September 04, 2024

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to provide an update on its Auld Creek Project in Reefton.

Highlights

- Three metallurgical samples from Auld Creek were tested for gold and antimony recoveries at ALS in Perth.

- All three samples gave excellent gold flotation recoveries ranging from 95-98%.

- Antimony recoveries are modest (around 64-90%) using copper sulphate as an activator.

- Changing from copper sulphate to lead nitrate as an activator boosted antimony recovery from 71% to 97%.

- The rougher concentrate grade for the lead nitrate test was 44.8g/t Au and 13.2% Sb. Cleaning tests are expected to enhance these grades further.

- Additional optimisation work using lead nitrate as an activator is expected to commence in Q4 of CY2024.

Siren Managing Director and CEO, Victor Rajasooriar commented:

” These are excellent results as we progress our Reefton gold and antimony projects into the future. The commodity pricing outlooks for both metals are excellent and the introduction of antimony as a critical mineral brings additional potential benefits to New Zealand. We are now in the final stages of completing our Auld Creek mineral resource calculations following the drilling program earlier this year and expect to have that completed in the coming weeks. Concurrently, additional metallurgical testwork will be carried out to optimise the recoveries of antimony at Auld Creek.”

Background

Three metallurgical samples were collected from Auld Creek diamond core within the Fraternal Shoot to test for both gold and antimony recoveries into a flotation concentrate. The samples were delivered to ALS Perth in May 2024 for a range of metallurgical tests under the supervision of metallurgist Graham Brock (Leo Consulting Ltd).

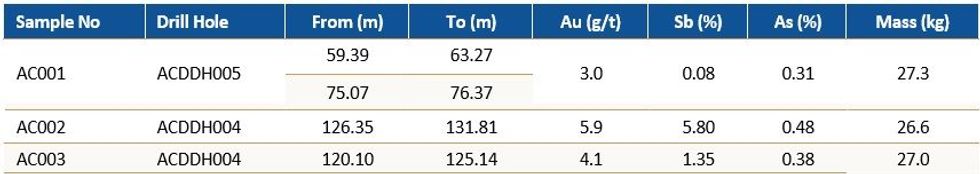

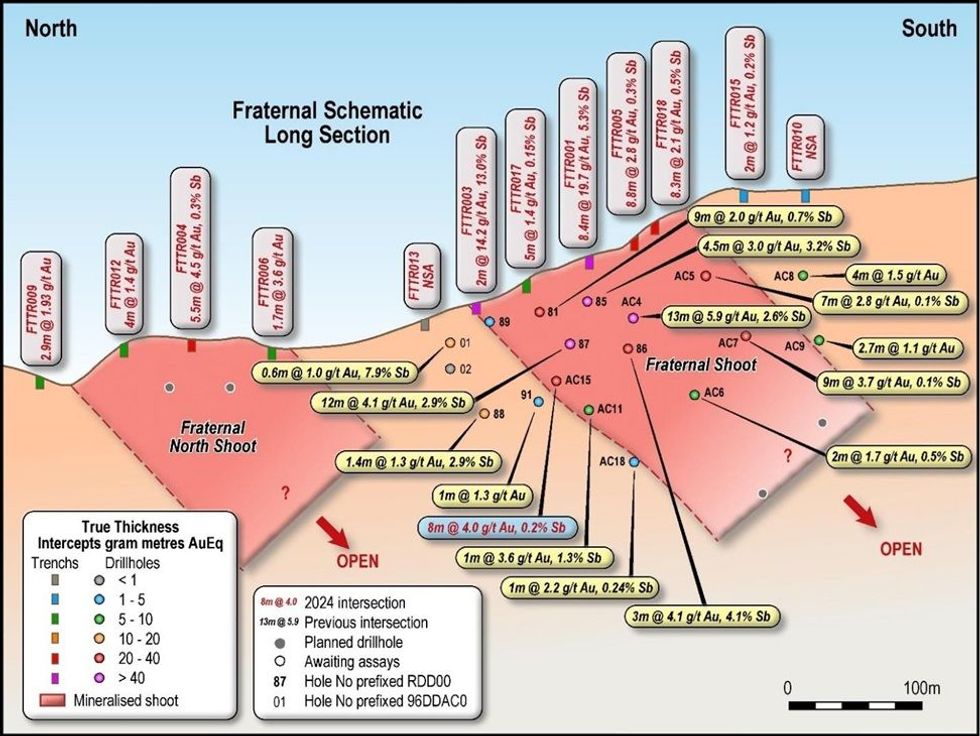

AC001 was collected from the top of the shoot that has little or no antimony. AC002 was collected from the middle of the shoot with high grade gold and antimony and AC003 was collected to represent the average resource gold and antimony grades (Table 1 and Figure 1).

AC001 Flotation Tests

Three tests were conducted on the low-grade antimony sample AC001. Test 1 was a standard kinetic rougher test giving a 95.8% recovery of the gold into the rougher concentrate at a grade of 51.2 g/t Au. Antimony recovery was also high, but the head grade was low at 0.05%.

Tests 2 and 3 were kinetic cleaner tests; Test 2 had no regrind and Test 3 included a regrind step. Test 2 produced a high-grade concentrate assaying 120.6g/t Au and Test 3 produced a grade of 136.6g/t Au. Gold recoveries were 91.9% in Test 2 and 87.7% in Test 3.

In summary, if this material was fed to a flotation concentrator 6% by weight would go to a 51g/t Au concentrate at 95.8% gold recovery. To reduce transport costs a cleaner circuit could be introduced such that for a small loss of recovery only 2.6% by weight at a grade of 120g/t Au could be produced. Testing showed little benefit in the regrind step.

Click here for the full ASX Release

This article includes content from Siren Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

19h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00