August 15, 2022

Alvo Minerals Limited (ASX: ALV) (Alvo or the Company) is pleased to announce multiple new FLEM conductors around the C3 prospect increasing the prospectivity of the C3 ‘cluster’. Follow-up mapping, sampling and trenching has improved the targeting at Mafico, a new and undrilled VMS prospect to the east of C3. Diamond drilling has recommenced at C3 after extensive drilling at C1. The targets around C3 will be the focus of discovery drilling in coming weeks.

HIGHLIGHTS

- Fixed loop electromagnetic (FLEM) surveys across C3 reveal multiple conductors prospective for Volcanogenic Massive Sulphide (VMS) style mineralisation

- Drilling set to commence imminently at Mafico and Ema

- Multiple conductors on and around C3 indicates it may be situated at the centre of local cluster

- Broad mineralised gossans defined on surface and in trenches at Mafico significantly enhance prospectivity

- Two diamond rigs and one RC rig are operational at C3

- Phase 2 diamond drilling underway - testing extensions to known high-grade mineralisation (C3 remains open to the NE, SW and at depth) and surrounding high priority FLEM conductors

- RC drilling is targeting supergene mineralisation and shallow VMS positions

- Compelling near-term newsflow expected with Phase 1 diamond drilling results at C1 due in coming weeks and metallurgical testwork on C3 diamond core underway

Alvo Minerals’ Managing Director, Rob Smakman, commented on the ongoing exploration:

“The surprising number of conductors surrounding C3 encouraged our geologists to start hunting for mineralised gossans to help rank drill targets. Finding gossanous float at Mafico and following it up with trenching, which defined broad mineralised gossans at surface, has got the team excited for drill testing and enhanced our discovery process.

“Our exploration model of a regional cluster of VMS deposits within the Palma district has been partially confirmed by the FLEM surveys completed across C3 and surrounds. The multiple conductors on and around C3 indicate it may be situated at the centre of local cluster. Drill testing of these new conductors will start shortly, as we seek our first “discovery” and the confirmation of our exploration model.”

Exploration at C3 and surrounds

Alvo initiated FLEM surveys in June 2022 using the recently purchased ‘state of the art’ equipment at the C3 prospect (see Figure 1). The surveys are designed to map and discover conductive minerals which could be mineralised, similar to the VMS style mineralisation currently being explored at C3 and C1.

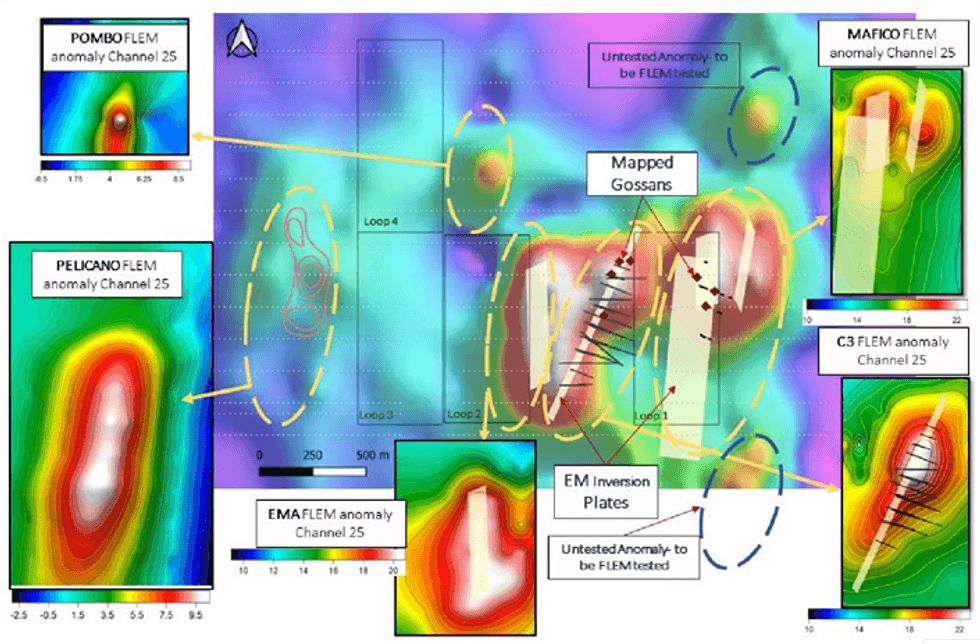

Figure 1. Compilation plan of FLEM surveys and conductive anomalies around the C3 prospect. New prospects including Mafico, Ema (previously named C3 West), Pelicano and Pombo (Channel 25) all represented at same size scale, with variable colour conductivity scale. Background is VTEM image (channel 30).

The first survey loop1 (Loop 1) targeted the known mineralisation at C3 and was instantly successful in defining the mineralisation previously intersected in drilling by Alvo and the Brazilian Geological Survey (CPRM). Alvo has completed over 4,000m of drilling at C3 to date, with phase 2 diamond drilling currently underway. FLEM surveys and the addition of downhole electromagnetic surveys (DHEM - currently underway) have the ability to expand the prospectivity and refine the drill targeting.

Click here for the full ASX Release

This article includes content from Alvo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ALV:AU

The Conversation (0)

08 August 2022

Alvo Minerals

District-Scale Copper-Zinc VMS Project in Brazil

District-Scale Copper-Zinc VMS Project in Brazil Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00