June 12, 2025

Camp opening and logistics have commenced with geophysics and drilling to follow in the coming weeks

Aston Bay Holdings Ltd. (TSXV:BAY)(OTCQB:ATBHF) ("Aston Bay" or the "Company") is pleased to announce the commencement of activities at the Storm Copper Project ("Storm" or the "Project") on Somerset Island, Nunavut. American West Metals Limited ("American West"), the Project operator, is conducting the exploration program. Aston Bay and American West have formed a 20/80 unincorporated joint venture with respect to the Storm Project property, with Aston Bay maintaining a free carried interest until a decision to mine is made upon completion of a bankable feasibility study.

Highlights:

- The 2025 drill program is set to begin. A pipeline of large-scale exploration targets prioritized for drilling includes:

- Cirrus Deeps - high-priority EM target below the Cirrus Deposit with a stratigraphic setting similar to Cyclone will be the first target to be tested with diamond drilling

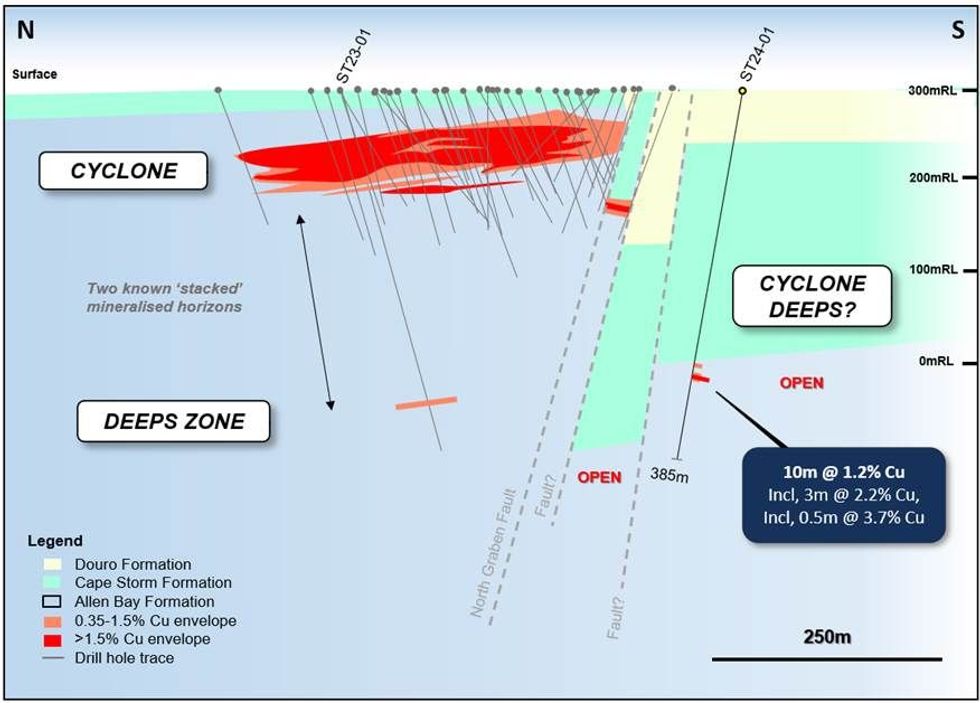

- Cyclone Deeps - potential continuation of the large Cyclone Deposit at depth with reconnaissance drill intercepts such as 10 metres ("m") @ 1.2% copper ("Cu") from 311m (including 0.5m @ 3.7% Cu from 315.5m), ready for follow-up with diamond drilling

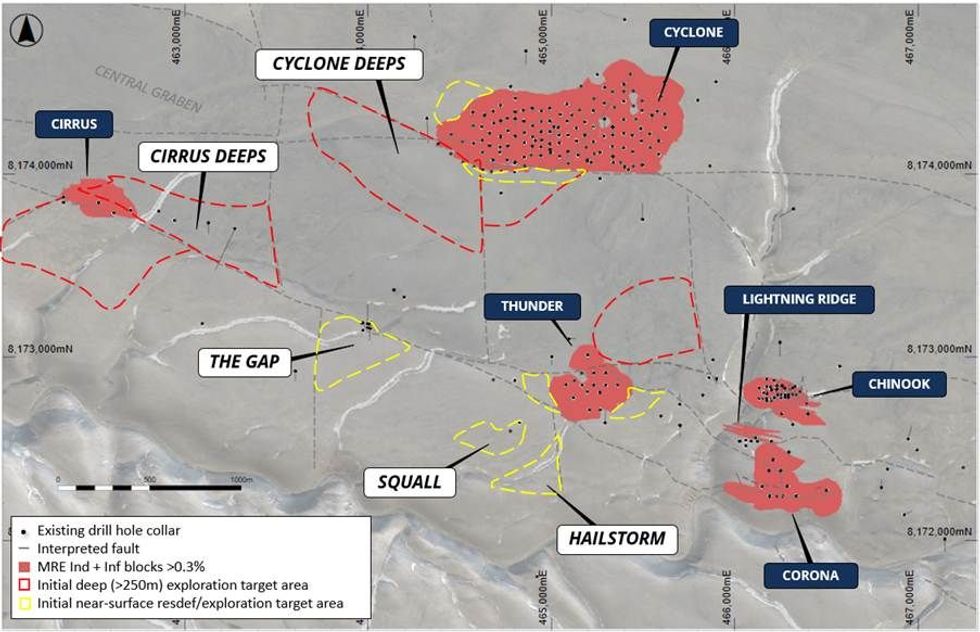

- Resource Expansion - several discoveries near the footprint of the Mineral Resource Estimate ("MRE") will be followed up, including the Gap Prospect, which contains a strong EM anomaly confirmed with drilling that returned 20m @ 2.3% Cu from 28m, and the Squall and Hailstorm Prospects

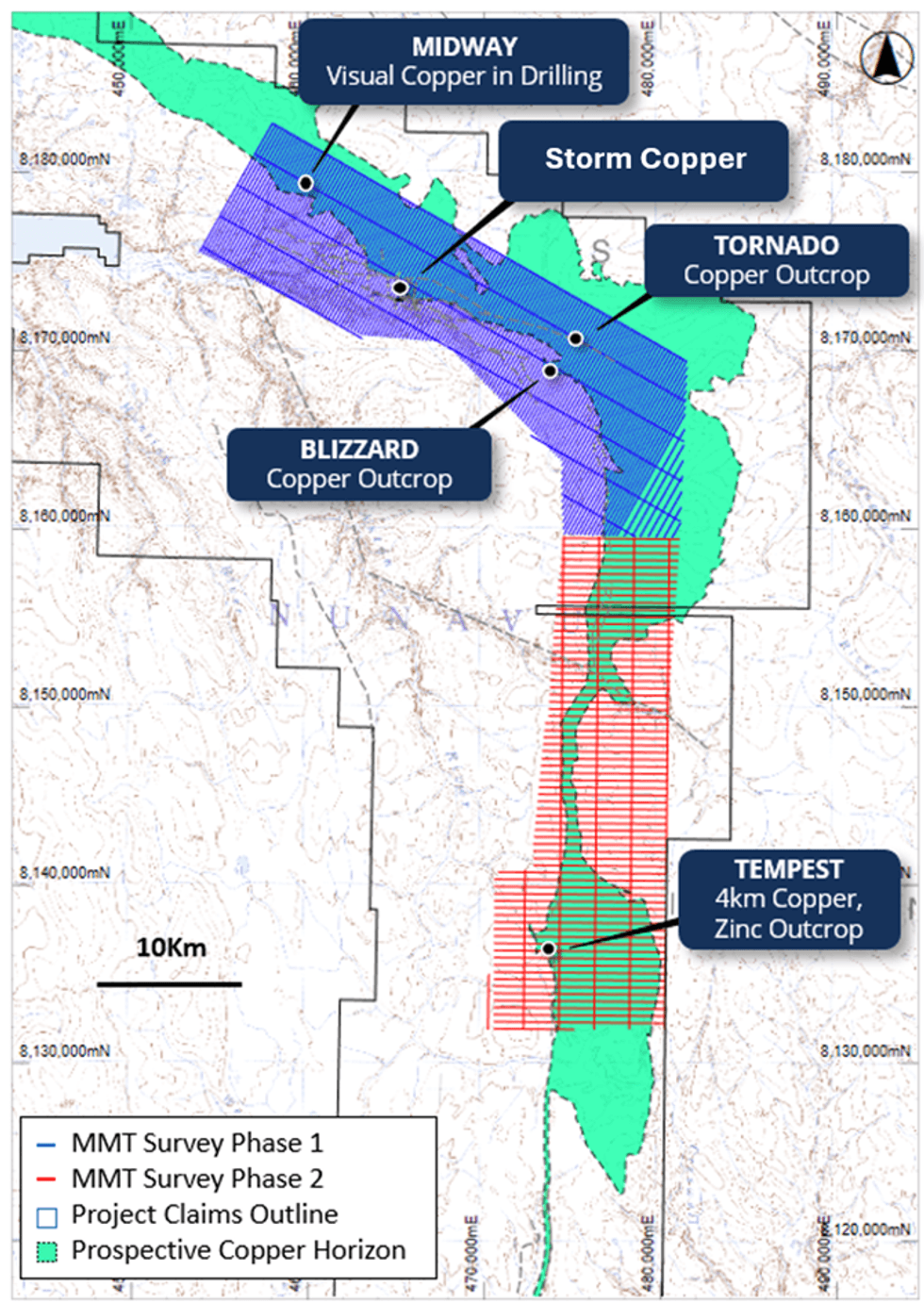

- Tornado/Blizzard - located 5km east of the Storm copper deposits, the area hosts a 3.2km x 1.5km geochemical copper anomaly and two large electromagnetic ("EM") plates yet to be drilled

- Midway - discovered by a single historical drill hole that intersected a total of 58m of visual copper sulfide, located approximately 5km to the west of the Storm MRE area, to be drilled

- Geophysics to generate new targets. An extensive airborne Mobile Magneto-Telluric ("MobileMT") survey is planned early in the season for the Storm MRE area and other areas of interest along the 110km prospective copper horizon, with results expected to inform drill targeting and prioritization this season.

Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Laboratory assays are required to determine the presence and grade of any contained mineralization within the reported visual intersections of copper sulfides. Portable XRF is used as an aid in the determination of mineral type and abundance during the geological logging process.

Thomas Ullrich, Chief Executive Officer of Aston Bay, commented:

"We are excited to begin another field season at Storm. The reverse circulation drill rig will work on adding to the resource and target near-surface exploration targets, while the diamond drill rig will focus on the deeper exploratory holes.

"In addition to the compelling targets generated in previous geophysical programs, we are very excited to be flying a comprehensive MobileMT survey at Storm. This is the same survey that has successfully delineated large conductive targets at our Epworth property. The significant contrast in the conductive properties of the mineralized rock versus the host rock at Storm is ideal for MobileMT, and its utilization of natural-source energy from within the Earth should help define deeper targets that may have eluded previous methods. These new targets will be ready for drilling this season.

"Investors can also look forward to the completion of a Preliminary Economic Analysis for the near-surface mineralization at Storm, currently underway. We are also working up drill targets for our Epworth copper project, also in Nunavut, for a potential late-season drill program."

INITIAL DIAMOND DRILL PLAN

The first diamond drill targets to be tested in the Storm MRE area are Cirrus Deeps and Cyclone Deeps (Figure 2). The drilling aims to follow up earlier intersections of high-grade copper mineralization and build evidence for the large-scale copper potential at depth, which could rapidly expand the copper endowment within the Storm MRE area.

Subsequent diamond drilling will continue to test high-priority geophysical anomalies and regional exploration targets. These will include the Tornado, Blizzard, Midway areas and any new targets defined by the upcoming MMT survey.

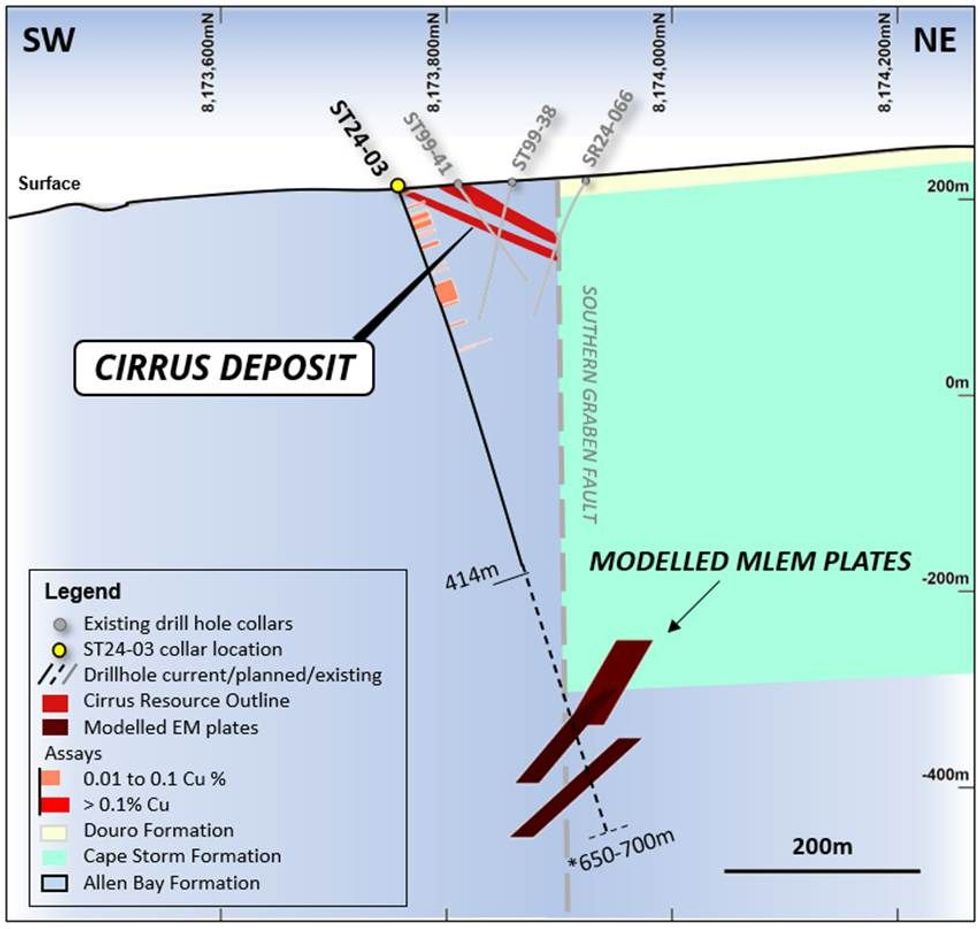

Cirrus Deeps

Diamond drill hole ST24-03 was designed to target a 1,300m x 500m MLEM anomaly (Figure 3 & 5) which is bounded by a series of large EM plates (approximately 350m to top, conductance ~40-60 siemens, moderate ~40-60° S/SW dip, striking ~WNW-ESE) at its northern edge. The EM anomalies are located below the Cirrus Deposit and the Gap high-grade copper prospect, and are interpreted to be proximal to the Southern Graben Fault.

This location in the Allen Bay Formation immediately below the Cape Storm Formation is the same stratigraphic location as Cyclone. In addition to the potential for flat-lying stratigraphic mineralization like Cyclone, the target is located along a fault zone similar to the well-mineralized Chinook Deposit. These anomalies may indicate a considerable, connected accumulation of copper within the Central Graben area. Similar EM targets drilled elsewhere in the Storm copper belt have been confirmed as high-grade copper mineralization.

ST24-03 has currently been drilled to a downhole depth of 414m (planned depth of 600-700m) and intersected several zones of fracturing and sporadic copper sulfides (Figure 3) in the upper portion of the hole, with increased fracturing at depth. Fracturing and voids in the rock are positive indications since permeability and open spaces are required for efficient mineralization in the sediment hosted copper model.

The drill hole will be the first diamond hole completed in the 2025 drill program.

Cyclone Deeps

High-grade copper mineralization has been discovered at depth, offset to the south of the Cyclone Deposit (Figure 4). The Cyclone Deeps intersection of 10m @ 1.2% Cu (drill hole ST24-01) displays a typical sediment hosted copper mineralogical profile with a high-grade core of native copper and chalcocite (including 3m @ 2.2% Cu) with peripheral chalcopyrite and other less copper-rich sulfide minerals.

The copper mineralization is hosted near the top of a thick sequence of fractured dolomudstone of the Allen Bay Formation. The Allen Bay is the main host of the known copper mineralization within the Storm area, and the stratigraphic position near the top of the formation also hosts Cyclone, the largest deposit discovered to date. This mineralization may represent the offset southern portion of the faulted Cyclone Deposit and presents an exceptional opportunity to add significant volume to the current resources. This prospective horizon extends for over 5km in the immediate Storm area.

INITIAL REVERSE CIRCULATION DRILL PLAN

Reverse Circulation ("RC") drilling will be used to test near-surface (<250m depth) resource upgrade, resource expansion, and exploration targets.

The first phase of drilling will commence at the Thunder, Lightning Ridge, and Corona Deposits before moving on to The Gap, Squall and Hailstorm Prospects (Figure 2). All of these opportunities have the potential to add significant mineral resources to the Storm Project, with high-grade mineralization similar to the known deposits already discovered.

Subsequent RC drilling will aim to test other nearby and regional exploration targets, which include the Tornado and Blizzard areas, and numerous untested geochemical, Electromagnetic (EM) and Induced Polarization (IP) anomalies.

The Gap Prospect is a 500m-long zone located between the Corona and Cirrus Copper Deposits (Figure 2), where multiple drill holes have intersected high-grade copper sulfides (including 1.5m @ 4.4% Cu, 9.8g/t Ag from 39m, and 2m @ 2.5% Cu from 74m downhole in AB18-09, and 20m @ 2.3% Cu, 3.3g/t Ag (Including 8m @ 5.3% Cu, 6.4g/t Ag) from 28m in SR24-003.

The Squall and Hailstorm Prospects are located immediately south of the southern graben fault and collectively extend 1.8km northwest along strike of the Corona Deposit (see Figure 2).

Drilling at Squall during the 2024 season intercepted 1.5m @ 2.36% Cu, 5.0g/t Ag from 181.4m (SR24-108) at the end of the hole, whilst surface geochemistry at Hailstorm has identified a 250m x 250m copper anomaly that remains open to the south (Figure 5).

Mobile Magneto-Telluric (MobileMT) Survey

A regional-scale MobileMT survey is planned to cover the Storm and wider exploration areas during the 2025 program (Figure 6). MMT utilizes natural source energy to capture a broader range of EM frequencies than the techniques used at Storm to date. The survey is designed to show a greater contrast between the host rocks and potential accumulations of conductive material (i.e. metalliferous sulfide) with improved spatial and depth resolution. This is potentially very useful in delineating deeper (>200m) occurrences of copper sulfide at Storm, where the resistive host rocks cause a decreased signal-to-noise ratio and decreased confidence in interpretation with depth in the historical geophysics.

The initial MobileMT survey will be completed over the Midway-Storm-Tornado area as an orientation survey to determine the response of the known deposits before extending the survey into more regional areas. The survey will begin in the coming week, allowing results to inform drill targeting and prioritization this season.

FORWARD PROGRAM

- MobileMT geophysical survey to commence imminently, with results expected to inform targeting for exploratory drilling this season.

- RC drilling to commence in the Storm area, testing high-priority geophysical and resource upgrade and definition targets.

- Diamond drilling to commence in the Storm area, following up on deep, high-priority copper targets and EM anomalies.

- Unsampled historical diamond drill holes with visual copper sulfides at the Tornado and Midway Prospects will be sampled immediately to expedite transport to the laboratory for assaying.

- Planning is complete, and preparations are underway for a broad range of environmental monitoring and survey activities during 2025.

- PEA and PFS activities, including permitting, processing, and mining studies, are continuing.

Qualified Person

Michael Dufresne, M.Sc., P.Geol., P.Geo., is a Qualified Person as defined by the NI 43-101 Standards of Disclosure for Mineral Projects and has reviewed and approved the scientific and technical information in this press release.

QA/QC Protocols

The analytical work reported herein was performed by ALS Global ("ALS"), Vancouver Canada. ALS is an ISO-IEC 17025:2017 and ISO 9001:2015 accredited geoanalytical laboratory and is independent of Aston Bay Holdings Ltd., American West Metals Limited, and the QP. Drill core samples were subject to crushing at a minimum of 70% passing 2 mm, followed by pulverizing of a 250-gram split to 85% passing 75 microns. Samples were subject to 33 element geochemistry by four-acid digestion and inductively coupled plasma atomic emission spectroscopy (ICP-AES) to determine concentrations of copper, silver, lead, zinc, and other elements (ALS Method ME-ICP61a). Overlimit values for copper (>10%) and were analyzed via four-acid digestion and ICP-AES (ALS Method Cu-OG62).

Aston Bay Holdings Ltd. and American West Metals Limited followed industry standard procedures for the work carried out on the Storm Project, incorporating a quality assurance/quality control (QA/QC) program. Blank, duplicate, and standard samples were inserted into the sample sequence and sent to the laboratory for analysis. No significant QA/QC issues were detected during review of the data. Aston Bay Holdings Ltd. and American West Metals Limited are not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

About Aston Bay Holdings

Aston Bay is a publicly traded mineral exploration company exploring for high-grade critical and precious metal deposits in North America.

The Company is currently exploring the Storm Copper Property and Cu-Ag-Zn-Co Epworth Property in Nunavut. The Company is also in advanced stages of negotiation on other lands with high-grade precious and critical metals potential in North America

The Company and its joint venture partners, American West Metals Limited and its wholly-owned subsidiary, Tornado Metals Ltd. (collectively, "American West"), have formed a 20/80 unincorporated joint venture in respect of the Storm Project property, which hosts the Storm Copper Project and the Seal Zinc Deposit. Under the unincorporated joint venture, Aston Bay shall have a free carried interest until American West has made a decision to mine upon completion of a bankable feasibility study, meaning American West will be solely responsible for funding the joint venture until such decision is made. After such decision is made, Aston Bay will be diluted in the event it does not elect to contribute its proportionate share and its interest in the Storm Project property will be converted into a 2% net smelter returns royalty if its interest is diluted to below 10%.

FORWARD-LOOKING STATEMENTS

Statements made in this news release, including those regarding entering into the joint venture and each party's interest in the Project pursuant to the agreement in respect of the joint venture, management objectives, forecasts, estimates, expectations, or predictions of the future may constitute "forward-looking statement", which can be identified by the use of conditional or future tenses or by the use of such verbs as "believe", "expect", "may", "will", "should", "estimate", "anticipate", "project", "plan", and words of similar import, including variations thereof and negative forms. This press release contains forward-looking statements that reflect, as of the date of this press release, Aston Bay's expectations, estimates and projections about its operations, the mining industry and the economic environment in which it operates. Statements in this press release that are not supported by historical fact are forward-looking statements, meaning they involve risk, uncertainty and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Although Aston Bay believes that the assumptions inherent in the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which apply only at the time of writing of this press release. Aston Bay disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by securities legislation.

Neither TSX Venture Exchange nor its regulation services provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

For more information contact:

Thomas Ullrich, Chief Executive Officer

thomas.ullrich@astonbayholdings.com

(416) 456-3516

Sofia Harquail, IR and Corporate Development

sofia.harquail@astonbayholdings.com

(647) 821-1337

BAY:CC

Sign up to get your FREE

Aston Bay Holdings Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 June 2022

Aston Bay Holdings

Aston Bay Holdings Ltd is an exploration-stage company. It is engaged in the exploration and development of gold and base metal deposits in Virginia, USA and Nunavut, Canada.

Aston Bay Holdings Ltd is an exploration-stage company. It is engaged in the exploration and development of gold and base metal deposits in Virginia, USA and Nunavut, Canada. Keep Reading...

10 February

Nine Mile Metals Intersects 44 Meters of Copper Mineralization and Provides Drill Program Update

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to provide the details of drill hole WD-25-05 in addition to a summary of the 2025 drill program completed in December at the Wedge Project.Drillhole WD-25-05:DDH WD-25-05 collared... Keep Reading...

09 February

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

Latest News

Sign up to get your FREE

Aston Bay Holdings Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00