(TheNewswire)

Edmonton, Alberta November 6, 2025 TheNewswire - Bitcoin Well Inc. (" Bitcoin Well " or the " Company ") ( TSXV: BTCW,OTC:BCNWF; OTCQB: BCNWF ), the non-custodial bitcoin business on a mission to enable independence, today announced financial and operating results for the third quarter ended September 30, 2025.

Key highlights

-

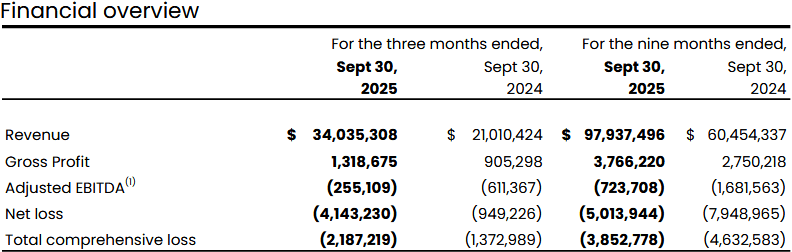

Revenue of $34.0 million for the 3-months ended September 30, 2025 (Q3 2024: $21.0 million, +62%) and $97.9 million for the 9-months ended September 30, 2025 (2024: $60.5 million, +62%).

-

Online Bitcoin Portal revenue of $17.5 million in Q3 2025 (+85%).

-

Bitcoin Well Infinite revenue of $9.4 million in Q3 2025 (+67%).

-

-

Over 57,000 unique users in the Bitcoin Portal as of September 30, 2025 (+78% from December 31, 2024 and +128% from September 30, 2024).

-

Gross profit of $1.3 million for the 3-months ended September 30, 2025 (Q3 2024: $0.9 million, +46%) and $3.8 million for the 9-months ended September 30, 2025 (2024: $2.8 million, +37%).

-

Adjusted EBITDA of negative $0.3 million for the 3-months ended September 30, 2025 (Q3 2024: negative $0.6 million, +58% improvement) and negative $0.7 million for the 9-months ended September 30, 2025 (2024: negative $1.7 million, +57% improvement).

-

Significant improvement in Adjusted EBITDA due to achieving higher revenue and gross profit.

-

-

As at September 30, 2025, held a net investment of 42.36 bitcoin in the Company's Bitcoin Treasury. Subsequent to September 30, 2025, Bitcoin Well acquired an additional 26.63 BTC to bring its total Bitcoin Treasury to 69.00 BTC as of November 5, 2025, purchased at an average purchase price of $112,477 USD / $157,897 CAD.

(1) See Non-IFRS Measures.

In Q3 2025, total revenue climbed to $34.0 million, marking a 62% increase from $21.0 million in Q3 2024. All segments experienced strong revenue growth during this period. The Online segment demonstrated the most significant growth, increasing by 85% to $17.5 million, up from $9.4 million in Q3 2024. Bitcoin Well Infinite also showed strong growth, with its revenue rising 59% to $9.4 million, compared to $5.6 million in the previous year. Additionally, ATM sales saw a 21% increase, reaching $7.2 million from $6.0 million in Q3 2024.

Revenue for the nine months ended September 30, 2024 increased to $97.9 million, compared to $60.5 million in 2024 (+62%), driven by higher transaction volumes on both the Online Bitcoin Portal and Bitcoin Well Infinite.

Gross profit increased by 46% to $1.3 million in Q3 2025 from $0.9 million in Q3 last year and to $3.8 million year-to-date in 2025 from $2.8 million last year (+37%) due to the higher revenue.

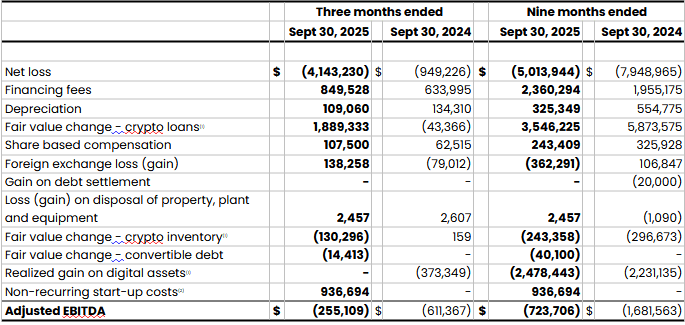

Adjusted EBITDA for Q3 2025 was negative $0.3 million, compared to negative $0.6 million in Q3 2024. The significant improvement was primarily due to higher revenue and higher gross profit. For the nine months ended September 30, 2025, Adjusted EBITDA saw a $1.0 million improvement, reaching negative $0.7 million compared to negative $1.7 million in the previous year.

The Company reported a net loss of $4.1 million and $5.0 million, respectively for the three and nine months ended September 30, 2025, an increase from the comparative periods in 2024, primarily due to unfavourable fair value changes related to cryptocurrency loans.

Additional information

This news release should be read in concert with the full disclosure documents. The Bitcoin W ell unaudited condensed consolidated interim financial statements and Management Dis cussion & Analysis for the three and nine months ended September 30, 2025 will be available on the Bitcoin Well website ( www.bitcoinwell.com ), via SEDAR+ ( www.sedarplus.ca ) or can be requested from the Company.

Closing of Debt Settlement

The Company also announces that, further to the Company's news release dated October 1, 2025, it received approval from the TSX Venture Exchange (the " TSXV ") for the issuance of 1,662,427 common shares (each, a " Share ") in settlement of C$212,599 interest owing on convertible debentures (the " Debt Settlement "), which Shares were issued on November 5, 2025.

Details of the Debt Settlement

The Company was indebted to certain creditors in the total amount of C$212,599, as of September 30, 2025 (the " Use of Coin and Debenture Interest Debt "), pursuant to certain use of bitcoin agreements and a convertible debenture agreement (collectively, the " Agreements "). The Use of Coin and Debenture Interest Debt represents interest accrued under the Agreements. Bitcoin Well settled C$98,787 by issuing 681,290 Shares at a deemed price of C$0.145 per Share, and settled C$113,812 by issuing 981,137 Shares at a deemed price of C$0.116 per Share.

The Shares issued in connection with the Debt Settlement are subject to a statutory hold period of four months and one day from the date of issuance.

Early Warning Disclosure

Terry Rhode, a director of the Company, through his wholly owned corporation, Beyond the Rhode Corp., acquired 213,201 Shares at a deemed price of C$0.145 per Share as settlement of $30,914 of debt pursuant to the Debt Settlement.

Mr. Rhode previously filed an early warning report dated December 30, 2024, at which point in time Mr. Rhode, directly and indirectly, exercised control over 15,881,000 Shares, 13,297,737 common share purchase warrants, 961,876 options and convertible debentures in the principal amount of C$5.0 million convertible into 20,313,043 Shares, representing an aggregate of 50,453,656 Shares on a partially-diluted basis and approximately 19.94% of the issued and outstanding Shares on a partially-diluted basis.

Prior to the Debt Settlement, Mr. Rhode, directly and indirectly, exercised control over 16,634,402 Shares, 13,297,737 common share purchase warrants, 961,876 options and convertible debentures in the principal amount of C$5.0 million convertible into 20,313,043 Shares, representing an aggregate of 51,207,058 Shares on a partially-diluted basis and approximately 13.36% of the issued and outstanding Shares on a partially-diluted basis.

Following closing of the Debt Settlement, Mr. Rhode, directly and indirectly, exercises control over 16,847,603 Shares, 13,297,737 common share purchase warrants, 961,876 options and convertible debentures in the principal amount of C$5.0 million convertible into 20,313,043 Shares, representing an aggregate of 51,420,529 Shares on a partially-diluted basis and approximately 13.36% of the outstanding Shares on a partially-diluted basis.

The Company has been advised that Mr. Rhode holds securities of the Company for investment purposes and does not currently have any plan to acquire or dispose of additional securities of the Company, however, may acquire or dispose of securities depending on market conditions, reformulation of plans or other relevant factors.

This news release is issued pursuant to National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues, which also requires an early warning report to be filed with the applicable securities regulators containing additional information with respect to the foregoing matters. A copy of the related early warning report will be available on the Company's issuer profile on SEDAR+ at www.sedarplus.ca and may also be obtained from the Company using the contact information provided below.

Related Party Transaction

Mr. Rhode, a director of the Company, participated in the Debt Settlement through a wholly owned corporation as detailed above. Such participation is considered to be a "related party transaction" within the meaning of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (" MI 61-101 ").

The Company relied on the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 in respect of the related party participation in the Debt Settlement as neither the fair market value (as determined under MI 61-101) of the subject matter of, nor the fair market value of the consideration for, the transaction, insofar as it will involve interested parties, exceeded 25% of the Company's market capitalization (as determined under MI 61-101).

Shares for Debt Settlement

The Company also announces that it is indebted to a vendor (the " Vendor ") in the total amount of USD $76,000 (CAD 106,536.80), as of October 31, 2025 (the " Debt "), pursuant to a sponsorship and advertising services agreement between the Company and the Vendor. The services provided by the Vendor are not considered investor relations services (as defined in the policies of the TSXV). Bitcoin Well has agreed to settle this Debt by issuing 926,406 "Shares at a deemed price of $0.115 per Share (the " Shares for Debt Transaction ").

The settlement of the Shares for Debt Transaction remains subject to the approval of the TSXV. Any Shares issued pursuant to the Shares for Debt Transaction will be subject to a statutory hold period of four months and one day from the date of issuance, in accordance with applicable securities laws.

About Bitcoin Well

Bitcoin Well is on a mission to enable independence. We do this by making bitcoin useful to everyday people to give them the convenience of modern banking and the benefits of bitcoin. We like to think of it as future-proofing money. Our existing Bitcoin ATM and Online Bitcoin Portal business units drive cash flow to help fund this mission.

Join our investor community and follow us on Nostr , , and to keep up to date with our business.

Bitcoin Well contact information

To book a virtual meeting with our Founder & CEO Adam O'Brien please use the following link: https://bitcoinwell.com/meet-adam

For additional investor & media information, please contact:

Adam O'Brien

Tel: 1 888 711 3866

Non-IFRS measures

The Company uses certain terms in this news release, such as ‘Adjusted EBITDA', which does not have a standardized or prescribed meaning under International Financial Reporting Standards (IFRS), and accordingly, these measurements may not be comparable with the calculation of similar measurements used by other companies.

Please refer to the "Non-IFRS Financial Measures" section in the Company's MD&A for applicable definitions, calculations, and rationale for use. Non-IFRS measures are provided as supplementary information by which readers may wish to consider the Company's performance, but should not be relied upon for comparative or investment purposes.

See the table below for a reconciliation of Adjusted EBITDA to net loss:

(1) Non-cash, fair value change on the revaluation of cryptocurrency loans is largely offset by revaluation changes in inventory and gains (losses) on digital assets, which are recorded in both income (if realized) and other comprehensive Income (if unrealized).

(2) Non-recurring start-up costs relate to professional and consulting fees incurred in establishing the Company's bitcoin treasury reserve.

Forward-looking information

Certain statements contained in this news release may constitute forward-looking information. Forward-looking information is often, but not always, identified by the use of words such as "anticipate", "plan", "estimate", "expect", "may", "will", "intend", "should", or the negative thereof and similar expressions. All statements herein other than statements of historical fact constitute forward-looking information including, but not limited to statements in respect of: revenue growth from the Online Bitcoin Portal and Bitcoin Well Infinite; the Shares for Debt Transaction; and Bitcoin Well's business plans, strategy and outlook.

Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information, including, but not limited to the following: economic and financial conditions, volatility in the capital or credit markets; the level of demand and financial performance of the cryptocurrency and digital asset industry, the occurrence of force majeure events; the extent to which the Company is successful in gaining new long-term users or retaining existing users; developments and changes in laws and regulations, disruptions to the Company's technology network; inability to obtain financing; competitive factors; and such other factors as discussed in the "Risks and Uncertainties" section of the Company's MD&A.

Bitcoin Well actual results could differ materially from those anticipated in this forward-looking information as a result of the foregoing risk factors and other factors, many of which are beyond the control of Bitcoin Well. Bitcoin Well believes that the expectations reflected in the forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking information should not be unduly relied upon. Any forward-looking information contained in this news release represents Bitcoin Well expectations as of the date hereof, and is subject to change after such date. Bitcoin Well disclaims any intention or obligation to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable securities legislation.

For more information, see the Note Regarding Forward Looking Statements found in the Bitcoin Well MD&A.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release .

Copyright (c) 2025 TheNewswire - All rights reserved.