Please note that on Wednesday, May 8th, Brunswick Exploration (TSX-V: BRW, OTCQB: BRWXF) issued the incorrect version of a press release under the same headline. The corrected release follows:

Brunswick Exploration Inc. (TSX-V: BRW, OTCQB: BRWXF; " BRW " or the " Company ") is pleased to report more significant results from the Mirage winter drilling campaign. The Mirage Project is located in the Eeyou Istchee-James Bay region of Quebec approximately 40 kilometres south from the Trans-Taiga Road. The winter drill campaign focused on the Central Zone and has continued to intersect multiple wide and well mineralized intervals within the MR-6 dyke and its vicinity, where it remains open in all directions.

Highlights include:

- Best interval to date at Mirage with 1.55% Li2O over 93.45 meters in drill hole MR-24-62 starting at surface and which extends the flat dipping MR-6 dyke a further 80 meters to the south-west.

- The MR-6 dyke was also extended 135 meters to the north of MR-24-62 where BRW intersected 1.05% Li2O over 34.05 meters in drill hole MR-24-65.

- MR-6 has now been drill traced over 220 meters of strike extent with true thickness varying from 25 meters and up to 70 meters. The dyke remains open in multiple directions with the strongest potential to the northeast and southwest.

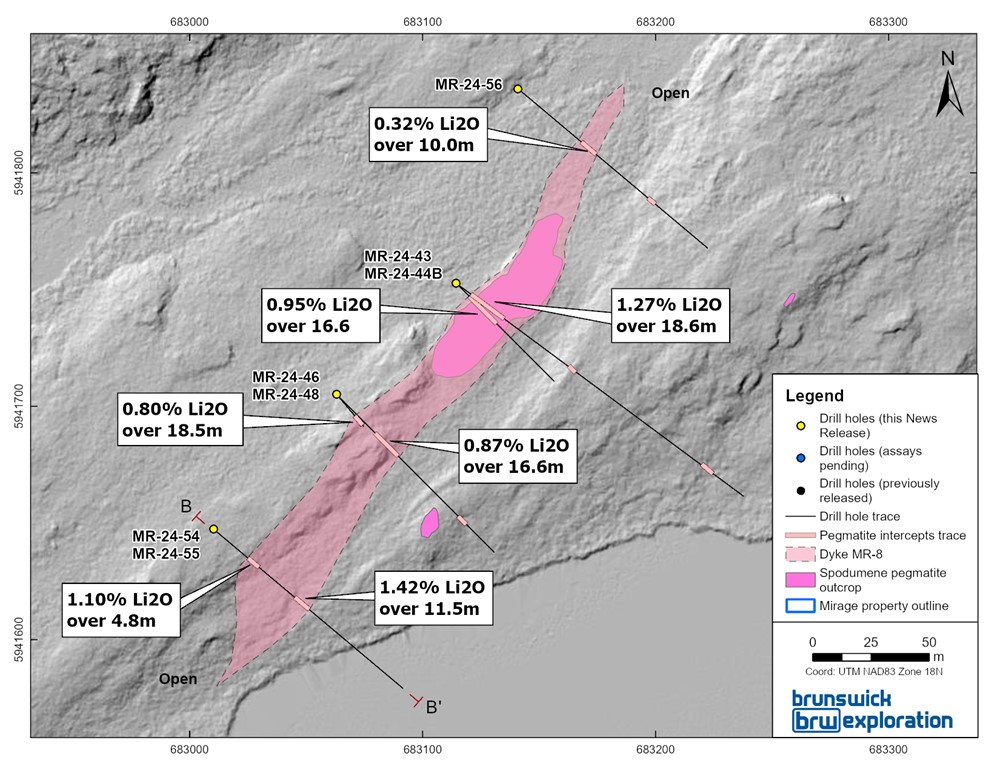

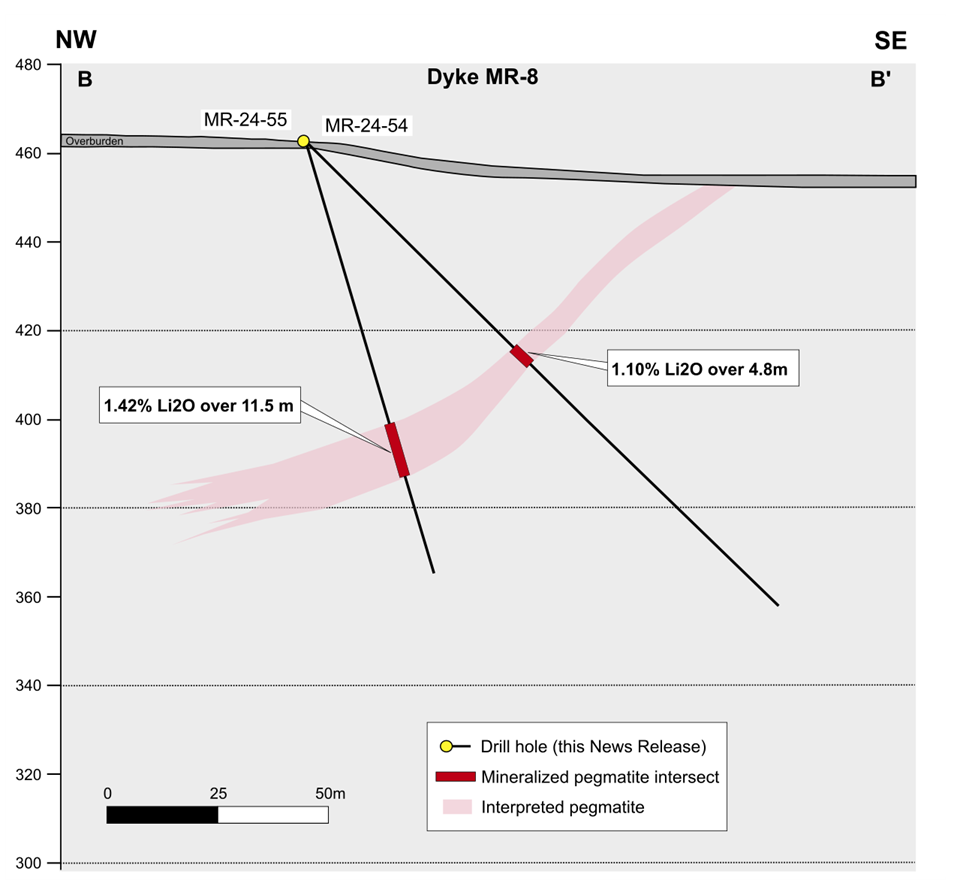

- New MR-8 dyke confirmed in the North zone with 1.27% Li2O over 18.6 meters in drill hole MR-24-43 and 1.42% Li2O over 11.5 meters in drill hole MR-24-55.

- New exploration drill hole located approximately 800 meters northeast of MR-6 intersected anomalous lithium values in drill hole MR-24-53 within a zone of stacked dykes. These intercepts continue to extend the central corridor of prospective dykes towards a spodumene bearing outcrop located 3.5 kilometers to the northeast, that has yet to be drill tested.

- A total of 26 drills holes results were received to date and 9 drills holes results style pending.

Mr. Killian Charles, President and CEO of BRW, commented: "With this latest set of results, MR-6 is rapidly becoming a top priority for Brunswick Exploration and will be the core focus of our next drill campaign. This is another very significant intercept which begins at surface and adds to the prior results of 58 meters at 1.59% Li2O and 37 meters at 1.80% Li2O. all starting from surface as well. Our understanding of the Mirage Project has grown tremendously over the last six months and we are extremely excited to announce our future plans for the project over the forthcoming weeks and months as we continue to see important exploration potential across the project and outside the drill program area."

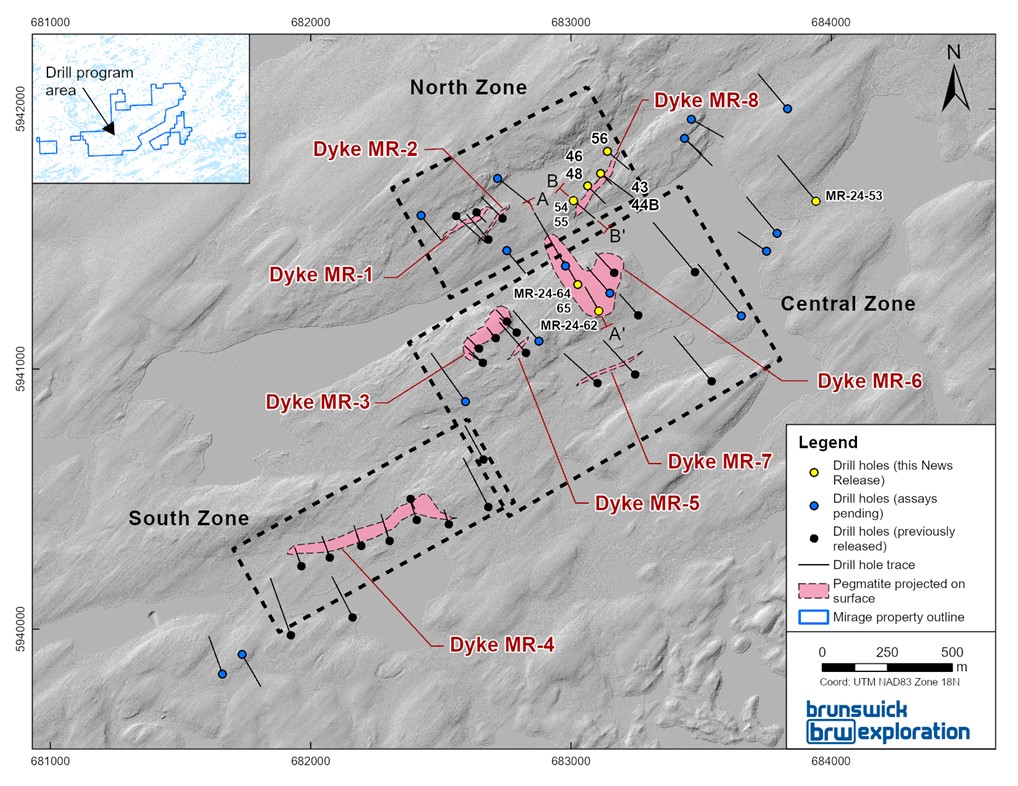

Figure 1 : Surface Map of the Mirage Project and Drill Holes Completed to Date

Table 1 : Highlights from 2024 Winter Drilling Program Mentioned in this Release

| Hole ID | Zone | Dyke | From (m) | To (m) | Lenght (m) | Li 2 O% | Ta 2 O 5 (ppm) |

| MR-24-43 | North | MR-8 | 9.85 | 28.45 | 18.6 | 1.27 | 81 |

| and | 83.95 | 86.7 | 2.75 | 0.99 | 101 | ||

| MR-24-44B | 14.4 | 31 | 16.6 | 0.95 | 81 | ||

| MR-24-46 | 35.4 | 52 | 16.6 | 0.87 | 97 | ||

| MR-24-48 | 43 | 61.5 | 18.5 | 0.80 | 93 | ||

| MR-24-53 | | | 225 | 227.2 | 2.2 | 0.55 | 143 |

| and | 251 | 274 | 23 | 0.33 | 95 | ||

| MR-24-54 | North | MR-8 | 66.55 | 71.35 | 4.8 | 1.10 | 198 |

| MR-24-55 | 67.6 | 79.1 | 11.5 | 1.42 | 166 | ||

| MR-24-56 | 49.05 | 59 | 9.95 | 0.32 | 44 | ||

| MR-24-62 | Central | MR-6 | 6.35 | 99.8 | 93.45 | 1.55 | 160 |

| MR-24-64 | 55.45 | 78.3 | 22.85 | N/A | 223 | ||

| MR-24-65 | 44.4 | 78.45 | 34.05 | 1.05 | 125 |

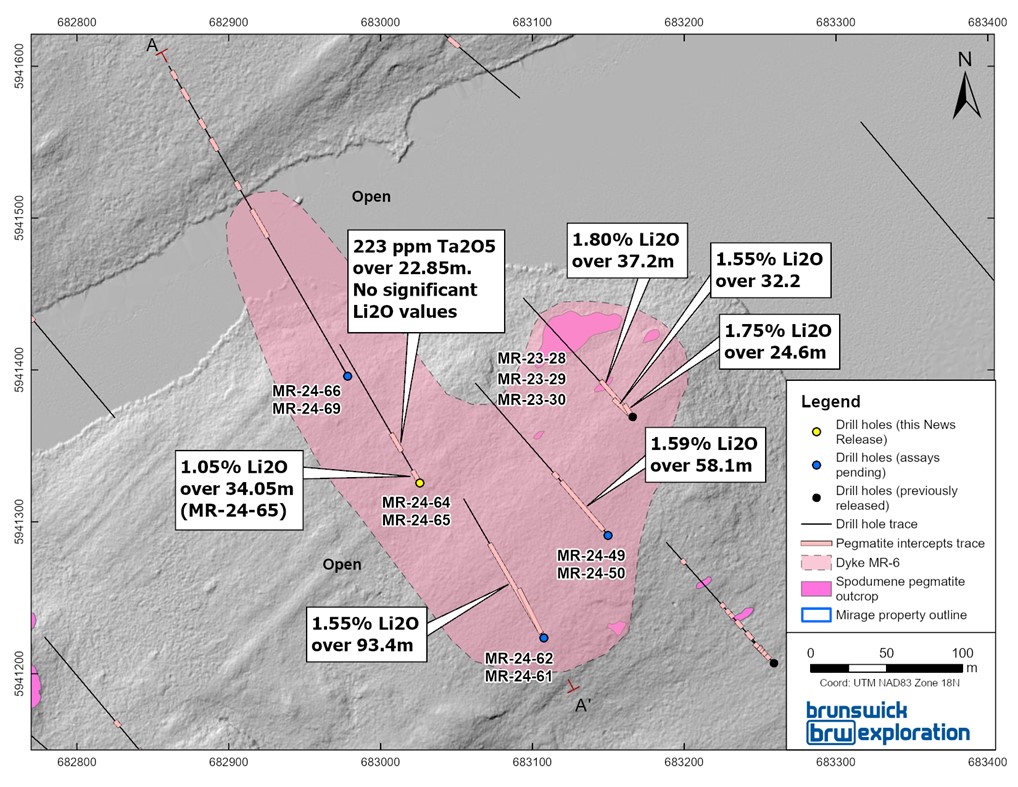

Figure 2 : Central Zone of the Mirage Project

Mirage Project Drilling Overview

The Mirage Project comprises 427 claims located roughly 40 kilometers south of the Trans-Taiga Highway in Quebec's James Bay region and 34 kilometers northeast of Winsome Resources' Adina Project. At Mirage, a spodumene-bearing pegmatite boulder field extends over 3.0 kilometers in a northeast direction and several dozen well-mineralized pegmatite outcrops have been observed along a 2.5 kilometers-long trend further to the northeast. Both the extent of the outcrops and boulder train remain open in all directions (See August 21, 2023 press release).

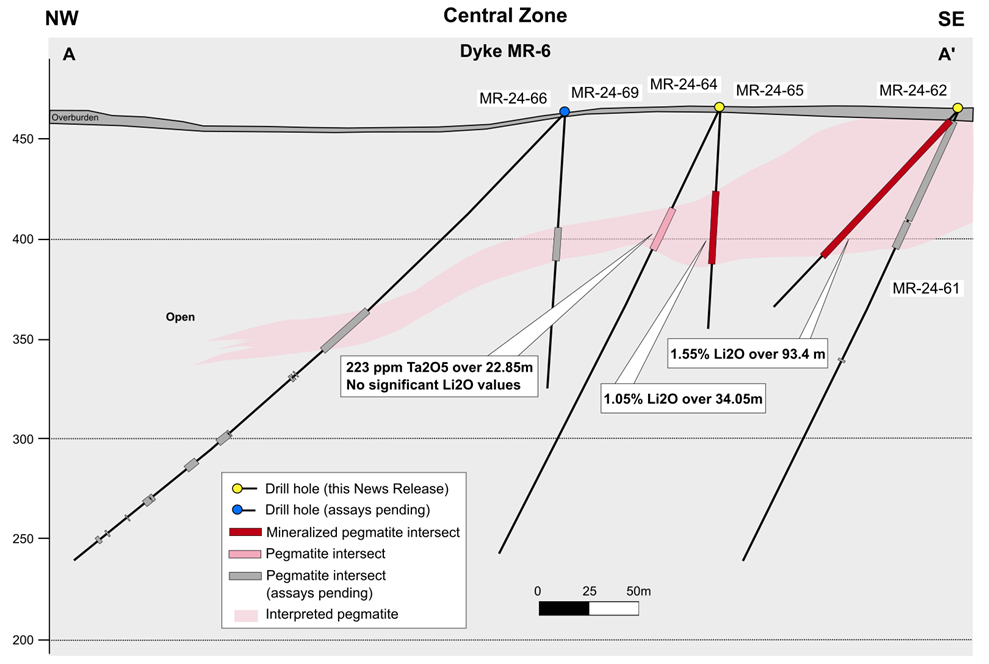

The Central Zone sits on a synformal fold hinge axis, oriented east-northeast, where multiple wide high grade pegmatite dykes were intercepted, predominantly in MR-3 and MR-6. MR-6 is interpreted to be a large, thick, sub-horizontal dyke with a higher-grade core with potential evidence of zonation to the northwest. Latest results confirm a thickening of the MR-6 dyke to the southwest in MR-24-62 where drilling intercepted 93.45 meters at 1.55% Li2O. This new hole significantly extends MR-6 to the southwest where the dyke remains open. Moreover, BRW believes there is extensive potential to expand the MR-6 dyke to the northeast where it also remains open. The higher-grade core which is generally oriented southwest-northeast was extended northwest of MR-24-62 with 34.05 meters at 1.05% Li2O. The true thickness varys between 75% and 95% of intersected intervals. This core is defined by coarser and more prevalent spodumene mineralization and is thicker than other portions of the dyke. Interestingly, a fence of holes continued to intersect the MR-6 dyke up to 350 meters north of MR-24-62 where it remains open and the results are still pending (see Figure 3). In this region, the MR-6 dyke appears to be more heterogenous with changing mineralization and highly variable spodumene concentration. MR-24-64 appears to be at the boundary of this new zone of the MR-6 dyke and outside of the high-grade core. Spodumene mineralization is observed in MR-24-66 indicating the possibility of economic grades outside of the core.

There is potential to extend MR-6 350 meters to the west where it remains open towards the MR-3 dyke. The MR-3 dyke demonstrates significant apparent thicknesses of up to 50.6 meters at 1.06% Li2O (See December 4, 2023 press release) in core with a moderate dip of 50 degrees towards the south with true thickness estimated at 95% in all reported holes. MR-3 is oriented NE and reaches the surface where it can be traced continuously for more than 400 meters of strike with consistent thickness of 40 meters.

Potential to extend Central Zone 800 meters to the east where MR-24-53 intersected the volcanic-sedimentary contact to test a similar geological context as the MR-4 dyke in the South Zone. Drill hole MR-24-53 returned 0.33% Li2O over 23 meters within evidence of dyke stacking. Although this intercept is not related to the MR-4 dyke (located 2 km to the southwest), the drillhole highlights the lithium potential of the lithological contact throughout the project and further to the northeast.

Figure 3 : Cross Sections A to A'

The North Zone is located on the north limb of a regional fold, where a newly drilled dyke, MR-8, was extended over 250 meters in strike (See figure 4 and 5) with 1.27% Li2O over 18.6 meters in drill hole MR-24-43 and 1.42% Li2O over 11.5 meters in drill hole MR-24-55. The dyke remains open to the southwest and to the northeast with 0.84% Li2O over 6.5 meters in drill hole MR-24-57 (See April 25, 2024 press release).

Figure 4 : Surface map project of the MR-8 dyke

Figure 5 : Cross Sections B to B'

QAQC

All drill core samples were collected under the supervision of BRW employees and contractors. The drill core was transported by helicopter and by truck from the drill platform to the core logging facility in Val-d'Or. Each core was then logged, photographed, tagged, and split by diamond saw before being sampled. All pegmatite intervals were sampled at approximately 1-meter intervals to ensure representativity. Samples were bagged; duplicated on ¼ core splits, blanks and certified reference materials for lithium were inserted every 20 samples. Samples were bagged and groups of samples were placed in larger bags, sealed with numbered tags, in order to maintain a chain of custody. The sample bags were transported from the BRW contractor facility to the ALS laboratory in Val-d'Or. All sample preparation and analytical work was performed by ALS by ICP-AES according to the ALS method ME-MS89L. All results passed the QA/QC screening at the lab and all inserted standard and blanks returned results that were within acceptable limits. All reported drill intersections are calculated based on a lower cutoff grade of 0.3% Li2O, with maximum internal dilution of 5 meters. Host basalts adjacent to the dykes may grade up to 0.3% Li2O but were excluded from the reported intersections.

Qualified Person

The scientific and technical information contained in this press release has been reviewed and approved by Mr. Simon T. Hébert, VP Development. He is a Professional Geologist registered in Quebec and is a Qualified Person as defined by National Instrument 43-101.

About Brunswick Exploration

Brunswick Exploration is a Montreal-based mineral exploration company listed on the TSX-V under symbol BRW. The Company is focused on grassroots exploration for lithium in Canada, a critical metal necessary to global decarbonization and energy transition. The company is rapidly advancing the most extensive grassroots lithium property portfolio in Canada and Greenland.

Investor Relations/information

Mr. Killian Charles, President and CEO ( info@brwexplo.ca )

Cautionary Statement on Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation based on expectations, estimates and projections as at the date of this news release. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of projects; the other risks involved in the mineral exploration and development industry; and those risks set out in the Corporation's public documents filed on SEDAR at www.sedar.com. Although the Corporation believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Corporation disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/5cc55a85-6e76-4085-8d65-5777109c6a76

https://www.globenewswire.com/NewsRoom/AttachmentNg/459018c8-6d33-47d1-939f-989b02625cc3

https://www.globenewswire.com/NewsRoom/AttachmentNg/32aec448-9670-47dc-83e3-be0bb9fcc76c

https://www.globenewswire.com/NewsRoom/AttachmentNg/c957a2f9-3ffe-4dee-9c0b-15c0d52021e1

https://www.globenewswire.com/NewsRoom/AttachmentNg/ffb1ce5b-1de1-47c0-abf9-0c530f233c11