September 07, 2022

Star Minerals Limited (ASX: SMS, “the Company” or “Star Minerals”) is pleased to advise that it has mobilised to site and commenced the Stage 3 Resource definition drilling program to expand the Resource and add to the Company’s knowledge of the geology and grade characteristics of its Tumblegum South gold project (“Tumblegum South”).

HIGHLIGHTS

- Star Minerals has commenced Stage 3 Resource definition drilling at its Tumblegum South gold project

- 300m drill program initiated to further define and expand on the current gold Resource, with accompanying logging and assays to allow for completion of geological model and Resource update

- Drill targeting intended to extend existing Resource after two successful drilling programs

- Existing Inferred Resource estimate for the project totals 600kt, at a grade of 2.2 g/t Au1

- Previous Stage 1 and 2 results include:

This follows the successful 1,994m Stage 1 and 2,669m Stage 2 drilling programs previously undertaken by Star Minerals which confirmed the existing mineralisation and extended the trends along strike and down dip of the existing resource.

This third drill program since its ASX listing on 27 October 2021 reiterates the Company’s continued commitment to immediately explore and develop Tumblegum South.

Stage 3 drilling has been designed to provide further information on the mineralised structures that are present in the area, to provide more structural information and to provide further data for an updated resource. This work has been designed with the benefit of the results from the earlier Stage 1 and 2 drilling.

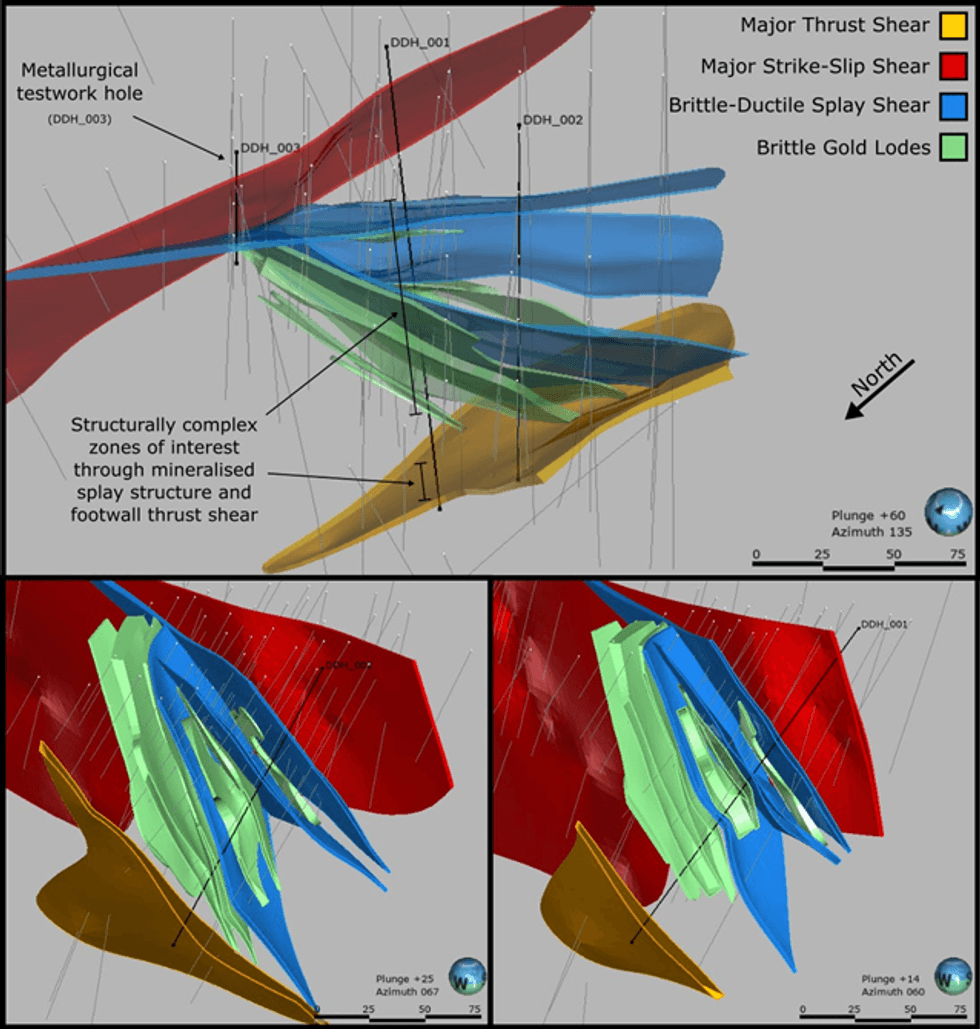

The image below (Figure 1) shows the proposed drill traces, targeting the structures modelled using the results from previous works on site.

Figure 1 - Tumblegum South planned diamond Phase 3 Resource definition drilling - indicating the trace of the two proposed holes, DDH001 and 002, and their planned path, running between the two identified shear structures (Red and Yellow) and through the identified gold mineralisation lodes (Green).

Planned Phase 3 Resource drilling totals approximately 320m although as with the Stage 1 and Stage 2 drill programs, holes may be extended if they remain in mineralisation. It is envisaged the program will be completed in 12 days.Star Minerals’ CEO, Greg Almond comments:

“We are excited to be back on site at Tumblegum South and looking forward to following up the great results we saw from the last round of drilling, building on the success of our RC drilling campaigns.

This will encourage our shareholders, as it demonstrates our further confidence in the asset we have at Tumblegum South, and the potential to increase our knowledge of the deposit as we follow up from the results of the previous stages of drilling and modelling.”

Click here for the full ASX Release

This article includes content from Star Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

04 October 2022

Star Minerals

Progressing towards gold production in Western Australia

Progressing towards gold production in Western Australia Keep Reading...

3h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

4h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

4h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

10h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

01 February

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00