- WORLD EDITIONAustraliaNorth AmericaWorld

October 16, 2024

Brixton Metals Corporation (TSX-V: BBB, OTCQB: BBBXF) (the “Company” or “Brixton”) is pleased to announce additional 2024 drill results from the Trapper Gold Target at its wholly owned Thorn Project. The project is located in Northwest British Columbia, 90km east of Juneau, Alaska.

Highlights

- Hole THN24-304 yielded 227.50m of 0.50 g/t Au from 40.00m depth

- Including 82.00m of 1.27 g/t Au

- Including 49.00m of 2.02 g/t Au

- Including 27.00m of 3.49 g/t Au

- Including 8.00m of 11.37 g/t Au

- Including 2.00m of 44.43 g/t Au

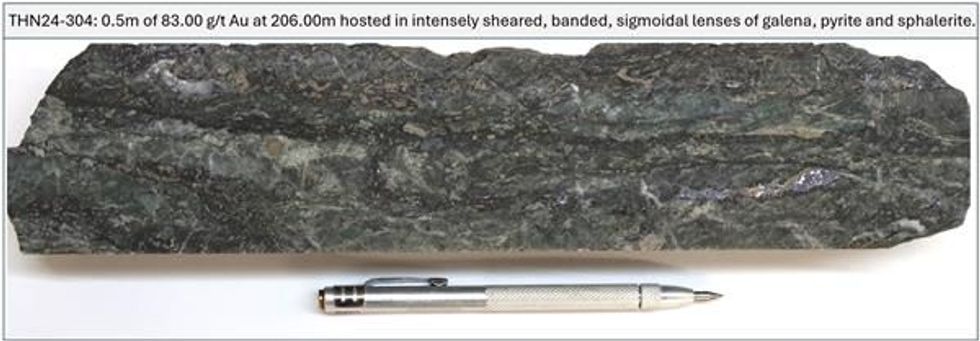

- Gold occurs as native gold and is associated with base metal veins as galena, sphalerite, chalcopyrite, quartz-carbonate and pyrite

Vice President of Exploration, Christina Anstey, stated, "It’s great to see these high-grade gold intercepts within the broad domain of gold mineralization at the Trapper Gold Target. The main Trapper drill target represents a 600m wide zone within a broader 4km gold on surface geochemical anomaly. The gold mineralization horizon identified with drilling correlates well with the magnetic vertical gradient response and this, in combination with the surface geochemical anomalies, provides many future drill targets to potentially expand the footprint at Trapper. We are looking forward to the next batch of assays from the 2024 drill program at the Trapper Gold Target.”

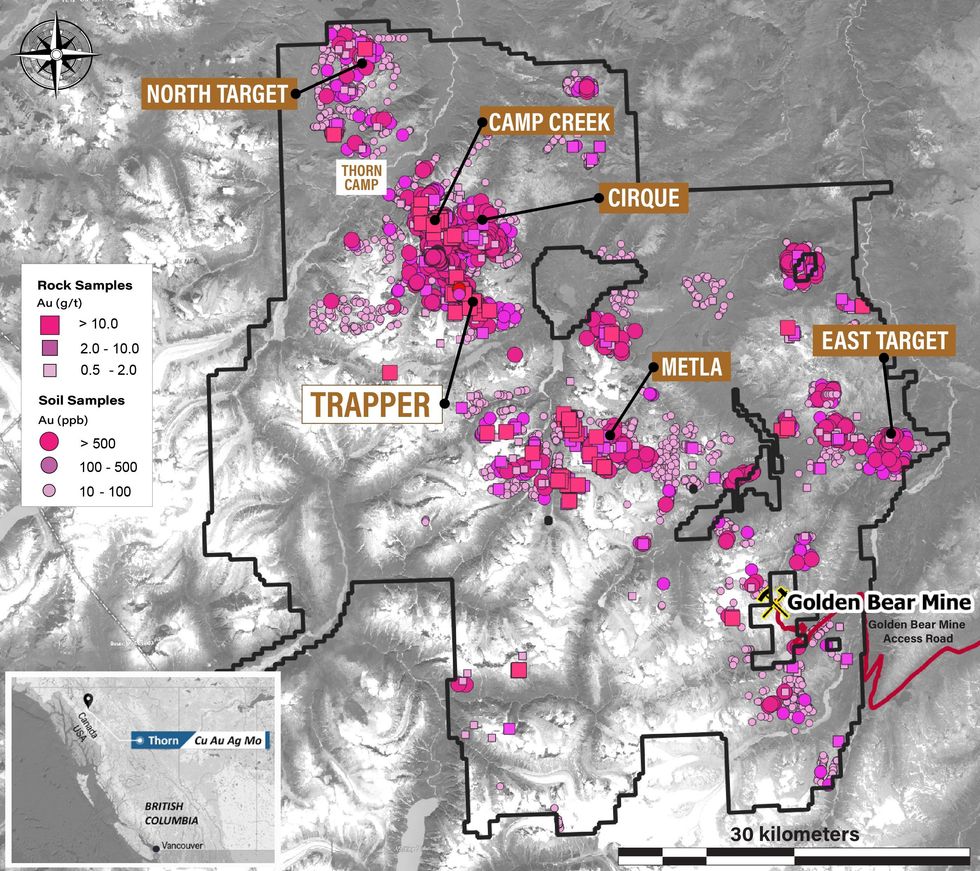

Figure 1. Gold Geochemistry and Trapper Target Location Map.

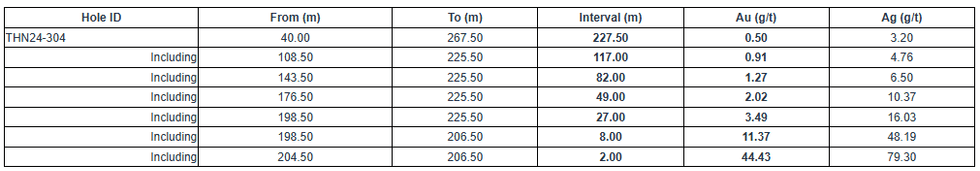

Table 1. Select Mineralized Intervals for the Trapper Target Drilling.

All assay values are uncut weighted averages and intervals reflect drilled lengths as further drilling is required to determine the true widths of the mineralization.

Discussion

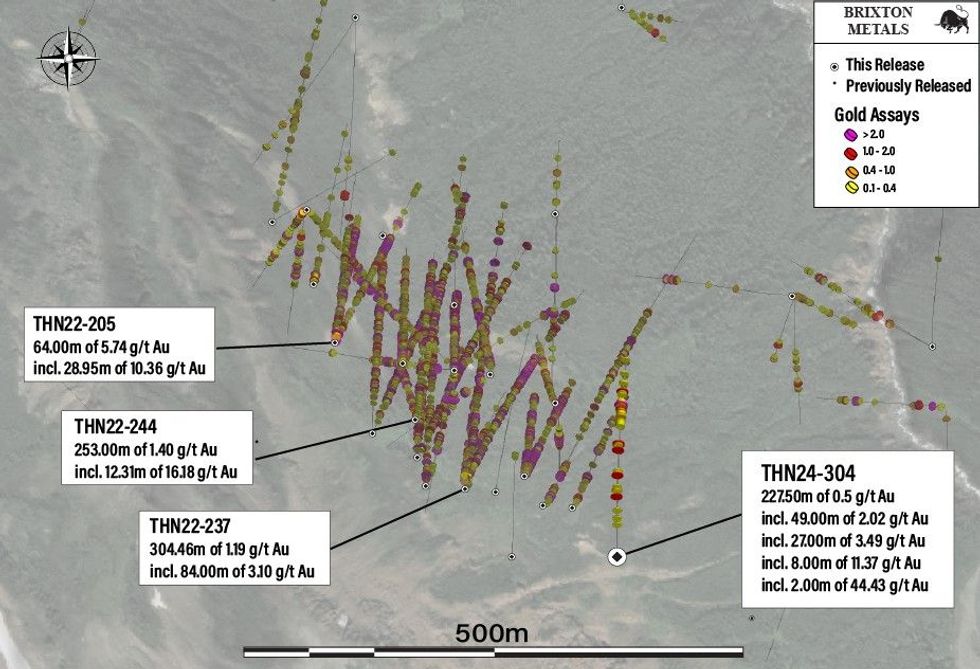

The 2024 drill campaign at the Trapper Gold Target totaled 2,745.60m of drilling across 11 HQ-sized diamond drill holes of which 331.60m are covered in this release. The program was designed to test the extents and continuity of the main mineralized corridor along the Lawless Fault zone through a combination of infill and step-out drilling. Additional step-out drilling was completed north of the main zone, following-up on undercover mineralized zones that were identified during the 2023 drill program. Drilling was planned through a combination of mapping, oriented core data analysis, geophysics, and soil geochemistry. Additional assays from the 2024 drill campaign will be released as they become available.

Figure 2. Planview Map with Collar Locations and Gold Drill Traces at the Trapper Target.

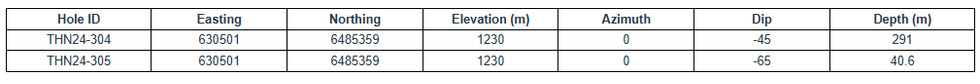

THN24-304 was drilled at an azimuth of 000 degrees and dip of -45 degrees to a final depth of 291m. Hole 304 was planned as a 65m southwest step out hole to test gold grade continuity to the southwest of the main target location. Hole 304 successfully intercepted broad intervals of gold bearing mineralization which included several high-grade vein intercepts assaying 227.50m of 0.50 g/t Au starting at 40.00m depth, including 82.00m of 1.27 g/t Au, including 27.00m of 3.49 g/t Au, including 8.00m of 11.37g/t Au and including 2.00m of 44.43 g/t Au.

THN24-305 was drilled from the same pad location as hole 304 to test the continuation of the veins targeted in hole THN24-304. Unfortunately, the drill rods became stuck at 40.60 meters and the hole had to be abandoned. No significant results were intercepted.

Gold mineralization at Trapper is structurally controlled along the Lawless Fault, trending northwest-southeast and dipping moderately to the north in the main drilling area. There are multiple CVG features (see news release dated October 10th, 2024) that could reflect similar parallel structures to the Lawless Fault which remain open to test for new gold potential. Mineralization appears to favour the contact between the Cretaceous (85.2 +/- 1.2Ma) quartz diorite and the Triassic lapilli tuffs with broad gold intervals largely hosted along the faulted contact. The gold is associated with silver and base metal veins containing pyrite-galena-sphalerite +/- chalcopyrite +/- bornite, which occur conjugate to the Lawless Fault. Through a combination of oriented core drilling, surface mapping, geochemistry and geophysics, the aim is to achieve predictability of the gold-bearing zones. The current drilling at the Trapper Target is located 7km southeast from the Camp Creek Copper Porphyry Target. At surface, the Trapper Target is expressed as a 4km northwest trending gold and zinc soil geochemical anomaly which is part of the larger 11km gold geochemical anomaly trending from Camp Creek to the Trapper Target. Future drilling at the Trapper Target will focus on identifying new zones of gold-bearing mineralization undercover within the footprint of this larger gold geochemical anomaly.

Figure 3. High Grade Gold Photograph of THN24-304.

Drilling Information

Table 2. Drill Collar and Hole Information of Current News Release.

About the Trapper Gold Target

The geochemical footprint for the Trapper Gold Target was expanded in 2021 to 4km by 1.5km with a gold-in-soil geochemical signature that has a strong positive correlation to zinc and lead. The Trapper Target represents an intermediate-sulphidation epithermal system hosted in volcanic and intrusive rocks. The volcanics are Triassic Stuhini lapilli tuff, while the intrusive phase is a Cretaceous quartz diorite dated at 85.2Ma +- 1.2Ma. Visible gold has been identified in both drill core and surface outcrops across the Trapper Target area and rock grab samples have returned up to 152 g/t Au. Visible gold is recognized in several environments: within base metal veins (sphalerite-galena-pyrite-chalcopyrite), quartz-stockwork, sulphosalt-pyrite veinlets, and rarely disseminated gold in the diorite. In 2021, 2022 and 2023 Brixton drilled 3,107m, 9,119m and 6,625m respectively. In 2011, forty-two drill holes were completed by a previous operator. The Trapper Target is royalty free.

Quality Assurance & Quality Control

Quality assurance and quality control protocols for drill core sampling were developed by Brixton. Core samples were mostly taken at 1.0m intervals. Blank, duplicate (lab pulp) and certified reference materials were inserted into the sample stream for at least every 20 drill core samples. Core samples were cut in half, bagged, zip-tied and sent directly to ALS Minerals preparation facility in Langley, British Columbia. ALS Minerals Laboratories is registered to ISO 9001:2008 and ISO 17025 accreditations for laboratory procedures. Samples were analyzed at ALS Laboratory Facilities in North Vancouver, British Columbia for gold by fire assay with an atomic absorption finish, whereas Ag, Pb, Cu and Zn and 48 additional elements were analyzed using four acid digestion with an ICP-MS finish. Over limits for gold were analyzed using fire assay and gravimetric finish. The standards, certified reference materials, were acquired from CDN Resource Laboratories Ltd., of Langley, British Columbia and the standards inserted varied depending on the type and abundance of mineralization visually observed in the primary sample. Blank material used consisted of non-mineralized siliceous landscaping rock. A copy of the QAQC protocols can be viewed at the Company’s website.

About the Thorn Project

The wholly-owned 2,945 square kilometer Thorn Project is located in British Columbia, Canada, approximately 90 km east of Juneau, AK. The southern limit of the Thorn claim boundary is roughly 50 km from tide water. The Thorn Project hosts a district-scale 80km megatrend of Triassic to Eocene, volcano-plutonic complex with several styles of mineralization related to porphyry and epithermal environments. Many large-scale copper-gold targets have been identified for further exploration work. Information on each of the targets may be found at the following link: https://brixtonmetals.com/thorn-gold-copper-silver-project/

Qualified Person

Mr. Corey A. James, P.Geo., is a Senior Project Geologist for the company and a qualified person as defined by National Instrument 43-101. Mr. James has verified the data disclosed in this press release, including the sampling, analytical and test data underlying the technical information and has approved this press release.

About Brixton Metals Corporation

Brixton Metals is a Canadian exploration company focused on the advancement of its mining projects. Brixton wholly owns four exploration projects: Brixton’s flagship Thorn copper-gold-silver-molybdenum Project, the Hog Heaven copper-silver-gold Project in NW Montana, USA, which is optioned to Ivanhoe Electric Inc., the Langis-HudBay silver-cobalt-nickel Project in Ontario and the Atlin Goldfields Project located in northwest BC which is optioned to Eldorado Gold Corporation. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB, and on the OTCQB under the ticker symbol BBBXF. For more information about Brixton, please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

For Investor Relations inquiries please contact: Mr. Michael Rapsch, Senior Manager, Investor Relations. email: michael.rapsch@brixtonmetals.com or call Tel: 604-630-9707

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

BBB:CA

Sign up to get your FREE

Brixton Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

12 January

Brixton Metals

Diversified exposure to copper, gold and silver with projects in North America

Diversified exposure to copper, gold and silver with projects in North America Keep Reading...

10 February

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Sign up to get your FREE

Brixton Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00