December 17, 2024

Alvopetro Energy Ltd. (TSXV: ALV) (OTCQX: ALVOF) announces November 2024 sales volumes, an update to our long-term natural gas sales agreement, and our Q4 2024 dividend.

President & CEO, Corey C. Ruttan commented:

"In 2024 we increased our productive capacity at Caburé and, with our recent success at Murucututu, this has allowed us to commit to a higher level of base committed firm sales volumes starting in 2025 further strengthening our disciplined capital allocation model, balancing returns to stakeholders and organic growth."

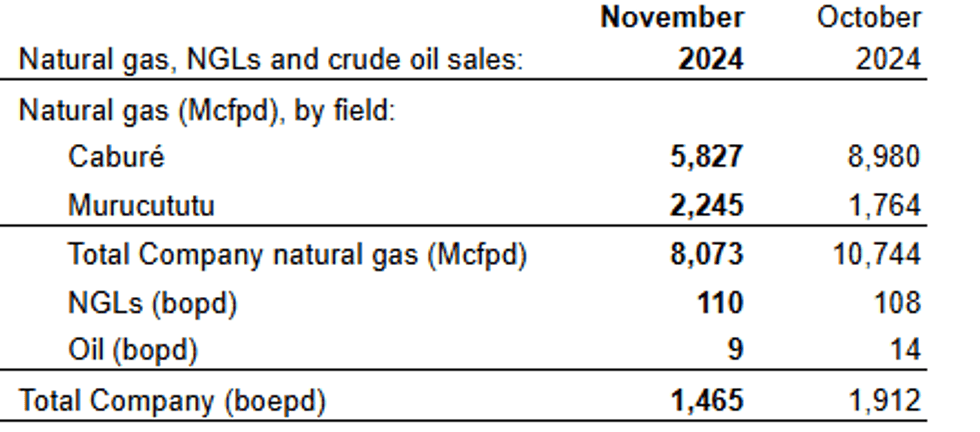

November Sales Volumes

November sales volumes averaged 1,465 boepd including natural gas sales of 8.1 MMcfpd, associated natural gas liquids sales from condensate of 110 bopd and oil sales of 9 bopd, based on field estimates. Our November sales were impacted by reduced demand in the state of Bahia resulting mainly from facility turnarounds. During this period Alvopetro also shut in all production for a 2-day period to complete mandatory turnaround and inspection works at all facilities. Based on field estimates, natural gas sales volumes to-date in December have averaged 11.6 MMcfpd.

Our Murucututu sales volumes accounted for 28% of November natural gas sales. Murucututu production in November was entirely from our 183-A3 well which was being prioritized and continues to perform well above expectations.

Bahiagas Sales Agreement Update

Alvopetro and Bahiagás have agreed to update our long-term gas sales agreement to increase Alvopetro's share of Bahiagas' supply and better align the contract with prevailing market conditions, highlighted as follows:

- Increasing Alvopetro's contracted firm volumes starting January 1, 2025 by 33% up to 400 e3m3/d(1).

- Adjusted the natural gas pricing model to be recalculated quarterly and to be a function of Brent oil equivalent prices and Henry Hub natural gas prices resulting in quicker adjustments for commodity price and foreign exchange rate fluctuations.

- Removed the contractual floor and ceiling provisions.

- Enhanced supply failure penalty mechanisms to reduce Alvopetro's exposure in the event of any supply failures.

- Retained existing take or pay provisions requiring Bahiagas to pay for any gas not taken to the extent deliveries are less than 80% of firm volumes monthly, or less than 90% annually. For reference in 2024, while Bahiagas was managing demand disruptions, Alvopetro delivered 104% of the firm contracted amount on average to-date.

- The updated contract extends to December 31, 2034.

The contracted firm volumes would be satisfied with delivered natural gas sales of 371 e3m3/d (13.1 MMcfpd)(1). At this sales level and including expected natural gas liquids (condensate) yields our 2025 sales volumes would average approximately 2,310 boepd, a 28% increase from forecast 2024 sales. Using currently forecast commodity prices in the futures markets, a constant foreign exchange rate of 6.05BRL:1USD, 2.2% US inflation, 4.1% Brazilian inflation and our average heat content, our natural gas price is forecast to average $10.37/Mcf in 2025. This is approximately 2.5% lower than what would be forecast under our previous natural gas pricing model.

(1) The 2025 firm volume of 400 e3m3/d (before any provisions for take or pay allowances) represents contracted volumes based on contract referenced natural gas heating value. Note that Alvopetro's reported natural gas sales volumes are prior to any adjustments for heating value of Alvopetro natural gas. Alvopetro's natural gas is approximately 7.8% hotter than the contract reference heating value. Therefore, to satisfy the contractual firm deliveries Alvopetro would be required to deliver approximately 371e3m3/d (13.1MMcfpd).

Q4 2024 Dividend

Our Board of Directors has declared a quarterly dividend of US$0.09 per common share, payable in cash on January 15, 2025, to shareholders of record at the close of business on December 31, 2024. This dividend is designated as an "eligible dividend" for Canadian income tax purposes.

Dividend payments to non-residents of Canada will be subject to withholding taxes at the Canadian statutory rate of 25%. Shareholders may be entitled to a reduced withholding tax rate under a tax treaty between their country of residence and Canada. For further information, see Alvopetro's website at https://alvopetro.com/Dividends-Non-resident-Shareholders.

Corporate Presentation

Alvopetro's updated corporate presentation is available on our website at:

http://www.alvopetro.com/corporate-presentation.

Social Media

Follow Alvopetro on our social media channels at the following links:

Twitter - https://twitter.com/AlvopetroEnergy

Instagram - https://www.instagram.com/alvopetro/

LinkedIn - https://www.linkedin.com/company/alvopetro-energy-ltd

YouTube -https://www.youtube.com/channel/UCgDn_igrQgdlj-maR6fWB0w

Alvopetro Energy Ltd.'s vision is to become a leading independent upstream and midstream operator in Brazil. Our strategy is to unlock the on-shore natural gas potential in the state of Bahia in Brazil, building off the development of our Caburé and Murucututu natural gas assets and our strategic midstream infrastructure.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

All amounts contained in this new release are in United States dollars, unless otherwise stated and all tabular amounts are in thousands of United States dollars, except as otherwise noted.

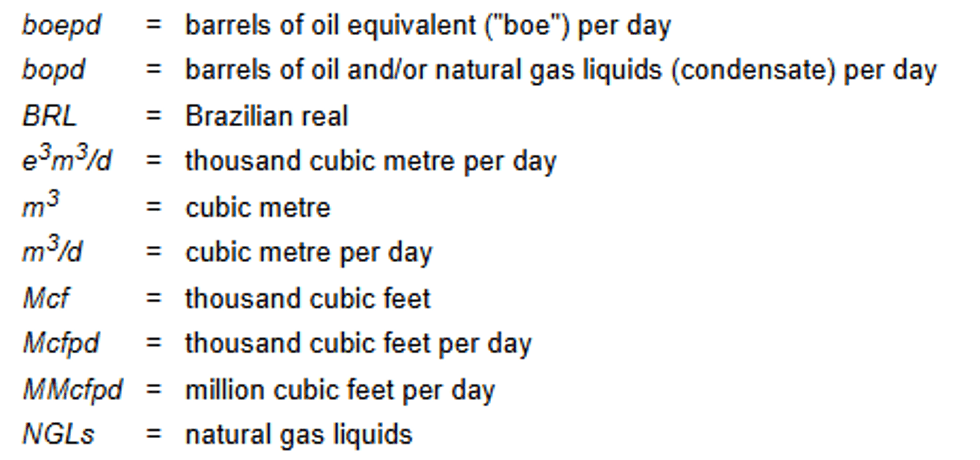

Abbreviations

BOE Disclosure. The term barrels of oil equivalent ("boe") may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet per barrel (6Mcf/bbl) of natural gas to barrels of oil equivalence is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. All boe conversions in this news release are derived from converting gas to oil in the ratio mix of six thousand cubic feet of gas to one barrel of oil.

Well Results. There is no representation by Alvopetro that the information contained in this press release with respect to production data from the 183-A3 well is necessarily indicative of long-term performance or ultimate recovery. The reader is cautioned not to unduly rely on such data as such data may not be indicative of future performance of the well or of expected production or operational results for Alvopetro in the future.

Forward-Looking Statements and Cautionary Language. This news release contains "forward-looking information" within the meaning of applicable securities laws. The use of any of the words "will", "expect", "intend" and other similar words or expressions are intended to identify forward-looking information. Forward‐looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not such results will be achieved. A number of factors could cause actual results to vary significantly from the expectations discussed in the forward-looking statements. These forward-looking statements reflect current assumptions and expectations regarding future events. Accordingly, when relying on forward-looking statements to make decisions, Alvopetro cautions readers not to place undue reliance on these statements, as forward-looking statements involve significant risks and uncertainties. More particularly and without limitation, this news release contains forward-looking information concerning future production and sales volumes, Alvopetro's natural gas price and expected sales under the Company's long-term gas sales agreement, the Company's dividends, plans for dividends in the future, and the timing and amount of such dividends and the expected tax treatment thereof. Current and forecasted natural gas nominations are subject to change on a daily basis and such changes may be material. In addition, the declaration, timing, amount and payment of future dividends remain at the discretion of the Board of Directors. Forward-looking statements are necessarily based upon assumptions and judgments with respect to the future including, but not limited to, expectations and assumptions concerning forecasted demand for oil and natural gas, the success of future drilling, completion, testing, recompletion and development activities and the timing of such activities, the performance of producing wells and reservoirs, well development and operating performance, expectations regarding Alvopetro's working interest and the outcome of any redeterminations, the outcome of any disputes, the timing of regulatory licenses and approvals, equipment availability, environmental regulation, including regulation relating to hydraulic fracturing and stimulation, the ability to monetize hydrocarbons discovered, the outlook for commodity markets and ability to access capital markets, foreign exchange rates, general economic and business conditions, the impact of global pandemics, weather and access to drilling locations, the availability and cost of labour and services, the regulatory and legal environment and other risks associated with oil and gas operations. The reader is cautioned that assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be incorrect. Actual results achieved during the forecast period will vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. Although Alvopetro believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Alvopetro can give no assurance that it will prove to be correct. Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on factors that could affect the operations or financial results of Alvopetro are included in our annual information form which may be accessed on Alvopetro's SEDAR+ profile at www.sedarplus.ca. The forward-looking information contained in this news release is made as of the date hereof and Alvopetro undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

ALV:CC

Sign up to get your FREE

Alvopetro Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 September 2025

Alvopetro Energy

Leading independent upstream and midstream gas developer in Brazil

Leading independent upstream and midstream gas developer in Brazil Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Half Yearly Report and Accounts

BPH Energy (BPH:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Alvopetro Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00