June 12, 2023

Avrupa Minerals Ltd. (TSXV:AVU)(TSXV:AVU) is pleased to provide new assay results from the Sesmarias massive sulfide target area, Alvalade JV Project, Portugal. The program is a joint venture between Avrupa Minerals (“AVU” or “Company”) and Minas de Aguas Teñidas, S.A. (“Sandfire MATSA” or “MATSA”). Avrupa continues to operate the project through the JV entity PorMining Lda., and MATSA continues to fund the exploration work. Previously, through the JV, during 2020-2021, the Company drilled 17 diamond drill holes, totaling 8,900 meters, on six different fences along a strike length of 400 meters in the Sesmarias North Zone.

The JV returned to drilling at Sesmarias in mid-April, targeting the Central Zone, where Avrupa drilled the high-grade discovery hole, SES002, in 2014 (see February 27, 2014 News Release). Follow-up drilling in the immediate discovery area at that time unsuccessfully targeted shallow extensions of the mineralization seen in SES002 at a depth of about 150 meters. Armed with a significantly upgraded targeting model constructed after a total of 46 holes and nearly 20,000 meters of drilling at Sesmarias since 2014, the JV geological team aimed deeper to 400 meters depth to attempt to locate further high-grade mineralization.

Results from SES23-047 are:

- 26.95 meters of 2.18% copper; 2.58% lead; 5.60% zinc; and 88.2 g/t silver from 393.80 to 420.75 meters depth, within a wider interval of:

- 43.40 meters of 1.51% copper; 2.15% lead; 4.78% zinc; and 64.1 g/t silver from 392.80 to 436.20 meters depth.

At this time, with only one drill hole in the new zone, the true thickness of the massive sulfide mineralization is unknown. The drill hole intercepted at least part of the eastern limb of the target mineralized syncline, and possibly part of the hinge of the syncline. Further drilling is clearly necessary to search for both extension and shape of the mineral body. We are currently drilling a follow-up hole, collared approximately 150 meters southeast of SES23-047, with five more holes planned, also funded by the JV partner.

Paul W. Kuhn, President and CEO of Avrupa Minerals commented, “We are truly excited about the SES23-047 results. The entire team effort putting together a coherent targeting model led to this initial success in the Sesmarias Central Zone, which we hope will continue with follow-up drilling. Previous JV drilling demonstrated the potential for significant thicknesses of massive sulfide mineralization, and we recognized the potential for higher grade mineralization as we moved south towards the Central Zone, perhaps the center of the mineral system. We now recognize that the SES002 lens should be part of the new discovery lens, separated by faulting. Perseverance, continued creative thinking, and strong financial support led to a real success that shows possibilities for further follow-up success.”

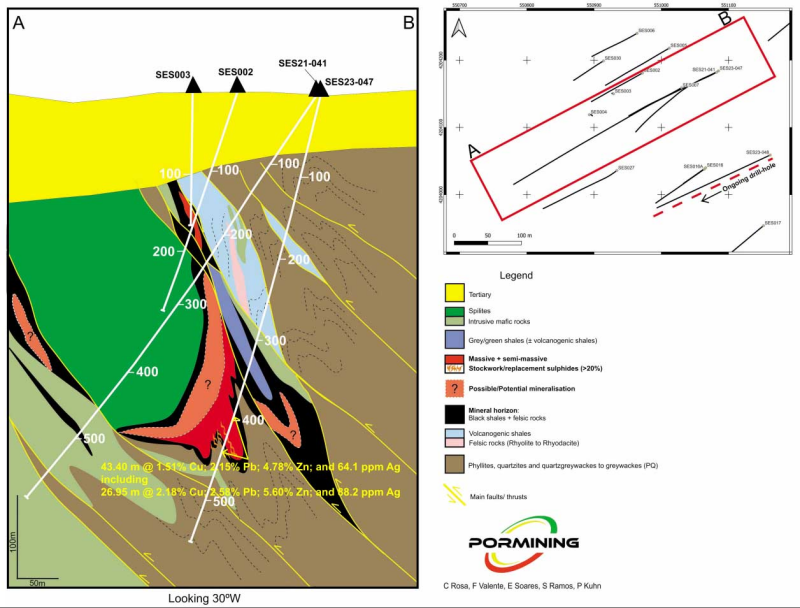

The following summary cross section demonstrates the potential for further mineralization on this section line, in the middle of the Central Zone.

Figure 1. SES23-047 cross section showing previous drilling and discovery hole SES002. The mineralized syncline seen here is a continuation from the previously-reported, more northerly sections that show development of an eastern overturned limb, a western normal limb, and development of a robust hinge zone. Further drilling is warranted to develop a potential high grade central zone to the developing system.

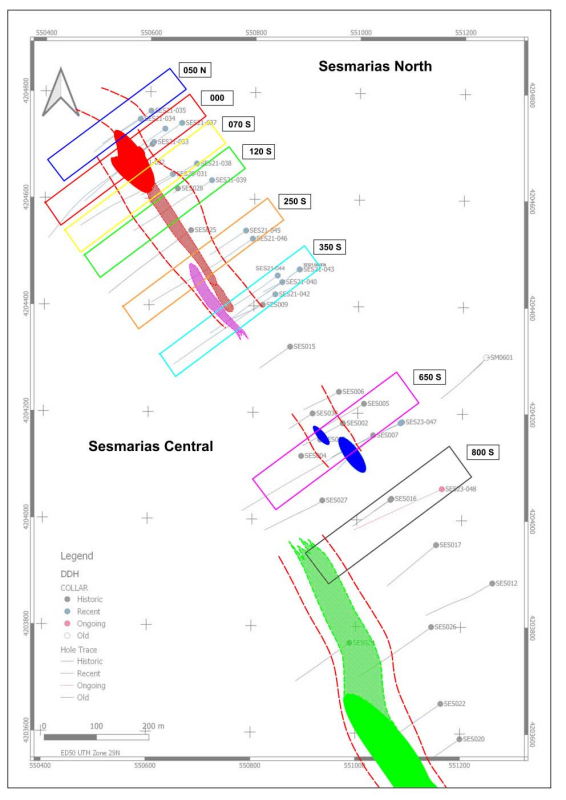

Potential for further higher-grade mineralization lies from the present 650S section to the 350S section, north of the present drilling, and possibly for another 300 to 400 meters to the south of the 650S section. We are presently drilling at SES23-048, collared approximately 150 SE of SES23-047, on the 800S section.

Figure 2. Simplified, schematic diagram of Sesmarias massive sulfide “lenses”, actually the limbs of the synclinal mineralization. Note that the Central Zone appears to be open and untested for at least 300 meters in either direction from the 650S section. Presently drilling on the 800S section line at SES23-048.

Results and information for SES21-044, Section 350S, may be found in the January 25, 2022 News Release. Results and information for SES026, located approximately 350 meters SE of SES23-047 on the 1000S section, may be found in the March 11, 2019 News Release.

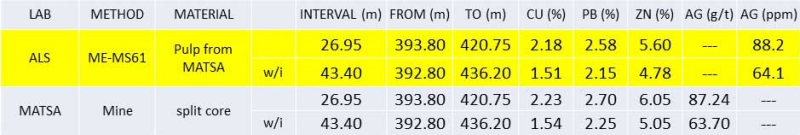

Notes on analytical methods and quality control. The JV analyzed the mineralized material at two different laboratories, as the table below demonstrates. For certified, NI43-101 – acceptable assay results, we selected the ME-MS61 method performed by ALS Global at their Seville sample preparation facility and Loughrea, Ireland analytical laboratory. For in-house reasons and desire to have overnight results, we authorized preliminary analytical procedures at the non-certified, MATSA laboratory facilities at the Aguas Teñidas Mine.

Table 1. Fully accredited, NI 43-101 compliant, certified analytical results from ALS Global laboratory highlighted in yellow. Overnight analytical results from MATSA mine lab at Aguas Teñidas, Spain.

For technical reasons, at the depth of the Sesmarias mineral intersection, drillers had reduced core size to NQ (47.6 mm diameter). Project personnel collected oriented drill core twice daily from the drill rig and delivered the boxes directly to the Project core storage facilities in Grândola, Portugal. Here, after geological and geotechnical review of the core, a Project geologist measured and marked the core for sampling, with sample length averaging one meter depending on visual factors such as change in texture, style of mineralization, and/or host rock type. Project employees systematically and methodically halved the core, utilizing an electric core saw, and then placed one half of the split material for each sample length into separate, numbered, plastic sample bags. In order to get fast, first-hand results, Project personnel transported the core samples to partner Sandfire MATSA’s Aguas Teñidas Mine laboratory in Almonaster la Real, Spain for preliminary, non-certified analytical information.

After acquiring the preliminary results, Project personnel carried the sample pulps (-80 mesh material used for metals’ digestion) to the ALS Global (“ALS”) sample preparation facility in Seville, Spain. ALS directly shipped the pulp material to their main European analytical laboratory located in Loughrea, Ireland. At the analytical laboratory, we requested the samples to be analyzed via the lab’s ME-MS61 technique which uses a four-acid, near-total metals’ extraction method, followed by analysis using the industry-standard technique of inductively coupled plasma – atomic emission spectroscopy (ICP-AES).

At all times, prior to submission of the samples to ALS Global, Project or Sandfire MATSA personnel maintained supervision, oversight, and custody of the samples.

In addition to ALS Global in-house quality assurance/quality control (QA/QC) for all work orders, the Project conducted its own normal, internal QA/QC from results generated by the systematic inclusion of certified reference materials, blank samples and field duplicate samples. Project personnel reviewed and evaluated the analytical results from the quality control samples in the SES23-047 work orders, and confirmed that these results conform to industry best practice standards.

Minas de Aguas Teñidas, S.A. (Sandfire MATSA) is a modern mining company which owns and operates the MATSA Mining Operations in the Huelva province of Spain. With a processing plant located to the north of the Iberian Pyrite Belt that sources ore from three underground mines, Aguas Teñidas and Magdalena Mines in Almonaster la Real and the Sotiel Mine in Calañas, Sandfire MATSA produces copper, zinc and lead mineral concentrates that are sold from the port of Huelva. Sandfire MATSA also holds an extensive portfolio of exploration tenements in both Portugal and Spain. Sandfire MATSA is a wholly owned company of Sandfire Resources Ltd, a mining and exploration company listed on the Australian Securities Exchange (ASX: SFR).

Avrupa Minerals Ltd. is a growth-oriented junior exploration and development company directed to discovery of mineral deposits, using a hybrid prospect generator business model. The Company holds one 100%-owned license in Portugal, the Alvalade VMS Project, presently optioned to Sandfire MATSA in an earn-in joint venture agreement. The Company now holds one 100%-owned exploration license covering the Slivova gold prospect in Kosovo, and is actively advancing four prospects in central Finland through its in-process acquisition of Akkerman Finland Oy. Avrupa focuses its project generation work in politically stable and prospective regions of Europe, presently including Portugal, Finland, and Kosovo. The Company continues to seek and develop other opportunities around Europe.

For additional information, contact Avrupa Minerals Ltd. at 1-604-687-3520 or visit our website at www.avrupaminerals.com.

On behalf of the Board,

Paul W. Kuhn, President & Director

This news release was prepared by Company management, who take full responsibility for its content. Paul W. Kuhn, President and CEO of Avrupa Minerals, a Licensed Professional Geologist and a Registered Member of the Society of Mining Engineers, is a Qualified Person as defined by National Instrument 43-101 of the Canadian Securities Administrators. He has reviewed the technical disclosure in this release. Mr. Kuhn, the QP, has not only reviewed, but prepared and supervised the preparation or approval of the scientific and technical content in the news release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Click here to connect with Avrupa Minerals Ltd. (TSXV:AVU) to receive an Investor Presentation

AVU:CA

The Conversation (0)

24 May 2023

Avrupa Minerals

European Prospect Generation

European Prospect Generation Keep Reading...

3h

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

8h

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

19h

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

19h

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00