June 10, 2024

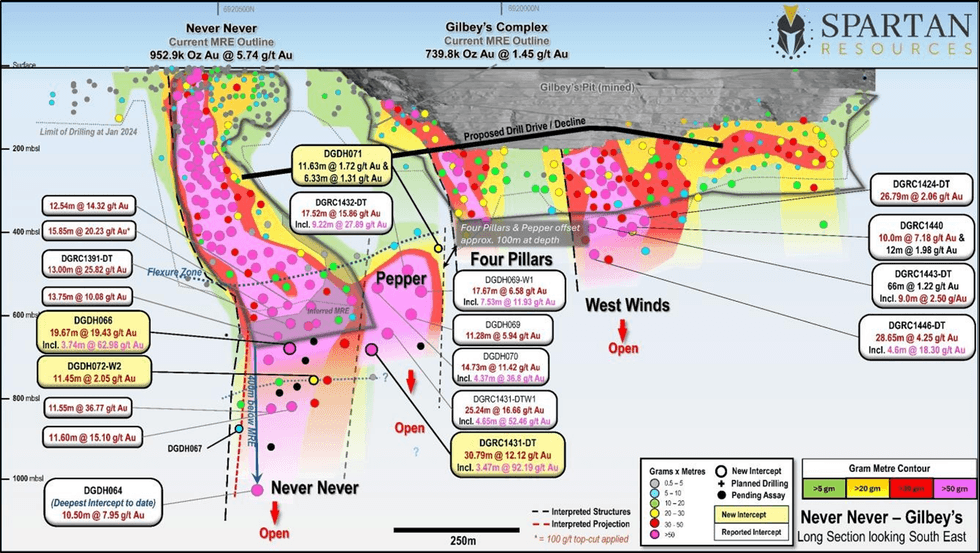

New deepest intercept at Pepper - 30.79m @ 12.12g/t and Never Never delivers19.57m @ 19.43g/t demonstrating grade and endowment of adjacent deposits

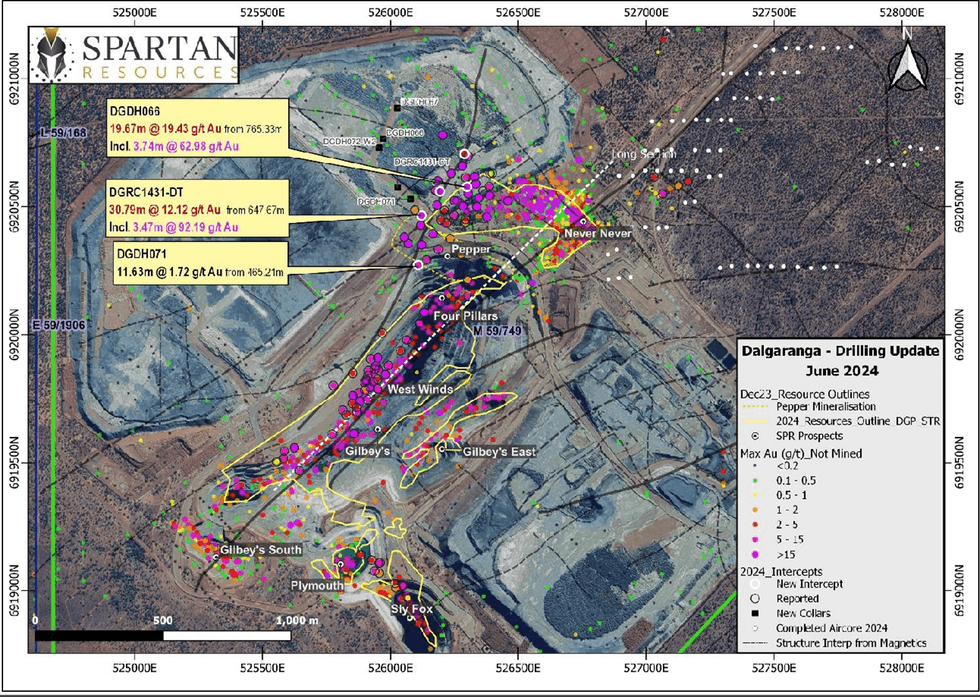

Spartan Resources Limited (“Spartan” or “Company”) (ASX: SPR) is pleased to provide an update on exploration activities at its 100%-owned Dalgaranga Gold Project (“DGP”), located in the Murchison region of Western Australia.

Highlights:

- Never Never Gold Deposit – strong in-fill drilling intercept strengthens deeper Resource extents:

- 19.67m @ 19.43g/t gold from 765.33m down-hole, incl. 3.74m @ 62.98g/t (DGDH066)

- Pepper Gold Prospect – new deepest intercept expands potential high-grade Resource extents:

- 30.79m @ 12.12g/t gold from 647.67m down-hole, incl. 3.47m @ 92.19g/t (DGRC1431-DT)

- Mineral Resource Estimate updates for the Never Never and Sly Fox Gold Deposits, as well as maiden standalone MRE’s for the Four Pillars, West Winds and Pepper Gold Prospects will be completed as part of the scheduled mid-year market update for the Dalgaranga Gold Project.

- Underground Exploration Drill Drive – submissions from four major underground mining contractors have been received. Submissions are currently being evaluated and awarding of the exploration drill drive development contract is expected in July. Surface support works in preparation for underground development activities are underway in anticipation of receiving approvals to commence the works to support the planned timing of development beginning later in the September quarter.

This release contains new assay results from recent surface drilling targeting the recently discovered high-grade Pepper Gold Prospect (DGRC1431-DT and DGDH071), as well as the immediately adjacent and growing Never Never Gold Deposit (DGDH066 and DGDH072-W2).

Management Comment

Spartan Managing Director and Chief Executive Officer, Simon Lawson, said: “The parent hole to the recently reported deepest intercept at Pepper of 25.24m @ 16.66g/t gold (DGRC1431-DT-W1) rewrites history again, being deeper still and returning an exceptional intercept of 30.79m @ 12.12g/t gold (DGRC1431-DT). These two holes are separated by about 50m and demonstrate the continuity of thick, high-grade gold mineralisation at this exciting new and growing prospect.

“The Never Never Gold Deposit also continues to throw up pleasant surprises, with a new thick and consistently high-grade intercept of 19.67m @ 19.43g/t gold (DGDH066) from within the Inferred area of the existing Mineral Resource Estimate. This near 400 gram x metre result provides strong support for our objective of converting Inferred ounces to the higher confidence Indicated category by in-filling this part of the existing MRE.

Click here for the full ASX Release

This article includes content from Spartan Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

20 February

Top 5 Canadian Mining Stocks This Week: Belo Sun is Radiant with 109 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Tuesday (February 17) Canadian Prime Minister Mark Carney announced the creation of... Keep Reading...

20 February

Gold and Silver Stocks Dominate TSX Venture 50 List

This year's TSX Venture 50 list showcases a major shift in sentiment toward the mining sector. The TSX Venture 50 ranks the top 50 companies on the TSX Venture Exchange based on annual performance using three criteria: one year share price appreciation, market cap growth and Canadian... Keep Reading...

19 February

Ole Hansen: Next Gold Target is US$6,000, What About Silver?

Ole Hansen, head of commodity strategy at Saxo Bank, believes US$6,000 per ounce is in the cards for gold in the next 12 months; however, silver may not enjoy the same price strength. "If gold moves toward US$6,000, I would believe that ... silver at some point will struggle to keep up, and... Keep Reading...

19 February

Kinross’ Great Bear Gold Project Accelerated Under Ontario’s 1P1P Framework

Ontario is moving to accelerate one of Canada’s largest emerging gold projects, cutting permitting timelines in half for Kinross Gold's (TSX:K,NYSE:KGC) Great Bear development in the Red Lake district.The province announced that Great Bear will be designated under its new One Project, One... Keep Reading...

19 February

Massan Indicated Conversion Programme Continues to Deliver

Asara Resources (AS1:AU) has announced Massan indicated conversion programme continues to deliverDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00