FAS-425). Certified gold reference standards, blanks, and field duplicates are routinely inserted into the sample stream, as part of G2 Goldfield's quality control/quality assurance program (QAQC). No QA/QC issues were noted with the results reported herein.

About G2 Goldfields Inc.

G2 Goldfields finds and develops gold deposits in Guyana. The founders and principals of the Company have been directly responsible for the discovery of more than 10 million ounces of gold in the prolific and underexplored Guiana Shield. G2 continues this legacy of exploration excellence and success.

In March 2025, G2 announced an Updated Mineral Resource Estimate (" MRE ") for the Oko property in Guyana [see press release dated March 10, 2025]. Highlights of the Updated MRE include:

Total combined open pit and underground Resource for the Oko Main Zone ( OMZ ):

- 513,500 oz. Au – Inferred contained within 3,473,000 tonnes @ 4.60 g/t Au

- 808,000 oz. Au – Indicated contained within 3,147,000 tonnes @ 7.98 g/t Au

Total combined open pit and underground Resource for the Ghanie Zone :

- 1,024,500 oz. Au – Inferred contained within 12,062,000 tonnes @ 2.64 g/t Au

- 663,400 oz. Au – Indicated contained within 10,288,000 tonnes @ 2.01 g/t Au

Total open pit Resource for the Oko NW Zone :

- 97,200 oz. Au – Inferred contained within 4,976,000 tonnes @ 0.61 g/t Au

The MRE was prepared by Micon International Limited with an effective date of March 1, 2025. The Oko district has been a prolific alluvial goldfield since its initial discovery in the 1870s, and modern exploration techniques continue to reveal the considerable potential of the district.

All scientific and technical information in this news release has been reviewed and approved by Dan Noone (CEO of G2 Goldfields Inc.), a "qualified person" within the meaning of National Instrument 43-101. Mr. Noone (B.Sc. Geology, MBA) is a Fellow of the Australian Institute of Geoscientists.

Additional information about the Company is available on SEDAR+ ( www.sedarplus.ca ) and the Company's website ( www.g2goldfields.com ).

On behalf of the Board of G2 Goldfields Inc.

"Daniel Noone"

CEO & Director

For Further Information

Jacqueline Wagenaar, VP Investor Relations

Direct: +1.416.628.5904 x.1150

Email: j.wagenaar@g2goldfields.com

Forward-Looking Statements

This news release contains certain forward-looking statements, including, but not limited to, statements about the mineralization and mineral resource estimates in respect of the Company's properties, an updated MRE and PEA for a multi-open pit and underground operation and the anticipated timing thereof, multiple gold targets being explored along a prominent 15km trend. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "schedule", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof. Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements, including the risk factors set out in the annual information form of the Company for the year ended August 25, 2025. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. The Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

A PDF accompanying this announcement is available at

http://ml.globenewswire.com/Resource/Download/61711074-5974-40f5-87ae-0dbf86bd01f9

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/20088d93-4465-42dc-98d3-88a1ebc49612

https://www.globenewswire.com/NewsRoom/AttachmentNg/f112018a-7eee-4431-8ac9-42623f8e9f1a