May 11, 2023

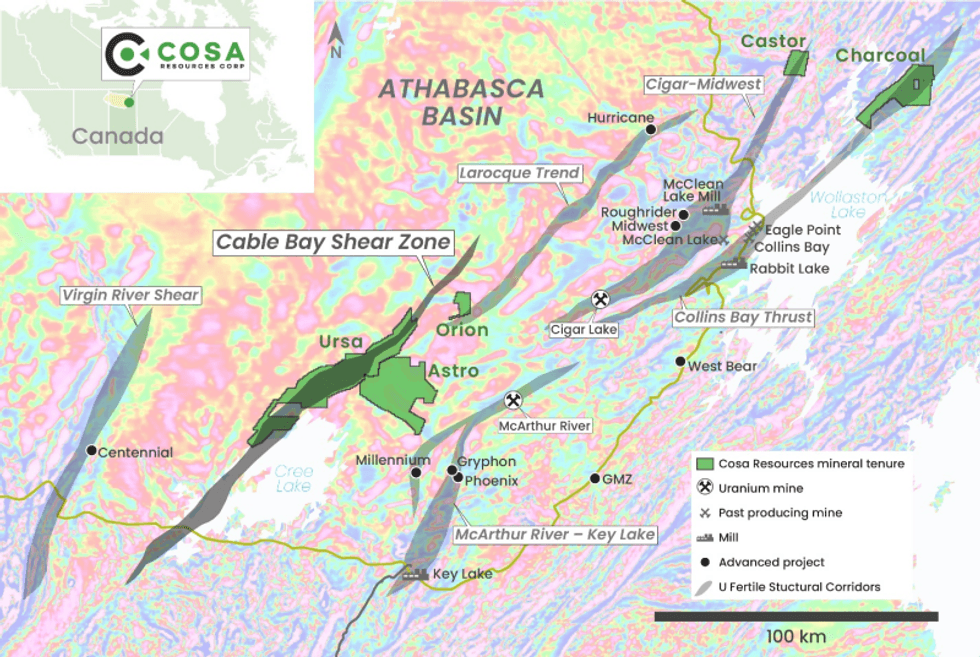

Cosa Resources Corp. (CSE: COSA ) (“ Cosa Resources ” or the “Company”) is pleased to announce it has engaged Expert Geophysics Limited (“Expert”) to conduct airborne MobileMT™ surveys at its 100% owned Ursa and Orion uranium projects in the Athabasca Basin.

Highlights

- Magnetotelluric (MT) survey method capable of detecting basement electromagnetic (EM) conductors and anomalous resistivity zones in the sandstone

- Planned surveying totals 2,900 line-kilometres to provide property-wide coverage at Ursa and Orion

- Modern geophysical dataset will facilitate identification and prioritization of target areas for follow-up

Keith Bodnarchuk, President & CEO, commented: “Cosa’s first pass work at the Ursa and Orion projects demonstrates our commitment to efficiently and effectively exploring these projects for the next major uranium deposit. We are eager to see the results of this survey and work towards drill testing.”

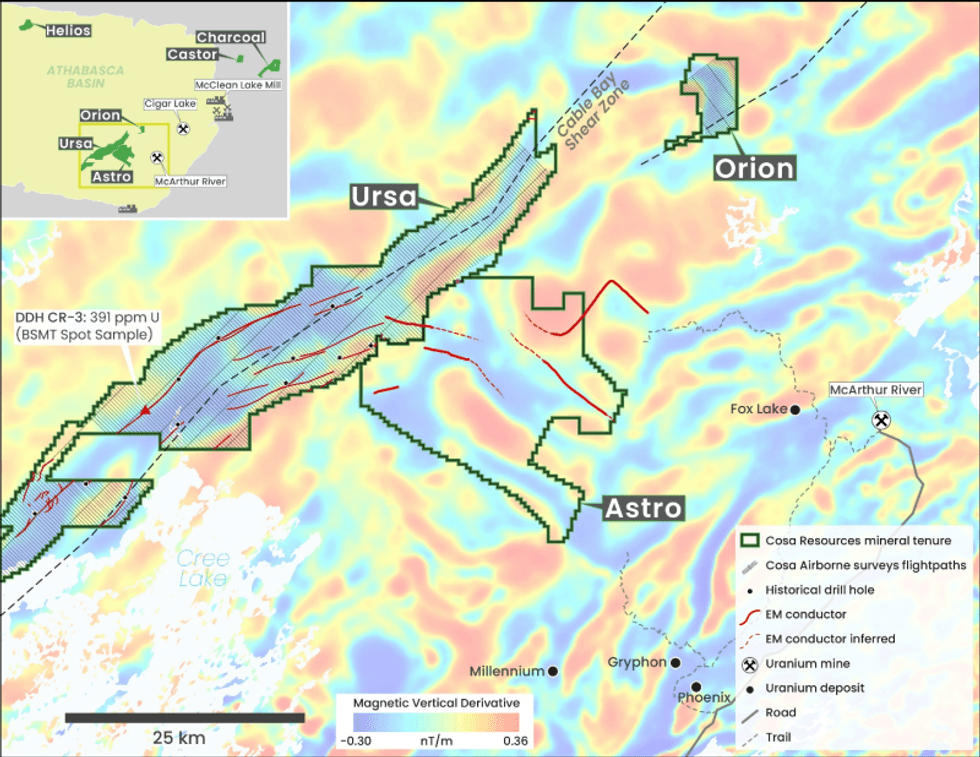

Andy Carmichael, VP of Exploration commented: “Ursa and Orion contain nearly 75 kilometres of combined strike length of highly underexplored magnetic lows hosting EM conductors. With such a large area to explore, MobileMT results will evaluate prospective corridors in their entirety to identify and prioritize key areas for follow-up.”

Planned Survey

Approximately 2,900 line-kilometres of MobileMT surveying is planned at Ursa and Orion in summer 2023, with 90% of the work to be completed at Ursa. MobileMT is a modern, helicopter-borne, magnetotelluric (MT) survey system capable of detecting both the basement-hosted EM conductors and sandstone-hosted zones of anomalous resistivity commonly associated with significant Athabasca Basin uranium deposits. MobileMT is capable of resolving resistivity contrasts to depths exceeding 1000 metres, and MT surveys have mapped basement conductors and sandstone alteration zones at both the McArthur River and Shea Creek uranium deposits.

The planned survey is a time- and cost-effective approach to gaining a high-level assessment of the nearly 75 kilometres of underexplored, prospective strike length covered by the properties, and will accelerate exploration through the prioritization of target areas. Surveying is planned to begin in late June and will take approximately three weeks to complete.

Ursa Property

Existing geophysical coverage at Ursa comprises a patchwork of historical airborne and ground surveys, most of which were completed between 1978 and 2008. Historical airborne EM surveys generally confirmed that basement-hosted EM conductors are present but lacked the resolution for meaningful interpretation. Historical ground EM surveys also indicate basement EM conductors are present, but follow-up drilling rarely intersected conductive basement units. Despite ineffective targeting, the sparse historical drilling intersected structurally disrupted sandstone and basement, hydrothermal alteration, and weak mineralization. Most notably, drill holes CR-03 and CR-08 intersected up to 0.05% and 0.18% U 3 O 8 uranium in the basement, respectively, which has not been adequately followed up (Figure 2).

The upcoming MobileMT survey will be the first time this portion of the Cable Bay Shear Zone (CBSZ) has been covered by an airborne system capable of imaging the basement well beyond the unconformity. Cosa believes the results will greatly improve the understanding of this regional-scale structural corridor.

The 65 kilometres of the CBSZ covered by Ursa offers a highly prospective, significantly underexplored geological analogue to the geological settings underpinning major current- and past-producing uranium mines in the eastern Athabasca Basin. The depth to the unconformity on the project is estimated to be between 600 and 1000 metres.

Orion Property

Located 15 kilometres northeast of Ursa, Orion covers eight kilometres of a curvilinear zone of low magnetic susceptibility with historical electromagnetic conductors mantling a magnetic high, implying favorable structural complexity. No historical drilling has been completed on the project, and the depth to the unconformity is estimated to be between 750 and 900 metres based on neighboring drilling.

Expected Follow-up

Following receipt of the finalized MobileMT dataset, 3D inversion of the survey results will be completed by third party specialists. Cosa aims to utilize inversion results to guide ground-based EM surveys over high-priority target areas and generate quality targets for subsequent drill testing.

About Cosa Resources

Cosa Resources is a Canadian mineral exploration company based in Vancouver, BC and is focused on the exploration of its uranium and copper properties in northern Saskatchewan. The portfolio includes six uranium exploration properties: Ursa, Orion, Castor, Charcoal, Helios, and Astro, totaling 140,677 ha in the eastern and northern Athabasca Basin.

The team behind Cosa Resources has a track record of success in Saskatchewan, with several decades of combined experience in uranium exploration, discovery, and development in the province.

Qualified Person

The Company’s disclosure of technical or scientific information in this press release has been reviewed and approved by Andy Carmichael, P.Geo., Vice President, Exploration for Cosa Resources. Mr. Carmichael is a Qualified Person as defined under the terms of National Instrument 43-101. This news release refers to neighboring properties in which the Company has no interest. Mineralization on those neighboring properties does not necessarily indicate mineralization on the Company’s properties.

Contact

Keith Bodnarchuk, President and CEO

info@cosaresources.ca

+1 888-899-2672 (COSA)

Cautionary Statements

Neither the Canadian Securities Exchange nor the Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain “Forward‐Looking Statements” within the meaning of applicable securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward looking statements or information relate to, among other things: the exploration, development, and production at the Company’s mineral projects.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of the Company, future growth potential for the Company and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; the Company’s ability to operate in a safe and effective manner.

These statements reflect the Company’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company's mining activities; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the speculative nature of exploration and development; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified in the Company’s public disclosure documents. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Click here to connect with Cosa Resources Corp. (CSE: COSA ), to receive an Investor Presentation

COSA:CC

The Conversation (0)

05 December 2023

Cosa Resources

Exploring Uranium Assets in the Prolific Athabasca Basin

Exploring Uranium Assets in the Prolific Athabasca Basin Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00