January 09, 2024

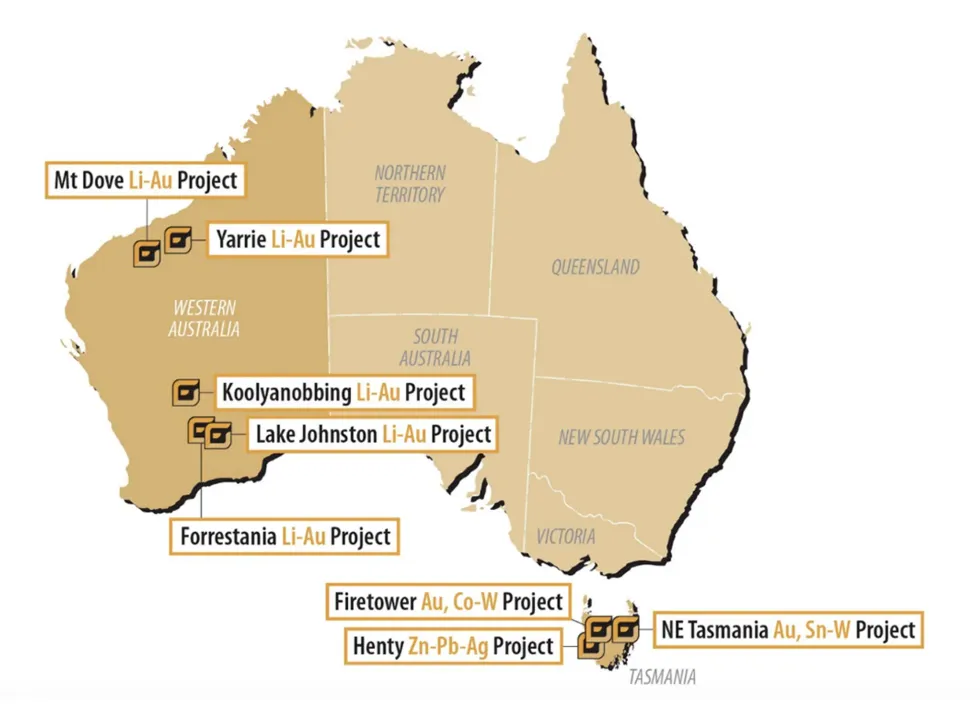

Flynn Gold Limited (ASX:FG1) advances its portfolio of gold and battery metals projects in Tasmania and Western Australia. The company holds 12 tenements spread across 1,475 sq. km. in Tasmania and 24 tenements across 1,140 sq. km. in Western Australia.

The company's flagship Golden Ridge project is located 75 kilometres east of Launceston in Northeast Tasmania with exploration efforts focused on an 8-kilometer-long granodiorite-metasediment contact zone. Flynn Gold successfully completed initial metallurgical tests in November 2023 on 26 drill samples from the Trafalgar prospect. Average gold recovery of 94.5 percent was recorded using conventional bottle roll leaching.

Flynn Gold is also building a strategic lithium and gold portfolio in Western Australia, targeting hard-rock lithium pegmatites and intrusive related gold deposits in the Pilbara region and Yilgarn Craton.

Company Highlights

- Flynn Gold is an Australian mineral exploration company with a portfolio of gold and battery metals projects in Tasmania and Western Australia.

- In Tasmania, the company holds 12 tenements spread across 1,475 sq. km., including three main projects in Northeast Tasmania — Golden Ridge, Warrentinna and Portland — that are prospective for gold and tin. Moreover, it has two projects in Northwest Tasmania: the Henty zinc-lead-silver project and the Firetower gold-cobalt-tungsten-copper project.

- In Western Australia, Flynn holds 24 tenements across 1,140 sq. km., including lithium-gold projects in the Pilbara and Yilgarn regions. The Yilgarn region has three lithium-gold projects: Forrestania; Lake Johnston and Koolyanobbing. The Pilbara hosts two gold-lithium projects: Mt Dove and Yarrie.

- In addition to these focus areas, the company holds an option to acquire two exploration licences at Parker Dome in Western Australia, situated near the world-class Mount Holland lithium project.

- The company’s near-term focus is on its Northeast Tasmania gold portfolio due to its geological similarity to the Victorian goldfields.

- Flynn Gold’s exploration at its flagship Golden Ridge Project in NE Tasmania has focused on an 8-kilometre-long granodiorite-metasediment contact zone with diamond drilling to date intersecting multiple high-grade gold vein intervals.

- In November 2023, the company announced strong metallurgical test results from the Golden Ridge project, as exploration commenced at two other Tasmanian projects — Warrentinna and Firetower – with results pending.

- In December 2023, the company announced plans to raise $2.4 million that will help advance its exploration activities including the acquisition of the exploration licences at Parker Dome.

- The company’s senior leadership team has a proven track record in the mining sector to capitalize on the high resource potential of its projects.

This Flynn Gold profile is part of a paid investor education campaign.*

Click here to connect with Flynn Gold (ASX:FG1) to receive an Investor Presentation

FG1:AU

The Conversation (0)

12 August 2024

Flynn Gold

Advancing three high-grade gold projects in Tasmania

Advancing three high-grade gold projects in Tasmania Keep Reading...

20 February 2025

Exploration Update - Golden Ridge Project, NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Update - Golden Ridge Project, NE TasmaniaDownload the PDF here. Keep Reading...

18 February 2025

High-Grade Silver-Lead at Henty Project, Western Tasmania

Flynn Gold (FG1:AU) has announced High-Grade Silver-Lead at Henty Project, Western TasmaniaDownload the PDF here. Keep Reading...

30 January 2025

December 2024 Quarterly Activities Report and Appendix 5B

Flynn Gold (FG1:AU) has announced December 2024 Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

12 January 2025

Flynn Expands Key Gold Targets at Golden Ridge, NE Tasmania

Flynn Gold (FG1:AU) has announced Flynn Expands Key Gold Targets at Golden Ridge, NE TasmaniaDownload the PDF here. Keep Reading...

08 December 2024

Exploration Licence Granted at Beaconsfield in NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Licence Granted at Beaconsfield in NE TasmaniaDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00