March 04, 2024

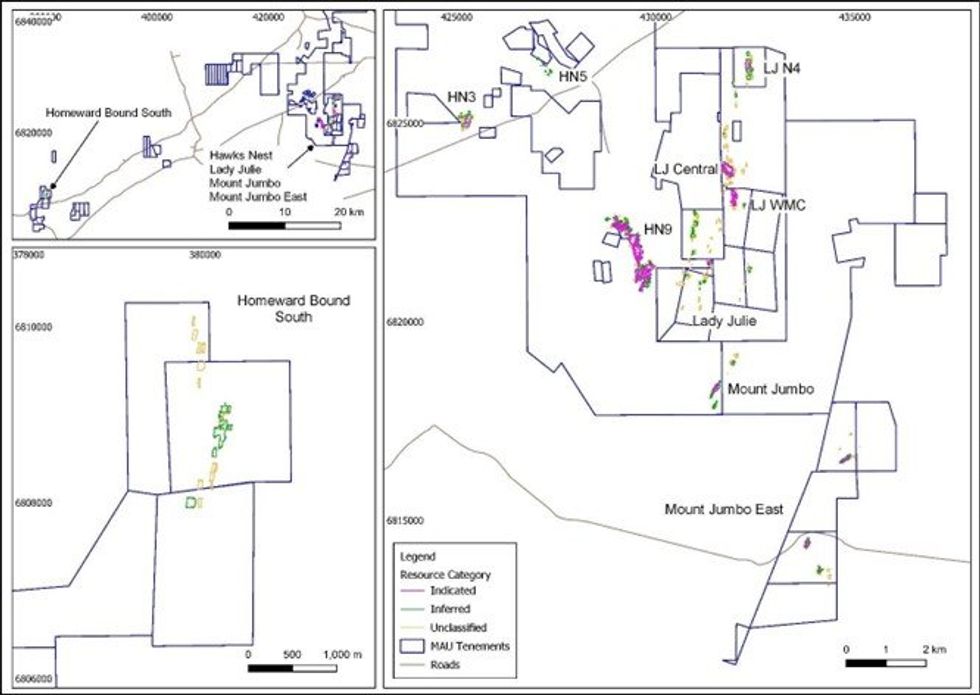

Magnetic Resources NL (Magnetic or the Company) is pleased to announce an Updated Mineral Resource Estimates from its deposits in the Laverton and Homeward Bound area.

HIGHLIGHTS

- This update incorporates results from recent drilling results carried out at Lady Julie North 4 (LJN4) since the last resource report announced in November 2023 (“Significant 107% Increase of Mineral Resource at Laverton Project”, ASX release 24 November 2023”).

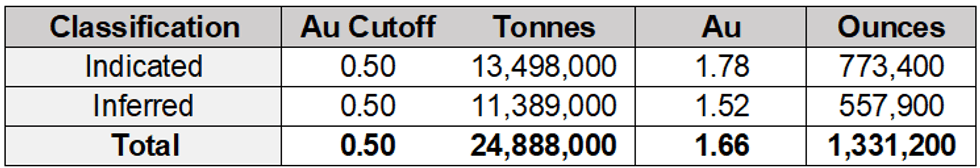

- Upgraded Mineral Resources Estimate for the project area of:

- 24.9Mt @ 1.66g/t Au totaling 1.33Moz of gold at 0.5g/t cutoff.

- Increase of 7.7% in contained gold over the 24 November 2023 ASX Release.

- Contained gold in LJN4 has risen 11 % from 852,000oz to 948,200oz Au.

- Recent drilling has also confirmed lode continuity on and between sections and as a result, the proportion of Indicated resource category ore has increased.

- Ongoing extension drilling continues at LJN4 and is expected to result in further resource increases as the northern, central and southern parts are still open downdip.

- Results for 6 deep diamond holes are pending and one deep hole is currently being completed.

The update follows extensive down-dip drilling at LJN4.

The verification and reporting of Mineral Resources on behalf of the Company was completed by its JORC Competent Person, Mr M Edwards of Blue Cap Mining. The Mineral Resources Estimate has been prepared and reported in accordance with the 2012 Edition of the JORC Code.

Total Mineral Resources reported for the Laverton and Homeward Bound South projects is now 24.9Mt @ 1.66g/t Au at 0.5g/t cut-off totaling 1.33Moz of gold (See Table 1 below). The cutoff grade is considered appropriate for a large-scale open pit operation.

Managing Director George Sakalidis commented:

“The Lady Julie North 4 Resource has been the key focus for recent drilling, with multiple stacked lodes identified with a number of thick intersections that have still not been closed off at depth. The LJN4 deposit keeps on adding ounces, increasing from 204,000oz in Feb 2023 to 948,000oz in this report.

The northern part of LJN4 is continuous over 300m down dip. The central part is continuous down dip to 550 and the southern part is continuous down dip to 400m. Note in all these cases LJN4 is still open further down dip and augers well for future drilling and resource update, Currently, there are results for 6 deep diamond holes pending with one deep diamond hole in progress.

Following the completion of all baseline background studies, our attention over recent months has turned to completing a Pre-Feasibility, which is being prepared on the basis of the resource, which was defined at November 2023. While this resource estimate does not include the benefit of the recent drilling results at LJN4, this latest drill program was deep and widely spaced and should not have materially changed the outcomes of the project economics.

Preparations are also underway for the development of a Mining Proposal. One mining lease application has already been lodged over LJN4 with others following the lodgement of the Mining Proposal.”

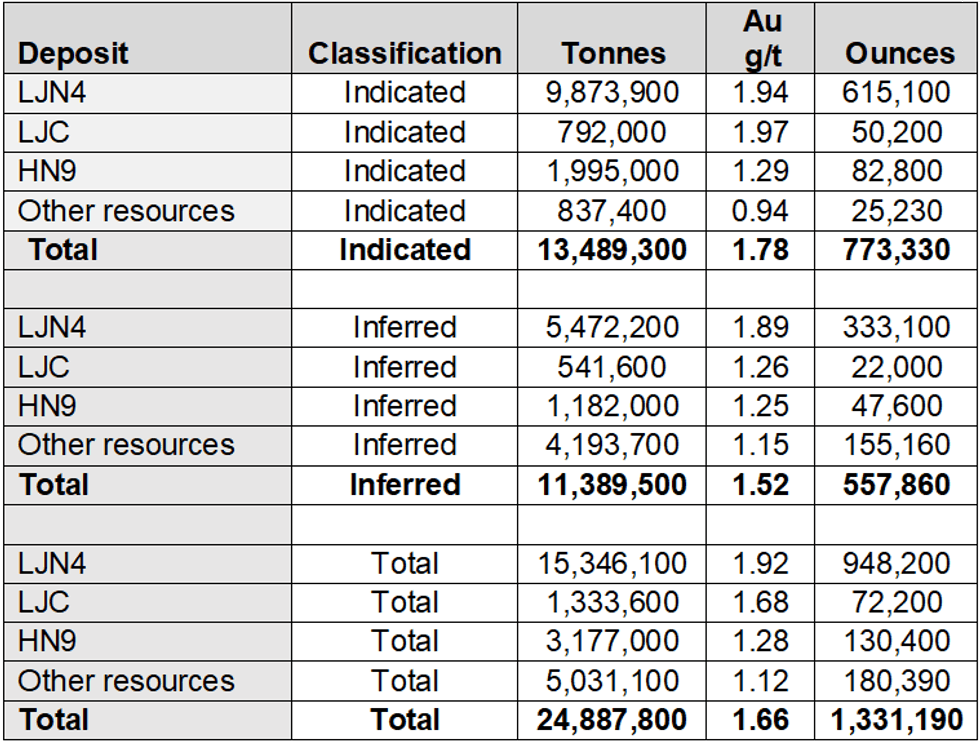

The Table below summarises the updated Total Mineral Resource at a 0.5g/t Au cutoff (Table 1), with Table 2 providing details of the major resources. Details for the smaller resources which have not changed can be found in the 3 February 2023 ASX release.

Drilling has concentrated on LJN4 over the last 4 months, which are shown in Table 2 and are further summarised below:

LJN4 Resource

The LJN4 (Indicated and Inferred) Resource of 15.3 Mt at 1.92 g/t for 948,200 oz has a present footprint of 750m x 500m (Figure 4) and remains open down dip to the east. Recent drilling results have confirmed the previous interpretation of a moderately dipping, multi-lode structure. Where the drilling encounters breccia, the mineralised structure expands considerably. This is particularly the case below 150m depth. More recent step out drilling has encountered large breccia zones which auger well for continuation of mineralisation at depth. Additional drilling is being planned to further test these expanded breccia zones.

From November 2023 to February 2024, some 29 DD/RC holes were completed for 10,741m with the deepest hole reaching 585.9mRL (500m below surface). A further 6 DD holes for 869m were drilled for geotechnical follow up. Exploration drilling is continuing and results are due for 6 deep diamond holes and with one deep diamond hole being completed.

Some 62% of the resource is classified in the Indicated Category – the increase over the November 2023 report is linked to the excellent continuity evidenced from recent drilling.

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

5h

WGC: Gold Demand Tops 5,000 Tons for the First Time on Investment, Central Bank Buying

Global gold demand surged past 5,000 tons in 2025 for the first time on record driven by a historic wave of investment inflows and sustained central bank buying, according to the World Gold Council’s (WGC) latest Gold Demand Trends report.Total gold demand, including over-the-counter... Keep Reading...

21h

Don Durrett: Gold, Silver Prices Going Higher, Watch These Stocks

Don Durrett of GoldStockData.com explains why gold's record-setting price run isn't over. "The reason gold is at US$5,000 (per ounce) and going higher is because the US bond market is fragile and becoming more fragile every day," he said. "But not only that — I've said this — it's going to fail,... Keep Reading...

21h

Kalgoorlie Gold Mining Targets Multimillion-Ounce Deposit in a Proven Gold Corridor

Kalgoorlie Gold Mining (ASX:KAL) is advancing a focused exploration strategy aimed at uncovering a multimillion-ounce gold resource within one of Western Australia’s most established gold corridors. With the gold price strengthening and regional activity accelerating, the company is intensifying... Keep Reading...

22h

Mayfair Gold Begins NYSE American Trading, Fast Tracks Fenn-Gib Project

Mayfair Gold (TSXV:MFG,NYSEAMERICAN:MINE) reached a significant milestone by officially commencing trading on the NYSE American under the ticker "MINE." This strategic move from the OTCQX aims to broaden the company's US shareholder base as it fast tracks its flagship property, the Fenn-Gib gold... Keep Reading...

29 January

Selta Project - Gold Exploration Update

First Development Resources plc (AIM: FDR), a UK-based, Australia-focused mineral exploration company with interests in Western Australia and the Northern Territory, is pleased to provide an update on its gold ("Au") focused exploration at the Selta Project ("Selta" or the "Project"), located in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00