December 19, 2023

Final 2023 assays include HOT016, drilled outside the current Mineral Resource area, which returned 26.4m @ 0.59% Ni including 1.2m @ 1.02% Ni

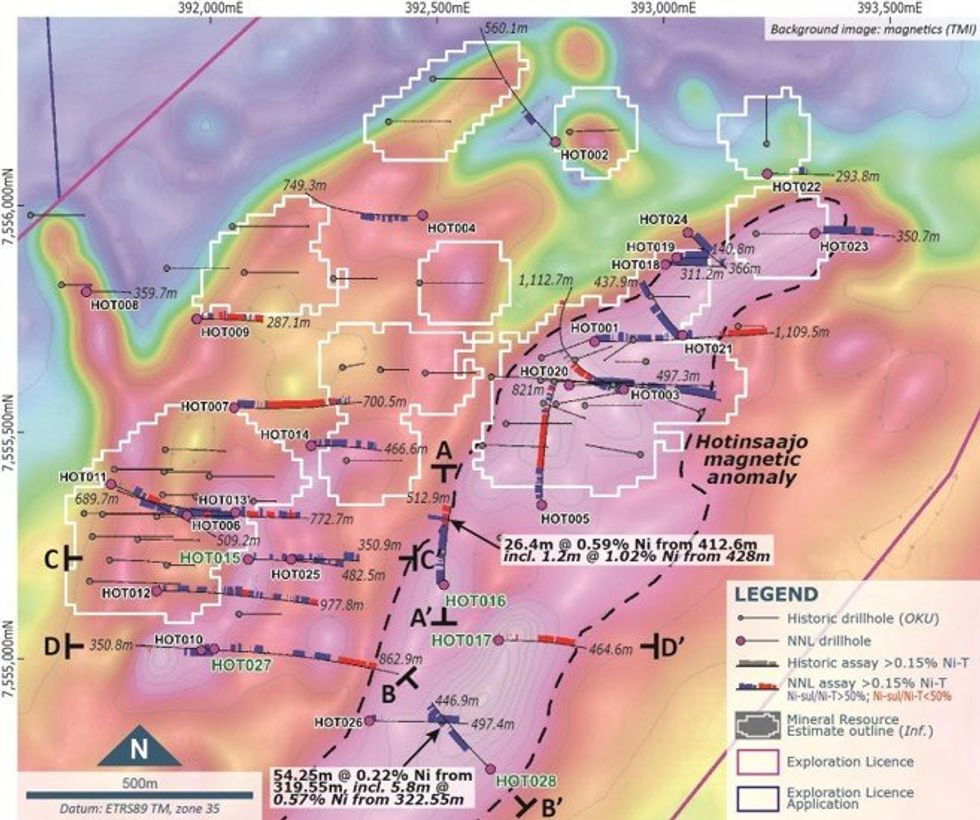

Nickel sulphide explorer Nordic Nickel Limited (ASX: NNL; Nordic, or the Company) is pleased to report the final assay results from the 2023 drilling program at the Hotinvaara Prospect at its 100%-owned flagship Pulju project, situated in Northern Finland (Pulju, or the Project) within the Central Lapland Greenstone Belt (CLGB). The Company completed 28 diamond drill-holes for 15,432m as part of its maiden drilling program at the Project.

HIGHLIGHTS

- Nordic Nickel continues to discover substantial extensions to its Hotinvaara resource and vector in on higher grade nickel sulphide zones, based on assays received from the final five diamond drill holes of the 2023 drilling program.

- Additional extensive zones of disseminated nickel sulphide containing zones of higher-grade nickel sulphides, with significant results including:

- HOT016 – strongest nickel mineralisation reported to date at Hotinvaara:

- 91.7m @ 0.22% Ni from 1.6m; and

- 164.15m @ 0.20% Ni from 216m; and

- 26.4m @ 0.59% Ni from 412.6m, including:

- 6.1m @ 0.74% Ni from 412.6m; and

- 4m @ 0.77% Ni from 420m; and

- 3.35m @ 0.91% Ni from 428m, including:

- 1.2m @ 1.02% Ni from 428m; and

- 2m @ 0.52% Ni from 433m

- HOT028

- 125.7m @ 0.19% Ni from 152.3m; and

- 54.25m @ 0.22% Ni from 319.55m, including:

- 5.8m @ 0.57% Ni from 322.25m

- HOT027

- 99.1m @ 0.22% Ni from 4.7m

- HOT015

- 64.3m @ 0.19% Ni from 220.3m; and

- 57.35m @ 0.17% Ni from 331.9m

- HOT016 – strongest nickel mineralisation reported to date at Hotinvaara:

- Results confirm significant nickel sulphide mineralisation outside the current Mineral Resource Estimate (“MRE”), with an updated MRE due in Q1 2024.

- Presence of higher grade zones reinforces the fertility of the system and provides vectors for follow-up drilling next year.

- Partial leach assaying further confirms the predominance of nickel in sulphide.

- Hotinvaara Prospect represents just 2% of the total prospective mineralised belt within the broader Pulju Project.

- Planning and consultation with key stakeholders underway for 2024 winter drill program.

Final assays have been received for a further five drill holes, which were designed to expand the limits of the current resource and target a series of modelled geophysical anomalies (electromagnetic (EM) and magnetic).

The results have confirmed a large extension of the mineralised system coincident with the Hotinsaajo magnetic anomaly and the potential for the mineral system to contain high-grade nickel sulphide mineralisation such as that intersected in HOT016 (Figure 1, Table 1 & Appendix 1).

Management Comment

Nordic Nickel Managing Director, Todd Ross, said: “It’s great to finish the year with one of the widest zones of higher grade nickel sulphide mineralisation seen at the project. This is a very encouraging indication of the fertility and endowment of the system, providing clear evidence that Hotinvaara has the potential to host large accumulations of high grade nickel sulphides.

“While work is continuing on an update to the current Mineral Resource Estimate, the team is now also actively engaged in a detailed review of the data generated from the 2023 drill program.

“The focus now is on building our understanding of the controls and orientation of the mineralisation by developing interpretive cross-sections across the deposit and matching this information with what we know about the broader structural geological context and position of the drilled intercepts within the mineralising system.

“With the help of some of the most experienced nickel exploration geologists in the business, we are working towards a refined geological model which will help us to more accurately design and target the next round of holes to hopefully lead us towards a breakthrough discovery. The final batch of assays has delivered some real encouragement that we are now moving much closer to achieving that objective.

“I would like to take this opportunity to thank the entire Nordic team, both in Finland and Australia, for their hard work during the year – and also to acknowledge the support of our loyal shareholders. We are very excited about what 2024 will deliver for the Company.”

Click here for the full ASX Release

This article includes content from Nordic Nickel, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NNL:AU

The Conversation (0)

03 July 2024

Nordic Resources

Exploring district-scale nickel asset in Finland to support growing demand

Exploring district-scale nickel asset in Finland to support growing demand Keep Reading...

28 May 2025

Total Finland Gold Resources Increase to 961,800oz AuEq

Nordic Resources (NNL:AU) has announced Total Finland Gold Resources Increase to 961,800oz AuEqDownload the PDF here. Keep Reading...

25 May 2025

A$3.5M Institutional Placement and New Chairman Appointed

Nordic Resources (NNL:AU) has announced A$3.5M Institutional Placement and New Chairman AppointedDownload the PDF here. Keep Reading...

21 May 2025

Trading Halt

Nordic Resources (NNL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

11 May 2025

Excellent Gold Intersections Verified at Kiimala Project

Nordic Resources (NNL:AU) has announced Excellent Gold Intersections Verified at Kiimala ProjectDownload the PDF here. Keep Reading...

23 April 2025

Quarterly Activities Report & Appendix 5B

Nordic Resources (NNL:AU) has announced Quarterly Activities Report & Appendix 5BDownload the PDF here. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00