July 04, 2023

Pegmatite Mapping And Sampling Re-Commenced

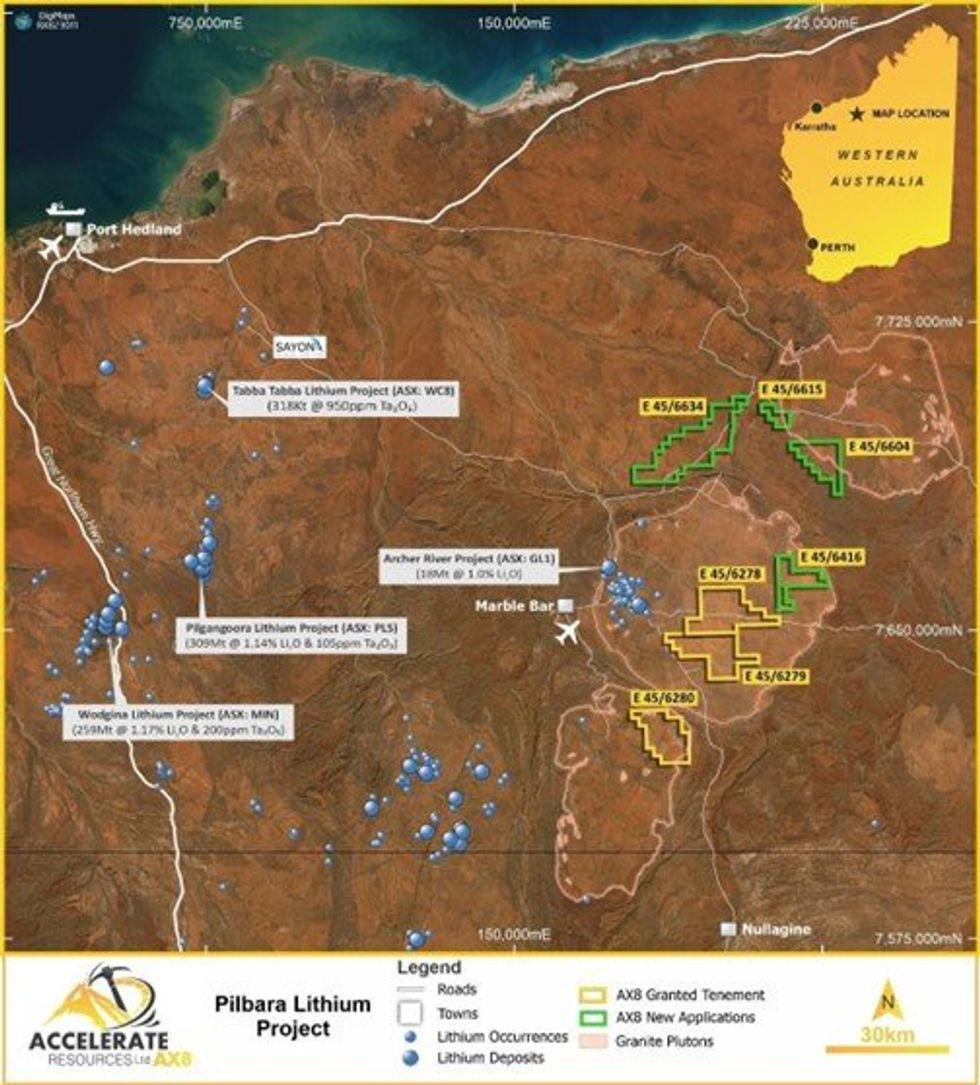

Accelerate Resources Limited (ASX: AX8) ("AX8" or the “Company") is pleased to announce the expansion of its lithium exploration project footprint in the East Pilbara region of WA, with the recent application for four new tenements (E45/6416, E45/6604, E45/6615 and E45/6634) covering an additional 395 km2 in an area proven to host lithium deposits. Two of Accelerate’s tenement applications (E45/6416 and E45/6634) are subject to competing applications by other companies, with final ownership to be decided by ballot.

- AX8 has expanded its 100%-owned East Pilbara Lithium Project adjacent to Global Lithium Resources’ (ASX:GL1) Archer deposit (18 Mt @ 1.0% LiO2), with four new tenement applications.

- AX8 now has ~800 km2 of lithium prospective tenure under application (seven licences) in WA’s Pilbara region. Two applications are subject to a ballot.

- AX8 has identified targets across the new tenements using the same exploration model applied by GL1 at the nearby Archer Deposit.

- Initial mapping and rock chip sampling of pegmatites to evaluate new targets has recently been completed with results pending.

AX8 Managing Director Yaxi Zhan commented:

"Accelerate's East Pilbara Lithium project, strategically positioned just 30 km southeast of Global Lithium Resources' (ASX:GL1) Archer deposit, holds promise for delivering positive lithium exploration results. Our recent application for four new tenement applications has expanded our exploration project area to over 800 km2, unlocking geological potential akin to the large Archer Lithium Deposit.

Utilising the same proven exploration model employed for the Archer Deposit, we have successfully identified potential lithium targets in these new areas which is an exciting development. Our initial ground-based mapping and sampling program targeting potential lithium, tin and tantalite mineralisation has been completed, and we eagerly await the imminent results in the coming weeks."

East Pilbara Lithium Project

Accelerate's East Pilbara Lithium Project (Figure1) is strategically situated within a region of active lithium exploration and discovery, encompassing the following prominent deposits: Global Lithium Resources' Archer deposit (ASX:GL1), Tabba Tabba Lithium Project (ASX:WC8), Pilgangoora Lithium Project (ASX:PLS) known for its large-scale lithium mine, and Wodgina Lithium Project (ASX:MIN), which demonstrates the significant lithium prospectivity of the area (Figure 1).

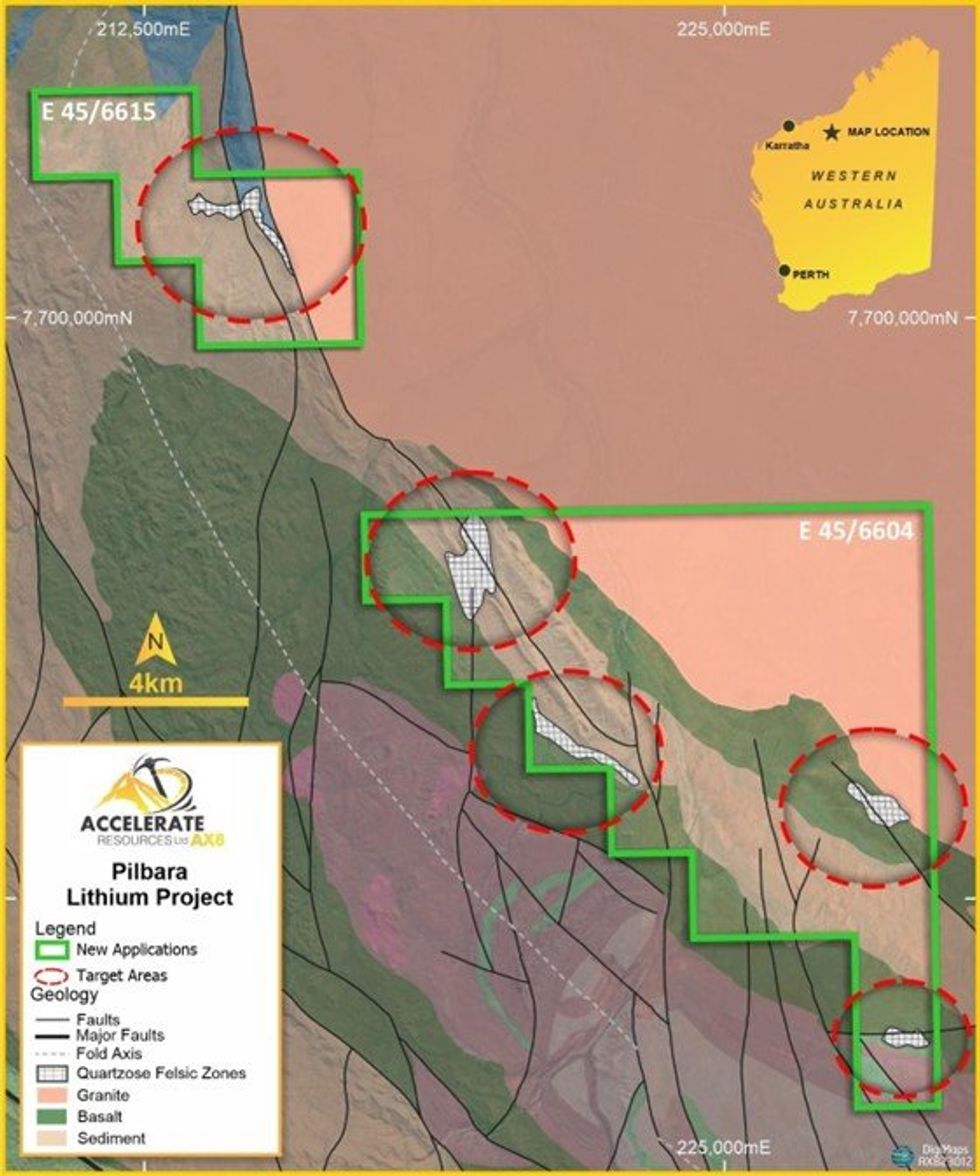

Two of the Company’s new tenement applications are located within the sedimentary-basalt rim adjacent to a large granite pluton (informally known as the Wongawobbin Pluton), which contains several granite suites (such as the Cleland Supersuite granite) located within a swarm of north oriented faults. Satellite image interpretation has identified several zones of quartzose felsic rocks that are prospective for lithium bearing pegmatites (see Figure 2).

These intrusive suites contain various granitic phases, including tonalite, monzogranite and granodiorite compositions. Within the Pilbara Craton, monzogranites are frequently associated with lithium mineralisation. For example, the Wongawobbin Pluton contains similar granite types and granite supersuites as the Moolyella Pluton, immediately east of Marble Bar, which is known for its associated Tin-Tantalum-Lithium mineralisation (Figure 3).

The Archer Lithium Deposit (ASX:GL1) is located on the western edge of the Moolyella Pluton within a rim of interleaved basalt, gneiss and granite material, which is associated with a NNE trending quartz-filled, concentric fault system. The GSWA has identified the Bishop Creek Monzogranite, which is part of the Cleland Supersuite, as being a potential lithium source for the Archer Deposit.

Accelerate’s new tenement applications cover a broadly analogous position around the Wongawobbin Pluton, similar to that of the Archer Lithium Deposit and the Moolyella Pluton (Figure 3).

Click here for the full ASX Release

This article includes content from Accelerate Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

23 January

Top 5 Canadian Mining Stocks This Week: Euro Manganese Gains 134 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Monday (January 19), Statistics Canada released the consumer price index (CPI) figures for... Keep Reading...

22 January

Manganese Market Forecast: Top Trends for Manganese in 2026

After taking a bearish turn in late 2024, manganese prices started 2025 on a flat note despite a robust demand outlook supported by growth in the electric vehicle (EV) battery segment. In the first half of 2025, the manganese market experienced mixed signals as supply dynamics shifted and demand... Keep Reading...

04 December 2025

Rubidium Could be Next Frontier for Critical Minerals Exploration, Investment

In the evolving landscape of critical minerals investing, the alkali metal rubidium is increasingly gaining attention as a potential growth opportunity. Historically under the radar compared to lithium, cobalt or rare earth elements, rubidium’s unique properties, constrained supply and emerging... Keep Reading...

12 November 2025

Spartan Metals Touts Eagle Project as Critical Minerals Supply Source to DoD

On the heels of the recent identification of a silver-rich deposit at its Eagle project in Nevada, Spartan Metals (TSXV:W) is ramping up exploration and drilling efforts toward a potential resource estimate.In a recent interview, Spartan President and CEO Brett Marsh highlighted the polymetallic... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

11h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00