March 25, 2025

Gibb River Diamonds Limited (ASX:GIB) has announced Edjudina Gold Project, WA - Permitting Application to Mine Neta Prospect Lodged.

- Gibb River Diamonds Limited (‘GIB’ or the ‘Company’) is pleased to announce that a Mining Proposal covering the Edjudina Gold Project (GIB 100%) has been lodged with the West Australian Mines Department (DEMIRS)

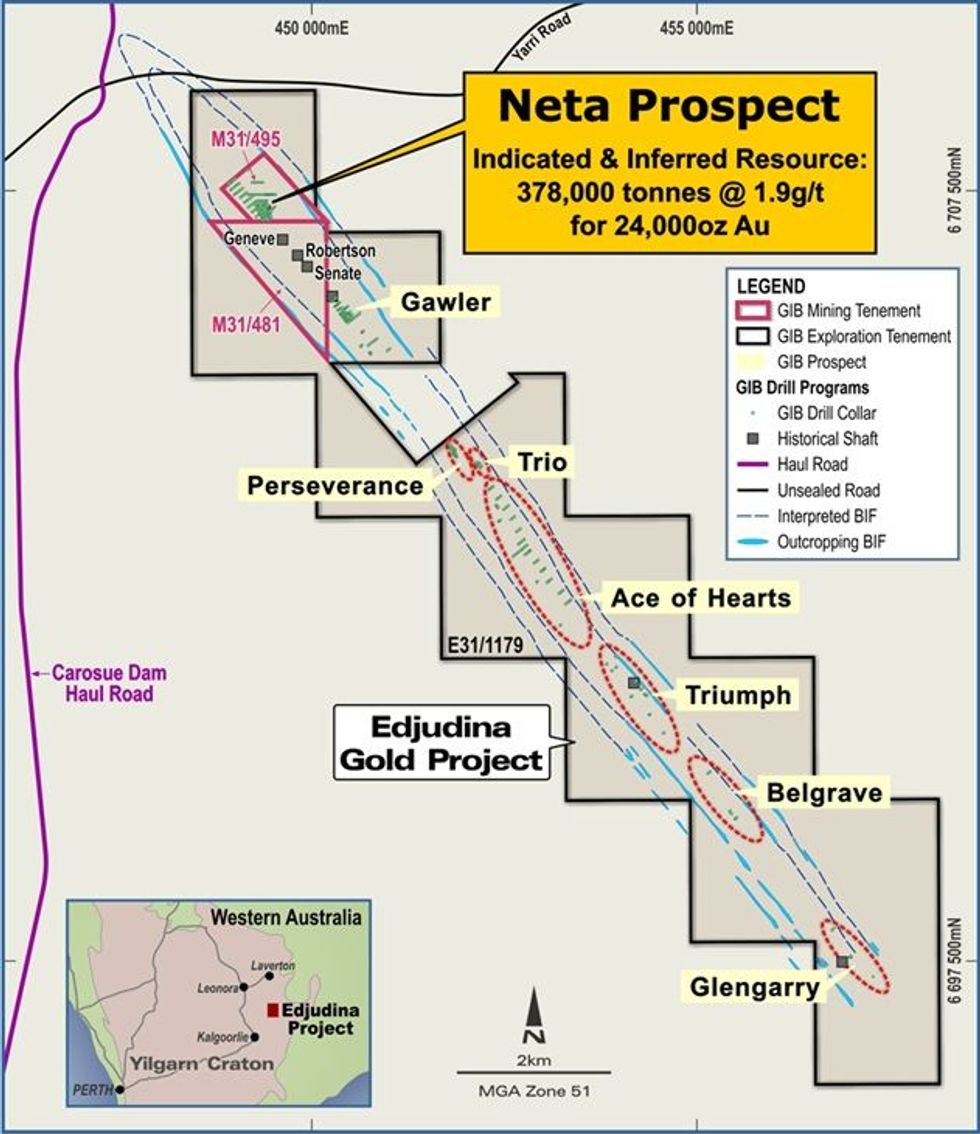

- The aim of the ‘Mining Proposal For Small Mining Operations’ is to permit mining of the Neta Prospect, part of the Edjudina Gold Project, which is on granted mining lease M31/495

- The Indicated and Inferred Resource JORC resource at the Neta Prospect is 378,000 tonnes @1.9 g/t for 24,000 Oz Au and includes an Indicated Resource of 110,000 tonnes @ 2.2g/t for 8,000 Oz Au1

- It is the primary focus of GIB to mine or otherwise monetise this Neta resource as soon as is practicable. The lodging of this Mining Proposal is an important step forward in achieving this aim

- Once granted, the Mining Proposal will permit for a Mine and Haul operation to be conducted at the Neta Gold Prospect, using toll treatment at a third-party mill (pending commercial contracts). This is the Company’s current priority.

- The Company is currently communicating with the WTAC Native Title group to finalise a date for a heritage survey to be conducted at the Edjudina Project. It is anticipated that this heritage survey will take place sometime in April 2025. This survey will assist in facilitating both mining at the Neta Prospect and the drilling of new exploration targets in the Company’s recently acquired and highly prospective mining lease M31/481, adjacent to the proposed Neta mining area

- Discussions are ongoing with various West Australian groups which specialises in mine, haul and toll milling gold operations

NB: it is anticipated that subsequent to the commencent of mining, from time to time, that additional permitting will be required at Edjudina. It is not the intention of GIB to report to the ASX permitting applications, or re-submissions, which the Company does not consider to be material, but are a routine part of permitting mining operations.

About the Edjudina Gold Project

GIB’s Edjudina Gold Project is 145km north east of Kalgoorlie and is located in the heart of the Eastern Goldfields of WA. The project comprises multiple parallel lines of nearly continuous historic gold workings over a 13km strike in which high grade veins have been worked2. A haul road owned and operated by Northern Star Resources Limited runs through the north of the project directly to the Carosue Dam milling complex 45 km to the south.

Click here for the full ASX Release

This article includes content from Gibb River Diamonds, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00