July 03, 2022

BlackEarth Minerals NL (ASX: BEM) (the Company or BlackEarth) is pleased to announce it has received further outstanding assay results from its Razafy Northwest (NW) diamond drilling at its 100% owned Maniry Graphite Project in Southern Madagascar.

Highlights

- Further assay results received from the Company’s Razafy NW Resource add to the potential of this high-grade area.

- Additional assay results received for drillholes MNDD114 to MNDD119 and MNDD130 to MNDD135; intersections include:

- 22.3m at 8.14% TGC incl. 10m at 11.36% TGC (MNDD118)

- 38.25m at 6.45% TGC incl. 8.1m at 10.16% TGC (MNDD130)

- 13.8m at 13.98% TGC incl. 8m at 18.60% TGC (MNDD130)

- 35.95m at 8.18% TGC (MNDD134)

- Given the high grade nature of this area, the current DFS will now incorporate the Razafy NW area as a priority feed material into the Maniry Graphite Project.

- Additional Assay Results will allow the Company to shortly publish an updated and expanded Resource Statement.

- The updated and expanded Resource has the potential to significantly increase the proposed mine life for Maniry.

- Final assay results from the area are expected shortly.

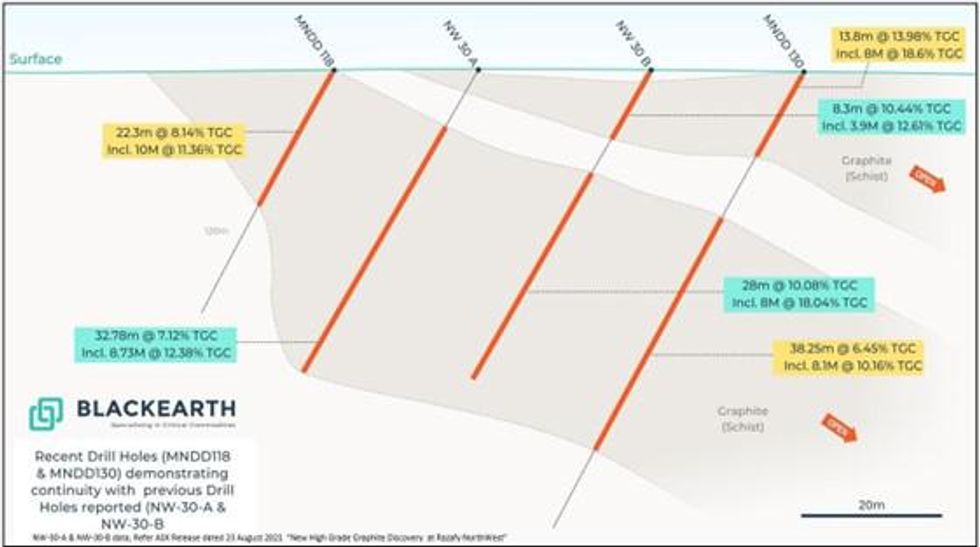

Figure 1: Razafy North West – Drilling Cross-section (A-B)

The assays received to date from Razafy NW, have confirmed the continuity not only of the graphite mineralisation at depth and along strike but also the high grade nature of the Resource. As a result the Board believes it is advantageous to integrate the Razafy NW area into the DFS as “initial priority feed”.

Applications have been sent to the Madagascan Mining authorities to expand the current mining license (ML 5394) to include a broader area including the Razafy NW Resource. The key benefits of this approach will be to:

- Position the Project to start up with higher grade material

- Take advantage of the rising price of natural graphite concentrate and

- Provide potential project financiers an optimum payback period

In order to integrate the Razafy NW material into the current DFS, the Study is now likely to be completed in October 2022. As part of current Study activities, an updated Razafy Resource will be released to the market shortly.

Commenting on these results, BlackEarth Managing Director, Tom Revy, said:

“The current and expanding data base on the Razafy NW area has certainly surpassed our initial expectations; exploration activities are continuing in the area.

Our new approach to accelerate its development as part of the current DFS is a critical component towards ultimately achieving Project development finance.”

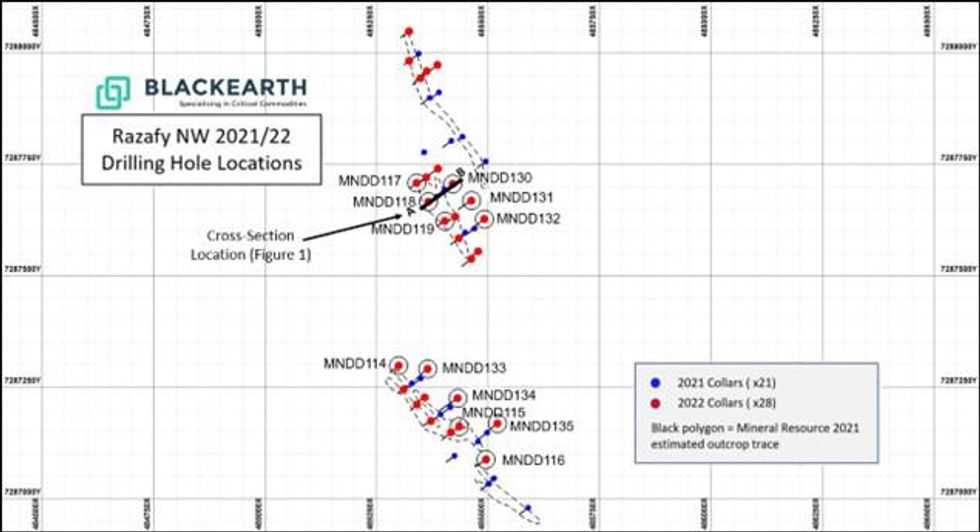

Map 1: Drill collars and drill traces for Razafy NW. Map grid = 250 m x 250 m, north at top of map Location of Section A-B highlighted on Map (refer Figure 1)

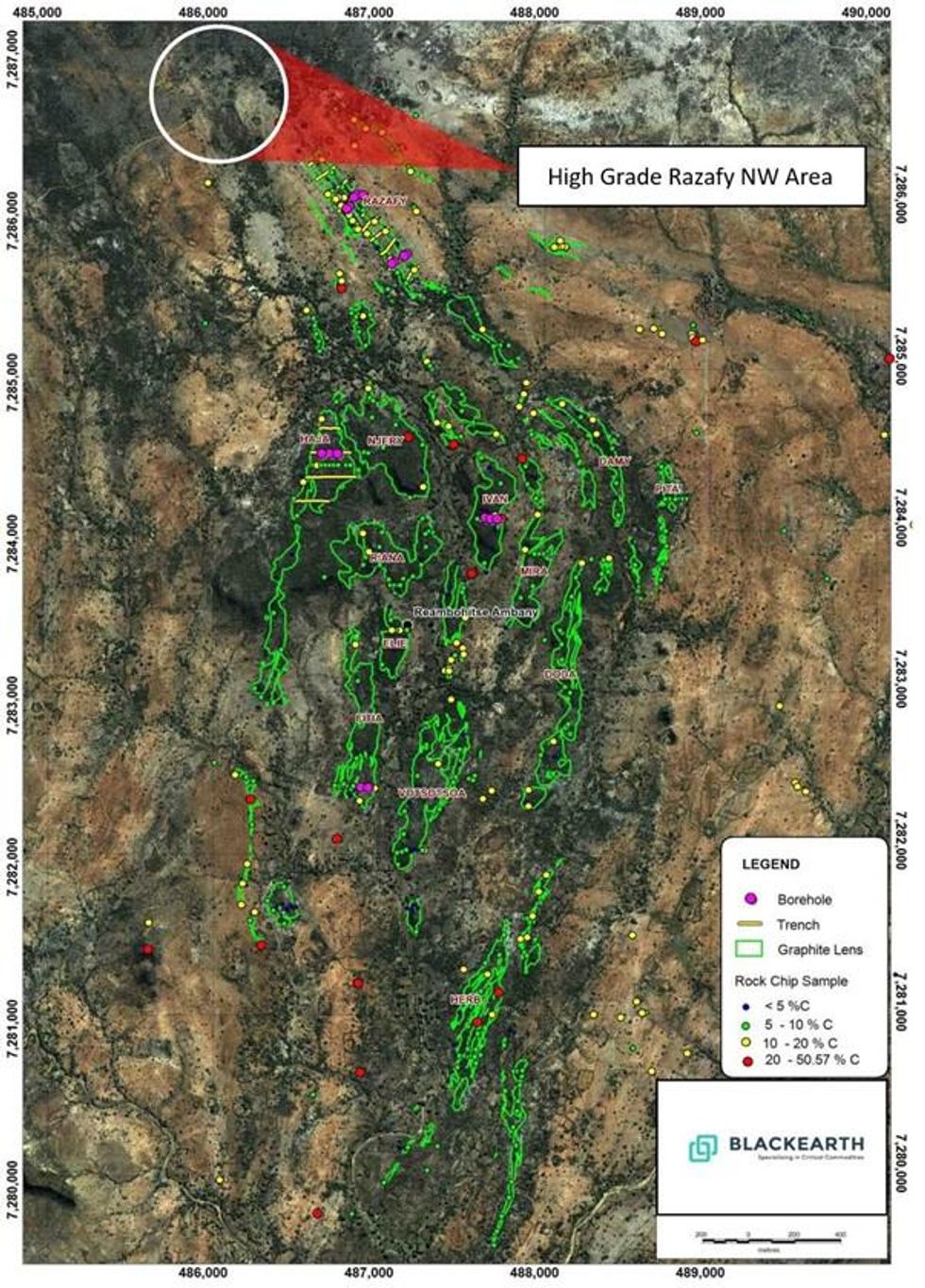

Map 2: Maniry Graphite Project Area

Competent Person’s Statement

The information in this statement that relates to Exploration Targets and Exploration Results is based on information compiled by Mr Jannie Leeuwner – BSc (Hons) Pr.Sci.Nat. MGSSA and is a full-time employee of Vato Consulting LLC. Mr. Leeuwner is a registered Professional Natural Scientist (Pr.Sci.Nat. - 400155/13) with the South African Council for Natural Scientific Professional (SACNASP). Mr. Leeuwner has sufficient experience which is relevant to the style of mineralisation and type of deposits under consideration and the activity being undertaken to qualify as a Competent Person as defined in the Note for Mining Oil & Gas Companies, June 2009, of the London Stock Exchange and the 2012 Edition of the ‘Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code). Mr. Leeuwner consents to the inclusion of the information in this release in the form and context in which it appears.

Forward Looking Statements

Some of the statements appearing in this announcement may be in the nature of forward looking statements. You should be aware that such statements are only predictions and are subject to inherent risks and uncertainties. Those risks and uncertainties include factors and risks specific to the industries in which BlackEarth operates and proposes to operate as well as general economic conditions, prevailing exchange rates and interest rates and conditions in the financial markets, among other things. Actual events or results may differ materially from the events or results expressed or implied in any forward-looking statement.

No forward looking statement is a guarantee or representation as to future performance or any other future matters, which will be influenced by a number of factors and subject to various uncertainties and contingencies, many of which will be outside the Company’s control.

The Company does not undertake any obligation to update publicly or release any revisions to these forward- looking statements to reflect events or circumstances after today's date or to reflect the occurrence of unanticipated events. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions or conclusions contained in this announcement. To the maximum extent permitted by law, none of the Company’s Directors, employees, advisors or agents, nor any other person, accepts any liability for any loss arising from the use of the information contained in this announcement. You are cautioned not to place undue reliance on any forward-looking statement. The forward- looking statements in this announcement reflect views held only as at the date of this announcement.

This announcement is not an offer, invitation or recommendation to subscribe for, or purchase securities by the Company. Nor does this announcement constitute investment or financial product advice (nor tax, accounting or legal advice) and is not intended to be used for the basis of making an investment decision. Investors should obtain their own advice before making any investment decision.

Click here for the full ASX Release

This article includes content from Black Earth, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

24 February

Iyan Deposit Delivers Further Significant Graphite Intercepts from Surface in the Final Release of Assays

Final Assay Batch Again Reinforces Bulk Blending Strategy, Resource Growth and Imminent JORC

Blencowe Resources Plc (LSE: BRES) is pleased to report the final set of assay results completed from the 87 shallow holes drilled at the Iyan deposit, part of the Company's Orom-Cross Graphite Project in Uganda. These results represent the third batch from the Stage 7 drilling programme, with... Keep Reading...

18 February

US Slaps Higher Tariffs on Chinese Graphite Imports After Final Commerce Determination

The US Department of Commerce has sharply increased trade penalties on Chinese graphite anode materials, concluding that producers in China engaged in unfair pricing and subsidy practices that harmed the US market.In a final determination issued February 11, 2026, Commerce raised countervailing... Keep Reading...

27 January

Top 5 Canadian Graphite Stocks (Updated January 2026)

Graphite stocks and prices have experienced volatility in recent years recently due to bottlenecks in demand for electric vehicles, as graphite is used to create lithium-ion battery anode materials. One major factor experts are watching is the trade war between China and the US.China introduced... Keep Reading...

09 December 2025

Greenland Government Grants Exploitation Licence for Amitsoq

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is delighted to announce that the Government of Greenland has granted an Exploitation Licence for the Amitsoq Graphite Project to Greenland Graphite a/s ("Greenland... Keep Reading...

30 November 2025

Altech - Board Renewal and Strategic Focus

Altech Batteries (ATC:AU) has announced Altech - Board Renewal and Strategic FocusDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00