October 03, 2024

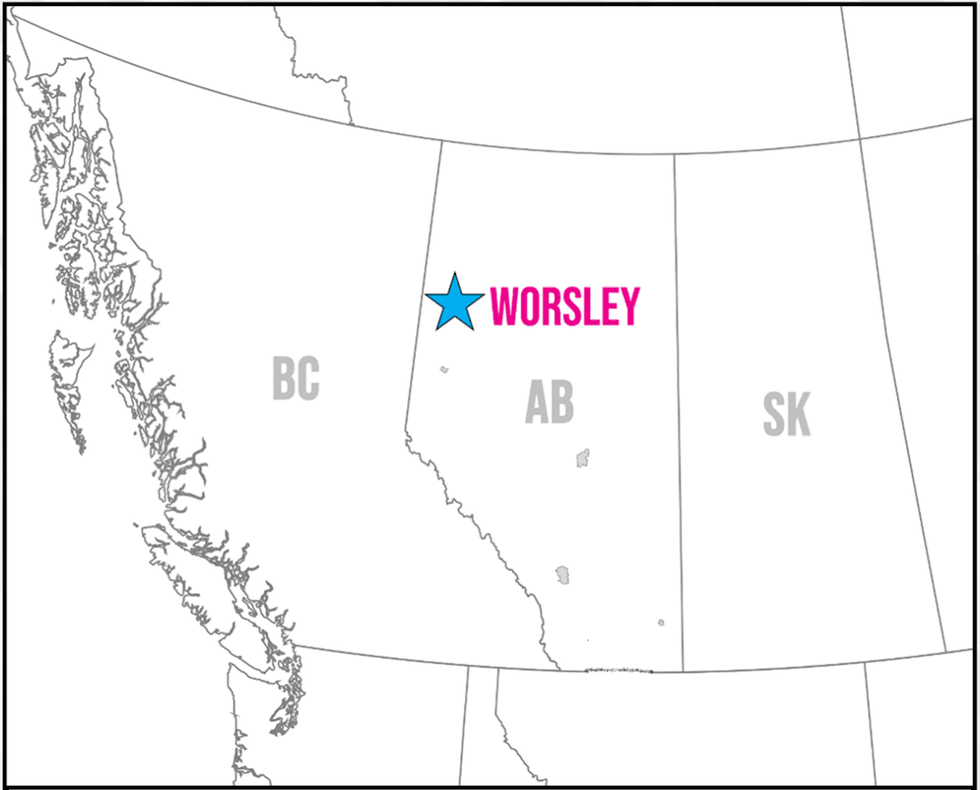

First Helium (TSXV:HELI,OTCQB:FHELF,FRA:2MC) is a Canadian company developing helium resources in Alberta, Canada. The company’s primary asset is the Worsley project spanning 53,000 acres, including helium-enriched natural gas, oil and other natural resources. First Helium has made significant progress with multiple discoveries, including a helium discovery well and successful oil wells. The company aims to grow its production and cash flow through ongoing exploration and drilling activities.

First Helium targets over $100 million in annual revenue within the next three to five years. Based on current projections, vertical drilling alone could generate over $100 million in annual revenue, with cash flow estimated to reach $70 million annually.

The Worsley project is distinguished by its significant helium resources and multi-zone drilling potential for helium, natural gas and oil. Worsley area has produced over 1 Bcf of helium, which was not recovered in previous natural gas operations, highlighting the untapped potential of the region for helium extraction.

The Worsley project area benefits from an existing natural gas gathering infrastructure, expediting the timeline to bring helium to market. First Helium expects the first production to begin in the fourth quarter of 2025, positioning it to become a key supplier in the growing North American helium market.

Company Highlights

- Helium is a critical mineral with steady growth in demand. Major companies like Google, Amazon, SpaceX, Samsung, NVIDIA and Intel rely on it.

- Helium prices have increased by over 50 percent in the last three years and the market is expected to grow 300 percent by 2030.

- First Helium’s indicative cash netbacks are three to four times higher than typical Canadian natural gas producers.

- First Helium offers exposure to helium, natural gas and oil revenue streams, which diversifies risk and increases value.

This First Helium profile is part of a paid investor education campaign.*

HELI:CA

The Conversation (0)

10 February 2025

First Helium

Advanced stage, high-value oil, and helium-enriched natural gas project in Alberta, Canada

Advanced stage, high-value oil, and helium-enriched natural gas project in Alberta, Canada Keep Reading...

13h

Syntholene Energy Corp. Announces Upsize to Previously Announced Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it will be increasing the size of its previously announced... Keep Reading...

06 February

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

05 February

Angkor Resources Celebrates Indigenous Community Land Titles and Advances Social Programs, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 5, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") is pleased to announce that nine Indigenous community land titles have been formally granted to Indigenous communities in Ratanakiri Province, Cambodia, following a... Keep Reading...

05 February

Syntholene Energy Corp Strengthens Advisory Board with Former COO of Icelandair Jens Thordarson

Mr. Thordarson brings two decades of expertise in operations, infrastructure development, and large-scale business transformation in the aviation industrySyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the nomination of Jens... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00