FPX Nickel Corp. (TSX-V: FPX) (OTCQB: FPOCF) (" FPX " or the " Company ") is pleased to announce the results of an internal engineering scoping study (" the Study ") evaluating the production of nickel sulphate for the electric vehicle (" EV ") battery supply chain from the high-grade awaruite nickel concentrate to be produced by the Company's Baptiste Nickel Project (" Baptiste " or " the Project ") in central British Columbia. The Study highlights FPX's potential to develop the world's largest integrated nickel sulphate production facility, linking the Company directly into the EV battery supply chain via the production of low-cost, low-carbon nickel sulphate over Baptiste's projected 35-year mine life.

Highlights

- Development of an integrated nickel operation at Baptiste producing approximately 43,500 tonnes of nickel contained in nickel sulphate per annum, enough to fulfill approximately 17% of the projected North American EV battery demand for nickel in 2030 (according to Goldman Sachs 1 )

- Study outlines conventional hydrometallurgical flowsheet for production of high-purity nickel sulphate directly from Baptiste's high grade awaruite nickel concentrate (60-65% nickel), without the intermediate smelting typically required for sulphide concentrates or the extensive, aggressive pressure oxidation conditions required for laterite ores and sulphide concentrates

- Anticipated capital costs for nickel sulphate production expected to be competitive with large-scale refinery operation recently developed by Terrafame ( Finland )

- Nickel sulphate production at Baptiste is expected to be more environmentally sustainable than traditional production methods for nickel sulphate, with reduced carbon intensity, fewer supply chain participants, and synergies with an integrated site

"This scoping study demonstrates that Baptiste could become a globally significant producer of low-cost, low-carbon nickel for electric vehicles for decades to come," commented Martin Turenne , FPX's President and CEO. "Baptiste's awaruite nickel mineralization has clear technical advantages over sulphide and laterite ores for producing nickel sulphate, offering a lower-cost, lower-carbon path from mine-to-market in the EV battery supply chain. Given its extremely high nickel content (over 60% nickel) and low levels of impurities, our high-grade nickel concentrate has distinct advantages over low-grade nickel sulphide concentrates (under 20% nickel), and is already comparable to intermediate nickel sulphate feedstocks like mixed hydroxide precipitate (" MHP "), mixed sulphide precipitate (" MSP "), or nickel matte.

"We look forward to continued engagement with downstream participants in the EV battery supply chain, including chemical companies, battery makers and automotive OEMs, and expect to incorporate the results of this internal scoping study into the next stage of formal project study for Baptiste, with a new National Instrument 43-101 technical report anticipated in the first half of 2023."

Awaruite – An Advantageous Nickel Feedstock

Nickel mineralization at Baptiste is primarily present in awaruite (Ni 3 Fe), a nickel-iron alloy composed of 75% nickel and 25% iron. In comparison to typical nickel sulphide concentrates, the Baptiste awaruite nickel concentrate is notable for its extremely high nickel content and low level of sulphur and associated impurities, as shown in Table 1.

Table 1 – Select Elemental and Mineral Content for Baptiste Nickel Concentrate and Typical Nickel Sulphide Concentrates

| Elements and Minerals | Baptiste Awaruite | Nickel Sulphide |

| Nickel (Ni) | 60-65% | 8-21% |

| Iron (Fe) | 30-32% | 25-41% |

| Sulphur (S) | 0.6 % | 14-31% |

| Cobalt (Co) | 1 % | 0-1.2% |

| Copper (Cu) | 0.5 % | 0-5.0% |

| Magnesium Oxide (MgO) | 1 % | 4-10% |

As described in the Company's January 7, 2020 news release, successful pressure leach testwork on Baptiste's awaruite nickel concentrate was undertaken by Sherritt Technologies (" Sherritt "). These tests demonstrated awaruite has favourable leaching characteristics, with up to 99% nickel extraction under moderate conditions and short treatment times. In addition, these tests demonstrated that the expected pregnant leach solution will contain low levels of impurities, allowing the utilization of conventional downstream unit operations for the production of nickel sulphate.

The favourable leaching characteristics of Baptiste's awaruite nickel concentrate, relative to a nickel sulphide concentrate, arises from the absence of sulphur in the awaruite mineral. While leaching of nickel sulphide concentrates is industrially proven, as demonstrated by Vale's Long Harbour refinery, they require more aggressive leaching conditions owing to the inherently refractory nature of sulphide minerals. Further to the simpler processing route, the significantly higher nickel grade of awaruite translates to a reduced plant size for a given nickel output.

Engineering Study Evaluating Nickel Sulphate Production

Strategy and Basis

Upstream of EV battery manufacturers are chemical plants producing P-CAM (precursor cathode active material) and CAM (cathode active material) for inclusion into the battery cathode cells. These chemical plants require nickel feedstock to produce P-CAM and CAM, with a preference for nickel sulphate specifically.

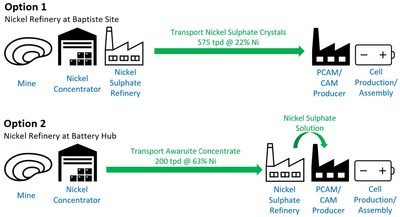

FPX engaged Ausenco Engineering Canada Ltd. (" Ausenco ") to complete an independent scoping study evaluating upgrading the high-grade Baptiste awaruite nickel concentrate to nickel sulphate. The Study evaluated options for producing nickel sulphate in either crystal form (Option 1) or solution form (Option 2), including an assessment of the various technical, economic and strategic considerations of each alternative. Figure 1 below provides a conceptual product flow diagram for each Option's integration into the EV battery supply chain.

Option 1 entails the production of nickel sulphate crystals at a hydrometallurgical refinery to be located either at the Baptiste site or a separate off-site location. The primary advantage of producing nickel sulphate in crystal form (versus Option 2's solution form) is the greater flexibility for servicing multiple downstream users, which is a tangible consideration considering the significant potential annual production volume from Baptiste (nominally 43,500 tonnes per year of nickel contained in approximately 200,000 tonnes per year of nickel sulphate crystal grading 22% nickel).

Option 2 is based on the transport of Baptiste concentrate to a refinery co-located with P-CAM and CAM manufacturing facilities (and potentially downstream battery cell manufacturing and battery pack assembly facilities). In this scenario, the refinery would produce a nickel sulphate solution, which would then be directly fed to an adjacent chemical plant producing P-CAM and CAM. The primary advantage of Option 2 is the potential synergies of co-locating refining, P-CAM, and CAM facilities in a common location.

In addition to the production of nickel sulphate, the Study also evaluated the capture of cobalt units into a cobalt intermediate product, representing a new by-product opportunity for the Project.

Processing Concept

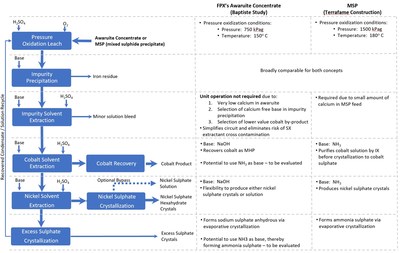

The Study envisioned a processing concept with a conventional flowsheet, including unit operations of leaching, purification, solvent extraction, and crystallization. The process envisioned in the Study is also broadly comparable with the recently constructed Terrafame nickel refinery, which treats a mixed sulphide precipitate (" MSP ") product, with nickel intermediates such as MSP having broadly comparable processing requirements to Baptiste's awaruite nickel concentrate, as presented in Table 2.

Table 2 – Comparison of Baptiste's Awaruite Nickel Concentrate and Typical MSP Feedstock

| | Baptiste Awaruite Nickel Concentrate | Typical MSP Feedstock |

| Composition Nickel (Ni) Iron (Fe) Sulphur (S) Cobalt (Co) Copper (Cu) Magnesium Oxide (MgO) | 60-65% 30-32% 0.6% 1.0% 0.5% 1% | 55% 0.1-0.2% 33% 1-5%

|

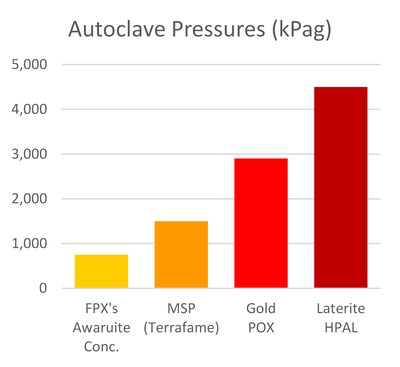

| Pressure Leaching Requirements: Pressure (kpag) Temperature (°C) Residence Time (hours) | 750 150 1.5 | 1,200-1,500 160-180 2.5 |

| Pregnant Leach Solution: Nickel (g/L) Iron (g/L) Free Sulphuric Acid (g/L) | 60-70 2.0 10-25 | 80 0.5 20-30 |

Selection of the process design, equipment sizing and reagent quantities in the Study was based on a review of previous testwork, internal databases, and benchmarking against similarly-sized nickel sulphate operations, including Terrafame's refinery in Finland and BHP's Kwinana refinery in Australia. The FPX Study developed overall flowsheets, mass and energy balances, key mechanical equipment lists, general arrangement layouts, capital cost estimates, and operating cost estimates.

Figure 2 presents a comparison of the Study's processing concept to the comparable Terrafame processing concept, with key differences highlighted.

Key Results

Based on the Study's process design, the production of nickel sulphate from Baptiste's awaruite nickel concentrate is expected to achieve stage nickel recoveries of approximately 97%, resulting in the annual production of approximately 43,500 tonnes of nickel in nickel sulphate in the form of either crystals (Option 1) or solution (Option 2). At this scale, Baptiste would significantly exceed the scale of the world's current largest nickel sulphate producers.

Further, the proposed design is expected to yield cobalt recoveries from flotation concentrate of approximately 95%, resulting in the annual production of approximately 650 tonnes of cobalt in either an MSP or MHP product grading 40-50% Co. At this scale, Baptiste would become one of Canada's five largest cobalt operations, alongside nickel-cobalt mines operated by Glencore and Vale in central and eastern Canada .

Based on preliminary estimates developed for the Study, it is expected that the capital costs of nickel sulphate production at Baptiste will be competitive with the comparable Terrafame refinery in Finland , which was commissioned in 2021 (see Table 3). Similarly, the Study's operating cost estimate in well aligned with other industry benchmarks.

Table 3 – Key Parameters for Recent and Planned Nickel Sulphate Refinery Operations

| | Baptiste | Terrafame |

| Basis | Independent scoping study | Constructed |

| Location | Canada | Finland |

| Feedstock | Awaruite concentrate 60-65% Ni | MSP 55% Ni |

| Production (tpa nickel contained in nickel sulphate) | 43,500 | 37,400 2 |

| Capital Cost (USD, millions) | Internal Estimates | $333 3 |

| Capital Intensity (USD / tpa nickel) | Internal Estimates | $8,900 |

| Operating Cost (USD / lb nickel) | Internal Estimates | Not published |

The production of (a) nickel sulphate and (b) cobalt MHP (or MSP) products are expected to generate high-value alternatives for the utilization of Baptiste concentrate in the global EV battery supply chain. With easy access to well established domestic and international shipping routes, the Baptiste products can be readily integrated into the rapidly expanding EV production chain both within North America and abroad.

Comparison of Nickel Sulphate Feedstocks – Awaruite vs. Sulphides and Laterites

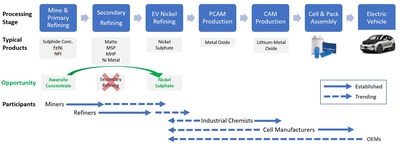

Typically, nickel sulphate is produced from intermediate or refined nickel products that have been subject to multiple complex metallurgical processes. These intermediate nickel products are typically either produced from sulphide or laterite nickel ores. The treatment process for Baptiste's awaruite nickel concentrate presents a simplified and lower risk route to producing large quantities of nickel sulphate.

Awaruite vs. Sulphide Ores

As compared to nickel sulphide concentrates, results from FPX's testwork and the Study suggest Baptiste's awaruite nickel concentrate has significant technical advantages, as follows:

- Reduced Processing Requirements – the lack of sulphur and associated impurities eliminates the need for intermediate smelting prior to downstream hydrometallurgical processing into nickel sulphate (see Figure 3)

- Reduced Process Complexity – the efficient dissolution of Baptiste's awaruite nickel concentrate eliminates the need for intermediate smelting and/or complex leaching processes, such as ultra-fine grinding, chlorine pre-leaching, chloride addition, or ammonia leaching

- Reduced Carbon Intensity – the extremely high nickel content of Baptiste nickel concentrate (60-65% nickel) reduces the volume of concentrate for shipment by up to 85% in comparison with nickel sulphide concentrates, which typically grade 10-15% nickel, and the elimination of a secondary refining stage (e.g., smelting) further reduces the carbon emissions associated with transportation to multiple refining locations

Awaruite vs. Laterite Ores

As compared to nickel laterite ores, results from FPX's testwork and the Study suggest Baptiste's awaruite nickel concentrate has significant technical advantages, as follows:

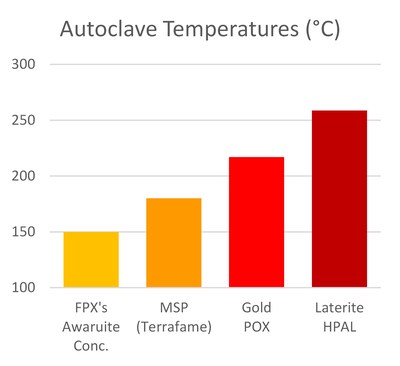

- Process Complexity – the leaching characteristics of awaruite require significantly lower pressure and temperature than high-pressure acid-leach ("HPAL") processes ( See Figures 4 and 5)

- Process Footprint – the extremely high nickel content of Baptiste concentrate (60-65%+ nickel) tangibly reduces the volume of material subjected to pressure oxidation and leaching, significantly reducing the footprint and cost of the hydrometallurgical facility

- Reduced Carbon Intensity – tangibly reduced process requirements for Baptiste concentrate fed by British Columbia's hydroelectric-based grid with demonstratively lower carbon intensity

Based on FPX's testwork and Study results, a refinery upgrading Baptiste's awaruite nickel concentrate would generate a low-carbon, low-cost, high-volume and high-purity nickel sulphate product for the EV battery supply chain, with a favourable competitive position driven by:

- Single integrated facility to convert concentrate directly to nickel sulphate

- Low cost of feedstock for a refinery integrated with the Baptiste mine-and-mill operation, versus higher-cost refined nickel feedstocks like nickel matte, MSP, MHP, powder, and briquettes

- High refinery recovery rates for both nickel and cobalt

- Efficiencies in the use of power, water and reagents and tailings disposal in an integrated site

- Low-carbon footprint leveraging access to low-cost hydroelectric power in British Columbia

Next Steps

The near-term path for development of a nickel refinery upgrading Baptiste's awaruite nickel concentrate to nickel sulphate includes further testwork, further engineering studies, and general project development activities.

As part of FPX's ongoing three-phase metallurgical testwork campaign, approximately 17 tonnes of Baptiste material is currently being treated by a pilot plant at Corem in Quebec City. In addition to supporting refinement of the upstream mineral processing flowsheet, this large-scale piloting will also generate sufficient awaruite nickel concentrate for hydrometallurgical testwork. Concentrate is anticipated to be available in October 2022 , with the subsequent hydrometallurgical testwork campaign to run through the fourth quarter of 2022. This hydrometallurgical testwork campaign will:

- Optimize awaruite nickel concentrate leaching conditions

- Validate the conventional solution purification route for awaruite feedstock producing battery grade nickel sulphate

- Evaluate opportunities specific to awaruite to further simplify the process and significantly reduce capital and operating costs

Building on the engineering studies to date and incorporating the testwork results as available, FPX will commence a more advanced engineering study in the fourth quarter of 2022, with results available in the second or third quarter of 2023. This new technical study will adhere to National Instrument 43-101, thereby allowing a fulsome disclosure of estimate results which will complement the more advanced engineering basis.

Andrew Osterloh , P. Eng., FPX Nickel's Qualified Person under NI 43-101, has reviewed and approved the technical content of this news release.

References:

- Goldman Sachs Commodities Research, "Nickel's Class Divide", April 28, 2022 .

- https://www.terrafame.com/media/terrafame-ltd-carbon-footprint.pdf

- https://www.terrafame.com/news-from-the-mine/news/2021/06/production-ramp-up-at-terrafames-battery-chemicals-plant-has-started.html#:~:text=Production%20ramp%20up%20at%20Terrafame's%20new%20battery%20chemicals%20plant%20has,of%20the%20highest%20production%20capacities

About the Decar Nickel District

The Company's Decar Nickel District claims cover 245 km 2 of the Mount Sidney Williams ultramafic/ophiolite complex, 90 km northwest of Fort St. James in central British Columbia . The district is a two-hour drive from Fort St. James on a high-speed logging road.

Decar hosts a greenfield discovery of nickel mineralization in the form of a naturally occurring nickel-iron alloy called awaruite (Ni 3 Fe), which is amenable to bulk-tonnage, open-pit mining. Awaruite mineralization has been identified in four target areas within this ophiolite complex, being the Baptiste Deposit, and the B, Sid and Van targets, as confirmed by drilling, petrographic examination, electron probe analyses and outcrop sampling on all four targets. Since 2010, approximately US $28 million has been spent on the exploration and development of Decar.

Of the four targets in the Decar Nickel District, the Baptiste Deposit, which was initially the most accessible and had the biggest known surface footprint, has been the focus of diamond drilling since 2010, with a total of 99 holes and 33,700 m of drilling completed. The Sid target was tested with two holes in 2010 and the B target had a single hole drilled in 2011; all three holes intersected nickel-iron alloy mineralization over wide intervals with DTR nickel grades comparable to the Baptiste Deposit. In 2021, the Company executed a maiden drilling program at Van, which has returned promising results comparable with the strongest results at Baptiste.

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Decar Nickel District, located in central British Columbia , and other occurrences of the same unique style of naturally occurring nickel-iron alloy mineralization known as awaruite. For more information, please view the Company's website at www.fpxnickel.com or contact Martin Turenne , President and CEO, at (604) 681-8600 or ceo@fpxnickel.com .

On behalf of FPX Nickel Corp.

"Martin Turenne"

Martin Turenne , President, CEO and Director

Forward-Looking Statements

Certain of the statements made and information contained herein is considered "forward-looking information" within the meaning of applicable Canadian securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators. Actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE FPX Nickel Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/September2022/07/c2441.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/September2022/07/c2441.html