January 10, 2025

Boab Metals (ASX:BML) is a base and precious metals explorer and developer progressing toward a final investment decision (FID) on its Sorby Hills project, a world-class lead-silver deposit. Boab Metals is poised to capitalize on the rising demand for lead and silver, delivering value to shareholders and supporting the global transition to sustainable energy systems.

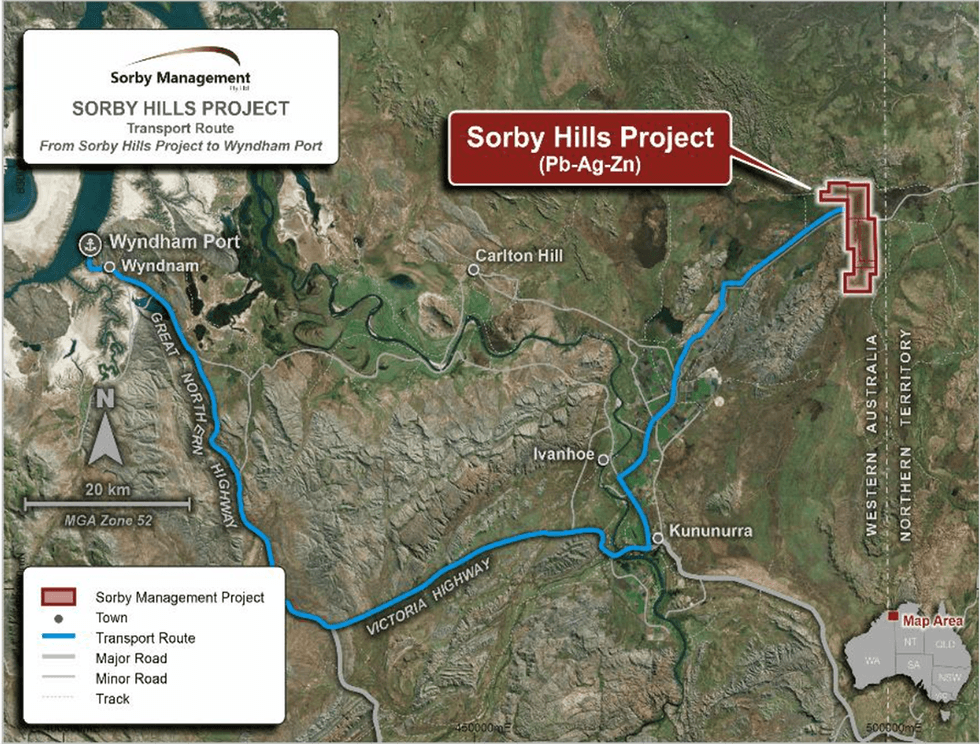

The Sorby Hills project is strategically located 150 km from Wyndham Port providing access to excellent infrastructure, and green power from the Ord River hydroelectric plant. Boab Metals combines technical expertise, sustainable practices, and robust financial planning to advance the Sorby Hills project, which is slated to produce high-grade lead-silver concentrate through conventional open-pit mining.

Boab Metals owns 75 percent of the Sorby Hills Project, with the remaining 25 percent held by Henan Yuguang Gold & Lead Co., China's largest lead smelting and silver producer. The project boasts a substantial, high-quality resource base of 47.3 million ton resource base at 4.3 percent lead equivalent (123 g/t silver equivalent), including 53 million ounces of contained silver, all with significant exploration upside.

Company Highlights

- Boab Metals is an ASX-listed base and precious metals explorer and developer with a flagship project poised for near-term production.

- The Sorby Hills project, Boab’s flagship asset, boasts a high-quality 47.3 Mt resource at 4.3 percent lead equivalent (123 g/t silver equivalent), including 53 Moz contained silver, and is in Western Australia, 50 km northeast of Kununurra.

- Strong economics underpin the project with an NPV (8 percent) of AU$411 million and an IRR of 37 percent, as confirmed by the completed FEED study. Life-of-mine operating cash flow of AU$1.1 billion with an average annual EBITDA of AU$126 million. Competitive C1 cash cost of US$0.36/lb payable lead (after considering silver credits).

- Binding offtake and prepayment agreements with Trafigura.

- Access to green hydroelectric power and existing environmental approvals enhance the project’s sustainability credentials and support reduced operational costs.

- Committed to community engagement, Boab Metals fosters strong relationships with local stakeholders and supports regional development initiatives.

- Expert leadership with a proven track record in exploration and development of mining assets

This Boab Metals profile is part of a paid investor education campaign.*

Click here to connect with Boab Metals (ASX:BML) to receive an Investor Presentation

BML:AU

The Conversation (0)

09 January 2025

Boab Metals Limited

Advancing toward near-term lead and silver production in Western Australia

Advancing toward near-term lead and silver production in Western Australia Keep Reading...

07 September 2025

Extension of Option to Acquire 100% of Sorby Hills

Boab Metals Limited (BML:AU) has announced Extension of Option to Acquire 100% of Sorby HillsDownload the PDF here. Keep Reading...

03 September 2025

EPBC Approval Granted for Sorby Hills

Boab Metals Limited (BML:AU) has announced EPBC Approval Granted for Sorby HillsDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Boab Metals Limited (BML:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 June 2025

Completion of Capital Raising

Boab Metals Limited (BML:AU) has announced Completion of Capital RaisingDownload the PDF here. Keep Reading...

16 June 2025

A$6 Million Placement to Advance the Sorby Hills Project

Boab Metals Limited (BML:AU) has announced A$6 Million Placement to Advance the Sorby Hills ProjectDownload the PDF here. Keep Reading...

11 February

10 Bodies Found as Mexico Probes January Kidnapping at Vizsla Silver Site

Mexican authorities have recovered 10 bodies as part of an investigation into the January abduction of workers from a mining site operated by Vancouver-based Vizsla Silver (TSXV:VZLA) in the northern state of Sinaloa.Mexico’s Attorney General’s Office said the bodies were located in the... Keep Reading...

10 February

Gary Savage: Silver Run Not Over, US$250 is Easy in Next Leg

Gary Savage, president of the Smart Money Tracker newsletter, breaks down gold and silver's recent price activity, saying that while the precious metals have reached the parabolic phase of the bull market, it's typical to see a correction midway through. "The second phase I think will be several... Keep Reading...

09 February

Panelists: Silver in Bull Market, but Expect Price Volatility

Gold often dominates conversations at the annual Vancouver Resource Investment Conference (VRIC), but silver's price surge, which began in 2025 and continued into January, placed the metal firmly in the spotlight. At this year’s silver forecast panel, Commodity Culture host and producer Jesse... Keep Reading...

09 February

Southern Silver Intersects 5.8 metres averaging 781g/t AgEq at Cerro Las Minitas Project in Durango, México

Southern Silver Exploration Corp. (TSXV: SSV,OTC:SSVFF) (the "Company" or "Southern Silver") reports additional assays from drilling which continues to outline extensions of mineralization on the recently acquired Puro Corazon claim and identified further thick intervals of high-grade and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00