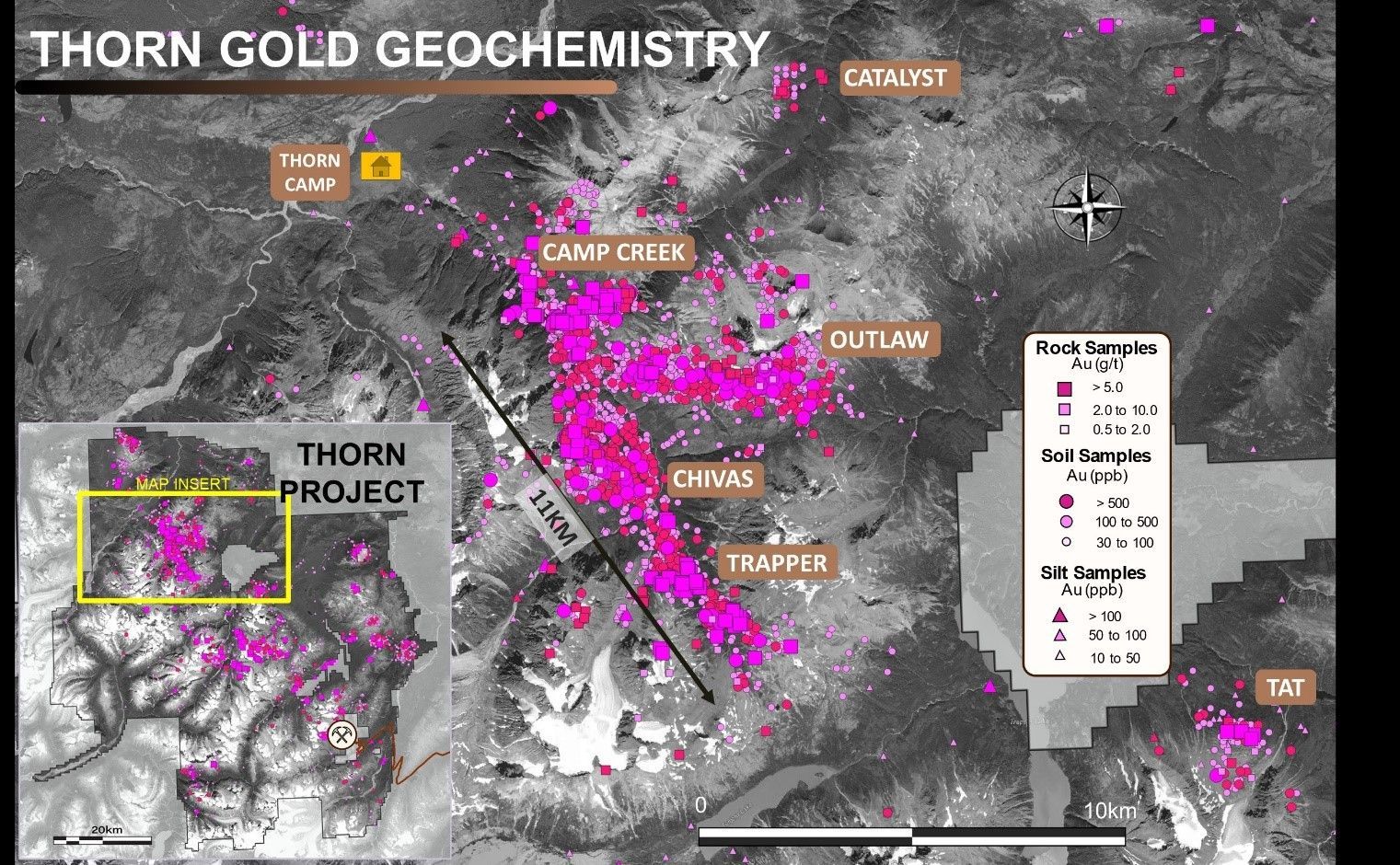

Brixton Metals Corporation (TSX-V: BBB, OTCQB: BBBXF) (the " Company " or " Brixton ") is pleased to announce that its Thorn exploration camp is now open for the season and drilling has commenced. Brixton is fully funded for the 2025 exploration program with plans to expand near surface gold mineralization within the Camp Creek Corridor and at the Trapper Gold Target, and to drill test new, near surface copper porphyry mineralization at Catalyst Target. The 2,945 km 2 project is located in Northwest British Columbia, Canada, approximately 90 km northeast from Juneau, Alaska.

2025 Thorn Exploration Plan Highlights:

- The 2025 exploration plan consists of 8,000 to 10,000 meters of drilling across several target areas and is split between gold and copper targets as previously stated in the news release dated May 6, 2025 .

- CLICK HERE for a 3D presentation of the Thorn Project.

Chairman and CEO Gary R. Thompson stated, " We are excited to have the drills turning again at the Thorn Project. Between the new gold mineralization and copper porphyry discovery potential, we are in for an interesting exploration season."

Figure 1. Thorn Project Gold Geochemistry Map.

Camp Creek Feeder Structures

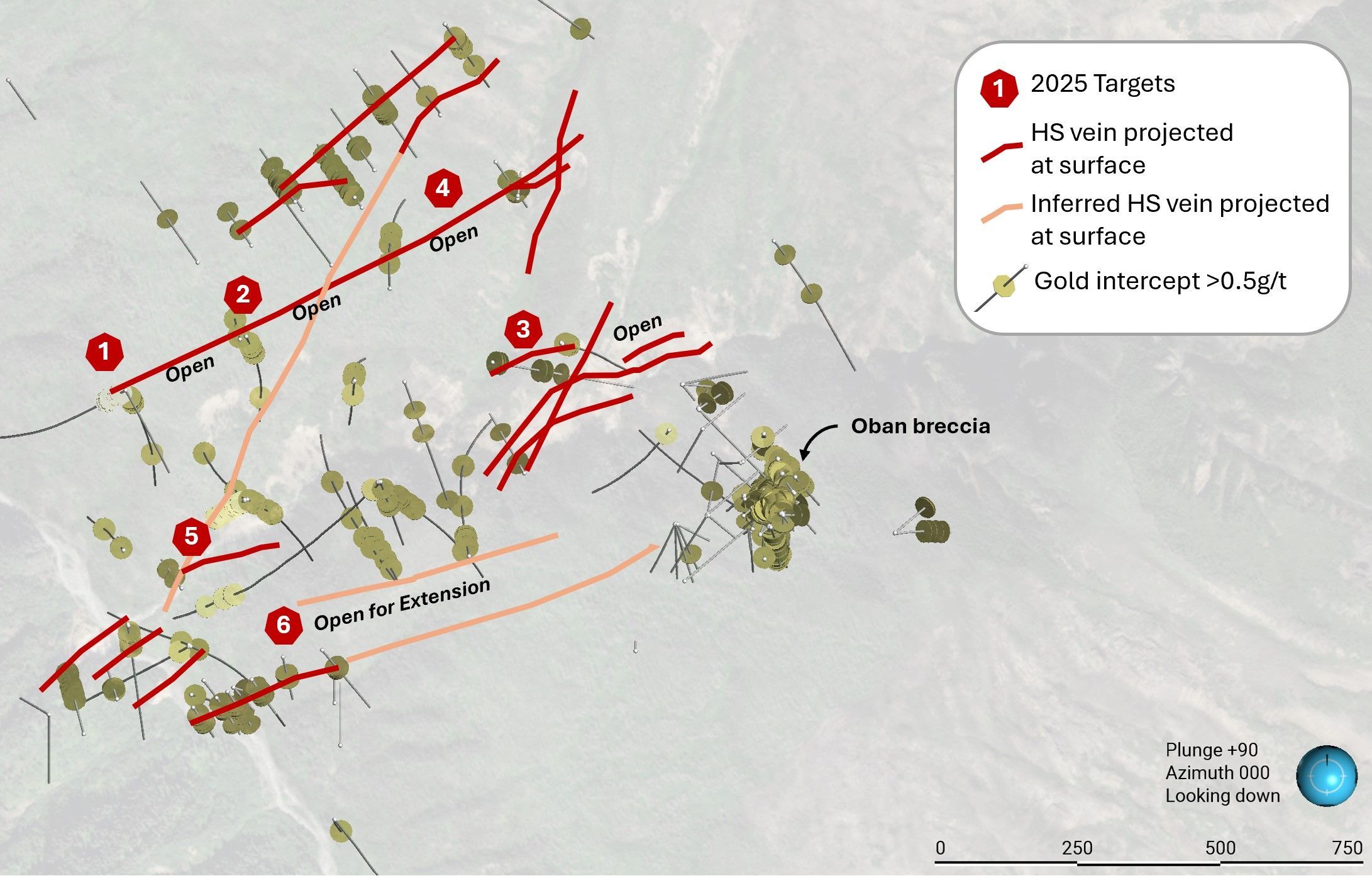

High-sulphidation style gold mineralization is located near surface, these zones are interpreted as potential feeder structures. Three holes, 307, 221, and 294 encountered gold mineralization that appear to have a northeast trend, which is parallel to the Camp Creek structural corridor where drilling is planned to test the continuity of this structure. Hole 307 returned 26m of 1.89 g/t gold, 74.8 g/t silver, 0.28% copper from 172m depth including 8.00m of 4.52 g/t gold, 148.6 g/t silver, 0.54% copper (Targets in the Figure 2 below). Shallow drilling is planned to test the up-dip gold zone encountered in hole 221 that returned 55.8 g/t gold over 1.5m from 449.5m depth. Based on the success of the initial drilling further holes may be drilled in the area.

Figure 2. Camp Creek Shallow Gold Targets High-Sulphidation Feeder Structures.

Figure 3. Photograph of Drill at Site THN25-315 on Old Burn Area of Camp Creek.

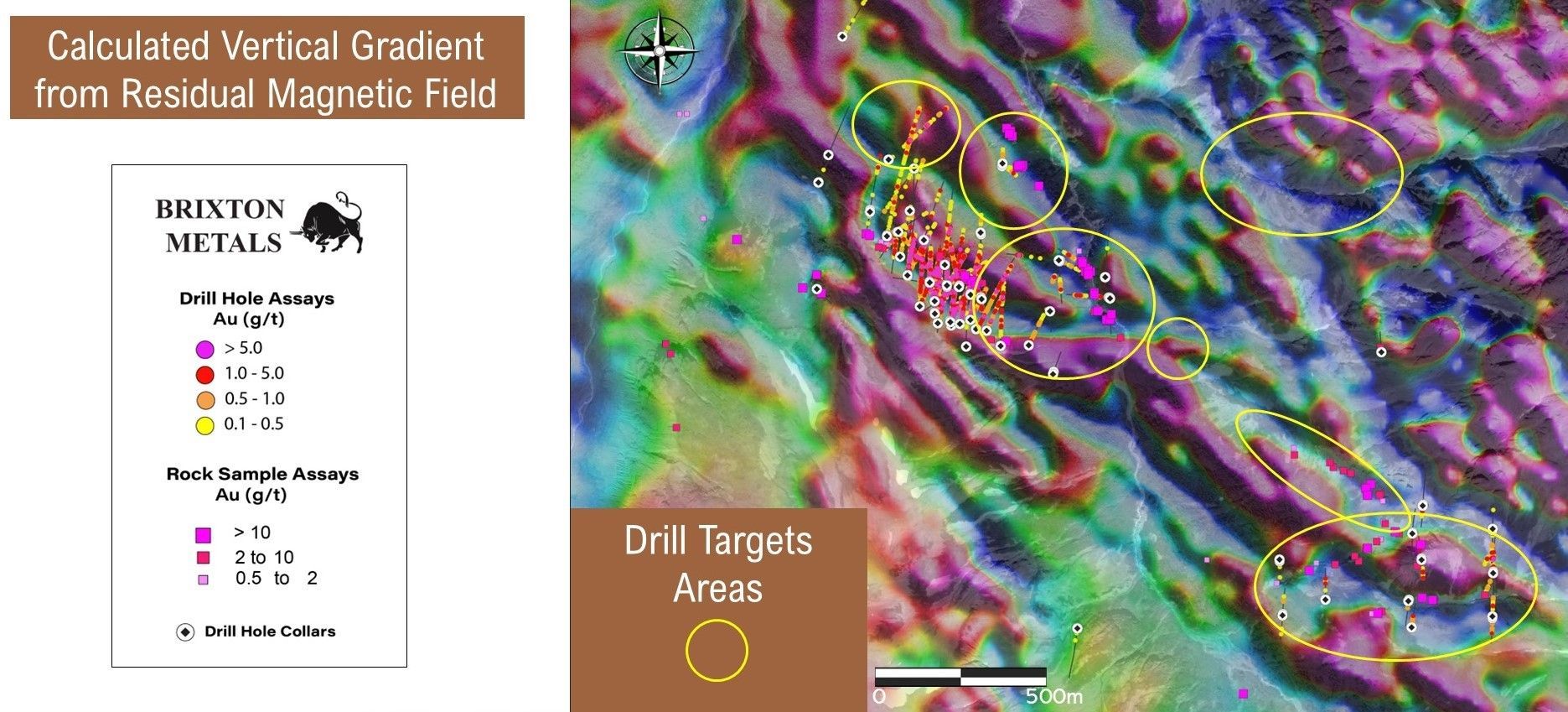

Trapper Gold Target Drilling

The most significant drill intercept in 2024 was recorded in hole THN24-304, yielding broad intervals of gold mineralization, which included several high-grade sub-intervals assaying 82.00m of 1.27 g/t gold, including 27m of 3.49 g/t gold, including 8m of 11.37g/t gold and including 2.00m of 44.43 g/t gold. In 2022, hole THN22-205 intercepted numerous visible gold counts reporting a drill intercept of 64.00m of 5.74 g/t gold, including 52.00m of 6.97 g/t gold and including 28.95m of 10.36 g/t gold. Follow up drilling is planned to extend this near surface gold mineralization.

Figure 4. Trapper Gold Target Areas, Drilling and Rocks Samples on Magnetic CVG.

Catalyst Target

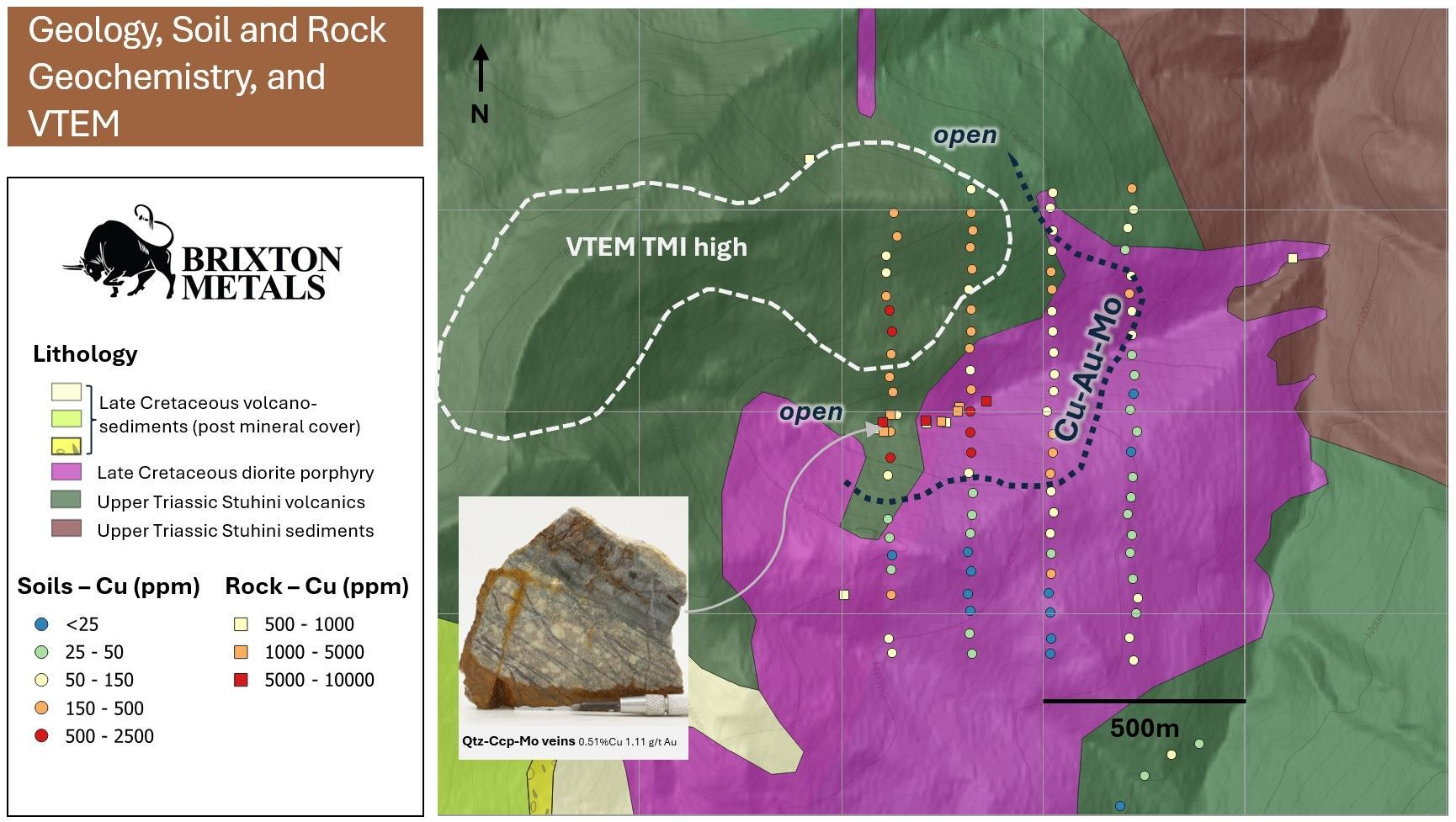

The Catalyst showing, located 6 km northeast of the Camp Creek Porphyry Target, is defined by a 300m long exposure consisting of stockwork quartz-chalcopyrite-molybdenite A veins hosted within a strong quartz-sericite-pyrite alteration zone. The showing is located within a broader 1.6 km by 1 km northeast trending alteration zone hosting phyllic to argillic assemblages, which transitions into a broader area of propylitic alteration. Rock samples from the Catalyst showing returned up to 0.56% Cu, 0.11% Mo, 2.87 g/t Au, and 30.0 g/t Ag, including a 1.55 m chip across a stockwork vein zone which assayed 0.46% Cu, 68 ppm Mo, and 0.37 g/t Au.

Figure 5. Catalyst Target Geology, Principal Components and Soil Geochemistry

A Cu- Mo-Ag-Au soil anomaly surrounds the area of exposed quartz-chalcopyrite-molybdenite veins. The location of the soil anomaly is straddling the contact between a Late Cretaceous diorite porphyry and mafic volcanic rocks of the Late Triassic Stuhini Group. A TMI high from the 2010 VTEM survey lies to the northwest of the sample grid where the Cu-Mo anomalies remain open.

Qualified Person

Mr. Gary R. Thompson, P.Geo., is a Director, Chairman, CEO and President for the Company who is a qualified person as defined by National Instrument 43-101. Mr. Thompson has verified the referenced data and analytical results disclosed in this press release and has approved the technical information presented herein.

Corporate Update

The Company has granted an aggregate of 4,300,000 Incentive Stock Options to officers, directors, employees and consultants to the Company at a per share price of $0.10 for a period of ten years from the date of grant. The options are subject to a 12-month vesting period until May 26, 2026.

About Brixton Metals Corporation

Brixton Metals is a Canadian exploration company focused on the advancement of its mining projects. Brixton wholly owns four exploration projects: Brixton's flagship Thorn copper-gold-silver-molybdenum Project, the Hog Heaven copper-silver-gold Project in NW Montana, USA, which is optioned to Ivanhoe Electric Inc., the Langis-HudBay silver-cobalt-nickel Project in Ontario and the Atlin Goldfields Project located in northwest BC which is optioned to Eldorado Gold Corporation. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB , and on the OTCQB under the ticker symbol BBBXF . For more information about Brixton, please visit our website at www.brixtonmetals.com .

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

For Investor Relations inquiries, please contact: Mr. Michael Rapsch, VP Investor Relations. email: michael.rapsch@brixtonmetals.com or call: 604-630-9707

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

Links:

https://vrtuous.com/tools/loader/brixton-thorn-3d/

https://brixtonmetals.com/wp-content/uploads/2025/05/Figure-1_28May2025.jpg

https://brixtonmetals.com/wp-content/uploads/2025/05/Figure-2_28May2025.jpg

https://brixtonmetals.com/wp-content/uploads/2025/05/Figure-3_28May2025.jpg

https://brixtonmetals.com/wp-content/uploads/2025/05/Figure-4_28May2025.jpg

https://brixtonmetals.com/wp-content/uploads/2025/05/Figure-5_28May2025.jpg