May 18, 2025

Red Mountain Project in Nevada, USA delivers the highest-grade intersection to date, with lithium now intersected over a 5.6km strike length

Astute Metals NL (ASX: ASE) (“ASE”, “Astute” or “the Company”) is pleased to report assay results from the first of six holes completed as part of its highly successful April 2025 diamond drilling campaign at the 100%-owned Red Mountain Lithium Project in Nevada, USA. Drill-hole RMDD003 has returned three high- grade intersections of lithium mineralisation:

- 32.4m @ 3,260ppm Li / 1.74% Lithium Carbonate Equivalent1 (LCE) from 57.2m, including an internal high-grade zone grading 8.6m @ 5,060ppm Li / 2.69% LCE from 67.7m;

- 13.8m @ 1,330ppm Li / 0.71% LCE from 39.6m; and

- 23.3m @ 1,610ppm Li / 0.86% LCE from 94.4m to End-of-hole.

Key Highlights

- Outstanding lithium mineralisation returned in assays for diamond drill-hole RMDD003, which intersected:

- 32.4m @ 3,260ppm Li from 57.2m, including 8.6m of ultra high-grade mineralisation @ 5,060ppm Li from 67.7m;

- 13.8m @ 1,330ppm Li from 39.6m; and

- 23.3m @ 1,610ppm Li from 94.4m to end-of-hole

- RMDD003 marks the highest-grade lithium intercept recorded to date at Red Mountain.

- Mineralisation successfully extended 630m north of previous northernmost intersection in hole RMDD002.

- Hole ends in lithium, with mineralisation remaining open down-dip to the east and along strike to the north.

- Assays pending from five other recently completed drill- holes.

To hear CEO Matt Healy discuss this ASX Release click here

The thick zones of lithium mineralisation encountered in the northernmost drill-hole at Red Mountain highlight the increasing scale of the project, with strong lithium mineralisation now intersected in all drill- holes spanning a north-south strike extent of over 5.6km and surface sample geochemistry indicating further potential to the north, south and west of the current drilled extents7, 9 (Figure 3).

Of particular significance in hole RMDD003 is the high-grade nature of the mineralisation. The nearest drill-hole is RMDD002, which intersected 32.1m @ 2,050ppm within a broader 86.9m intersection at 1,470ppm Li from 18.3m. The high-grade zone in RMDD002 has persisted north to RMDD003, and increased in grade significantly to over 3,000ppm lithium.

Assays are pending for the other five holes drilled as part of the April diamond drilling campaign.

Astute Chairman, Tony Leibowitz, said:

“Our 2025 exploration campaign is off to a fantastic start, with exceptional assays returned for the first step-out diamond hole, RMDD003. We are impressed by the thickness and grade of the mineralisation, with the high-grade intercept returned from this hole showing that the previously identified high-grade zone extends for a considerable distance to the north.

“This provides further indication that Red Mountain is unfolding as a lithium discovery of significance in North America. With mineralisation now defined by drilling over a strike length of almost 6 kilometres, we are looking forward to seeing what the remaining drill-holes will deliver. The information obtained from this round of drilling should put us on a clear trajectory to advance Red Mountain towards a maiden JORC Mineral Resource Estimate later this year.”

Background

Located in central-eastern Nevada (Figure 4) adjacent to the Grand Army of the Republic Highway (Route 6), which links the regional mining towns of Ely and Tonopah, the Red Mountain Project was staked by Astute in August 2023.

The Project area has broad mapped tertiary lacustrine (lake) sedimentary rocks known locally as the Horse Camp Formation2. Elsewhere in the state of Nevada, equivalent rocks host large lithium deposits (see Figure 4) such as Lithium Americas’ (NYSE: LAC) 62.1Mt LCE Thacker Pass Project3, American Battery Technology Corporation’s (OTCMKTS: ABML) 15.8Mt LCE Tonopah Flats deposit4 and American Lithium (TSX.V: LI) 9.79Mt LCE TLC Lithium Project5.

Astute has completed substantial surface sampling campaigns at Red Mountain, which indicate widespread lithium anomalism in soils and confirmed lithium mineralisation in bedrock with some exceptional grades of up to 4,150ppm Li2,8 (Figure 3).

A total of 13 RC and diamond drill holes have been drilled at the project for a combined 1,944m, prior to this current drilling program. These campaigns were highly successful, intersecting strong lithium mineralisation in every hole9.

Scoping leachability testwork on mineralised material from Red Mountain indicates high leachability of lithium of up to 98%, varying with temperature, acid strength and leaching duration, and proof of concept beneficiation test-work has indicated the potential to upgrade the Red Mountain mineralisation10,11.

Results

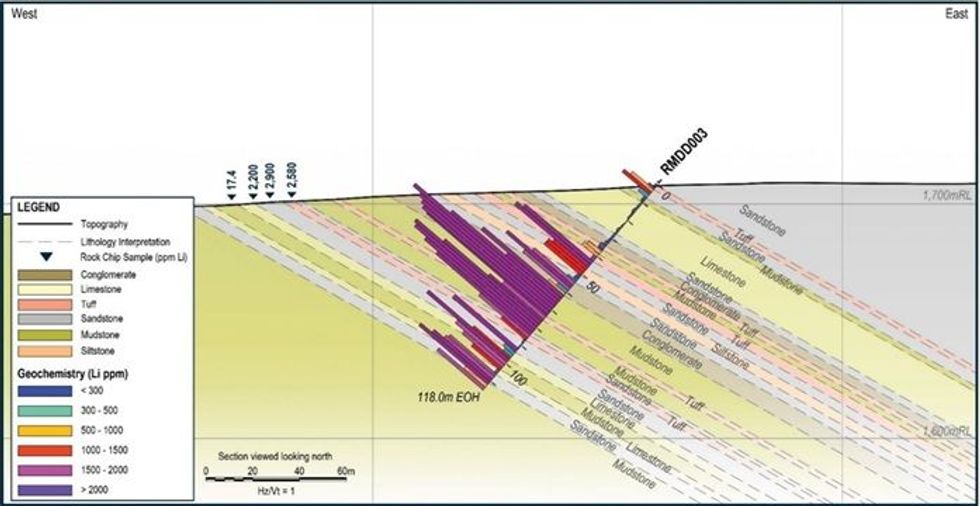

Hole RMDD003 successfully intersected three zones of lithium mineralised clay-bearing mudstones and sandstone, separated by narrow zones of unmineralised rocks (Figure 1). The intersections are as follows:

- 13.8m @ 1,330ppm Li / 0.71% LCE from 39.6m to 53.4m;

- 32.4m @ 3,260ppm Li / 1.74% LCE from 57.2m to 89.6m; and

- 23.3m @ 1,610ppm Li / 0.86% LCE from 94.4m to End-of-hole (117.7m).

The best grades were developed in the most clay-rich zones (Figure 2). An internal very high-grade zone of 8.6m returned a grade of 5,060ppm Li, with a maximum single sample grade of 5,660ppm Li from 69.2-70.7m (227-232ft), which is the drill sample with the highest lithium grade achieved to date at the project.

Click here for the full ASX Release

This article includes content from Astute Metals NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00