- WORLD EDITIONAustraliaNorth AmericaWorld

March 25, 2024

Odessa Minerals Limited (ASX:ODE) (“Odessa” or the “Company”) is pleased to provide an update on its Gascoyne East Project (“Project”) in the Gascoyne region of Western Australia.

Highlights:

- Completion of lithological and structural interpretation from geophysical datasets

- PoW approval for Phase 1 aircore drilling to assist bedrock mapping

- Geophysical interpretation has confirmed drill targets for:

- Intrusion-related porphyry and Iron Oxide Copper-Gold (IOCG) mineralisation

- Magmatic Ni-Cu-PGE mineralisation within a distinct layered mafic intrusion

- Orogenic and intrusion-related gold mineralisation within the Dalgaringa Supersuite and Camel Hills Metamorphics.

- Intrusion-related gold and base metal deposits within the Edmund Basin

- Sedimentary-hosted base metal deposits in the Edmund Basin analogous to the Abra deposit

- At-surface uranium targets identified through airborne radiometric survey data

Exploration Plan

Target Generation

The Gascoyne East Project is one of the most under-explored areas of the emergent Gascoyne Province. Due to being almost entirely concealed under a thin veneer of transported cover, previous explorers have largely overlooked the area encapsulated by Odessa’s Gascoyne East Project, despite multiple mantle-tapping structures transecting the Project along strike from known mineralisation.

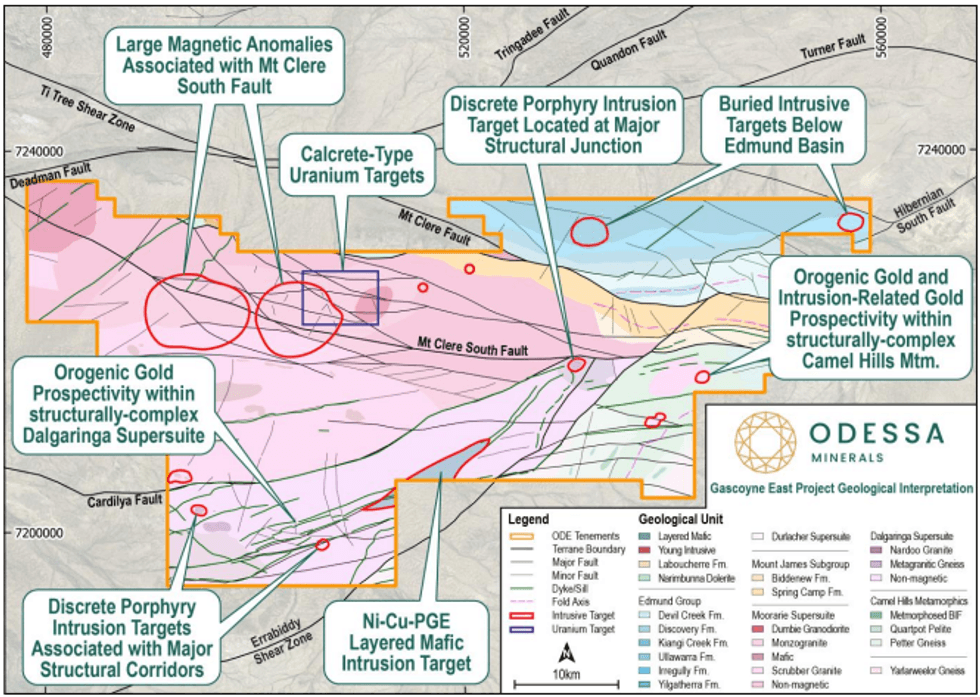

Odessa has now completed initial target generation through detailed litho-structural interpretation of the recently acquired airborne gradiometer-magnetic and radiometric data (Figure 1).

Multiple intrusion-related targets have been highlighted across the Project, including a layered mafic intrusive in the south, that is prospective for Ni-Cu-PGE, large-scale intrusions that are prospective for IOCG mineralisation, multiple discrete porphyry Cu-Au targets throughout the region, and base metal targets within the Edmund Basin.

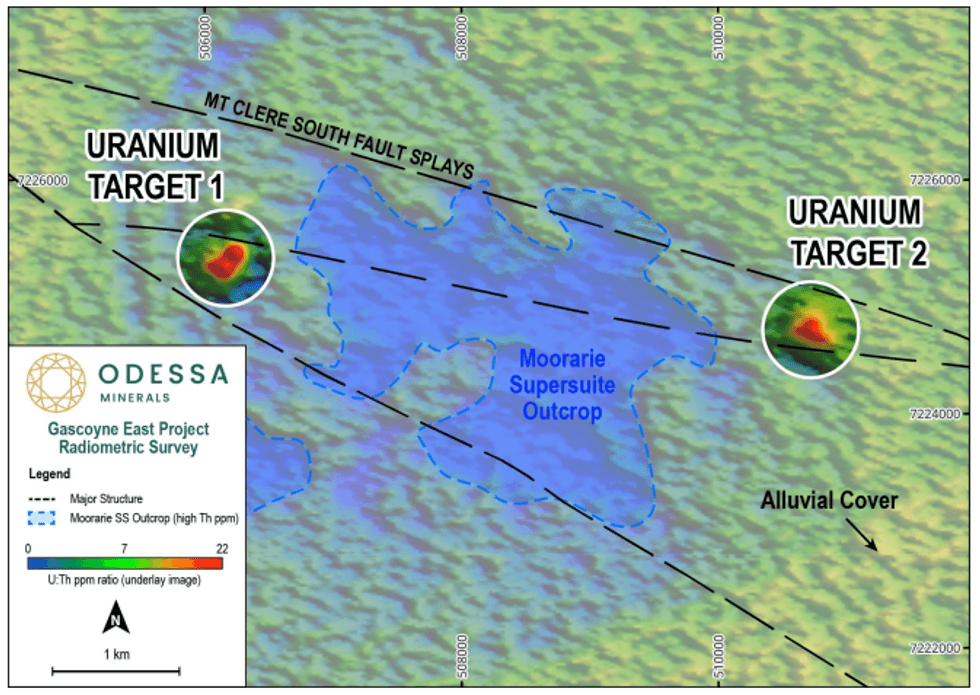

Additionally, several uranium anomalies have been highlighted by radiometric survey data across the Project, coincident with calcrete deposits mantling fault structures, within an outcrop of the Moorarie Supersuite granite, a potential host to uranium and REE carbonatite mineralisation (Figure 2).

Aircore Drilling

With no previous drilling and a lack of exposure, the basement lithologies remain almost entirely inferred from geophysical datasets. As such, a mineral systems-based approach to exploration at the Project is required to build up high-quality regional datasets that can inform targeted and impactful exploration across the highly prospective Project. As the company has now completed acquisition and interpretation of high resolution magnetic and radiometric data, drilling is required to confirm and update current interpretations.

Phase 1 aircore drilling is planned predominantly along existing tracks with hole spacings ranging from 200m to 400m. This round of drilling aims to intercept basement lithologies in fresh rock below the transported cover material to validate the litho-structural basement geology interpretation of geophysical data (Figure 1), as well as test key structural corridors and intrusive target features. Bottom-of-hole core of fresh rock will be collected to conduct petrographical and petrophysical analysis alongside multi-element geochemical characterisation of lithologies.

Upon completion of Phase 1 drilling, the basement geology model will be updated, and targets re-ranked accordingly for follow-up Phase 2 drill testing for mineralisation at depth associated with intrusion-related systems.

The Company has received PoW approval from the Department of Energy, Mines, Industry Regulation and Safety (DEMIRS) to conduct air core drilling across the Project as part of the Phase 1 drill campaign scheduled to commence in June 2024.

Click here for the full ASX Release

This article includes content from Odessa Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ODE:AU

The Conversation (0)

11 October 2023

Odessa Minerals

Uranium exploration in the Gascoyne Region of Western Australia

Uranium exploration in the Gascoyne Region of Western Australia Keep Reading...

27 February

Brunswick Exploration Files Maiden Mineral Resource Estimate NI 43-101 Technical Report for Mirage Project

Brunswick Exploration Inc. (TSX-V: BRW, OTCQB: BRWXF; FRANKFURT:1XQ; "BRW" or the "Company") is pleased to announce that it has filed on SEDAR the "NI 43-101 Technical Report for the Mirage Maiden Mineral Resource Estimate, Eeyou Istchee James Bay, Quebec, Canada", with an effective date of... Keep Reading...

27 February

Brunswick Exploration Announces Appointment of Vice President - International Projects

Brunswick Exploration Inc. (TSX-V: BRW, OTCQB: BRWXF; FRANKFURT:1XQ; "BRW" or the "Company") is pleased to announce the appointment of Charles Kodors to Vice President International Projects. Mr. Kodors has been with Brunswick Exploration since its rebranding in 2020 and has been instrumental in... Keep Reading...

26 February

SAGA Metals Announces Expiry of Warrant Acceleration Program and Receipt of C$3,422,888 in Warrant Proceeds since January 1, 2026

Saga Metals Corp. ("SAGA" or the "Company") (TSXV: SAGA,OTC:SAGMF) (OTCQB: SAGMF) (FSE: 20H), a North American exploration company focused on critical mineral discoveries, is pleased to announce the successful completion and expiry of its Warrant Acceleration Program (the "Acceleration") of... Keep Reading...

26 February

Canadian Investment Regulatory Organization Trade Resumption - LAF

Trading resumes in: Company: Lithium Africa Corp.TSX-Venture Symbol: LAFAll Issues: YesResumption (ET): 8:00 AMCIRO can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair and orderly... Keep Reading...

25 February

Western Uranium & Vanadium Corp. to Attend Red Cloud's Pre-PDAC Mining Showcase and the Prospectors & Developers Association of Canada Convention 2026

Western Uranium & Vanadium Corp. (CSE: WUC,OTC:WSTRF) (OTCQX: WSTRF) ("Western" or the "Company") is pleased to announce that Grant Glasier, Vice President Marketing, Project Development and Government Affairs, will present at Red Cloud's Pre-PDAC 2026 Mining Showcase on Friday, February 27,... Keep Reading...

25 February

Lithium Africa Acquires Advanced Lithium Asset in South Africa

Lithium Africa Corp. (TSXV: LAF) (the "Company" or "Lithium Africa") is pleased to announce that it has entered into a definitive agreement dated February 25, 2026 to acquire a large lithium project in South Africa, including a past-producing spodumene mine, a related ore stockpile and 1,675 km2... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00