February 20, 2024

GTI Energy Ltd (ASX: GTR) (GTI or Company) is pleased to advise that planning for the 2024 field season in Wyoming has progressed well and permitting is on track to facilitate drilling during Q3.

Highlights

- Lo Herma drilling permit amendment in progress to optimise follow-up drilling, increase total number of drill holes, and construct monitoring wells for groundwater data collection – drilling is scheduled for Q3 2024

- Lo Herma Mineral Resource Estimate & Exploration Target to be updated in Q4 2024

- Green Mountain maiden drilling planned for 2024 with permitting underway

- Utah uranium/vanadium projects under evaluation to determine potential paths for renewed exploration, resource development or other value creating activities

LO HERMA PROJECT: 2024 DRILLING PERMIT AMENDMENT

42 drill holes remain permitted and undrilled at Lo Herma, however a review of the drilling conducted during December 2023 has helped the Company to refine and expand the planned 2024 drilling program to include 71 drill hole locations and construction of up to 5 groundwater monitoring wells. This next phase of exploration at Lo Herma will be focused on expanding the resource areas and where possible, upgrading the current mineral resource classification. Collection of important data including, hydrogeologic parameters of the mineralised aquifers and collection of rock core samples for metallurgical testing will be also prioritised.

GTI intends to mobilise drilling rigs to Lo Herma as soon as the activity is fully permitted, and environmental clearances are finalised. At this time, GTI anticipates that drilling will commence at Lo Herma during July 2024.

Following completion of the 2024 drill program at Lo Herma, GTI intends to publish an updated mineral resource estimate and exploration target range for the project. The Company expects that the updated mineral resource estimate will support near-term development of a Scoping Study to demonstrate the economic potential of the project.

The most recent drill results from Lo Herma and a summary of the project geology can be found in the Company’s 20 December 2023 news release.

GREEN MOUNTAIN PROJECT: DRILLING PERMIT

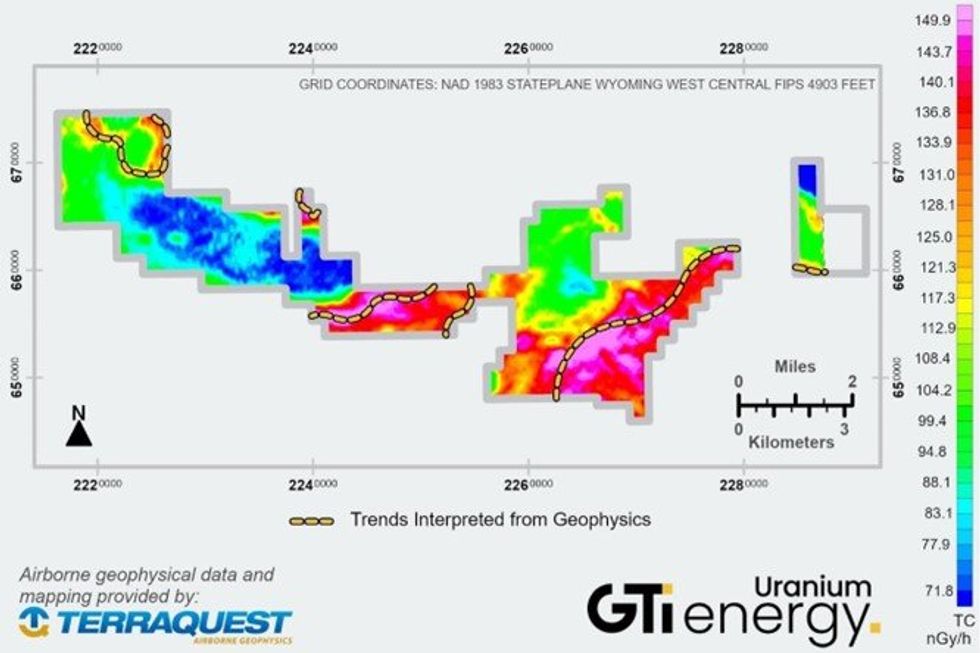

As previously advised on 21 November 2023, the Company completed an airborne geophysical survey at its Green Mountain Project to help refine a previously planned (but not permitted) drilling program. The now updated drilling plan includes 16 potential drill holes targeting 12 Miles of anomalous radiometric signature (Figure 1) which has been correlated with historical Kerr McGee drill holes maps.

A conceptual universe of 50 drill holes was initially developed with specific drill hole locations and access routes selected in consideration of site-specific topography and environmental considerations – the GTI technical team has now finalised this drill plan, selecting 16 drill holes that will be permitted for the 2024 drilling season should funding and weather conditions allow. The planned drill program will test the validity of the historical Kerr McGee drill hole maps, as well as the interpreted mineralised regions as determined from the airborne geophysical survey.

A “Class I Cultural Resource Report” and site Environmental Review have been completed with both of these studies incorporated into the planning of the drill program. Final on-site review of access will be completed as weather allows after which the Company will file the Drilling Notification. GTI will make a final decision to proceed once reclamation bonding is approved by Wyoming’s DEQ & the Federal BLM.

GREEN MOUNTAIN PROJECT: GEOLOGIC SETTING AND MINERALISATION

The Green Mountain Project is located along the northeastern flank of the Great Divide Basin (GDB). The GDB consists of up to 25,000 feet of Mesozoic to Quaternary sediments and along with the Washaki Basin to the southwest, comprise the greater Green River Basin which occupies much of southwestern Wyoming. The Great Divide basin is structurally bounded by uplifted and fault displaced Precambrian rocks, creating an internally drained and isolated hydrogeologic basin.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

12h

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

20h

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00