July 17, 2024

CuFe Ltd (ASX: CUF) (CuFe or the Company) is pleased to provide an update on the status of its West Arunta tenure.

HIGHLIGHTS

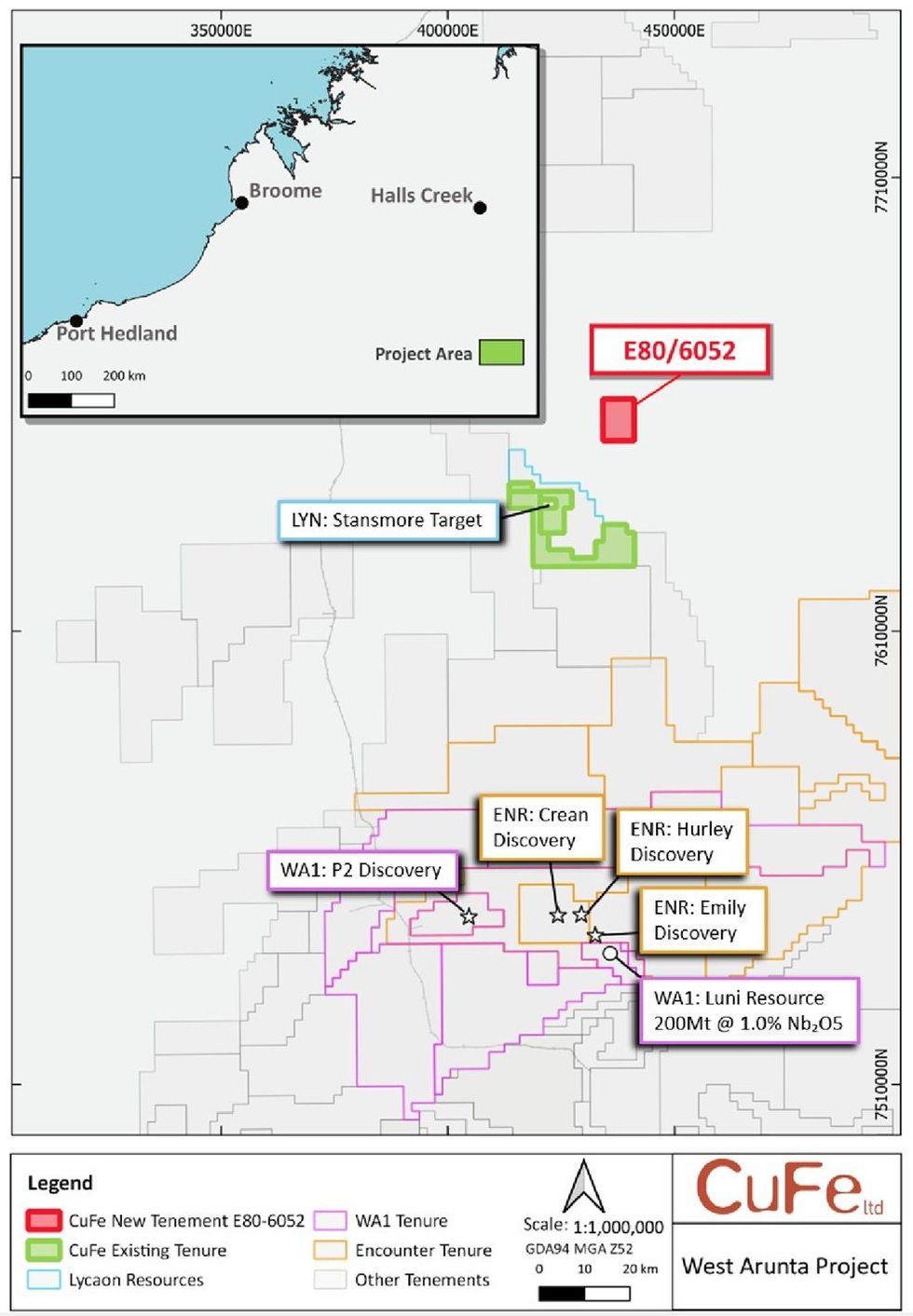

- CuFe acquires E80/6052, located 13km north-east of existing tenure expanding its position in the emerging West Arunta Niobium province to over 281 km².

- Geophysical review of 3D inversion modelling magnetic data over new tenure has identified two prospective targets within E80/6052.

- Land Access agreement negotiations ongoing, with the Parna Ngururrpa Traditional Owners Group to facilitate the commencement of on-ground works.

CuFe Executive Director, Mark Hancock, commented “We are pleased to acquire new ground in the exciting West Arunta region. This acquisition gives us an additional target area that shows the right geophysical characteristics to represent carbonatites / intrusive bodies. The tenement has synergies with our existing landholding and there has been very little exploration undertaken in this area historically. We continue to work with Parna Ngururrpa Traditional Owners Group in aim of securing a heritage and land access agreement, which is required to commence on ground works given the tenure is located with an Aboriginal Reserve area.”

Acquisition Details

CuFe has entered a binding agreement to acquire exploration application E80/6052 from an unrelated entity, Territory Prospecting Pty Ltd. The terms of purchase comprise an upfront payment of $10,000 cash and $25,000 in CuFe shares at an issue price of 1.6c per share (1,562,500 shares). Upon the later of the grant of the tenure or the execution of heritage agreement a further payment is due of $50,000, to be made in cash.

Tenure Update

The new tenement is located 13km North-East of CuFe’s West Arunta Project and 18km North-East of Lycaon Resources Stansmore Nb-REE Project (Figure 1). The tenure is on land of the Parna Ngururrpa Traditional Owners Group and exploration requires the consent of the Minister of Aboriginal Affairs. The tenement covers an area of 64km², this has increased CuFe’s tenement holding from 217km² to 281km² (See Figure 1).

The tenement was previously held by CRA Ltd in the early nineties who were pursuing the geophysical target as a potential kimberlite pipe however no exploration on ground was undertaken.

The Company further advises that wo of its three previous tenement applications E80/5925 and E80/5950 have been granted by the Department of Energy, Mines, Industry Regulation, and Safety (DEMIRS) on 30 May 2024 and 4 June 2024 respectively, with the third expected to proceed to grant within the next month. The granted tenure covers an area of 58 km² and forms part of the Company’s 100% owned West Arunta Project in the highly prospective West Arunta region (Figure 1).

On ground exploration activities are restricted until a signed agreement is in place with the Parna Ngurrurrpa Traditional Owners Group and approval is given by the Minster of Aboriginal Affairs. CuFe continues to work with the group on achieving this.

Click here for the full ASX Release

This article includes content from CUFE LTD, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CUF:AU

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 July 2025

CuFe Limited

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium.

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium. Keep Reading...

02 February

Government Funding to Unlock Critical Metals Processing

CuFe Limited (CUF:AU) has announced Government Funding to Unlock Critical Metals ProcessingDownload the PDF here. Keep Reading...

29 January

Quarterly Activities and Cashflow Report

CuFe Limited (CUF:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

28 October 2025

Quarterly Activities and Cashflow Report

CuFe Limited (CUF:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

20 October 2025

Review Highlights High Grade Bismuth Intercepts at Orlando

CuFe Limited (CUF:AU) has announced Review Highlights High Grade Bismuth Intercepts at OrlandoDownload the PDF here. Keep Reading...

14 October 2025

Placement to Raise $5.4 Million

CuFe Limited (CUF:AU) has announced Placement to Raise $5.4 MillionDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00