The Conversation (0)

Golden Queen Updates Resource Estimates for Soledad Mountain

Feb. 10, 2015 09:49AM PST

Gold InvestingGolden Queen Mining Co. Ltd. (TSX:GQM,OTCQX:GQMNF) announced the completion of updated mineral resource and mineral reserve estimates for its 50-percent-owned Soledad Mountain project. It also updated its feasibility study for the project.

Golden Queen Mining Co. Ltd. (TSX:GQM,OTCQX:GQMNF) announced the completion of updated mineral resource and mineral reserve estimates for its 50-percent-owned Soledad Mountain project. It also updated its feasibility study for the project.

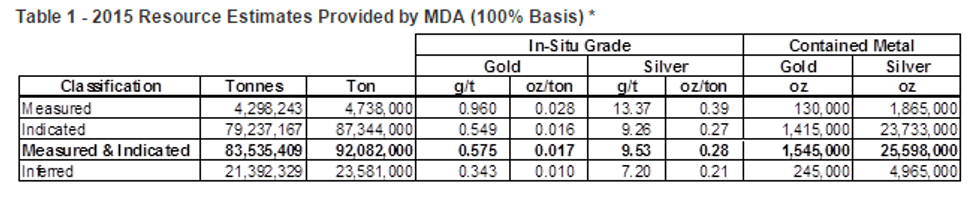

The updated mineral resource estimates are as follows:

Updated feasibility highlights include:

- Life of mine average annual production of 74k oz of gold and 781k oz of silver during full production Years 2-11;

- Total production of 807k oz of gold and 8.3mm oz of silver;

- Stripping ratio of 3.41:1 (waste tons : ore tons);

- First quartile total cash costs net of by-products of $518/oz of gold (including royalties, California fees, property taxes, off-site refining charges and reclamation financial assurance) and of $558/oz of gold including sustaining capital costs;

- Pre-production capital costs of approximately $144 mm in-line with the capital costs update provided in March 2014: $99.3 mm in pre-production capital costs (of which $25.4 mm was spent as of December 31, 2014), $15 mm contingency, $10.5 mm in working capital and financial assurance estimate and $19.2 mm for the mobile mining equipment (of which $1.1 mm was spent as of December 31, 2014). The mobile mining equipment is intended to be financed through Komatsu;

- Base case after-tax net present value (5% discount rate) of $214 mm with a gold price of $1,250/oz and a silver price of $17/oz; and

- Base case after-tax IRR of 28.3% with a gold price of $1,250/oz and a silver price of $17/oz.