September 29, 2024

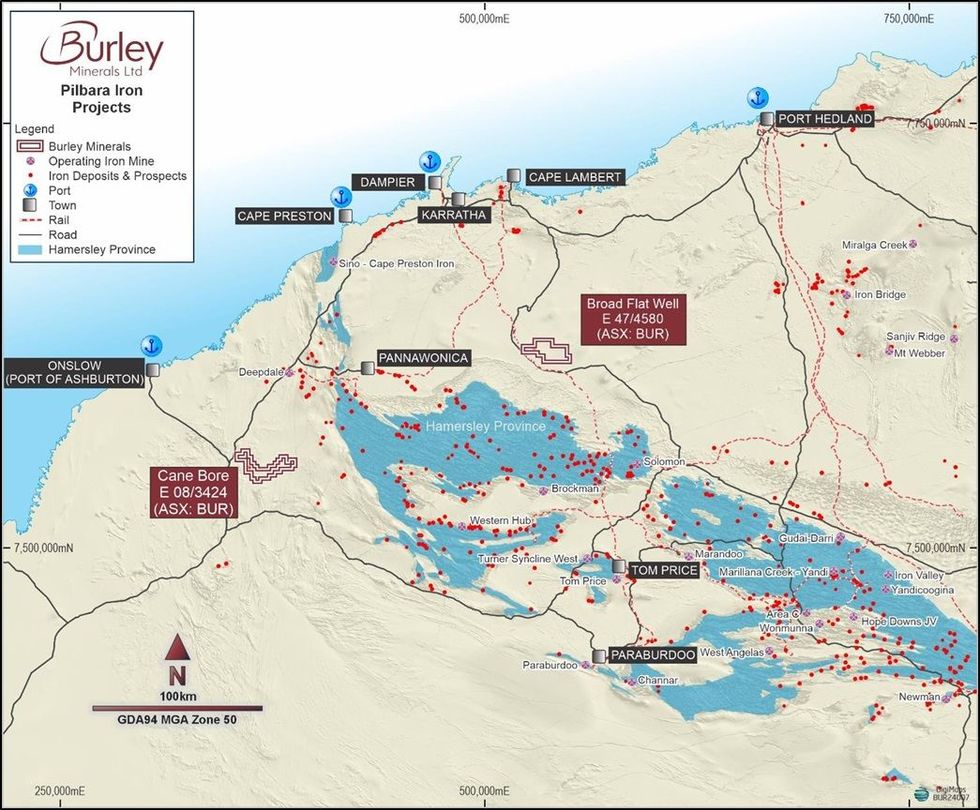

Burley Minerals Limited (ASX: BUR, “Burley” or “the Company”) is pleased to announce that Exploration License E08/3424 (the Cane Bore Iron Project) was granted by The Department of Energy, Mines, Industry Regulation and Safety (DEMIRS). Cane Bore is located within the world class Pilbara Province of the Western Australia and located less than 100 km by sealed road from the export Port of Onslow.

Highlights

Cane Bore Iron Project, WA – 100% Interest

- Exploration License (E08/3424) granted over the Cane Bore Iron Ore Project within the Hamersly Province of the Pilbara, Western Australia ~ 100 km by sealed road from Port of Onslow.

- More than 30km of remnant Channel Iron Deposits (CID) identified with historic rock sampling indicates grades of 51.3% to 55.0% Fe.

- The CID averages 400m widths and sits up to 20m above the surrounding surface.

- Burley is readying for a mapping and rock-chip sampling programme and is preparing a Programme of Work for its maiden drilling programme.

- Burley is currently engaging with Traditional Owners to complete heritage surveys for the maiden drill programme.

The grant of E08/3424 is subject to the conditions outlined in the Conservation Management Plan (CMP) approved by Department of Biodiversity, Conservation and Attractions (DBCA) earlier this year. The CMP provides details of the proposed exploration programmes at Cane Bore and the measures that will be implemented to mitigate environmental impacts of exploration activities.

Burley has Heritage Protection Agreements in place with the PKKP Aborginal Coporation and Buurabalayji Thalanjyi Aborginal Coporation, and is pursuing heritage surveys now. Furthermore, the Programme of Work (PoW) application for the maiden drilling programme is being prepared. This maiden drilling program is well defined in the CMP, faciliatiing the PoW application process. In addition, Burely is preparing a preliminary mapping and rock chip sampling exercise over the Channel Iron Deposit (CID) target areas at Cane Bore.

The Cane Bore Iron Project is adjacent to the sealed Northwest Coastal Highway, interesecting the Osnslow Road, and approximately 200 km southwest of Burley’s Broad Flat Well Iron Project (see Figure 1). The Cane River area was historically explored for iron resources in the late 1960s, but only wide-spaced sampling of surface materials was reported. More recent reconnisaince work, using recent satellite imagery, multi-spectral imagery, topographic data and extrapolation of known regional resources, indicates the potential to delineate more than 30 linear km of CID mineralisation at Cane Bore.

Burley Minerals Managing Director and CEO, Stewart McCallion commented:

“We are very pleased to have the Cane Bore exploration license granted. This is a major milestone for Burley as Cane Bore has the potential for significant CID-style iron resources, rivalling its neighbours in the local region. Our geologists are getting ready to mobilise to site and complete mapping and surface sampling over 30km of remnant Channel Iron Deposits (CID) that sits up to 20m above the surrounding terraine.

We are liasing with the Traditional Owners of the land to arrange heritage surveys over the primary drilling targets. The approved Conservation Management Plan detailed the proposed exploration programme at Cane Bore and this forms the basis to lodge a PoW application to DEMIRS now; there is more than 200 hectares of CID target areas to explore in this first pass. We are very excited about commencing a maiden drill programme over this substantial project and thank Burley shareholders for their patience while we reached this significant milestone.”

Click here for the full ASX Release

This article includes content from Burley Minerals Ltd., licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

11 November 2025

BHP Invests AU$944 Million in Western Australia Communities

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has released its 2025 Community Development Report for Western Australia, demonstrating a record-breaking investment of AU$944 million. According to the report, a majority of this year’s investment went to local suppliers, with AU$737 million spent. Of this, AU$529... Keep Reading...

02 April 2025

Fortescue's Forrest Hones in on Renewable Energy, Aims to Go Green by 2030

Andrew Forrest, founder and executive chair of major mining company Fortescue (ASX:FMG,OTCQX:FSUMF), has been making headlines following his bold statements on renewable energy.Toward the end of February, the mining tycoon was quoted as saying that Fortescue is quitting fossil fuels. According... Keep Reading...

10 March 2025

Rio Tinto Plans US$1.8 Billion Investment in BS1 Extension, Completes Arcadium Acquisition

Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) made headlines after two announcements on March 6. The mining giant said it will invest US$1.8 billion to develop the Brockman Syncline 1 mine project (BS1), a move that will extend the life of the Brockman region in West Pilbara, Western Australia.BS1 now... Keep Reading...

13 August 2024

Australia's Mining Dilemma: Can ESG Goals and Competitive Production Coexist?

With investors placing increasing value on environmental, social and governance (ESG) issues, mining companies are having to choose between maintaining competitive production and promoting ESG principles. That's the topic explored in an August 8 report from Callum Perry, Solomon Cefai, Alice Li... Keep Reading...

27 February 2020

Rio Tinto to Invest US$1 Billion to Reach Zero Emissions Goal by 2050

Mining giant Rio Tinto (ASX:RIO,LSE:RIO,NYSE:RIO) is set to invest US$1 billion in the next five years to reach its new climate change targets. The company is aiming to reduce emissions intensity by 30 percent and absolute emissions by a further 15 percent from 2018 levels by 2030. “Climate... Keep Reading...

02 January 2020

Iron Outlook 2020: Prices to Stabilize Following Supply Shock

Click here to read the latest iron outlook. Iron ore prices have come off their highest level of 2019, but are still ending on a high note. The year was marked once again by a disaster in the space, with Vale’s (NYSE:VALE) news of a dam collapse in January remaining in the spotlight throughout... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00