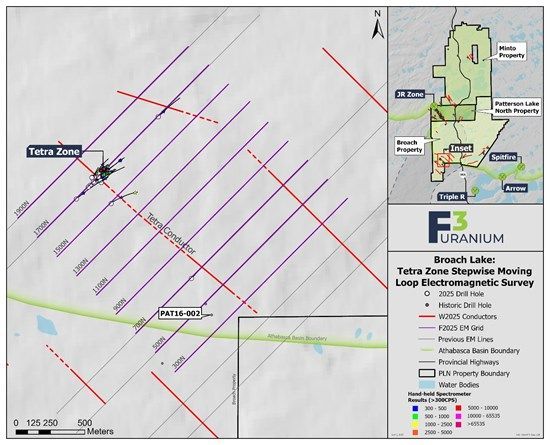

F3 Uranium Corp (TSXV: FUU,OTC:FUUFF) (OTCQB: FUUFF) (FSE: GL7) ("F3" or "the Company") is pleased to announce the commencement of ground EM surveys at its 100% owned Broach Lake Property, where F3 intersected 67.0m total composite radioactivity at the Tetra Zone (see NR August 5, 2025). A uniquely designed 65km of stepwise moving loop electromagnetic (SWMLEM) surveying will be completed initially on a priority grid covering the mineralized conductive zone between the Tetra Zone and historic drillhole PAT-16-002, located 1.2km to the southeast, where maiden geochemical analysis by F3 returned 423ppm uranium over 0.5m (see NR July 21, 2025). This survey will give greater confidence in locating the Tetra conductor and reduce the number of drillholes required to target along step-outs.

Sam Hartmann, Vice President Exploration, commented:

"Earlier this year (see NR February 11, 2025) we announced the commencement of our exploration program at the Patterson Lake Project, including the Broach Lake Project with a 41 line-km moving loop time domain (MLTDEM) ground geophysics survey which was a first pass exploratory survey. By March (see NR March 18, 2025) we intersected the first anomalous radioactivity with PLN25-202 which encountered six distinct zones of anomalous radioactivity over a 90m downhole interval. In April (see NR April 15, 2025) we discovered the Tetra Zone with PLN25-205 which returned a 1.0m high grade interval with 2.50% U3O8 within a 22.5m mineralized main interval averaging 0.26% U3O8 from 384.5m to 407.0m.

Today we announce a new stepwise moving loop electromagnetic (SWMLEM) survey designed to cover the highest priority section of the Tetra Conductor over a 1,600m strike length including the ~1,200m between the Tetra Zone and PAT-16-002. It aims to detect subtle basement-hosted conductors through highly conductive overburden. This tighter survey based on 200m spaced lines will give us greater control over local conductor locations and reduce exploration drilling."

Map 1. Broach Lake - Tetra Zone Stepwise Moving Loop Electromagnetic Survey

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8110/264644_c31f2d8cc4d9a81f_002full.jpg

About the Patterson Lake North Project:

The Company's 42,961-hectare 100% owned Patterson Lake North Project (PLN) is located just within the south-western edge of the Athabasca Basin in proximity to Paladin's Triple R and NexGen Energy's Arrow high-grade uranium deposits, an area poised to become the next major area of development for new uranium operations in northern Saskatchewan. The PLN Project consists of the 4,074-hectare Patterson Lake North Property hosting the JR Zone Uranium discovery approximately 23km northwest of Paladin's Triple R deposit, the 19,864-hectare Minto Property, and the 19,022-hectare Broach Property hosting the Tetra Zone, F3's newest discovery 13km south of the JR Zone. All three properties comprising the PLN Project are accessed by Provincial Highway 955.

Qualified Person:

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and approved on behalf of the company by Raymond Ashley, P.Geo., President & COO of F3 Uranium Corp, a Qualified Person. Mr. Ashley has reviewed and approved the data disclosed.

About F3 Uranium Corp.:

F3 is a uranium exploration company, focusing on the high-grade JR Zone and new Tetra Zone discovery 13km to the south in the PW area on its Patterson Lake North (PLN) Project in the Western Athabasca Basin. F3 currently has 3 properties in the Athabasca Basin: Patterson Lake North, Minto, and Broach. The western side of the Athabasca Basin, Saskatchewan, is home to some of the world's largest high grade uranium deposits including Paladin's Triple R project and NexGen's Arrow project.

Forward Looking Statements

This news release contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, including statements regarding the suitability of the Properties for mining exploration, future payments, issuance of shares and work commitment funds, entry into of a definitive option agreement respecting the Properties, are "forward-looking statements." These forward-looking statements reflect the expectations or beliefs of management of the Company based on information currently available to it. Forward-looking statements are subject to a number of risks and uncertainties, including those detailed from time to time in filings made by the Company with securities regulatory authorities, which may cause actual outcomes to differ materially from those discussed in the forward-looking statements. These factors should be considered carefully and readers are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements and information contained in this news release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

The TSX Venture Exchange and the Canadian Securities Exchange have not reviewed, approved or disapproved the contents of this press release, and do not accept responsibility for the adequacy or accuracy of this release.

F3 Uranium Corp.

750-1620 Dickson Avenue

Kelowna, BC V1Y9Y2

Contact Information

Investor Relations

Telephone: 778 484 8030

Email: ir@f3uranium.com

ON BEHALF OF THE BOARD

"Dev Randhawa"

Dev Randhawa, CEO

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264644