June 21, 2023

European Lithium Limited (ASX: EUR, FRA: PF8, OTC: EULIF) (European Lithium or the Company) is pleased to confirm it has completed the acquisition of 100% of the rights, title and interest in the Bretstein-Lachtal Project, Klementkogel Project and the Wildbachgraben Project (together Austrian Lithium Projects) (Acquisition) from 2743718 Ontario Inc. (Ontario), a subsidiary of Richmond Minerals Inc. (TSX-V: RMD) (Richmond).

HIGHLIGHTS

- Acquisition of 100% of the rights, title and interest in the Bretstein-Lachtal, Klementkogel and Wildbachgraben projects (Austrian Lithium Projects) completed after a satisfactory Due Diligence process

- Underexplored areas covered by exploration licences that total 114.6 km2, targeting lithium with known occurrences in the Styria mining district of Austria

- Strong Li2O values up to 3.98% Li2O reported from the Due Diligence sampling of spodumene pegmatites

- Consideration of $250,000 cash, 2 million shares and 2 million options in the Company

- Company provides update on the completion of the Transaction and NASDAQ Listing

Tony Sage, Chairman, commented: “We are pleased to complete the acquisition and add this highly prospective lithium ground to our portfolio of European projects. The Company intends to commence initial work focusing primarily on the Bretstein-Lachtal Project area.”

The Austrian Lithium Projects consist of 245 exploration licenses covering a total area of 114.6 km². The licenses cover ground that is considered prospective for lithium occurrences in the Styria mining district of Austria, approximately 70km north of the Company’s Wolfsberg Project.

The Company will shortly commence the initial work program that will include:

- Stakeholder engagement;

- Detailed geological and structural mapping of prospective areas to determine potential extent of pegmatite veins and lenses;

- Additional trenching and sampling;

- Geophysical investigations; and

- Definition of potential drill target.

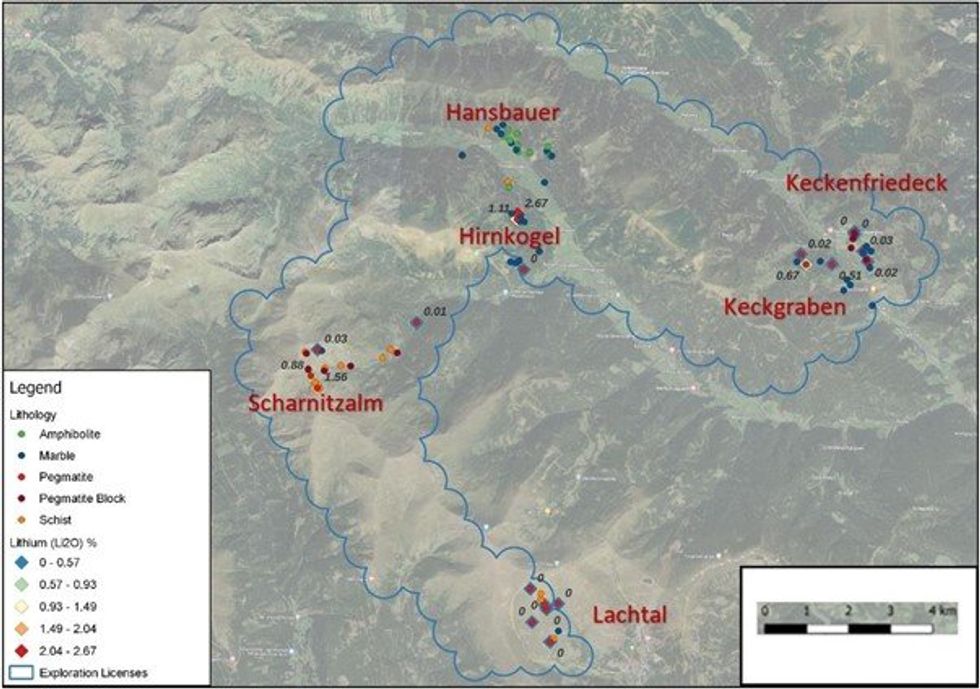

The work program is focused primarily on Bretstein-Lachtal Project Area (see Figure 1).

Refer to the Company's ASX announcement dated 27 March 2023 for further details on the terms and conditions of the Acquisition. The Company has agreed to issue the broker who facilitated the Acquisition consideration of 2 million fully paid ordinary shares and 2 million unlisted options ($0.12 each expiring 3 years from the date of issue) (Facilitator Securities) which is to be issued out of the Company’s capacity. A cleansing notice pursuant to section 708A(5)(e) of the Corporations Act 2001 (Cth) and an Appendix 2A and 3G in respect of the issue of securities in respect to the Acquisition and the Facilitator Securities will be released to the market in the near future.

Geological Context of Lithium Mineralisation in Austria

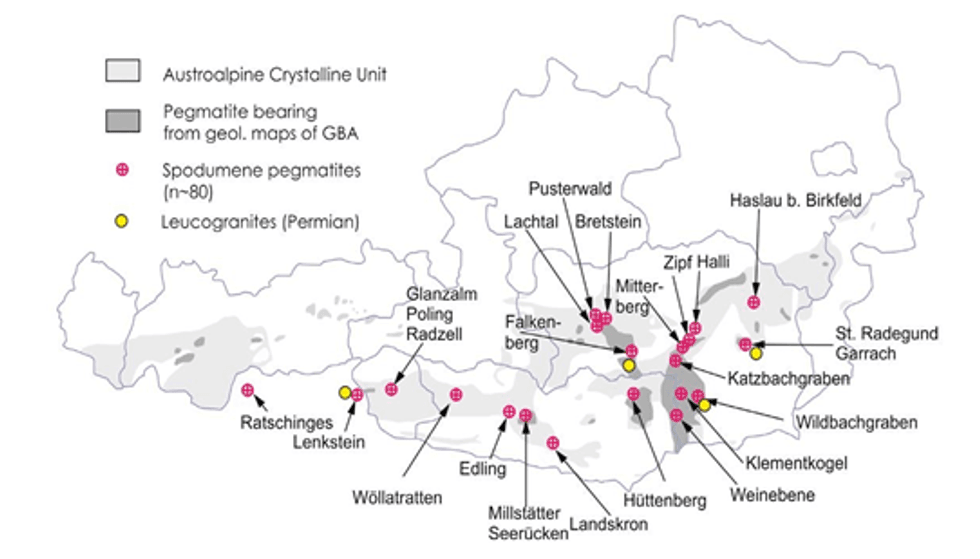

Spodumene pegmatite occurrences have been mapped by Austrian geologists (Mali, 2004) in an east- west belt associated with the intrusion of Permian leucogranites into high-grade metamorphosed basement rocks (figure 2). In 2022 Richmond Minerals Inc acquired tenements in the Lachtal, Pusterwald, Bretstein, Klementkogel and Wildbachgraben areas where spodumene pegmatites had been recorded by Mali and carried out reconnaissance rock chip sampling. The results shown in figure 1 above, confirmed that the spodumene pegmatites carried significant lithium values.

Click here for the full ASX Release

This article includes content from European Lithium Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EUR:AU

The Conversation (0)

07 September 2023

European Lithium

Developing the Advanced Wolfsberg Lithium Deposit in Austria

Developing the Advanced Wolfsberg Lithium Deposit in Austria Keep Reading...

27 August 2025

CRML signs LOI Offtake Agreement with UCORE (DOD Funded)

European Lithium (EUR:AU) has announced CRML signs LOI Offtake Agreement with UCORE (DOD Funded)Download the PDF here. Keep Reading...

20 August 2025

Outstanding New 2024 Diamond Drill Results Tanbreez Project

European Lithium (EUR:AU) has announced Outstanding New 2024 Diamond Drill Results Tanbreez ProjectDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities Report and Appendix 5B

European Lithium (EUR:AU) has announced Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

24 July 2025

EUR Sells 0.5m CRML Shares for U$1.8m (A$2.7m)

European Lithium (EUR:AU) has announced EUR Sells 0.5m CRML Shares for U$1.8m (A$2.7m)Download the PDF here. Keep Reading...

09 July 2025

EUR Sells 0.5m CRML Shares for U$1.625m (A$2.5m)

European Lithium (EUR:AU) has announced EUR Sells 0.5m CRML Shares for U$1.625m (A$2.5m)Download the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00