October 05, 2021

Balkan Mining and Minerals Ltd (BMM or the Company) (ASX:BMM)is pleased to announce the completion of its reconnaissance and rock sampling at the Dobrinja Lithium-Borate Project.

The Company has conducted an extensive surface prospecting and a permit wide sampling program, consisting of 97 outcrops being observed and the required information being obtained and recorded into the company database. Additionally, 61 samples of lacustrine-appearing sediments were taken for geochemical analysis.

The sampling program was conducted in order to identify prospective stratigraphy with elevated lithium and boron and to allow the inference of prospective sections.

The samples have been submitted to ALS Bor for sample preparation to be conducted and once completed, the samples will be dispatched to ALS Ireland and Vancouver for multi-element ICP analysis. The Company will release the results once received.

Dobrinja

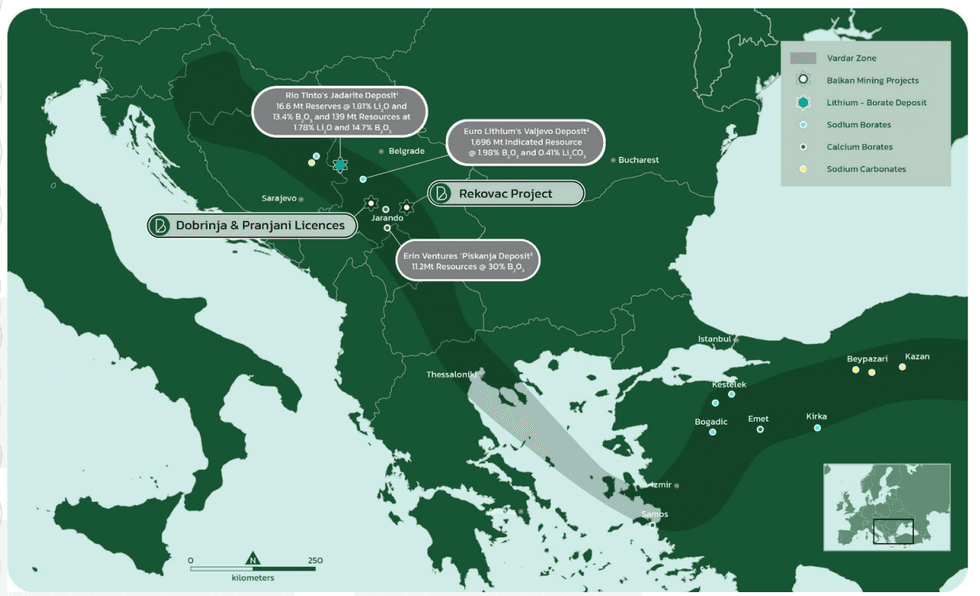

The project occupies intermontane lacustrine Neogene basin within the trend called the Vardar Zone. The Dobrinja license, covering 37.58km2, is located in western Serbia along trend where lithium– borate Mineral Resources and Ore Reserves have been defined (Rio Tinto, Euro Lithium and Erin Ventures)1.

The Dobrinja basin is generally elongated in a northwest-southeast direction, controlled by the Neogene tectonic. The targeted lacustrine sedimentary sequence comprises of Lower, Middle and Upper Miocene fine pelitic sediments, marlstone, ash-flow tuffs, oil shale and basal clastic flows.

Basement rocks vary in both age and rock type, and include Paleozoic metamorphic rocks, Mesozoic carbonates and Vardar Ophiolites formations. Northwest - southeast trending faults are thought to be major structural controls on basement fracturing and basin development and may also serve as zones of migration for mineral-bearing fluids.

For further information pls contact:

RossCotton MediaInquiries

Managing Director Nick Doherty

White Noise Communications

Authorised for release by the Managing Director of Balkan Mining and Minerals Limited

-ENDS-

BMM:AU

The Conversation (0)

05 September 2021

Bayan Mining and Minerals

Mining Critical Minerals from the Balkan Region

Mining Critical Minerals from the Balkan Region Keep Reading...

19 January 2025

Further Exploration Targets Identified at Bayan Springs

Bayan Mining and Minerals (BMM:AU) has announced Further Exploration Targets Identified at Bayan SpringsDownload the PDF here. Keep Reading...

31 October 2024

Quarterly Activities/Appendix 5B Cash Flow Report

Balkan Mining and Minerals (BMM:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00