July 02, 2024

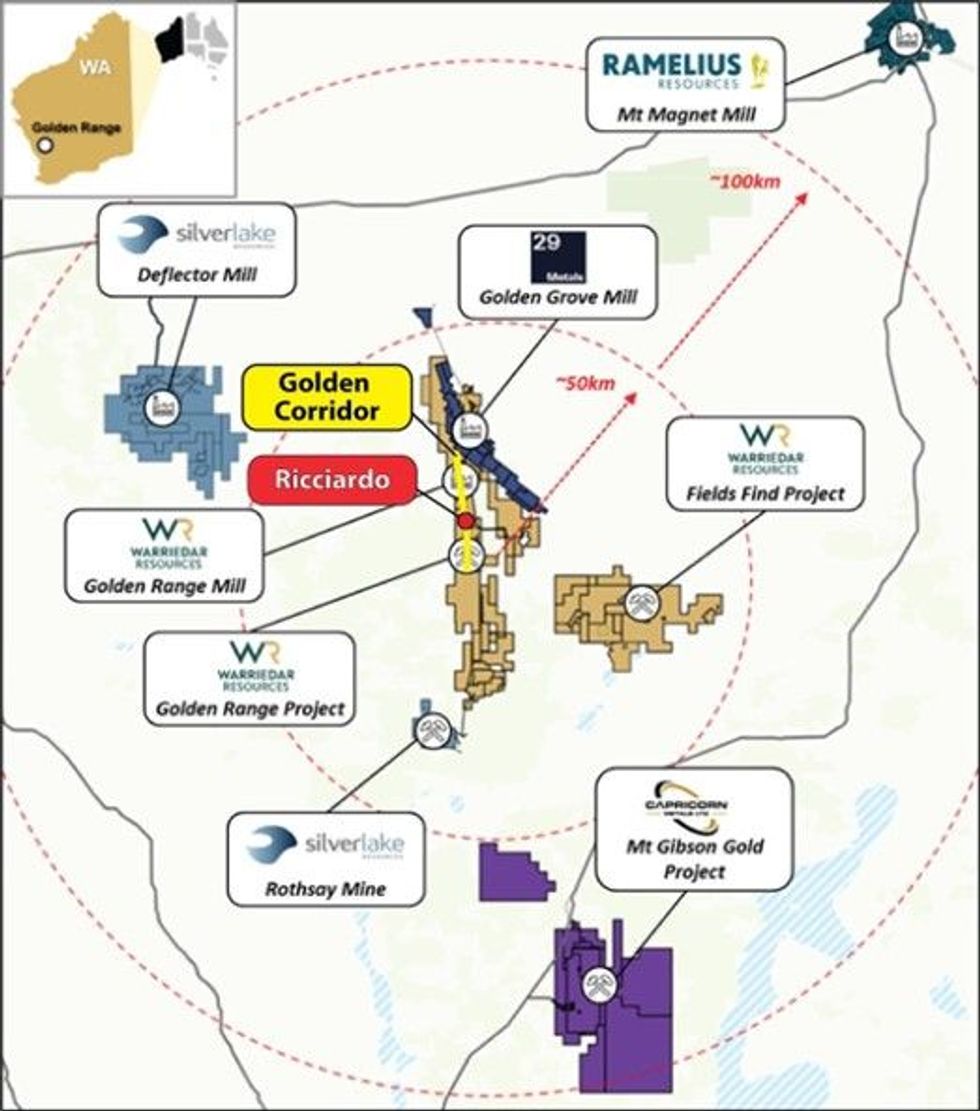

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to provide an update on drilling progress and release the first results from diamond drilling undertaken at the Ricciardo deposit within its Golden Range Project, located in the Murchison region of Western Australia (Figure 1).

HIGHLIGHTS:

- Next phase of drilling activities progressing strongly at Ricciardo and M1.

- Approximately 5,030m RC (29 holes) and 1,420m diamond drilling (16 holes) completed to date.

- The first diamond drilling undertaken at the 2.3km long Ricciardo deposit by any operator in ten years.

- Assay results returned for the first four (4) diamond tails (255m) of the program at Ricciardo have seen all holes intersect significant gold intervals, including:

- 19m @ 4.94 g/t Au from 188m (RDRC039 DD) * includes contiguous final RC result of 4m @ 14.49 g/t from 188m

- 12m @ 6.98 g/t Au from 110m (RDRC040 DD) inc. 3m @ 22.12 g/t Au from 112m

- 16m @ 2.30 g/t Au from 243m (RDRC055 DD) inc. 6m @ 3.13 g/t Au from 252m

- 17m @ 2.38 g/t Au from 264m (RDRC055 DD) inc. 8m @ 4.03 g/t Au from 273m

- Delivers further high-grade extensional success to existing Mineral Resource Estimate (MRE) model below the Silverstone North pit (Holes 40, 55) and infill confidence to MRE below northern end of the Ardmore pit (Hole 39).

- These outcomes build on the growth in high-grade deposit margins delivered at Ricciardo from the significant RC program executed earlier this year.

- Ricciardo sits in the middle of the 25km-long ‘Golden Corridor’ at Golden Range, which hosts six discrete deposits (18 historic pits) that are all open at depth and possess immediate growth potential.

- The ‘Golden Corridor’ is Warriedar’s key exploration focus in 2024.

This is the first diamond drill program at Ricciardo since 2014, when just three (3) diamond holes were drilled by the previous operator.

The results reported in this release are for four (4) (255m) of the 16 (1420m) diamond holes drilled to date. Approximately 2,200m of diamond drilling is planned as part of the current phase of combined RC and diamond drilling at Ricciardo and M1.

The results from these initial four diamond holes extend the high-grade shoot below the Silverstone North pit and infill a previous gap in the high-grade zone of the MRE below the northern part of the Ardmore pit (adding confidence and continuity to the MRE in this area).

These outcomes, while stemming from only a small part of the overall current phase of drilling, continues to demonstrate the outstanding MRE growth potential that exists at Ricciardo and along the broader ‘Golden Corridor’ trend.

The Ricciardo gold system (within the Golden Range Project) spans a strike length of approximately 2.3km, with very limited drilling having been undertaken below 100m depth. Ricciardo possesses a current Mineral Resource Estimate (MRE) of 8.7 Mt @ 1.7 g/t Au for 476 koz gold.1 The oxide material at Ricciardo has been mined by previous operators.

Click here for the full ASX Release

This article includes content from Warriedar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WA8:AU

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

18 November 2024

Targeted Exploration Focus Delivers an Additional 471koz or 99% Increase in Ounces, and a Higher Grade for Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on an updated MRE for its flagship Ricciardo Gold Deposit, part of the broader Golden Range Project located in the Murchison region of Western Australia. HIGHLIGHTS:Updated Mineral Resource Estimate (MRE) for... Keep Reading...

30 September 2024

Continued Delivery of High Grade Antimony Mineralisation at Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides an update on its initial review of the antimony (Sb) potential at the Ricciardo deposit, located within its Golden Range Project in the Murchison region of Western Australia. HIGHLIGHTS:Review of the antimony (Sb)... Keep Reading...

29 September 2024

Further Strong Extensional Diamond Drill Results from Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. HIGHLIGHTS:All residual assay results received from the recent 2,701m (27 holes) diamond drilling program at... Keep Reading...

26 August 2024

Further Step-Out Gold Success and High-Grade Antimony Discovery

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. The results reported in this release are for a further 6 of the 27 diamond holes drilled in the current program at... Keep Reading...

10h

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

22h

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00