January 29, 2025

American Rare Earths (ASX: ARR | OTCQX: ARRNF | ADR: AMRRY) ("ARR" or "the Company") is pleased to provide an overview of its quarterly activities for the period ending 31 December 2024. This review highlights the key achievements and ongoing activities that are shaping the Company’s future development. The Company continued its upward trajectory in the fourth quarter of 2024, advancing its Halleck Creek Project. With new partnerships, facility developments, and robust drilling results, ARR is poised to solidify its role as a cornerstone of the U.S. critical minerals supply chain.

Highlights

- Strategic Collaboration with BMO Capital Markets: The engagement of BMO Capital Markets as a financial advisor is a critical milestone in ARR’s strategy to accelerate the development of Halleck Creek by securing strategic investments and partnerships

- High-Grade Drilling Results: The Cowboy State Mine at the Halleck Creek Project yielded some of the highest- grade Total Rare Earth Oxide (TREO) results to date, including:

- 148.0m @ 4,451 ppm TREO (max 6,198 ppm TREO)

- Strategic Facility Secured: ARR’s subsidiary, Wyoming Rare USA Inc., secured a key facility at the Western Research Institute in Wyoming. This facility will centralise operations, house core samples, and serve as the future site for a pilot plant

- $7.1 Million State Grant: ARR received the first reimbursement of over A$450,000 from the Wyoming Energy Authority to support ongoing initiatives

Strategic Engagement

ARR engaged BMO Capital Markets, a global leader in metals and mining financial advisory, to accelerate the development of its Halleck Creek Project in Wyoming. BMO will assist ARR and its U.S. subsidiary, Wyoming Rare USA Inc., in securing strategic investments, partnerships, joint ventures, and offtake agreements to position Halleck Creek as a cornerstone of the U.S. critical minerals supply chain. This move aligns with growing U.S. bipartisan support for onshoring critical minerals and Wyoming’s economic goals. With support from the Wyoming Energy Authority and a Letter of Interest from the U.S. Export-Import Bank, ARR aims to capitalise on favourable market dynamics and establish long-term shareholder value while contributing to the national agenda for a secure, domestic rare earth supply chain.

Drilling Operations

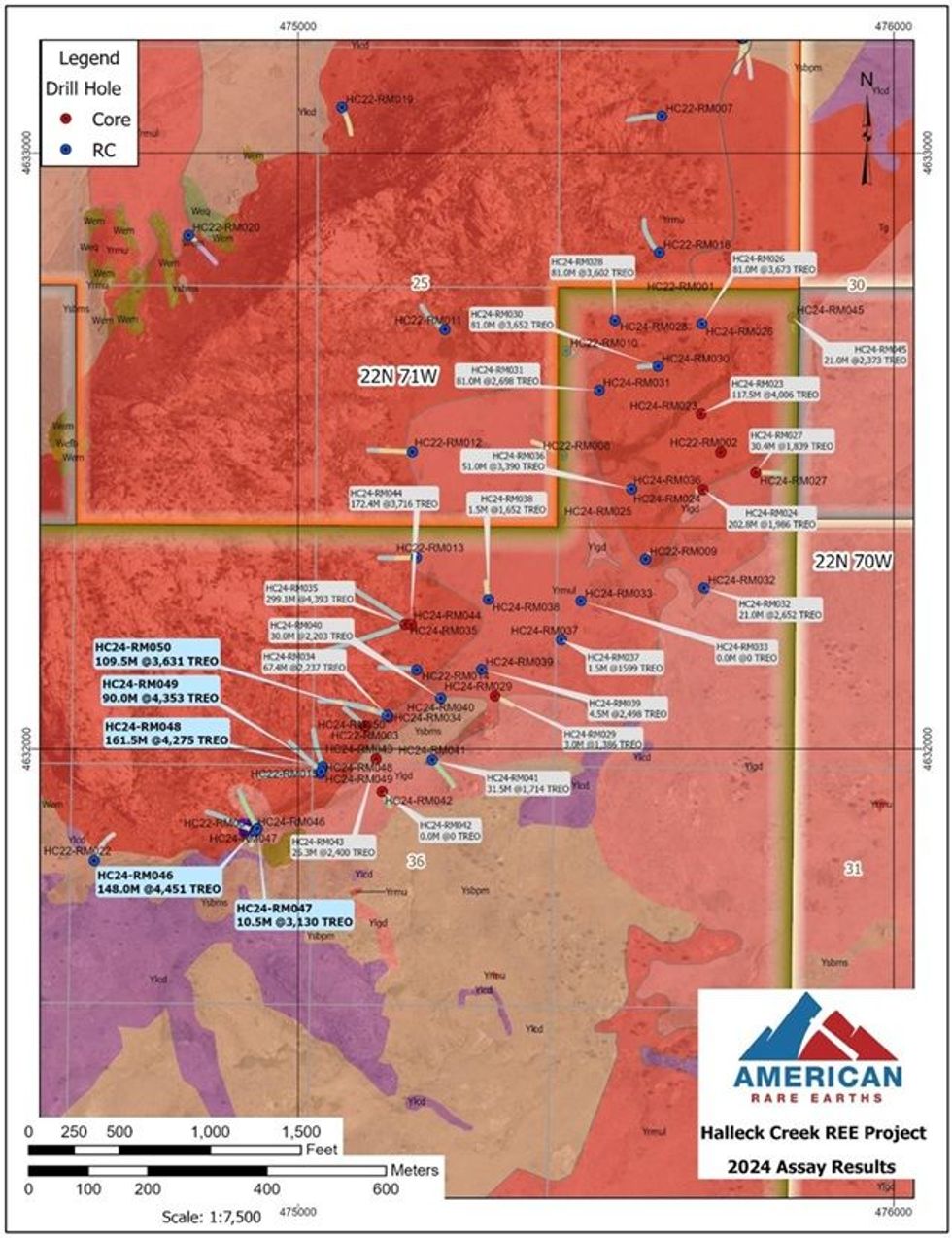

ARR announced on 27 November final assay results from its 2024 drilling campaign at the Cowboy State Mine (CSM) within the Halleck Creek Project, Wyoming. These results highlight some of the highest-grade Total Rare Earth Oxide (TREO) intersections recorded in the region, confirming the project’s potential as a leading North American rare earth resource.

Key Highlights:

- High-Grade Intersections:

- HC24-RM046: 148.0 m @ 4,451 ppm TREO, including 52.5 m @ 5,273 ppm TREO (maximum 6,198 ppm TREO)

- HC24-RM048: 161.5 m @ 4,275 ppm TREO, including 40.5 m @ 5,287 ppm TREO (maximum 5,869 ppm TREO)

- HC24-RM049: 90.0 m @ 4,353 ppm TREO, including 16.5 m @ 5,313 ppm TREO (maximum 6,049 ppm TREO)

Drilling results demonstrate extensive high-grade zones, which will support updated geological models and resource estimates, crucial for advancing the project’s development.

These results emphasise the project’s potential to become a flagship rare earth resource for North America, aligning with the U.S. government’s strategic push to secure domestic critical mineral supply chains for defence and energy transition needs.

2024 Drill Hole Locations and Assay Summaries

With geological maps updated and Odessa Resources Ltd refining resource estimates, ARR announced an updated resource estimate on 29 January 2025 is and progressing a Pre-Feasibility Study (PFS), while engaging with strategic partners to unlock the project’s value.

Facility to Support Halleck Creek Project

Wyoming Rare (USA) Inc. secured a facility at the Western Research Institute in Laramie, Wyoming, marking a major step forward for the Halleck Creek Rare Earths Project. The facility will centralise operations by housing all drill core and assay samples and will also accommodate the construction of a pilot plant to advance rare earth processing capabilities. This partnership with the Western Research Institute, a renowned non-profit organisation specialising in energy systems and materials research, enables collaboration to enhance critical mineral development. The move aligns with Wyoming’s strategic goal of becoming a leader in rare earth element development while supporting the onshoring of critical mineral supply chains for the USA.

Wyoming Grant

The Company has received its first reimbursement of over A$450,000 from the Wyoming Energy Authority (WEA) grant, marking progress in developing the Cowboy State Mine at Halleck Creek. Part of a larger A$10.7 million (US$7.1 million) grant awarded in June 2024, the funds will support exploration drilling, environmental studies, and prefeasibility assessments, helping de-risk the project and achieve the Company’s 2025 goals. This milestone underscores ARR’s commitment to advancing the project and collaborating with the WEA to support Wyoming's energy strategy.

Corporate

After many years of service to the Company farewelled Geoff Hill, a founding shareholder and long-standing member of the Board. ARR thanks Geoff for his exceptional leadership and strategic insights, which have significantly contributed to the Company’s growth and strengthened its position in the rare earths sector. His dedication and guidance leave a lasting legacy, providing a strong foundation for ARR’s future success.

The Company welcomed Mr. Hugh Keller to the Board as a Non-Executive Director, bringing extensive experience from his 34-year legal career at Dawson Waldron (now Ashurst) and various leadership roles across ASX-listed companies, private investment firms, and charities. Currently serving as a Non-Executive Director and Audit Committee Chairman for Cobalt Blue Holdings Limited, Hugh adds expertise in commercial contracts, audit procedures, and team leadership to the Board.

CEO, Chris Gibbs, was appointed as a Non-Executive Director on the Board of Godolphin Resources Limited (ASX: GRL). This appointment aligns with ARR’s increased investment in Godolphin, raising its shareholding to 19.82%, supported by a contribution of up to $510,000 to advance key projects, including the Lewis Ponds Gold and Base Metals Project and the Narraburra Rare Earths Project in New South Wales.

Melissa Sanderson has been appointed Co-Chair of the Critical Minerals Institute (CMI), a global organisation addressing challenges in the minerals sector. This role underscores her expertise in sustainable development and policy advocacy, aligning with ARR's mission to establish a secure North American rare earth elements (REE) supply chain. Mel’s extensive experience in geopolitics and ESG strategies further strengthens ARR’s leadership in advancing a sustainable and ethically sourced REE supply chain.

The Company’s Annual General Meeting was held on November 28, 2024.

Click here for the full ASX Release

This article includes content from American Rare Earths Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

American Rare Earths Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

12 February 2025

American Rare Earths Limited

Advancing one of the largest REE deposits in North America

Advancing one of the largest REE deposits in North America Keep Reading...

17h

Application to Trade on OTCQB Market

Altona Rare Earths plc (LSE: REE), the critical raw materials exploration and development company focused on Africa, is pleased to announce that it has applied for its ordinary shares to be admitted to trading on the OTCQB Venture Market in the United States ( "OTCQB").The Company has submitted... Keep Reading...

21h

Brazil, India Ink Rare Earths Pact to Expand Supply Chain Cooperation

Brazil and India have signed a new agreement to deepen cooperation on rare earths and critical minerals as both countries seek to strengthen supply chains and reduce reliance on trading partners.The non-binding memorandum of understanding, sealed on February 21 during Brazilian President Luiz... Keep Reading...

22 February

LKY Commences Diamond Drilling at Desert Antimony Mine

Locksley Resources (LKY:AU) has announced LKY Commences Diamond Drilling at Desert Antimony MineDownload the PDF here. Keep Reading...

20 February

Cellulose Breakthrough Could Simplify Rare Earths Separation

A team of researchers at Penn State have developed a plant-based nanomaterial capable of selectively extracting dysprosium from rare earth mixtures, according to a recent report.The findings published in the study detail how the team engineered a modified form of cellulose capable of isolating... Keep Reading...

Latest News

Sign up to get your FREE

American Rare Earths Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00